Stock Market Valuations: BofA Explains Why Investors Shouldn't Worry

Table of Contents

BofA's Argument: Why Current Valuations Aren't Necessarily Overvalued

BofA's assessment suggests that while valuations appear high, several factors mitigate the risk of an imminent market crash. Let's examine these key arguments:

The Role of Interest Rates

Low interest rates play a significant role in supporting higher stock market valuations. The Federal Reserve's policy of keeping interest rates low, coupled with quantitative easing (QE) programs, has injected significant liquidity into the financial system.

- Lower discount rates increase the present value of future earnings. This means that future profits are worth more today when interest rates are low, justifying higher stock prices.

- QE injects liquidity into the market, boosting asset prices. This increased liquidity allows investors to bid up asset prices, including stocks.

- Comparing current interest rates to historical averages reveals a prolonged period of exceptionally low rates, a factor contributing to elevated stock valuations. For instance, the current federal funds rate is significantly lower than the average rate observed throughout the past few decades.

Strong Corporate Earnings and Profitability

Despite concerns about valuations, corporate earnings have been surprisingly robust. Many companies have reported strong profits, indicating a healthy underlying economy.

- Data on earnings growth across various sectors, particularly in technology and healthcare, showcases a positive trend.

- Several prominent companies have exceeded earnings expectations, bolstering investor confidence. For example, [insert example of a company that exceeded expectations]. This signals strong fundamentals and sustained growth potential.

- Strong earnings directly impact stock prices. Higher profits generally lead to increased investor demand, driving prices upward.

Long-Term Growth Potential

Looking beyond the short-term fluctuations, the long-term growth prospects for the economy and specific sectors remain promising.

- Key drivers of future economic growth include technological innovation, demographic shifts (e.g., a growing global middle class), and continued investment in infrastructure.

- The potential for increased productivity and efficiency through automation and technological advancements further supports long-term growth.

- This continued expansion creates a foundation for expanding markets and further investment opportunities, suggesting that current valuations may not be as inflated as they initially appear.

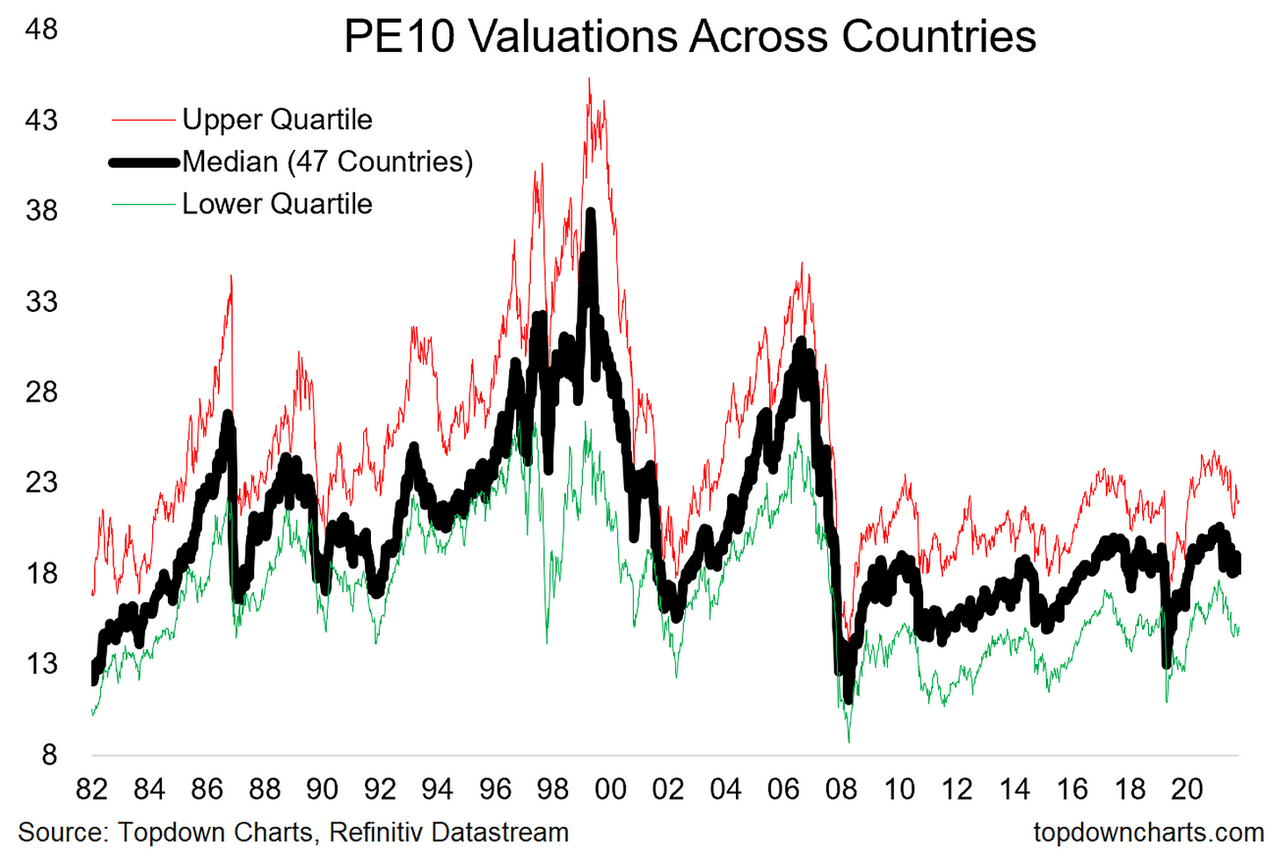

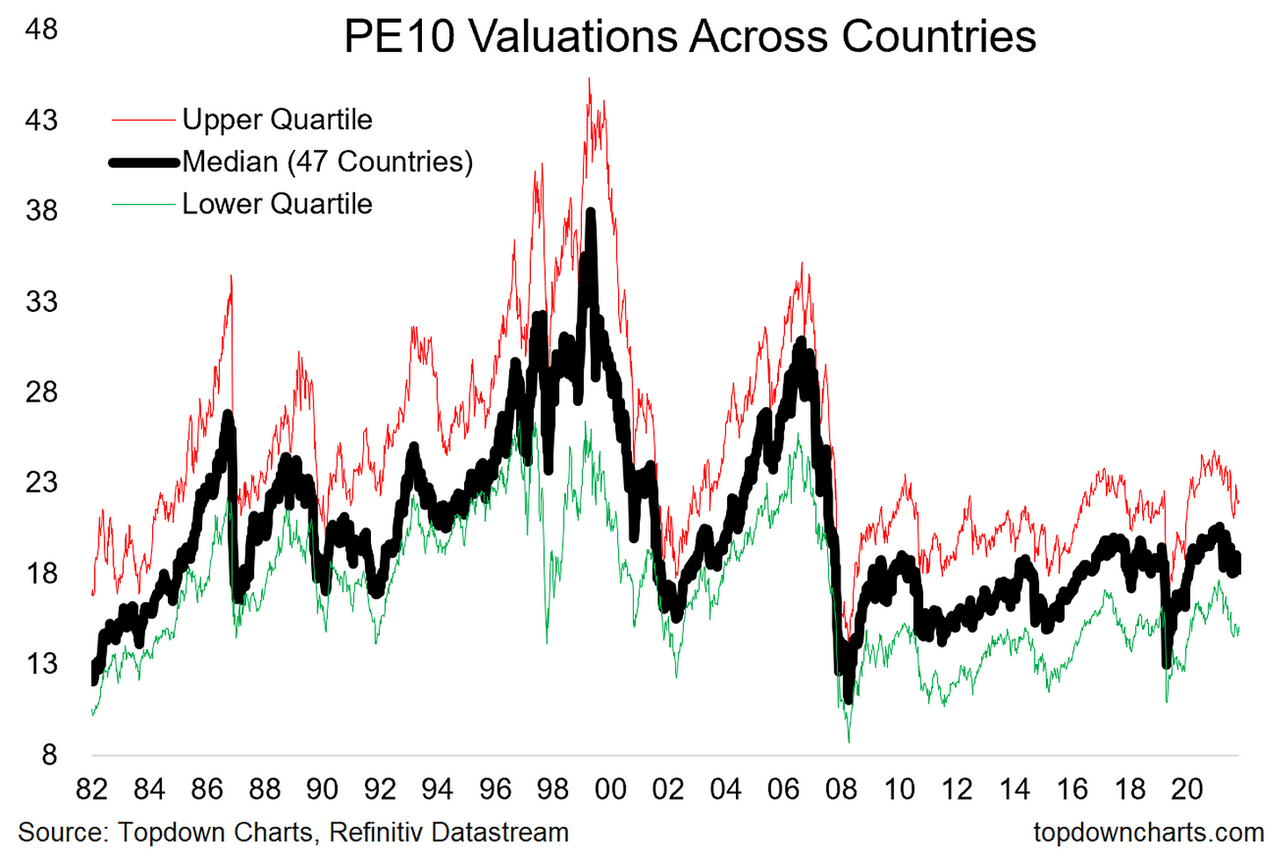

Comparing Valuations to Historical Context

While comparing current valuation metrics like the Price-to-Earnings ratio (P/E) and the Shiller P/E (CAPE) to historical averages might initially raise concerns, it's crucial to consider the broader economic context.

- Charts illustrating historical valuation metrics show periods of higher and lower valuations throughout history.

- Relying solely on historical comparisons can be misleading, as the current economic climate differs significantly from previous periods due to factors like persistently low interest rates and technological advancements.

- Macroeconomic factors like inflation rates, interest rate policies, and global economic growth significantly influence stock market valuations and should not be ignored when drawing comparisons.

Conclusion: Understanding Stock Market Valuations and Making Informed Decisions

BofA's perspective highlights that while stock market valuations may seem high, factors such as low interest rates, strong corporate earnings, and long-term growth potential offer a mitigating perspective. It's crucial to avoid knee-jerk reactions and instead consider a holistic view incorporating interest rates, corporate profitability, and future growth prospects when assessing stock market valuations. Don't let fear dictate your investment choices – understand the nuances of stock market valuation analysis. Conduct your own thorough research, carefully consider your risk tolerance, and perhaps consult a financial advisor for personalized guidance. Making informed decisions based on a comprehensive understanding of stock market valuations is key to achieving your long-term financial goals.

Featured Posts

-

White House Cocaine Secret Service Concludes Investigation

Apr 22, 2025

White House Cocaine Secret Service Concludes Investigation

Apr 22, 2025 -

Global Mourning Pope Francis Dies At 88

Apr 22, 2025

Global Mourning Pope Francis Dies At 88

Apr 22, 2025 -

Kyiv Faces Trumps Ukraine Peace Plan A Ticking Clock

Apr 22, 2025

Kyiv Faces Trumps Ukraine Peace Plan A Ticking Clock

Apr 22, 2025 -

Jeff Bezos Blue Origin A Bigger Flop Than Katy Perrys Super Bowl

Apr 22, 2025

Jeff Bezos Blue Origin A Bigger Flop Than Katy Perrys Super Bowl

Apr 22, 2025 -

Google Under Fire The Growing Pressure For A Company Split

Apr 22, 2025

Google Under Fire The Growing Pressure For A Company Split

Apr 22, 2025