Tesla And Tech Power US Stock Market Surge

Table of Contents

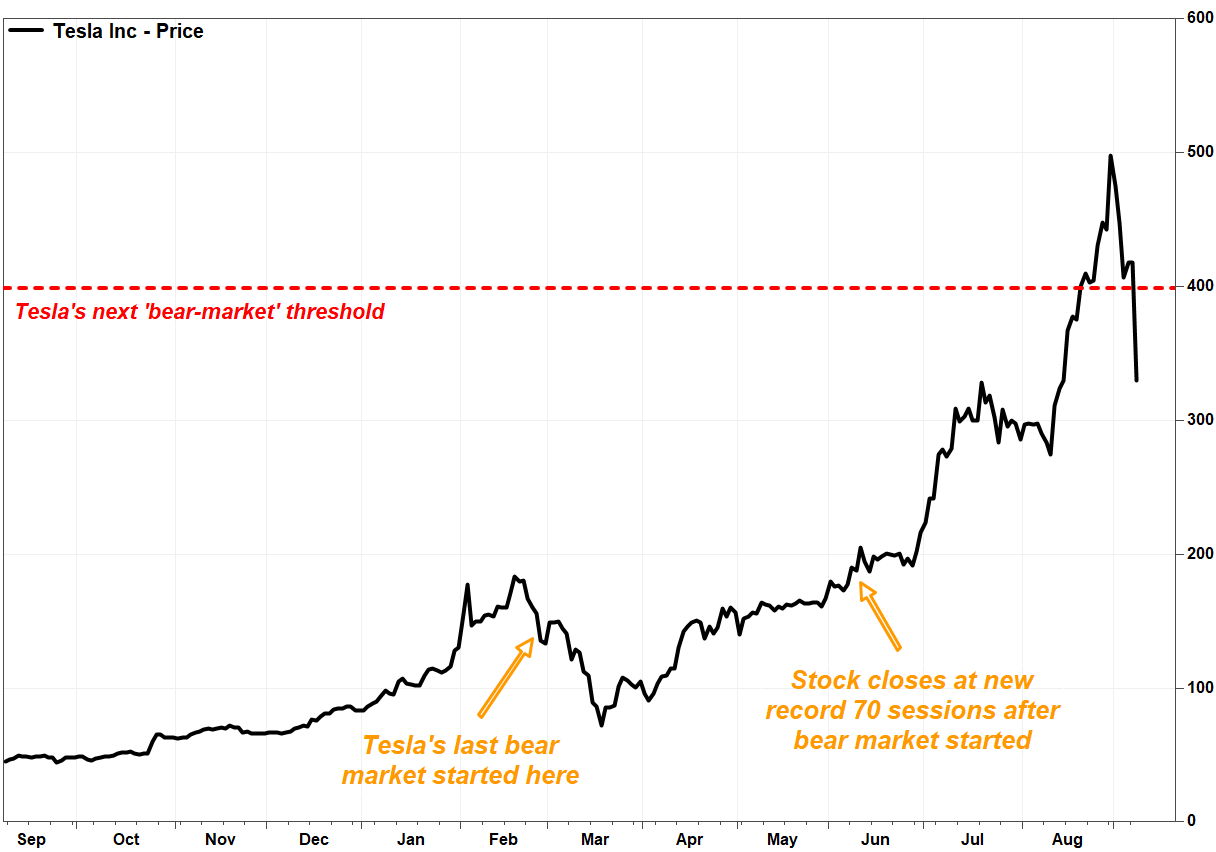

Tesla's Contribution to the Surge

Tesla's influence on the recent market surge is undeniable. Several factors have contributed to this remarkable performance, significantly impacting investor sentiment and the Tesla stock price.

Record-Breaking Deliveries and Production

Tesla's recent quarterly delivery numbers have consistently exceeded expectations, showcasing the company's impressive growth trajectory.

- Increased Production Capacity: The expansion of Gigafactories worldwide has dramatically increased Tesla's production capacity, leading to higher vehicle output.

- Global Market Expansion: Tesla continues to penetrate new markets globally, further fueling its growth and increasing its market share.

- Strong Demand: High demand for Tesla's electric vehicles (EVs) across various models contributes to the record-breaking delivery numbers.

These achievements have significantly boosted investor confidence, leading to a substantial increase in the Tesla stock price and overall market optimism. The impact of this increased Tesla production and the resulting Tesla deliveries cannot be overstated. Gigafactory output is a key indicator of future growth and market share dominance.

Innovation and Technological Advancements

Tesla's commitment to innovation is another significant factor driving its stock market performance. The company's continuous advancements in several key areas contribute to its competitive advantage.

- Battery Technology: Breakthroughs in battery technology translate to longer ranges, faster charging times, and improved overall vehicle performance.

- Autonomous Driving: Tesla's advancements in autonomous driving capabilities, although still under development, represent a significant technological leap and attract substantial investor interest.

- Energy Solutions: Tesla's expansion into energy storage solutions (Powerwall, Powerpack) diversifies its revenue streams and positions the company as a leader in the renewable energy sector.

These Tesla innovations solidify its position as a technology leader, attracting investors seeking exposure to cutting-edge technologies in the electric vehicle and renewable energy sectors. The buzz around Tesla innovation, autonomous vehicles, and battery technology continues to fuel investor excitement.

Positive Investor Sentiment and Analyst Upgrades

Positive media coverage, strong analyst ratings, and an overall optimistic outlook for Tesla's future growth have further propelled its stock price.

- Analyst Upgrades: Many analysts have issued buy recommendations for Tesla stock, citing its strong growth potential and technological leadership.

- Positive Media Coverage: Favorable media coverage highlighting Tesla's achievements and future prospects contributes to a positive investor sentiment.

- Social Media Sentiment: Positive social media sentiment further reinforces the overall optimistic outlook surrounding Tesla and its stock.

The combination of these factors has created a powerful upward momentum for Tesla's stock price, influencing the broader stock market's upward trend. Tracking Tesla stock price movements and understanding Tesla investor sentiment is crucial for anyone following the market. Looking at Tesla stock forecasts provides valuable insight for investment strategies.

Broader Tech Sector's Role in the Market Surge

Tesla's success isn't solely responsible for the market surge; the broader tech sector has also played a significant role.

Strong Earnings Reports from Tech Giants

Strong financial performances from leading tech companies have boosted overall market sentiment.

- Robust Earnings: Apple, Microsoft, Google, and other tech giants have reported strong earnings, indicating a healthy and growing sector.

- Positive Outlook: These strong earnings reports project a positive outlook for the tech sector, further bolstering investor confidence.

- Increased Investments: The positive performance encourages further investments in the tech sector, fueling the market's upward momentum.

The strong tech stock performance underscores the overall health of the tech industry and its contribution to the broader market surge.

Artificial Intelligence (AI) Hype and Investments

The excitement surrounding AI and its potential to revolutionize various sectors is driving significant investments in related tech companies.

- AI Investments: Increased investments in AI research and development are fueling growth in the AI sector.

- AI Applications: The growing number of practical AI applications across various industries further fuels investor enthusiasm.

- Future Potential: The perceived long-term potential of AI creates a sense of optimism and encourages further investments in AI-related companies.

The AI investment boom is a key factor in the current market uptrend, drawing investor interest to tech companies at the forefront of AI development.

Easing Interest Rate Concerns

The potential impact of easing interest rate hikes by the Federal Reserve has also positively influenced the tech sector's valuation.

- Lower Interest Rates: Lower interest rates reduce borrowing costs, making it cheaper for tech companies to expand and invest.

- Higher Stock Valuations: Lower interest rates can lead to higher stock valuations for growth stocks, many of which are in the tech sector.

- Reduced Market Volatility: Easing interest rate concerns can help reduce market volatility, creating a more stable environment for investors.

The interplay between interest rates, inflation, and market volatility significantly impacts stock valuations, particularly within the tech sector.

Conclusion

The recent surge in the US stock market is a result of a confluence of factors, with Tesla and the broader tech sector playing pivotal roles. Tesla's remarkable production and delivery numbers, technological advancements, and positive investor sentiment have fueled a significant increase in its stock price. Concurrently, strong earnings from tech giants, the excitement surrounding AI, and easing interest rate concerns have contributed to the overall market uptrend. While market fluctuations are inevitable, the current positive momentum driven by the Tesla stock market surge and the robust performance of the tech sector suggests a potentially strong outlook. Keep monitoring the Tesla stock market surge and the overall performance of the tech sector for continued insights into market trends. Stay informed and make informed investment decisions based on ongoing developments in the Tesla stock market and the broader tech industry.

Featured Posts

-

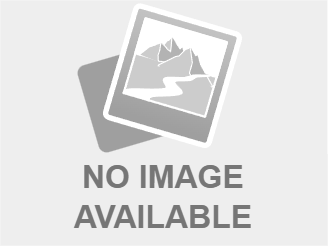

Mets Starting Pitchers Transformation A New Edge In The Rotation Battle

Apr 28, 2025

Mets Starting Pitchers Transformation A New Edge In The Rotation Battle

Apr 28, 2025 -

Aaron Judge And Wife Welcome First Child

Apr 28, 2025

Aaron Judge And Wife Welcome First Child

Apr 28, 2025 -

Challenges Faced By Laid Off Federal Employees Seeking State Local Roles

Apr 28, 2025

Challenges Faced By Laid Off Federal Employees Seeking State Local Roles

Apr 28, 2025 -

Wga And Sag Aftra Strike The Impact On Hollywood Productions

Apr 28, 2025

Wga And Sag Aftra Strike The Impact On Hollywood Productions

Apr 28, 2025 -

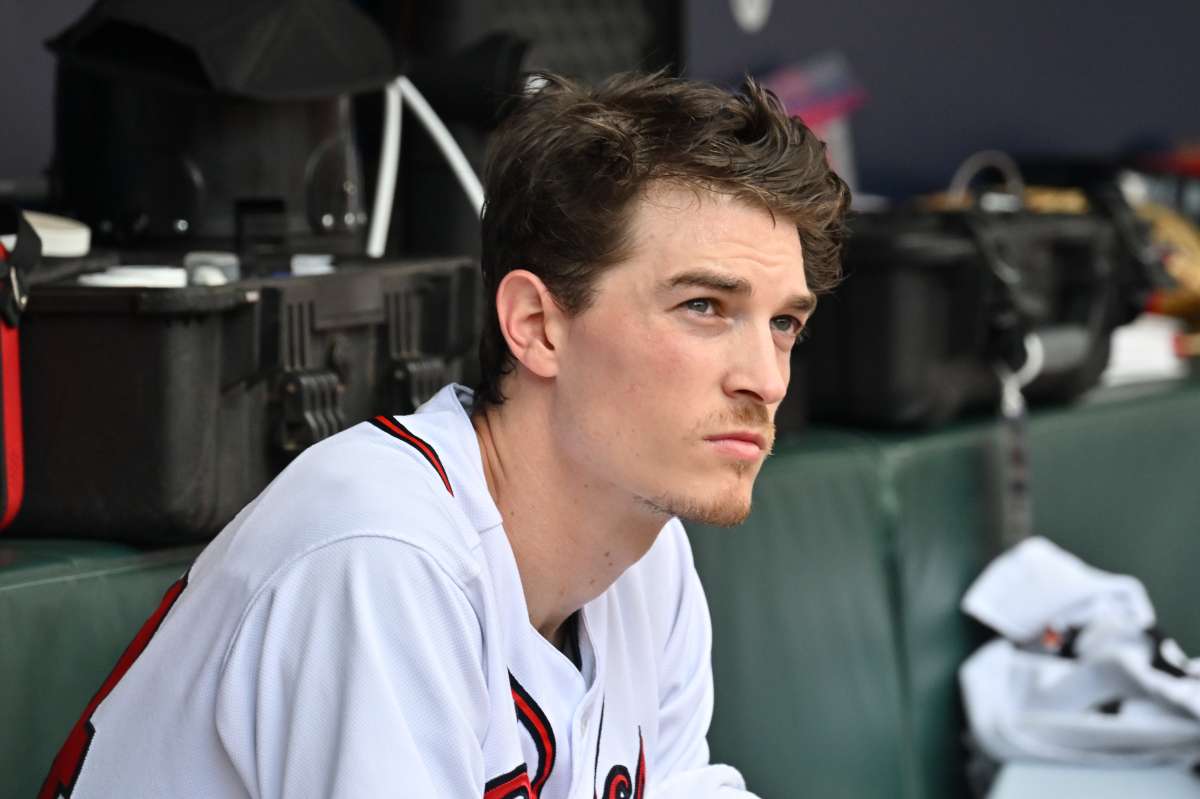

Yankees 12 3 Victory Max Frieds Debut And Offensive Dominance

Apr 28, 2025

Yankees 12 3 Victory Max Frieds Debut And Offensive Dominance

Apr 28, 2025