Tesla Q1 Earnings: Net Income Plunges 71% Amidst Political Headwinds

Table of Contents

The 71% Net Income Drop: A Deeper Dive

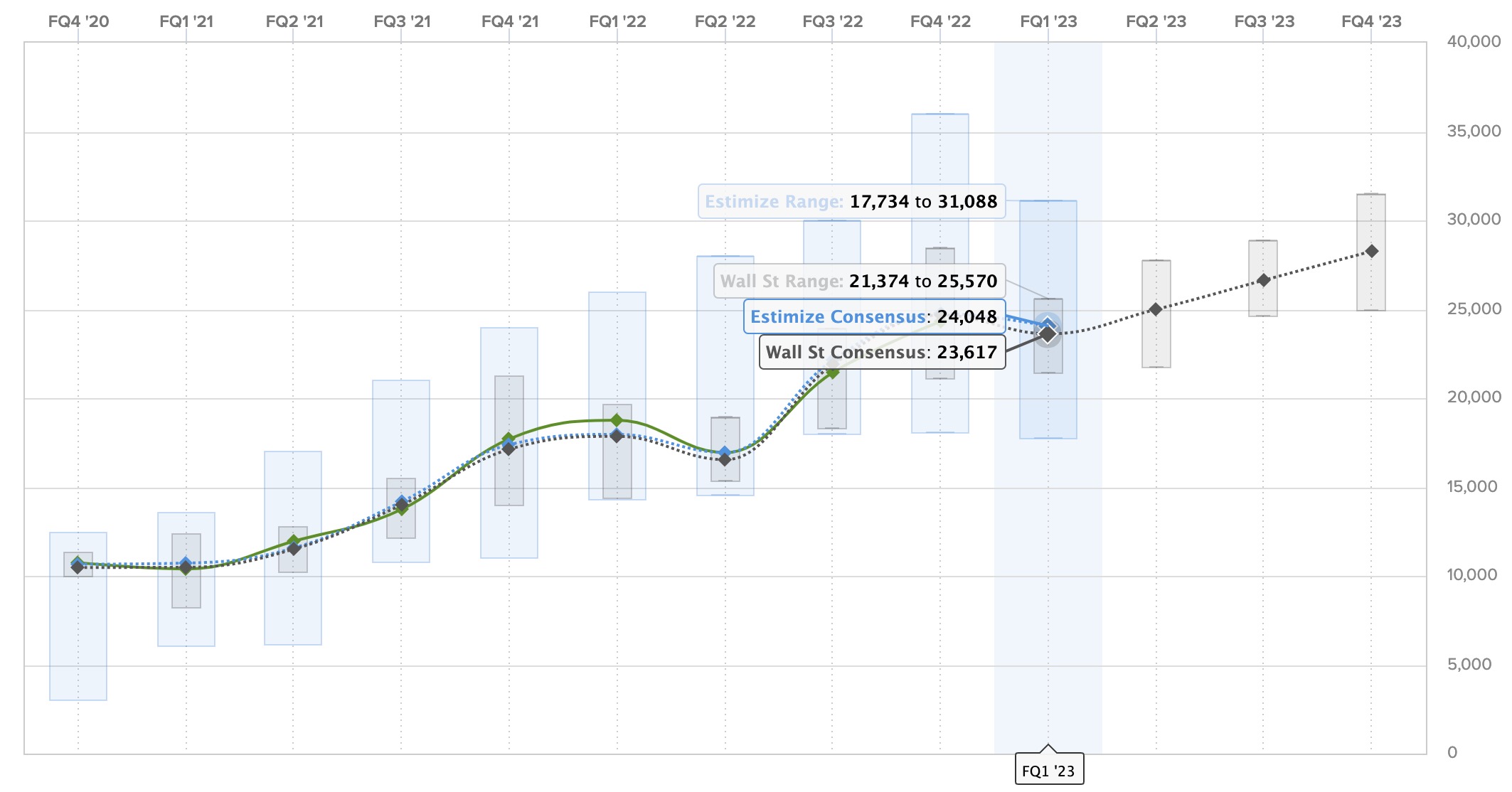

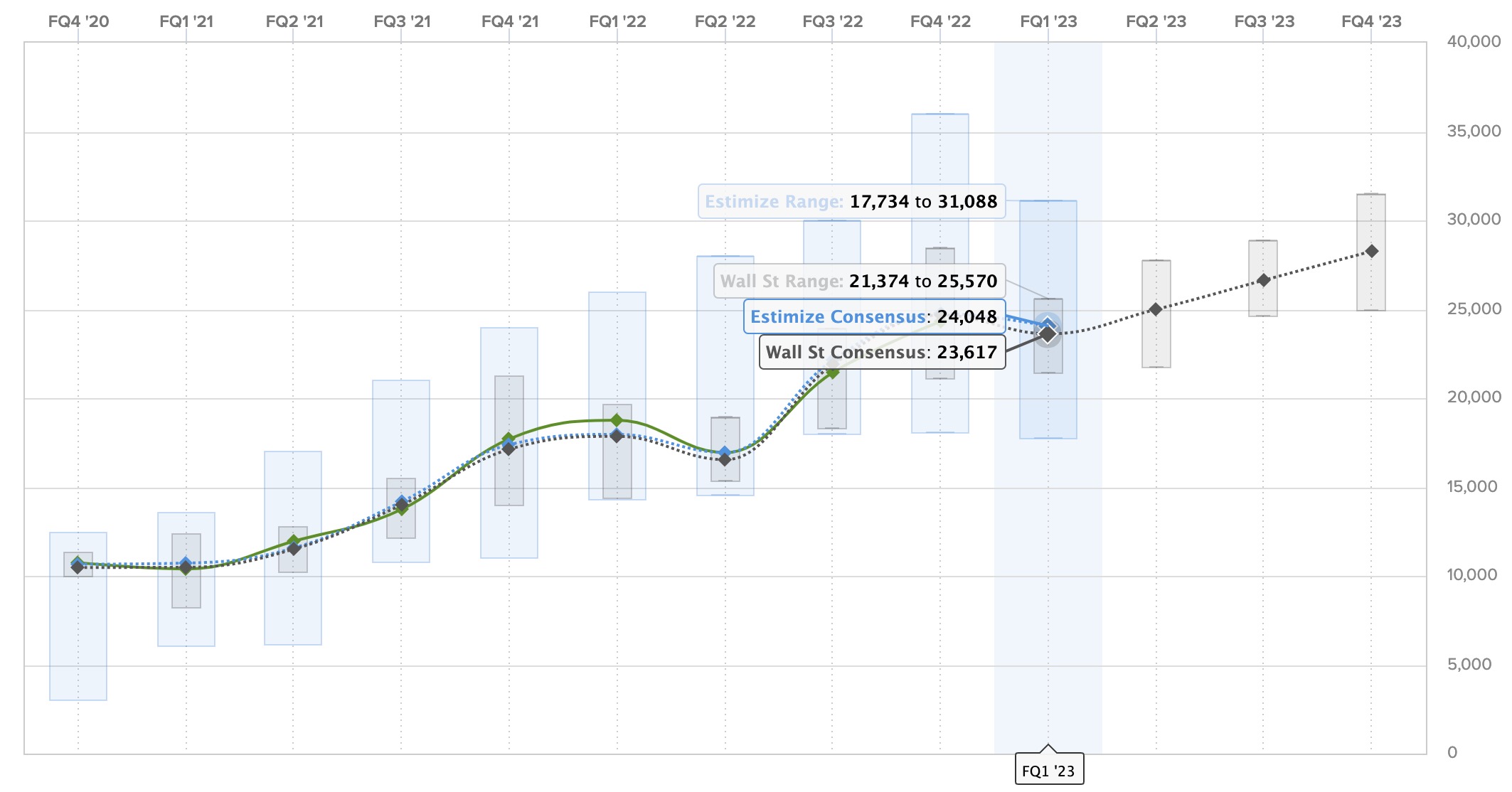

Tesla's Q1 2024 financial results paint a stark contrast to the previous year and expectations. The company reported a 71% decrease in net income compared to Q1 2023, significantly missing analyst forecasts. This dramatic fall raises serious questions about the company's short-term prospects and long-term strategy.

- Key Financial Metrics (Q1 2024 vs. Q1 2023):

- Net Income: Down 71%

- Revenue: [Insert actual figures – e.g., $20 Billion vs. $25 Billion] – showing percentage change.

- Earnings Per Share (EPS): [Insert actual figures – showing percentage change]

- Operating Margin: [Insert actual figures – showing percentage change]

The impact on Tesla's stock price was immediate and substantial, with shares experiencing a [Insert percentage change and specify timeframe, e.g., 5% drop in after-hours trading]. This volatility underscores the market's concern over the company's financial performance and future outlook. [Insert relevant chart or graph visualizing the stock price fluctuation]. Analyzing these Tesla financial results is crucial for understanding the current market sentiment surrounding the EV maker. The Tesla earnings report clearly highlights the challenges faced by the company in the first quarter.

Political Headwinds: Geopolitical Risks and Regulatory Challenges

Tesla's global operations are significantly impacted by geopolitical instability and shifting regulatory landscapes. The company faces numerous political risks that directly influence its profitability and growth.

-

Geopolitical Instability: [Mention specific events, e.g., the ongoing war in Ukraine impacting supply chains, tensions in the Taiwan Strait affecting chip production, etc.]. These events disrupt supply chains, increase material costs, and lead to production delays.

-

Regulatory Hurdles:

- China: [Discuss specific regulatory changes in China affecting Tesla's operations and market share, e.g., new emission standards, safety regulations, or trade disputes].

- United States: [Discuss the impact of US government policies on EV subsidies, tariffs, and trade relations affecting Tesla's competitiveness].

- Europe: [Discuss European Union regulations on emissions, battery production, and data privacy that affect Tesla’s operations].

Government incentives for electric vehicles play a significant role in market share. Changes in these incentives, or the introduction of new regulations, can directly impact Tesla's sales and profitability. The Tesla political risk is a major factor influencing their current financial performance.

Price Wars and Increased Competition

Tesla's aggressive price cuts, initiated in a bid to maintain market share, have triggered a price war within the EV industry. While boosting sales volume in the short term, this strategy has severely compressed profit margins.

- Impact of Price Cuts:

- Increased sales volume

- Significantly reduced profit margins per vehicle

- Potential long-term impact on brand perception and profitability

The rise of competitors such as [mention key competitors, e.g., BYD, Volkswagen, Rivian] and their increasingly competitive offerings further intensify the pressure on Tesla's profitability. These companies are employing various strategies including focusing on specific market niches, offering different vehicle types, or focusing on specific technological advancements. The Tesla competition is fierce and is directly impacting the company's bottom line. Analyzing the Tesla price war within the context of this increased competition is vital to fully understanding the Q1 results.

Production and Delivery Challenges

Tesla's Q1 performance was also hampered by production and delivery challenges.

-

Production Bottlenecks: [Mention specific issues affecting production, e.g., supply chain disruptions for specific components, factory shutdowns for maintenance or upgrades, labor shortages].

-

Delivery Delays: [Discuss the impact of production issues on vehicle deliveries, potentially leading to unmet customer demand and affecting revenue streams]. The company's Tesla production capacity, therefore, has become a key focus point. Comparing Tesla delivery numbers across different quarters allows us to track the progress (or lack thereof) in overcoming these bottlenecks.

[Include data on production volume and delivery figures, comparing them to previous quarters. For example: "Tesla produced X number of vehicles in Q1 2024, compared to Y in Q1 2023, representing a Z% change." and "Tesla delivered A number of vehicles in Q1 2024, compared to B in Q1 2023, representing a C% change."]

Conclusion

Tesla's Q1 2024 earnings report paints a complex picture. The significant drop in net income, a staggering 71%, is attributable to a confluence of factors, including intensifying political headwinds, fierce competition, and production challenges. While the price wars have boosted sales volume, the impact on profit margins is undeniable. Understanding these interconnected challenges is crucial for investors and analysts alike. Moving forward, careful analysis of geopolitical risks, regulatory changes, and competitive pressures will be key to predicting future Tesla Q1 Earnings performance. Stay informed on future reports to gain a complete understanding of Tesla’s financial trajectory.

Featured Posts

-

Tyler Herro And Cleveland Cavaliers Triumph At Nba All Star Weekend

Apr 24, 2025

Tyler Herro And Cleveland Cavaliers Triumph At Nba All Star Weekend

Apr 24, 2025 -

Canadian Auto Dealers Propose Five Point Plan To Combat Us Trade War

Apr 24, 2025

Canadian Auto Dealers Propose Five Point Plan To Combat Us Trade War

Apr 24, 2025 -

Ftc Probe Into Open Ai Implications For The Future Of Ai Development

Apr 24, 2025

Ftc Probe Into Open Ai Implications For The Future Of Ai Development

Apr 24, 2025 -

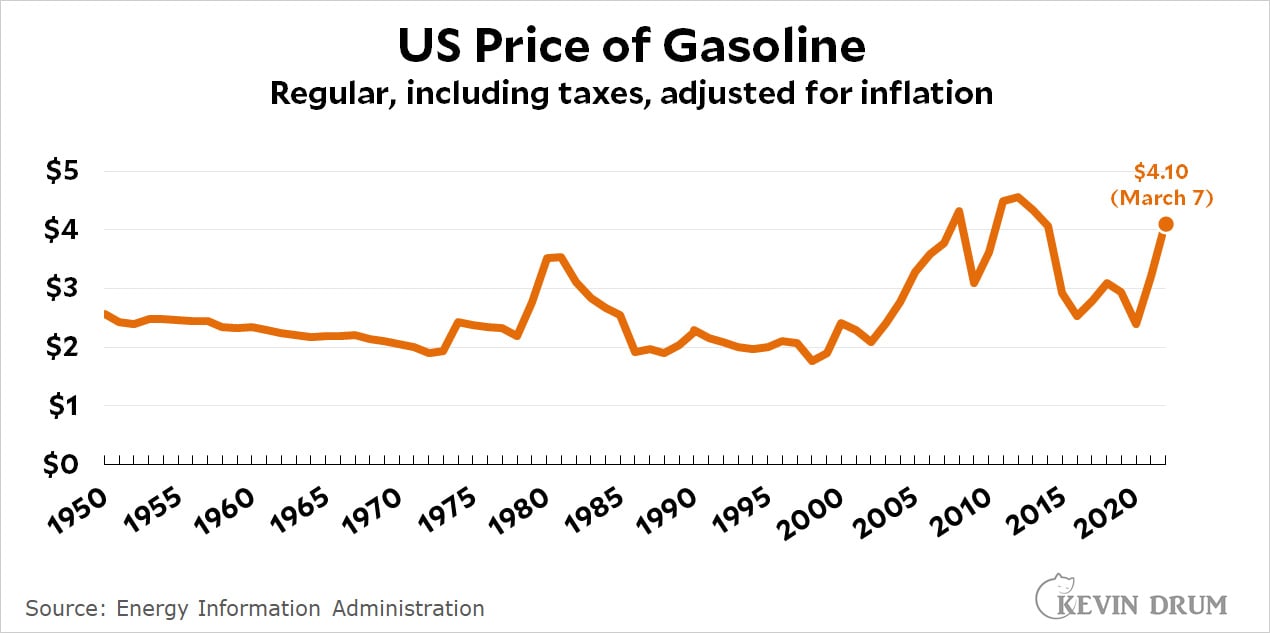

Newsoms Call To Action Addressing Californias High Gas Prices Through Industry Collaboration

Apr 24, 2025

Newsoms Call To Action Addressing Californias High Gas Prices Through Industry Collaboration

Apr 24, 2025 -

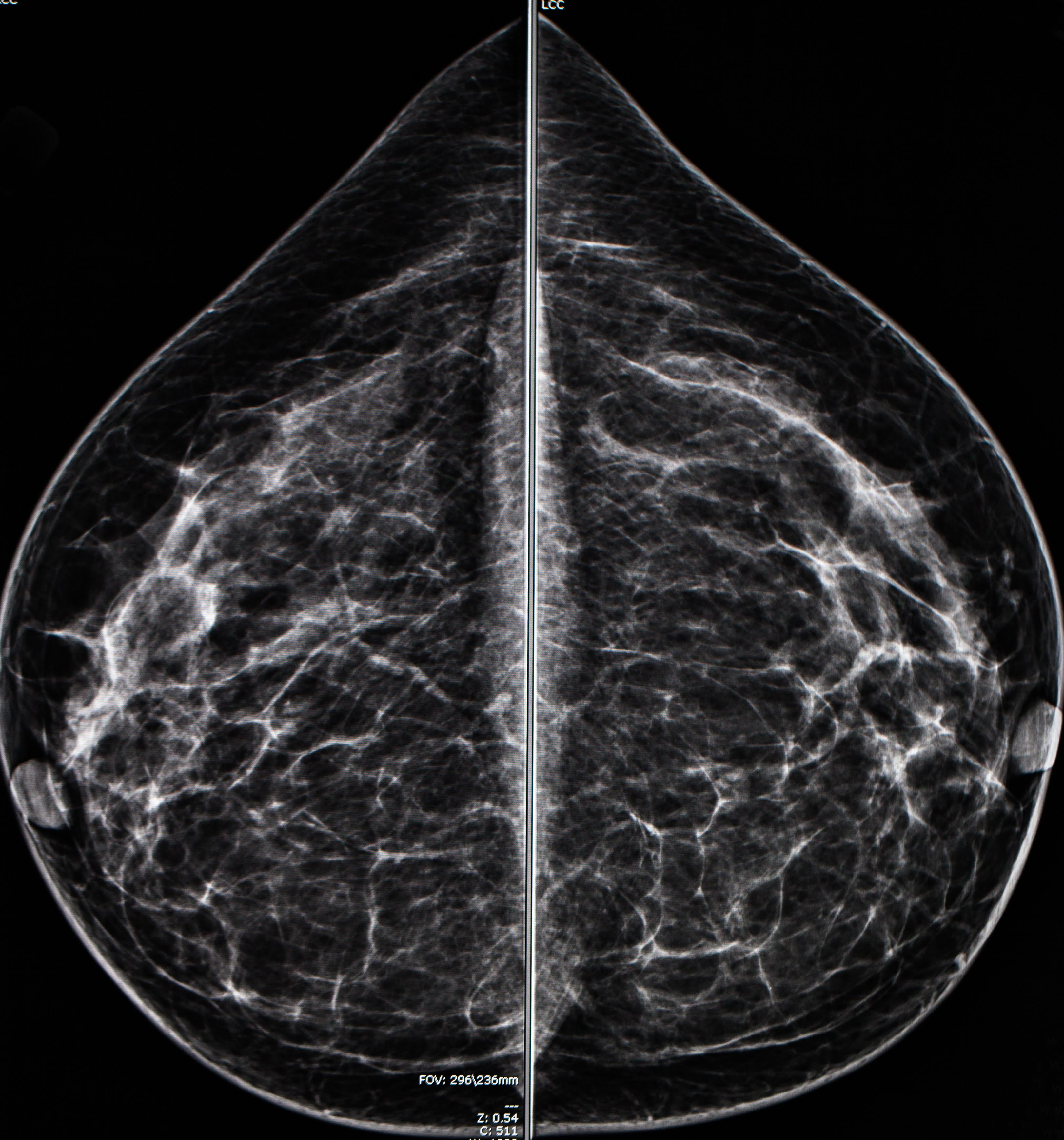

Breast Cancer Diagnosis After Missed Mammogram Learning From Tina Knowles Experience

Apr 24, 2025

Breast Cancer Diagnosis After Missed Mammogram Learning From Tina Knowles Experience

Apr 24, 2025