Tesla Q1 Profits Plunge Amid Musk Backlash And Trump Ties

Table of Contents

Plummeting Profits: A Detailed Look at Tesla's Q1 Financial Performance

Tesla's Q1 2024 financial performance paints a concerning picture. The company reported a substantial decrease in profits compared to Q1 2023 and previous quarters. Analyzing the specifics reveals a complex situation affecting Tesla's revenue and profitability. Key factors contributing to this decline include:

-

Significant Drop in Profit Margin: While precise figures require official release, preliminary reports indicate a sharp contraction in profit margins compared to previous quarters. This suggests challenges in managing the cost of goods sold (COGS) relative to revenue generated.

-

Declining Revenue Streams: While Tesla's car sales remain a significant portion of its revenue, analysis suggests a slowdown in growth compared to previous years. This needs further investigation into potential factors such as reduced demand, increased competition, and pricing strategies. Furthermore, revenue from energy generation and storage solutions also seems to have fallen short of expectations.

-

Increased Operational Expenses: Tesla's Q1 2024 results show a notable increase in operational expenses. This includes higher costs associated with raw materials (particularly battery components), manufacturing overheads, and significant investment in research and development. Rising inflation and supply chain disruptions are likely contributing factors.

-

Underperformance Compared to Analyst Expectations: Preliminary reports suggest Tesla's Q1 2024 earnings significantly missed analysts' expectations. This underperformance adds to investor concerns and contributes to the negative stock market reaction. The gap between projected and actual performance requires in-depth investigation to understand the underlying causes. A comparison to competitor performance further highlights the severity of this decline.

The Elon Musk Backlash: Impact on Tesla's Brand and Investor Confidence

The controversies surrounding Elon Musk's leadership have undeniably impacted Tesla's brand image and investor confidence. His involvement in various high-profile events, particularly those linked to Twitter and other ventures, has drawn significant negative press.

-

Negative Publicity and Brand Damage: Musk's controversial actions and statements have negatively affected Tesla's public image, potentially impacting consumer perception and purchasing decisions. This negative publicity directly contributes to a decreased demand for Tesla vehicles.

-

Erosion of Investor Sentiment: The uncertainty surrounding Musk's leadership and his focus on other ventures has eroded investor confidence. This uncertainty leads to decreased investment in Tesla stock and a negative impact on its market valuation.

-

Significant Stock Price Fluctuations: The Tesla stock price has experienced significant volatility in direct correlation with the unfolding controversies surrounding Elon Musk. Negative news cycles invariably lead to sell-offs, adding pressure to the company's overall financial performance. Specific examples of negative news coverage and its direct effect on the stock price should be analyzed in future reports.

Trump Ties and Geopolitical Risks: Adding Fuel to the Fire

Tesla's past connections to the Trump administration, and its significant presence in China, introduce further geopolitical risks that may have contributed to the Q1 profit plunge.

-

Potential Ramifications of Past Relationships: Tesla's past engagements with the Trump administration, including potential policy favors, may now face renewed scrutiny and potential negative consequences. This added uncertainty negatively impacts investor perception.

-

US-China Trade Tensions: Geopolitical tensions, particularly between the US and China, pose a significant risk to Tesla's supply chain and its substantial operations in China. Any escalation in these tensions could disrupt manufacturing, logistics, and sales, directly affecting profitability.

-

Risks Associated with Chinese Operations: Tesla's significant reliance on its Chinese operations presents inherent risks, including potential regulatory challenges, political pressure, and shifts in the local market. A detailed analysis of these risks and their potential impact on the company's bottom line is crucial.

Conclusion

Tesla's Q1 2024 profit plunge is a complex issue stemming from several intertwined factors. Decreased profits, fueled by increased costs and reduced revenue, are exacerbated by the ongoing negative publicity surrounding Elon Musk and the geopolitical risks associated with the company's global operations and past ties to the Trump administration. This situation necessitates a thorough assessment to determine whether this reflects a temporary setback or signals deeper-seated structural challenges for the electric vehicle giant. The future outlook for Tesla requires careful monitoring of these factors and their evolving impact on the company's financial performance and market position. Stay tuned for further updates on Tesla Q1 earnings and their implications. Follow our blog for continuous coverage of Tesla and its evolving market position.

Featured Posts

-

Selling Sunset Star Calls Out La Landlord Price Gouging After Fires

Apr 24, 2025

Selling Sunset Star Calls Out La Landlord Price Gouging After Fires

Apr 24, 2025 -

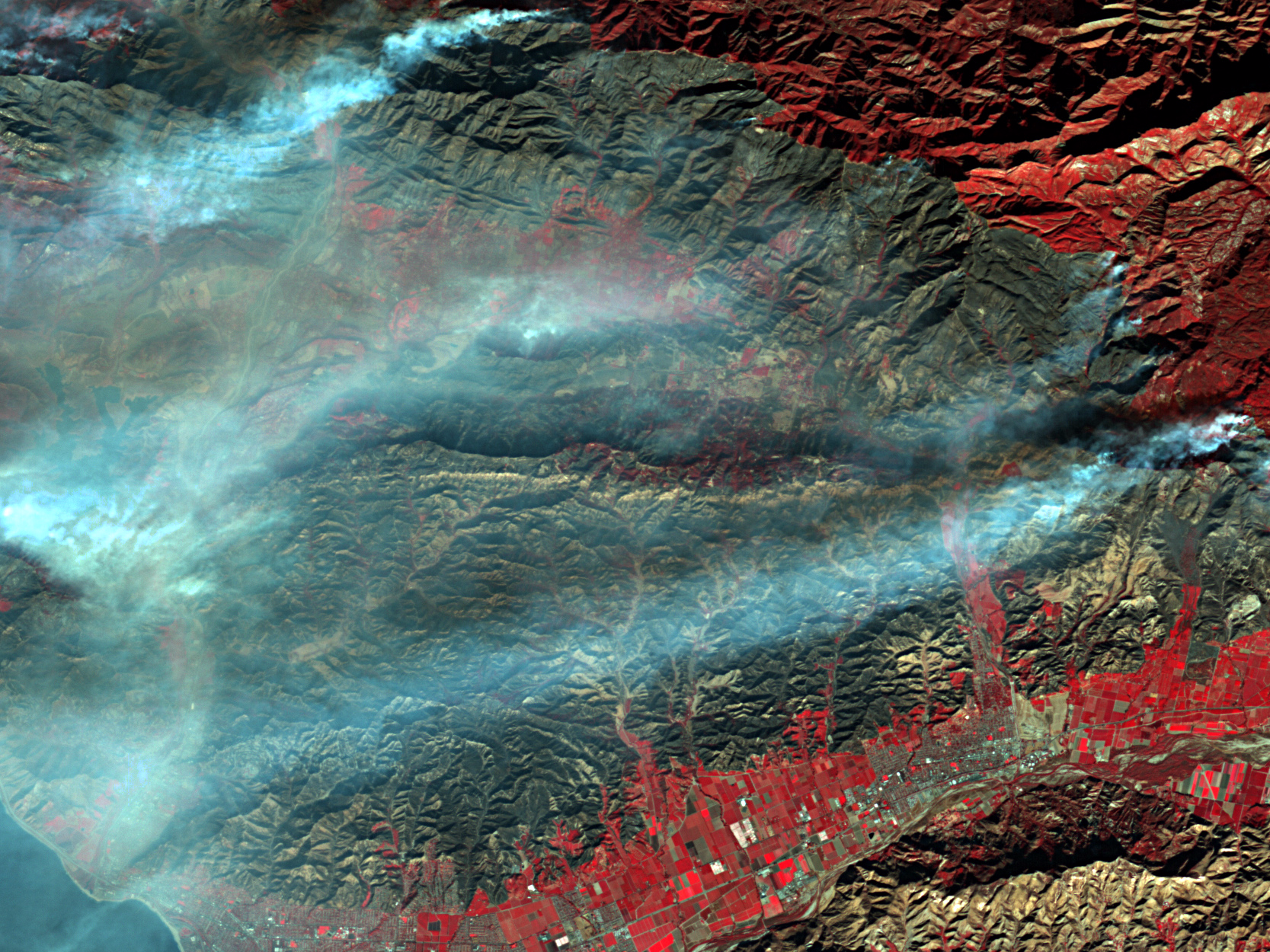

Los Angeles Wildfires The Dark Side Of Disaster Speculation

Apr 24, 2025

Los Angeles Wildfires The Dark Side Of Disaster Speculation

Apr 24, 2025 -

Us Dollar Rises As Trumps Criticism Of Fed Chair Powell Subsides

Apr 24, 2025

Us Dollar Rises As Trumps Criticism Of Fed Chair Powell Subsides

Apr 24, 2025 -

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive Into The Investigation

Apr 24, 2025

Open Ais Chat Gpt Under Ftc Scrutiny A Deep Dive Into The Investigation

Apr 24, 2025 -

Saudi Arabia And India To Build Two Joint Oil Refineries

Apr 24, 2025

Saudi Arabia And India To Build Two Joint Oil Refineries

Apr 24, 2025