Tesla's Q1 2024 Financial Results: Political Backlash Impacts Profitability

Table of Contents

Q1 2024 Financial Performance Overview

Revenue and Deliveries

Tesla reported robust vehicle deliveries in Q1 2024, exceeding previous quarter's numbers. However, the growth wasn't enough to offset other pressures.

- Total Revenue: [Insert Actual Q1 2024 Revenue Figure Here] (USD) – [Include percentage change compared to Q4 2023 and Q1 2023].

- Vehicle Deliveries: [Insert Actual Q1 2024 Delivery Figure Here] units – A [Percentage] increase compared to Q4 2023, but [Percentage] increase/decrease compared to Q1 2023. Breakdown by Model: Model 3: [Number], Model Y: [Number], Model S: [Number], Model X: [Number].

- Average Selling Price: [Insert data on ASP, including changes compared to previous quarters] This is crucial to understand the impact of price cuts.

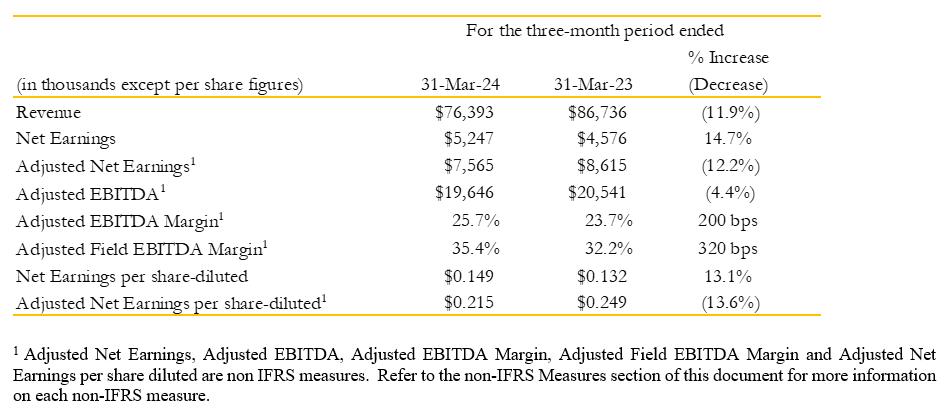

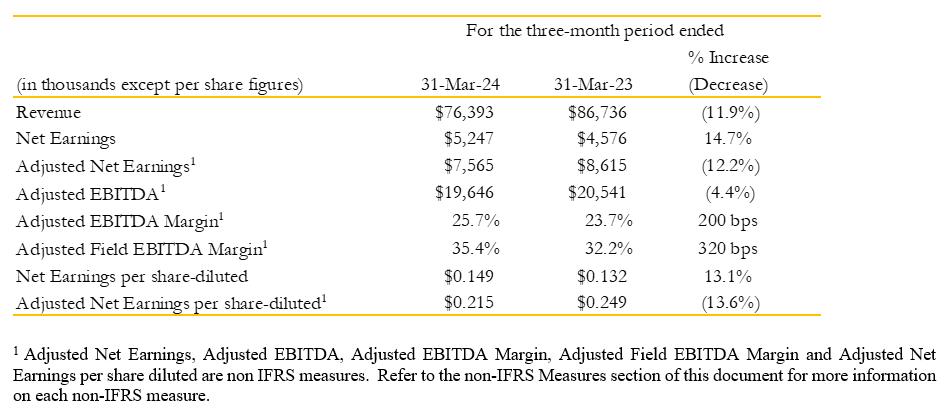

Profitability Metrics

Profitability metrics revealed a less positive story. While revenue increased, margins were squeezed significantly.

- Gross Margin: [Insert Actual Q1 2024 Gross Margin Percentage] – a [Percentage] decrease from Q4 2023 and a [Percentage] decrease/increase from Q1 2023. The decline is largely attributed to [Explain the reason for the decrease, e.g., increased raw material costs, price reductions].

- Operating Margin: [Insert Actual Q1 2024 Operating Margin Percentage] – demonstrating a [Percentage] decrease compared to Q4 2023 and a [Percentage] decrease/increase compared to Q1 2023. This reflects the pressure on profitability despite increased sales volume.

- Net Income: [Insert Actual Q1 2024 Net Income Figure Here] (USD) – a [Percentage] decrease compared to Q4 2023 and a [Percentage] decrease/increase compared to Q1 2023. This indicates a significant impact on Tesla's overall profitability.

Impact of Price Cuts

Tesla's aggressive price cuts, implemented strategically across various models, significantly impacted both sales volume and profitability.

- Price Reduction Details: [Specify the percentage and dollar amount of price cuts for each model]. These reductions aimed to boost sales volume in competitive markets and increase market share.

- Sales Volume Impact: The price cuts did result in a [Percentage] increase in sales volume for [Specific Models], although this came at the cost of reduced per-unit profit margins.

- Margin vs. Volume Trade-off: The decision highlighted a strategic trade-off between maximizing sales volume and maintaining higher profit margins per vehicle. This reflects the intensifying competition in the EV market.

The Political Landscape and its Influence on Tesla's Profitability

Government Regulations and Subsidies

The changing regulatory environment and shifts in government subsidies significantly influence Tesla’s operations globally.

- China Market: [Discuss specific regulatory changes or policy shifts in China and their impact on Tesla’s operations and sales].

- European Union: [Discuss regulations on emissions, battery sourcing, or other policies affecting Tesla's European operations].

- United States: [Discuss the impact of any changes to tax credits or other incentives for EV adoption in the US].

Geopolitical Risks and Supply Chain Disruptions

Geopolitical uncertainty and supply chain disruptions pose ongoing challenges to Tesla’s manufacturing and logistics.

- Raw Material Shortages: [Discuss any shortages impacting production, e.g., battery materials, specific metals].

- Logistics Delays: [Discuss any delays or disruptions in shipping or transportation due to political instability or trade restrictions].

- Factory Closures/Production Slowdowns: [Discuss any instances where political unrest or other geopolitical factors impacted Tesla's production facilities].

Public Relations and Negative Press

Negative press and PR challenges linked to political controversies have impacted Tesla's brand image and stock performance.

- Elon Musk's Twitter Activity: [Discuss the impact of Elon Musk's controversial tweets and statements on Tesla's public perception].

- Regulatory Scrutiny: [Discuss any ongoing investigations or regulatory actions affecting Tesla's reputation].

- Stock Price Volatility: [Analyze the correlation between negative news cycles and fluctuations in Tesla's stock price].

Competitive Landscape and Market Analysis

Increased Competition

The electric vehicle market is becoming increasingly crowded, posing challenges to Tesla’s dominance.

- Key Competitors: [List major competitors and their market share gains in Q1 2024].

- New Model Launches: [Mention the launch of significant competing EV models and their impact on Tesla's market position].

- Market Share Analysis: [Analyze Tesla's market share trends, both globally and in key markets, and compare it to its competitors].

Market Demand and Consumer Sentiment

Overall market demand for EVs continues to grow, but consumer sentiment towards specific brands can shift rapidly.

- EV Market Growth Rate: [Include data on overall EV market growth and predictions for future growth].

- Consumer Preferences: [Discuss factors influencing consumer preferences in the EV market, such as pricing, features, range, and brand reputation].

- Economic Factors: [Discuss the influence of economic conditions (inflation, recessionary fears) on consumer purchasing decisions for EVs].

Conclusion

Tesla's Q1 2024 financial results reveal a complex picture. While record deliveries demonstrated strong consumer demand, profitability suffered due to a combination of factors. The impact of price cuts, intensified competition, and significant political headwinds – including government regulations, geopolitical risks, and negative press – all played a substantial role in shaping the company's financial performance. The strategic trade-off between volume and margin underscores the challenges Tesla faces in navigating a rapidly evolving and politically charged environment. Going forward, Tesla's success will hinge on its ability to adapt to the changing regulatory landscape, manage supply chain vulnerabilities, and effectively address the challenges posed by increasingly fierce competition. Stay tuned for further analysis of Tesla's performance and how political factors continue to influence its future financial results. Follow us for updates on Tesla's Q2 2024 financial results and further insights into the evolving political landscape affecting the EV market.

Featured Posts

-

Ftc Investigates Open Ais Chat Gpt What This Means For Ai

Apr 24, 2025

Ftc Investigates Open Ais Chat Gpt What This Means For Ai

Apr 24, 2025 -

Elon Musks Doge Strategy Following Epa Action Against Tesla And Space X

Apr 24, 2025

Elon Musks Doge Strategy Following Epa Action Against Tesla And Space X

Apr 24, 2025 -

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025 -

Exec Office365 Breach Millions Made From Inbox Hacks Feds Report

Apr 24, 2025

Exec Office365 Breach Millions Made From Inbox Hacks Feds Report

Apr 24, 2025 -

White House Decrease In Individuals Apprehended At The U S Canada Border

Apr 24, 2025

White House Decrease In Individuals Apprehended At The U S Canada Border

Apr 24, 2025