The Dax And The Bundestag: Election Results And Market Reactions

Table of Contents

Historical Context: Past Election Results and DAX Performance

Analyzing historical data reveals a clear correlation between German federal elections and the subsequent performance of the DAX. By examining past election cycles, we can identify long-term trends and potential patterns influencing the DAX index. Studying the historical data allows for a more informed assessment of potential risks and opportunities during future elections.

- Examples of significant election years and their impact on the DAX: The 2005 election, which saw Angela Merkel become Chancellor, initially led to a period of market stability, followed by considerable growth. Conversely, periods of coalition negotiations and political uncertainty have often been accompanied by greater DAX volatility.

- Discussion of noticeable patterns or anomalies: While a consistent pattern is difficult to pinpoint due to the influence of global economic factors, historical data suggests that periods of political stability generally correlate with positive DAX performance, while periods of uncertainty tend to lead to increased market fluctuations.

- Mention of significant policy changes post-election and their market consequences: Significant policy shifts after elections, such as changes in tax laws or environmental regulations, can have a direct impact on specific sectors and the overall performance of the DAX. For example, the introduction of green energy policies might positively affect renewable energy companies but negatively impact traditional energy producers.

Analyzing the Current Political Landscape and Potential Market Impacts

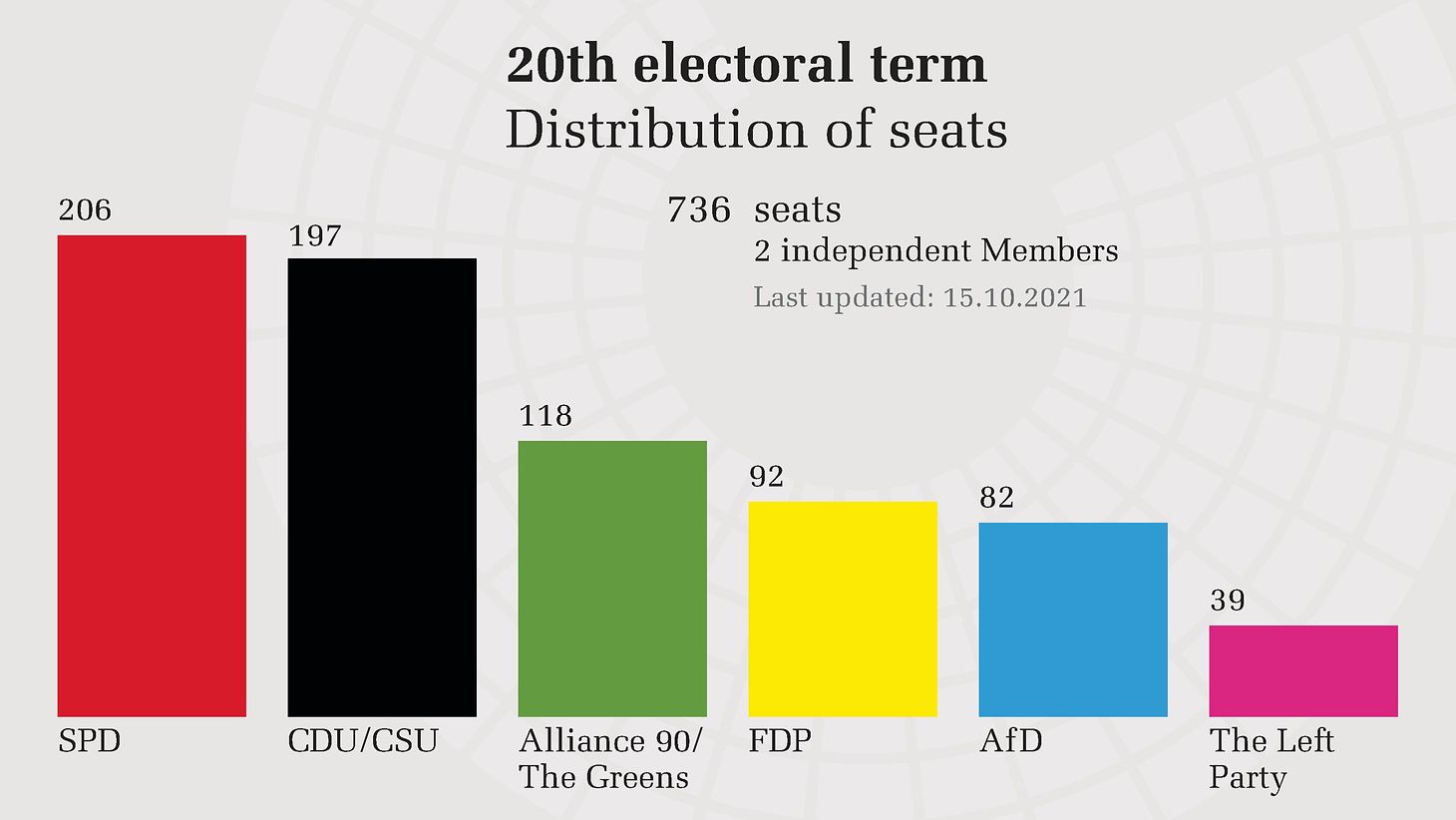

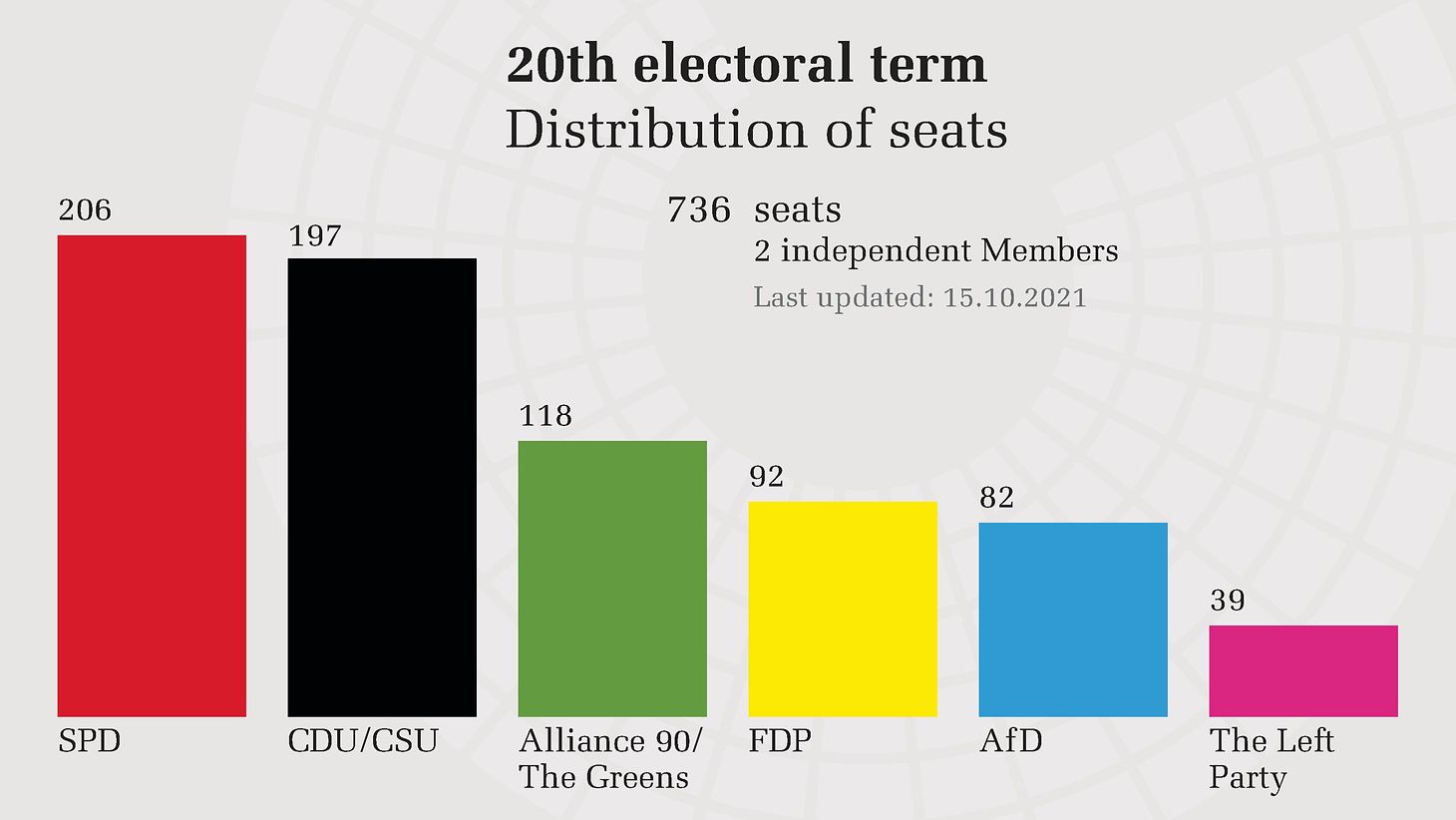

The current political landscape in Germany, with its diverse array of parties and potential coalition scenarios, presents a range of potential impacts on the DAX. Understanding the economic platforms of the main competing parties is vital for anticipating market reactions. Analyzing the potential coalition governments and their likely policies allows for a more accurate prediction of the post-election market environment.

- Summary of major party platforms relevant to the economy and markets: Each party has distinct positions on fiscal policy, taxation, environmental regulations, and social welfare programs, all of which can impact various sectors represented in the DAX. Carefully studying these platforms helps investors anticipate potential market shifts.

- Analysis of potential coalition governments and their likely economic policies: The formation of a coalition government can significantly alter the economic policy landscape. Different combinations of parties will likely result in varied approaches to economic issues, leading to distinct market outcomes.

- Assessment of the potential impact on key sectors (e.g., automotive, energy, technology): The automotive industry, a major component of the DAX, is particularly sensitive to governmental policies concerning emissions and environmental regulations. Similarly, energy and technology sectors can experience significant shifts depending on the government's focus on renewable energy, digitalization, and technological innovation.

Assessing the Level of Political Risk

The level of political uncertainty surrounding any election contributes to market volatility. Investors must acknowledge and manage the inherent political risk associated with the German elections. Understanding how to mitigate this risk is crucial for informed investment decisions.

- Discussion of factors contributing to political risk: Factors such as the potential for a hung parliament, lengthy coalition negotiations, and the introduction of unexpected policy changes can contribute to political uncertainty and market volatility.

- Strategies for mitigating political risk (diversification, hedging, etc.): Diversifying investments across various asset classes and sectors can help reduce portfolio risk. Hedging strategies, such as options trading, can also be employed to protect against potential market downturns.

- Recommendations for investors with different risk tolerances: Investors with higher risk tolerance might choose to maintain their current investment strategies, while more risk-averse investors may consider diversifying their portfolios or employing hedging strategies.

Post-Election Analysis: Interpreting Market Reactions

Following the election, carefully analyzing the DAX's reaction provides crucial insights into investor sentiment and expectations for the future. Monitoring key economic indicators helps gauge the long-term implications of the election results for the German economy.

- Explanation of how to interpret the immediate market response: An immediate positive market reaction might suggest investor confidence in the newly formed government's policies. Conversely, a negative reaction could signal concern about the potential economic impact of the election results.

- Discussion of factors influencing the long-term market impact: Long-term impacts are influenced by several factors, including the government's actual implementation of its policies, global economic conditions, and investor confidence.

- Key economic indicators to monitor post-election (e.g., GDP growth, inflation, unemployment): Monitoring these indicators provides a clearer picture of the government's success in achieving its economic goals and its overall impact on the DAX.

Conclusion

The Dax and the Bundestag are intrinsically linked. Understanding the historical impact of Bundestag elections on the DAX, analyzing the current political landscape, and interpreting post-election market reactions are crucial for informed investment decisions. The level of political risk associated with German elections needs careful consideration, and investors should employ appropriate risk management strategies.

To make sound investment decisions related to the Dax and the Bundestag election results, stay informed about German politics and economic developments. Conduct thorough research and consider subscribing to reputable financial news sources for up-to-date analyses of the Dax and its sensitivity to German political shifts. By actively monitoring the political and economic environment, you can better navigate the opportunities and challenges presented by the interplay between the Dax and the Bundestag.

Featured Posts

-

Dows Decision To Delay Canadian Project A Sign Of Market Instability

Apr 27, 2025

Dows Decision To Delay Canadian Project A Sign Of Market Instability

Apr 27, 2025 -

Government Appoints Vaccine Skeptic To Head Key Autism Vaccine Study

Apr 27, 2025

Government Appoints Vaccine Skeptic To Head Key Autism Vaccine Study

Apr 27, 2025 -

The Night Robert Pattinson Couldnt Sleep After Watching A Horror Film

Apr 27, 2025

The Night Robert Pattinson Couldnt Sleep After Watching A Horror Film

Apr 27, 2025 -

Ariana Grandes New Dip Dyed Ponytail For Swarovski

Apr 27, 2025

Ariana Grandes New Dip Dyed Ponytail For Swarovski

Apr 27, 2025 -

Ukraine Bombing Allegation Russian General Killed Near Moscow

Apr 27, 2025

Ukraine Bombing Allegation Russian General Killed Near Moscow

Apr 27, 2025