The Impact Of Reduced Non-Essential Spending On Credit Card Companies

Table of Contents

Decreased Transaction Volume and Revenue

Reduced non-essential spending directly translates to a decline in credit card transactions. This is a crucial factor impacting the profitability of credit card companies.

Lower Credit Card Spending

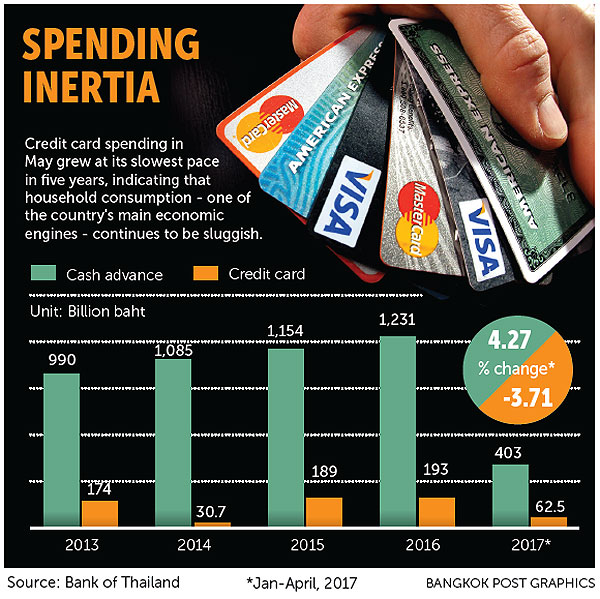

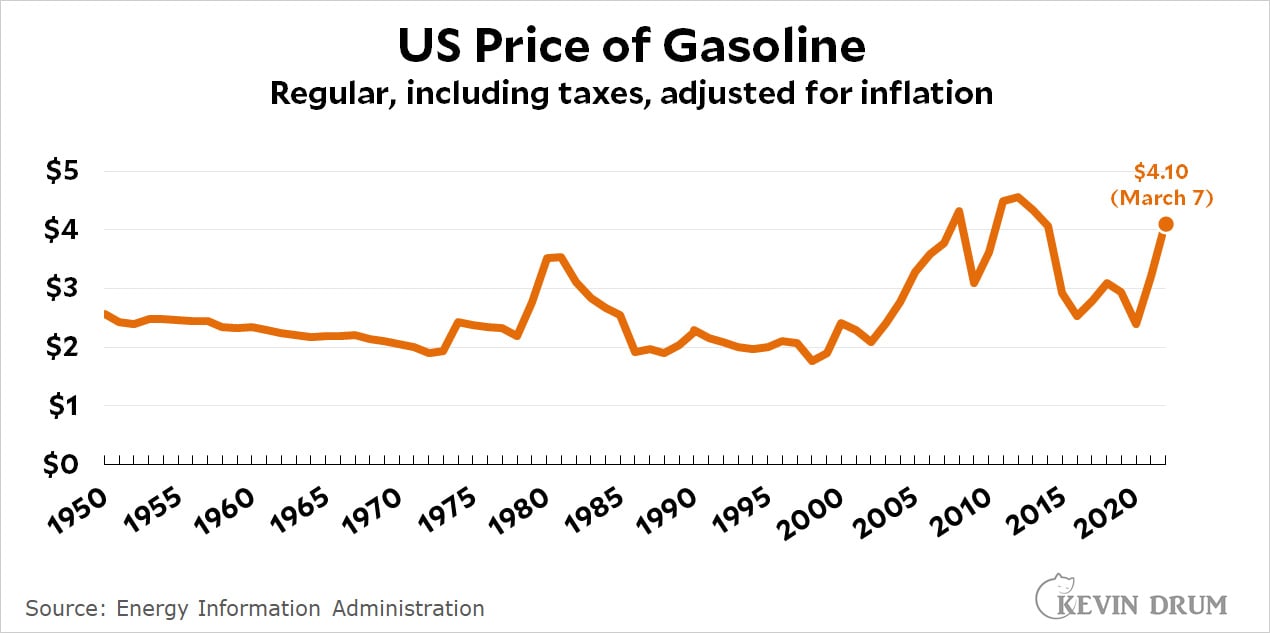

The correlation between reduced non-essential spending and lower credit card usage is undeniable. Consumers are cutting back on discretionary purchases, leading to a noticeable decrease in transaction volume.

- Examples of impacted spending areas: Dining out, entertainment (movies, concerts), travel (flights, hotels), and luxury goods are all experiencing significant reductions.

- Data on spending reductions: Recent reports show a double-digit percentage decrease in spending on non-essential items compared to pre-inflation levels. This directly translates into fewer credit card swipes and a decline in overall transaction value.

- Impact on credit card transaction fees: Credit card companies earn a significant portion of their revenue through transaction fees charged to merchants. Lower transaction volumes directly reduce these fees, impacting their bottom line.

Impact on Merchant Fees

Merchant fees represent a considerable portion of credit card companies' revenue. A decrease in overall spending leads to fewer merchant transactions, directly impacting this crucial revenue stream.

- Revenue models: Credit card companies generate revenue through several channels, including merchant fees (interchange fees), interest charges on outstanding balances, annual fees, and late payment fees. Merchant fees, however, are a cornerstone of their profitability.

- Significance of merchant fees: These fees represent a substantial portion of credit card companies' revenue. Any significant reduction in transaction volume directly impacts the revenue generated from this source.

- Potential for decreased profitability: The reduced transaction volume combined with lower merchant fees creates a scenario where credit card companies face decreased profitability and a need to explore alternative revenue streams.

Increased Credit Card Delinquency and Defaults

Reduced income and increased living costs are forcing consumers to prioritize essential spending, often leaving less disposable income to repay credit card debt. This leads to a rise in delinquency and defaults.

Financial Strain on Consumers

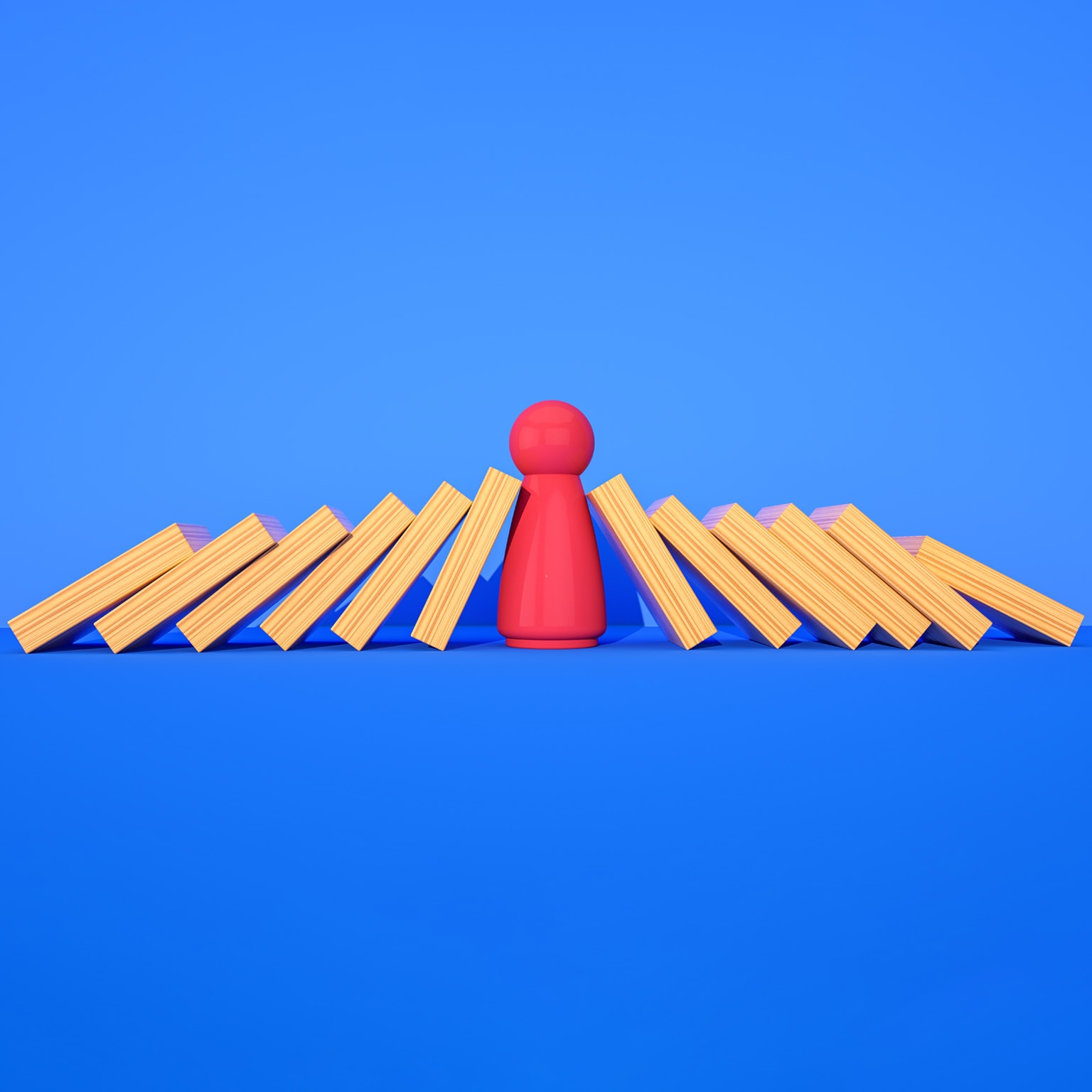

The combination of inflation, potential job losses, and rising interest rates is putting immense financial strain on consumers. Many are struggling to meet their monthly obligations, including credit card payments.

- Statistics on rising credit card delinquency rates: Recent data indicates a sharp increase in credit card delinquency rates, suggesting a growing number of consumers are falling behind on their payments.

- Connection between job losses and credit card defaults: Job losses often lead to decreased income, further exacerbating the problem and increasing the likelihood of credit card defaults.

- Impact of inflation on consumer debt: Inflation erodes purchasing power, making it more difficult for consumers to manage their existing debt levels, even with stable employment.

Rising Charge-Off Rates

Increased defaults result in higher charge-off rates for credit card companies. Charge-offs represent bad debts that are written off as irrecoverable.

- Definition of charge-off rates: Charge-off rates reflect the percentage of outstanding credit card debt that is deemed uncollectible.

- Financial consequences of increased charge-offs: Higher charge-off rates significantly impact credit card companies' profitability and financial stability. They represent a direct loss of revenue.

- Potential impact on credit scoring models: Increased defaults and charge-offs can also affect credit scoring models, making it more difficult for consumers to obtain future credit.

Strategic Responses by Credit Card Companies

Facing these challenges, credit card companies are adapting their strategies to mitigate the impact of reduced non-essential spending.

Adjusting Marketing Strategies

Credit card companies are shifting their marketing campaigns to focus on essential spending and attract customers with strong credit profiles.

- Examples of targeted marketing efforts: They may focus on promoting cards with cashback rewards on groceries or utilities, appealing to consumers prioritizing essential spending.

- Changes in rewards programs: Some companies are adjusting their rewards programs, focusing on rewards relevant to essential purchases rather than luxury items.

- Emphasis on responsible spending: Credit card companies are increasingly emphasizing responsible spending habits in their marketing materials to attract customers concerned about debt management.

Emphasis on Credit Building Products

Credit card companies are exploring new avenues to attract and retain customers, including offering products focused on credit building.

- Details on secured credit cards: Secured credit cards, which require a security deposit, are becoming more prominent as they help consumers build credit history.

- Credit-building apps: Many credit card companies are partnering with or developing credit-building apps and programs to assist consumers in improving their credit scores.

- Other financial products: Credit card companies are branching out, offering other financial products like personal loans and budgeting tools to diversify their revenue streams and cater to the changing needs of their customer base.

Long-Term Implications for the Credit Card Industry

Reduced non-essential spending has significant long-term implications for the credit card industry, potentially leading to industry consolidation and increased innovation.

Potential for Consolidation

The challenging economic climate may lead to mergers and acquisitions within the credit card industry as companies seek to improve profitability and gain market share.

- Examples of industry consolidation: We may see larger credit card companies acquiring smaller ones to achieve economies of scale and enhance their market position.

- Potential for increased competition: Consolidation could ultimately result in increased competition among the remaining larger players.

- Impact on consumer choice: The impact on consumers remains to be seen, as consolidation could lead to both benefits and drawbacks regarding product offerings and pricing.

Innovation in Credit Card Technology

To attract and retain customers, credit card companies are likely to invest heavily in innovative technologies.

- Examples of technological innovations: This includes advancements in mobile payment systems, personalized rewards programs, and enhanced fraud detection measures.

- Improved customer experience: Investing in technology can improve the overall customer experience, leading to greater customer satisfaction and retention.

- Enhanced security measures: New technologies are crucial in combating fraud and protecting consumer data, maintaining trust in the credit card system.

Conclusion

Reduced non-essential spending has a profound and multifaceted impact on the credit card industry. Lower transaction volumes, increased delinquency rates, and evolving consumer behavior are forcing credit card companies to adapt their strategies. Understanding the effects of reduced non-essential spending is crucial for both consumers and businesses. Continue your research on this evolving topic and learn more about responsible credit management and the changing landscape of the credit card industry.

Featured Posts

-

Ella Bleu Travolta Transformacija U Prekrasnu Mladu Zenu

Apr 24, 2025

Ella Bleu Travolta Transformacija U Prekrasnu Mladu Zenu

Apr 24, 2025 -

Why Investing In Middle Management Improves Company Performance

Apr 24, 2025

Why Investing In Middle Management Improves Company Performance

Apr 24, 2025 -

Newsoms Call To Action Addressing Californias High Gas Prices Through Industry Collaboration

Apr 24, 2025

Newsoms Call To Action Addressing Californias High Gas Prices Through Industry Collaboration

Apr 24, 2025 -

Immigration Crackdown The Trump Administrations Legal Setbacks

Apr 24, 2025

Immigration Crackdown The Trump Administrations Legal Setbacks

Apr 24, 2025 -

Navigate The Private Credit Boom 5 Essential Dos And Don Ts For Job Seekers

Apr 24, 2025

Navigate The Private Credit Boom 5 Essential Dos And Don Ts For Job Seekers

Apr 24, 2025