The Implications Of TikTok's "Just Contact Us" Tariff Advice

Table of Contents

The Risks of Informal Tariff Advice

Relying on informal advice from social media platforms like TikTok regarding tariffs carries significant risks. Incorrectly classifying goods or failing to adhere to specific import regulations can result in hefty fines, delays, and legal issues, ultimately harming a business's bottom line and reputation. Understanding TikTok tariffs and their implications is crucial for avoiding these pitfalls.

- Incorrect tariff classification leading to significant financial penalties: Misclassifying your goods can lead to substantial fines, often far exceeding the initial import cost. Customs authorities use a highly specific classification system (the Harmonized System or HS Code) and inaccuracies are costly.

- Failure to comply with customs regulations resulting in delayed shipments or seized goods: Non-compliance can cause significant delays, holding up your shipments indefinitely. In worse cases, goods can be seized entirely, resulting in total loss of inventory and revenue.

- Legal repercussions for non-compliance with import laws: Import regulations are complex and vary by country. Non-compliance can lead to legal action, including fines, lawsuits, and even criminal charges.

- Damage to brand reputation due to customs issues: Public knowledge of customs violations can severely damage a company's reputation, impacting future sales and investor confidence. This is particularly relevant for businesses selling via TikTok, where transparency is key.

- Increased operational costs due to resolving tariff disputes: Resolving disputes with customs authorities is time-consuming and expensive, adding unnecessary burdens to your business.

- Loss of market access due to import violations: Repeated violations can lead to suspension or denial of import privileges, effectively locking you out of key markets.

The Importance of Professional Tariff Advice

Businesses engaged in international trade should prioritize seeking professional advice from customs brokers, import consultants, or trade lawyers. Their expertise ensures compliance, minimizes risks, and protects against costly errors related to TikTok tariffs and other import challenges.

- Access to accurate and up-to-date tariff information: Professionals stay abreast of constantly changing import regulations and tariff schedules.

- Assistance with customs documentation and procedures: They handle the complex paperwork and procedures, ensuring accuracy and efficiency.

- Professional guidance on tariff classification: They ensure your goods are classified correctly under the Harmonized System (HS Code), minimizing the risk of penalties.

- Risk assessment and mitigation strategies: They identify potential risks and develop strategies to mitigate them, protecting your business from unforeseen issues.

- Representation in case of customs audits or disputes: They represent your company in audits or disputes with customs authorities, protecting your interests.

- Compliance with all relevant regulations: They ensure your business adheres to all relevant import regulations, minimizing the risk of penalties and legal action.

Finding Reliable Tariff Information Sources

Accessing reliable and official resources for tariff information is crucial. Avoid relying solely on unofficial channels, and always verify information from multiple credible sources. Understanding the intricacies of TikTok tariffs requires diligent research.

- Utilize official government websites for import regulations: Each country's customs agency provides detailed information on import regulations and tariffs.

- Consult reputable trade associations for industry-specific guidance: Trade associations often provide valuable insights and resources specific to your industry.

- Employ specialized tariff databases for accurate HS Code lookups: These databases offer precise classification information, reducing the risk of errors.

- Understand the Harmonized System (HS) for proper product classification: The HS Code is a globally standardized system for classifying traded products; understanding it is essential for accurate tariff calculation.

Strategies for Navigating TikTok’s Tariff Landscape

While using TikTok for marketing, businesses must implement proactive measures to navigate the complexities of international trade and ensure compliance with tariff regulations. Understanding the nuances of TikTok tariffs is vital for long-term success.

- Conduct thorough due diligence before launching international sales: Research import regulations, tariff rates, and customs procedures thoroughly before beginning sales.

- Develop a robust import strategy that incorporates tariff considerations: Your strategy should include a detailed plan for tariff classification, documentation, and compliance.

- Partner with reliable logistics providers experienced in international shipping: Choose providers with a proven track record in handling international shipments and navigating customs procedures.

- Implement risk management measures to protect against tariff-related issues: This includes contingency planning for potential delays, disputes, or penalties.

- Regularly review and update your import processes to comply with evolving regulations: Import regulations change frequently; stay informed and adapt your processes accordingly.

Conclusion

TikTok's simplistic "just contact us" approach to tariff advice is insufficient and potentially dangerous for businesses engaging in cross-border e-commerce. Relying on such casual guidance exposes companies to significant financial and legal risks. The implications of overlooking proper TikTok tariff implications can be severe. Don't gamble with your business's future. Seek professional advice on import tariffs and navigate the complexities of international trade with confidence. Properly understanding and adhering to all import regulations is essential for long-term success in global markets. Invest in expert guidance to mitigate risk and achieve sustainable growth in your international business endeavors.

Featured Posts

-

Ukraine Conflict Trumps Plan And Kyivs Critical Decision

Apr 22, 2025

Ukraine Conflict Trumps Plan And Kyivs Critical Decision

Apr 22, 2025 -

Mapping The Rise Of New Business Hubs Across The Nation

Apr 22, 2025

Mapping The Rise Of New Business Hubs Across The Nation

Apr 22, 2025 -

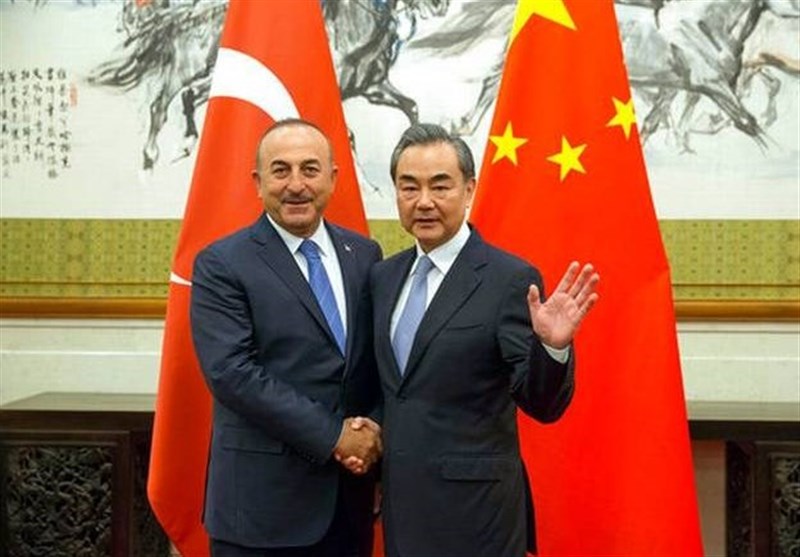

Boosting Security Cooperation China And Indonesia

Apr 22, 2025

Boosting Security Cooperation China And Indonesia

Apr 22, 2025 -

English Language Leaders Debate Top 5 Economic Impacts Highlighted

Apr 22, 2025

English Language Leaders Debate Top 5 Economic Impacts Highlighted

Apr 22, 2025 -

Technical Glitch Forces Blue Origin To Cancel Rocket Launch

Apr 22, 2025

Technical Glitch Forces Blue Origin To Cancel Rocket Launch

Apr 22, 2025