The Private Credit Job Market: 5 Essential Dos And Don'ts

Table of Contents

DO: Network Strategically

Building a strong professional network is paramount in the private credit job market. It's not just about who you know, but about how effectively you leverage those connections.

Leverage LinkedIn Effectively.

Your LinkedIn profile is your digital resume. Optimize it with relevant keywords like private credit, distressed debt, credit analysis, private equity, alternative lending, direct lending, and investment management.

- Keyword Optimization: Integrate keywords naturally throughout your profile summary, experience section, and skills section.

- Active Engagement: Participate in relevant groups, share insightful articles and industry news, and comment on posts to increase your visibility.

- Targeted Connections: Connect with recruiters specializing in private credit placements and professionals working at firms you admire.

Attend Industry Events.

Networking events are invaluable for making personal connections and learning about unadvertised opportunities.

- Key Conferences: Target conferences like SuperReturn, PEI events, and smaller, niche conferences focused on private debt or alternative credit strategies.

- Prepared Talking Points: Develop concise and compelling talking points that highlight your skills and experience relevant to private credit, including any experience with distressed debt analysis or other specialized areas.

- Follow Up: Always follow up with meaningful connections made at these events within 24-48 hours.

Informational Interviews are Crucial.

Informational interviews provide invaluable insights and help build relationships.

- Reach Out Proactively: Don't be afraid to reach out to professionals in private credit for informational interviews, even if you don't have a direct connection.

- Genuine Interest: Show genuine interest in their experiences and career paths within the private credit industry.

- Relationship Building: These interviews can lead to future opportunities or referrals.

DON'T: Neglect Your Resume and Cover Letter

Your resume and cover letter are your first impression. A generic application won't cut it in this competitive market.

Tailor Your Resume for Each Application.

Don't use a generic resume. Customize each one to highlight the skills and experience most relevant to the specific job description.

- Keyword Optimization: Include relevant keywords from the job posting.

- Quantifiable Achievements: Quantify your achievements whenever possible (e.g., "increased portfolio returns by 15%," "managed a portfolio of $XX million").

- Targeted Skills: Showcase skills directly related to private credit, such as financial modeling, credit analysis, and deal structuring.

Generic Cover Letters Won't Cut It.

Each cover letter should be personalized to the specific firm and role.

- Research the Firm: Demonstrate your understanding of the firm's investment strategy and culture.

- Explain Your Interest: Clearly articulate why you're interested in that specific firm and that specific role within private credit.

- Showcase Passion: Express your genuine passion for the private credit industry and its unique challenges.

DO: Develop Specialized Skills

The private credit industry demands a specific skill set. Continuous learning and development are essential.

Master Financial Modeling.

Proficiency in Excel and financial modeling software is non-negotiable.

- Advanced Modeling: Practice building complex models related to credit analysis, valuation, and leveraged buyouts (LBOs).

- Case Studies: Showcase your skills through personal projects and case studies.

- Software Proficiency: Demonstrate expertise in relevant software like Argus, Bloomberg Terminal, and Capital IQ.

Understand Credit Analysis and Underwriting.

A deep understanding of credit risk assessment and financial statement analysis is crucial.

- Credit Risk Assessment: Master techniques for evaluating creditworthiness, including financial ratio analysis and cash flow projections.

- Debt Structuring: Understand different debt structures and their implications for risk and return.

- Relevant Certifications: Consider pursuing relevant certifications, such as the CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst).

Stay Updated on Market Trends.

The private credit landscape is constantly evolving.

- Industry News: Follow industry news and publications (e.g., Private Equity International, PEI Media) closely.

- Market Conditions: Understand current market conditions and their impact on private credit investment strategies.

- Diverse Strategies: Demonstrate knowledge of various private credit strategies, including direct lending, mezzanine financing, and distressed debt.

DON'T: Underestimate the Importance of Soft Skills

Technical skills are only part of the equation. Strong soft skills are equally important.

Communication is Key.

Clear and concise communication is essential in conveying complex financial information.

- Written and Verbal Communication: Develop excellent written and verbal communication skills.

- Professionalism: Maintain a professional demeanor throughout the interview process.

- Confidence: Project confidence in your abilities and knowledge of private credit.

Teamwork and Collaboration are Essential.

Private credit often involves collaborative efforts.

- Teamwork Experience: Highlight your ability to work effectively in a team environment, providing specific examples.

- Contribution to Success: Demonstrate your ability to contribute to a team's overall success and goals.

- Conflict Resolution: Demonstrate your skills in navigating and resolving conflicts within a team setting.

DO: Prepare Thoroughly for Interviews

Thorough preparation is key to succeeding in private credit job interviews.

Research the Firm and the Interviewers.

Go beyond the company website. Understand the firm's investment strategy, portfolio, and culture.

- Interviewer Research: Research the interviewers on LinkedIn to understand their backgrounds and expertise.

- Insightful Questions: Prepare insightful questions to ask during the interview, demonstrating your genuine interest.

- Industry Knowledge: Demonstrate a strong understanding of current market trends and their impact on the private credit industry.

Practice Your Responses to Common Interview Questions.

Prepare for both behavioral and technical questions.

- Behavioral Questions: Use the STAR method (Situation, Task, Action, Result) to structure your answers to behavioral questions.

- Technical Questions: Practice answering technical questions related to financial modeling, credit analysis, and valuation.

- Mock Interviews: Conduct mock interviews to refine your responses and build confidence.

Conclusion

Securing a position in the competitive private credit job market requires a strategic and multifaceted approach. By following these dos and don'ts – focusing on strategic networking, impeccable application materials, specialized skills, strong soft skills, and thorough interview preparation – you can significantly increase your chances of success. Don't delay; start optimizing your private credit job search today!

Featured Posts

-

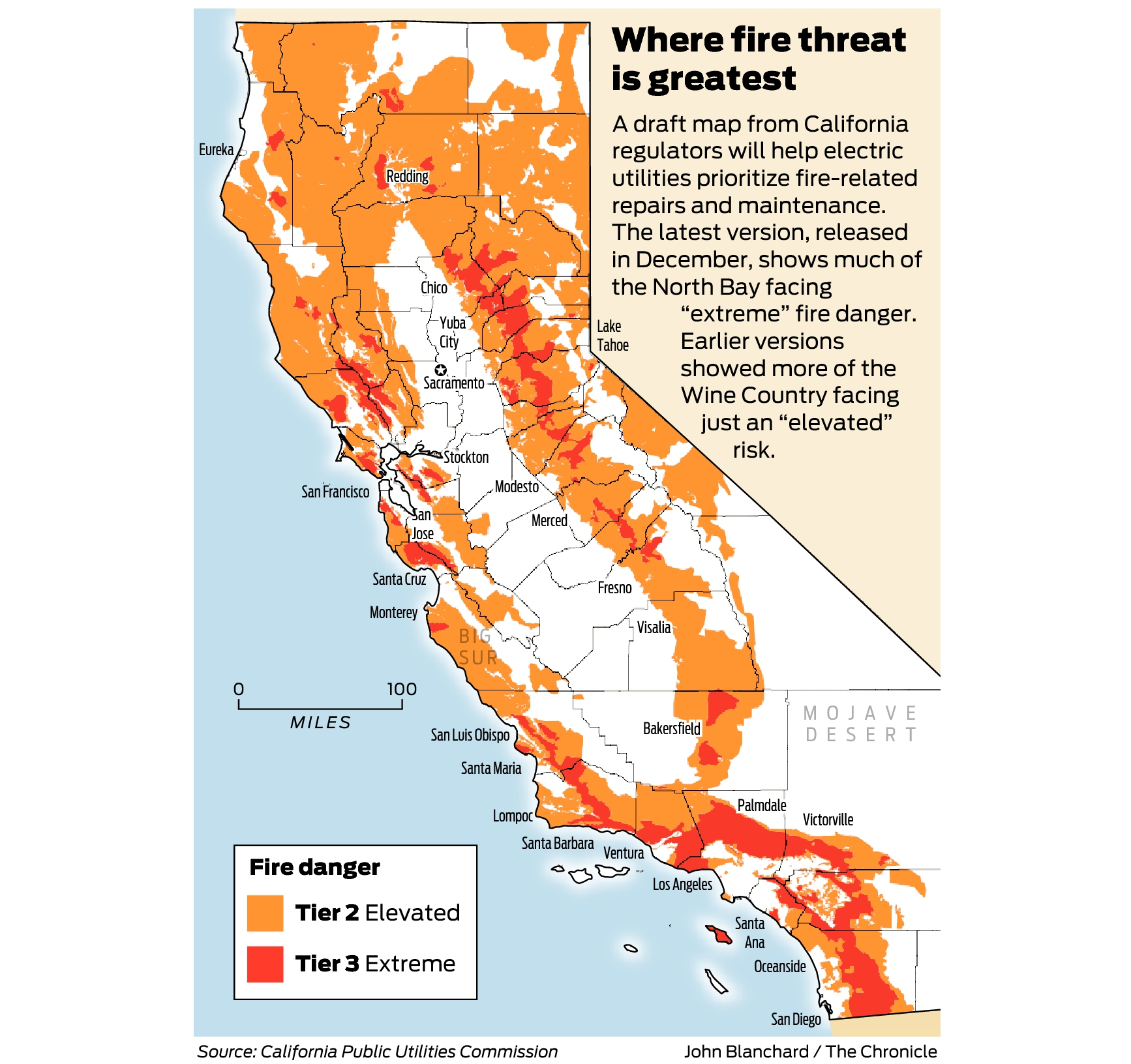

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 24, 2025

Full List Celebrities Affected By The Palisades Fires In Los Angeles

Apr 24, 2025 -

60 Minutes Executive Producer Resigns Amidst Trump Lawsuit Fallout

Apr 24, 2025

60 Minutes Executive Producer Resigns Amidst Trump Lawsuit Fallout

Apr 24, 2025 -

The Paradox Of Pope Francis Global Reach Internal Divisions

Apr 24, 2025

The Paradox Of Pope Francis Global Reach Internal Divisions

Apr 24, 2025 -

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience

Apr 24, 2025

Miami Steakhouse John Travoltas Pulp Fiction Culinary Experience

Apr 24, 2025 -

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Capitol Attack

Apr 24, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Detail Capitol Attack

Apr 24, 2025