Today's Stock Market: Dow Futures, Dollar, And Trade War Impacts

Table of Contents

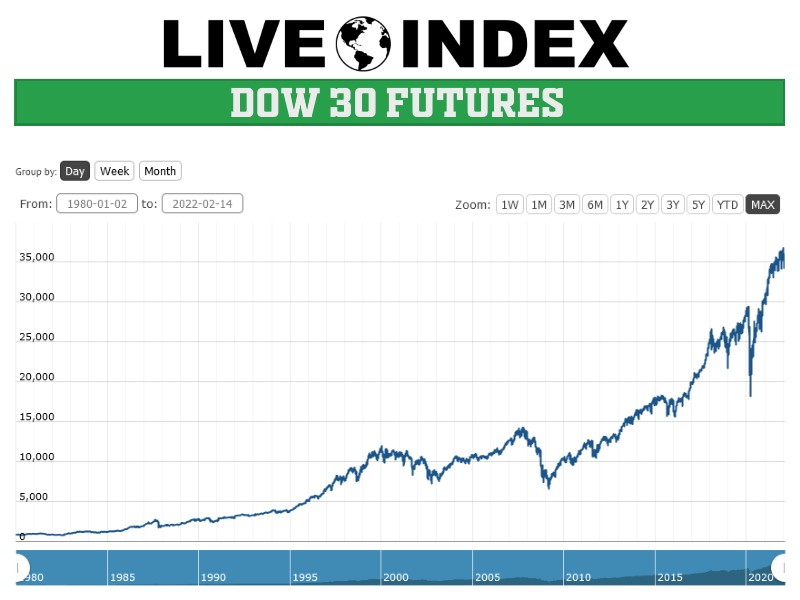

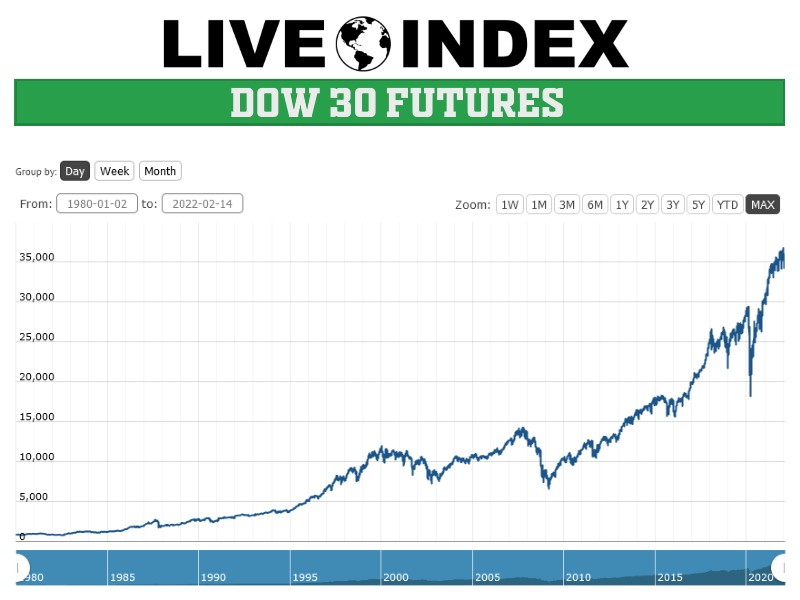

Dow Futures: A Leading Indicator

Dow futures contracts represent an agreement to buy or sell the Dow Jones Industrial Average at a predetermined price on a future date. They serve as a significant predictor of market performance, offering insights into investor sentiment and potential future price movements. Recent trends in Dow futures have shown considerable fluctuation, reflecting uncertainty about the economy's trajectory.

- Factors influencing Dow futures: Economic data releases (like employment numbers and inflation reports), geopolitical events (such as international conflicts or political instability), and corporate earnings announcements all significantly impact Dow futures pricing. Unexpected events can trigger dramatic shifts in futures prices, signaling potential changes in the broader market.

- Analyzing charts and interpreting Dow futures price movements: Traders carefully examine charts, looking for patterns and trends to anticipate directional shifts. A consistent upward trend in Dow futures often suggests a bullish outlook for the DJIA, while a downward trend indicates bearish sentiment.

- Relationship between Dow futures and the actual Dow Jones Industrial Average: While Dow futures don't perfectly mirror the actual DJIA, they provide a strong indication of its anticipated direction. A significant divergence between futures and the actual index warrants careful consideration, often suggesting potential market corrections or surprises. Analyzing this relationship is crucial for informed investment decisions in the stock market today. Understanding the dynamics of futures trading is essential for navigating "Today's Stock Market."

The US Dollar's Role in Global Markets

The US dollar's value plays a crucial role in shaping global markets. Generally, there's an inverse relationship between the US dollar's strength and global stock markets. A strong dollar makes US assets more expensive for foreign investors, potentially reducing demand and putting downward pressure on stock prices. Conversely, a weaker dollar can boost US exports and increase demand for US assets.

- Impact of interest rate changes on the dollar's value: Interest rate hikes by the Federal Reserve tend to strengthen the dollar, attracting foreign investment seeking higher returns. Lower interest rates can weaken the dollar.

- The effect of a strong dollar on import/export businesses: A strong dollar makes imports cheaper but exports more expensive, potentially hurting US companies heavily reliant on international sales. This impact varies widely across different sectors.

- Influence of geopolitical factors on the dollar's strength: Global uncertainty and political instability can drive investors to seek the perceived safety of the US dollar, leading to its strengthening. Conversely, positive global economic news may weaken the dollar. Keeping a close eye on the Forex market is key to understanding the impact on "Today's Stock Market."

Trade War Impacts on Stock Market Performance

Ongoing trade disputes significantly influence stock market performance. Tariffs and trade restrictions disrupt global supply chains, increase costs for businesses, and create uncertainty that impacts investor sentiment. This uncertainty leads to market volatility.

- Specific examples of industries affected by trade wars: The agriculture sector and technology companies have been particularly affected by recent trade wars. Tariffs on imported goods can increase prices for consumers and reduce the competitiveness of domestic industries.

- The impact of trade uncertainty on business investment and consumer confidence: Uncertainty surrounding trade policies can discourage business investment and dampen consumer spending, leading to slower economic growth and potentially impacting stock prices negatively.

- Strategies for mitigating trade war risks in an investment portfolio: Diversification across different sectors and geographies can help mitigate the impact of trade wars on an investment portfolio. Careful research and understanding of the specific companies and industries affected is crucial. Analyzing risk factors is critical for effective management of your investments in "Today's Stock Market."

Conclusion

Today's stock market is intricately linked to Dow futures, the US dollar's strength, and the consequences of ongoing trade wars. These factors are interconnected and influence each other, creating a complex environment for investors. Understanding their interplay is vital for making informed decisions. The key takeaway is the need to stay vigilant and well-informed.

Regularly checking for updates on Dow futures, dollar movements, and trade news is crucial for navigating "Today's Stock Market" effectively. Consult reputable financial news websites and economic analysis resources to stay updated on the latest developments and make intelligent investment choices. Staying informed is crucial for navigating the complexities of "Today's Stock Market" successfully.

Featured Posts

-

Anti Trump Protests Sweep The Us Hear Their Stories

Apr 22, 2025

Anti Trump Protests Sweep The Us Hear Their Stories

Apr 22, 2025 -

Stock Market Today Dow Futures Fall Dollar Weakens Amid Trade Tensions

Apr 22, 2025

Stock Market Today Dow Futures Fall Dollar Weakens Amid Trade Tensions

Apr 22, 2025 -

Mapping The Rise Of New Business Hubs Across The Nation

Apr 22, 2025

Mapping The Rise Of New Business Hubs Across The Nation

Apr 22, 2025 -

Anchor Brewing Company To Shutter A Legacy Concludes After 127 Years

Apr 22, 2025

Anchor Brewing Company To Shutter A Legacy Concludes After 127 Years

Apr 22, 2025 -

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 22, 2025

Ftc To Appeal Microsoft Activision Merger Ruling

Apr 22, 2025