Trump Affirms Powell's Continued Role As Fed Chair

Table of Contents

The Significance of the President's Affirmation of Powell as Fed Chair

The President's decision to retain Jerome Powell as Fed Chair carries immense weight. It's a powerful statement impacting market confidence and investor sentiment. Had the President opted for a replacement, the potential for market volatility would have been significant. The affirmation signals a commitment to continuity in monetary policy leadership—a crucial factor for economic stability.

- Market Volatility Avoided: A change in Fed Chair often leads to uncertainty, potentially causing significant stock market fluctuations and impacting investor confidence. The decision to keep Powell avoids this risk.

- Continuity in Monetary Policy: Consistent leadership at the Federal Reserve ensures a more predictable approach to managing interest rates and inflation. Sudden shifts in policy can disrupt economic growth.

- Managing Inflation and Interest Rates: The Fed Chair plays a critical role in controlling inflation and setting interest rates, directly affecting borrowing costs for businesses and consumers. Powell's experience is valuable in this regard.

- Historical Precedents: History shows that replacing Fed Chairs can have unpredictable economic consequences. While presidents have the authority to appoint, choosing stability often benefits the economy in the long run.

Powell's Performance and Policies under Scrutiny

Jerome Powell's tenure as Fed Chair has been marked by several key policy decisions. His approach to monetary policy, particularly regarding interest rate hikes, has been a subject of both praise and criticism.

- Interest Rate Hikes: Under Powell's leadership, the Federal Reserve implemented a series of interest rate hikes aimed at controlling inflation. These decisions have had a significant impact on borrowing costs and economic activity.

- Inflation Management: The effectiveness of these policies in managing inflation remains a subject of debate among economists. Some argue that the rate hikes were necessary, while others criticize their potential to stifle economic growth.

- Criticisms of Powell's Approach: Some critics have argued that Powell's policies were too slow to address inflation or that they prioritized fighting inflation over promoting employment.

- Economic Climate During Powell's Term: Powell's leadership coincided with periods of both robust economic growth and significant economic challenges, including the COVID-19 pandemic and subsequent recovery.

Potential Implications for the US Economy

Powell's continued tenure holds significant implications for the US economy, both in the short term and long term. The impact will ripple through various sectors.

- Stock Market Impact: The affirmation of Powell is generally viewed positively by the stock market, signaling stability and predictability. However, the actual market reaction will depend on upcoming economic data and policy decisions.

- Job Growth and Unemployment: The Fed's monetary policies directly influence employment levels. Powell's approach will continue to shape the job market, impacting unemployment rates and overall economic growth.

- Inflation and Consumer Spending: Controlling inflation is a key objective of the Federal Reserve. Powell's strategies will significantly affect consumer spending and price stability.

- Economist Predictions: Economists offer varied predictions on the future trajectory of the US economy under Powell's continued leadership. These forecasts provide insights into potential challenges and opportunities.

Political Considerations and the President's Decision

The President's decision to retain Powell wasn't solely based on economic considerations; political factors played a role.

- Political Pressure: The President faced various political pressures, potentially influencing his final decision. These pressures could have originated from within his own party or from external stakeholders.

- Past Criticism of Powell: Trump had previously been highly critical of Powell's monetary policy decisions, adding an extra layer of complexity to this decision.

- Impact on Presidential Legacy: The decision to retain or replace Powell could have significant implications for Trump's legacy. A successful economy could bolster his reputation, while economic difficulties might negatively impact it.

- White House-Federal Reserve Relationship: The relationship between the White House and the Federal Reserve is always complex, with the President having the authority to appoint, but the Fed operating with a degree of independence.

Conclusion

President Trump's decision to retain Jerome Powell as Federal Reserve Chair has significant implications for the US economy. This affirmation signifies a commitment to continuity in monetary policy, potentially promoting stability and reducing market volatility. Powell's leadership will continue to shape interest rates, inflation, and employment levels, impacting various sectors of the US economy. While the political considerations surrounding this decision are complex, the overall effect on market confidence and economic predictability is notable. Trump's choice to maintain Powell as Fed Chair could prove to be a stabilizing influence on the US economic landscape.

Call to Action: Stay informed about developments regarding the Federal Reserve and the US economy. Follow reputable financial news outlets and economic commentators for updates on the Trump and Powell relationship and its ongoing impact on the Federal Reserve Chair and monetary policy. Stay tuned for further updates on the impact of the affirmation of Powell as Fed Chair on the US economy.

Featured Posts

-

Legal Battles Hamper Trumps Immigration Enforcement

Apr 24, 2025

Legal Battles Hamper Trumps Immigration Enforcement

Apr 24, 2025 -

Los Angeles Palisades Fire A List Of Celebrities Who Lost Homes

Apr 24, 2025

Los Angeles Palisades Fire A List Of Celebrities Who Lost Homes

Apr 24, 2025 -

Elon Musks Doge Strategy Following Epa Action Against Tesla And Space X

Apr 24, 2025

Elon Musks Doge Strategy Following Epa Action Against Tesla And Space X

Apr 24, 2025 -

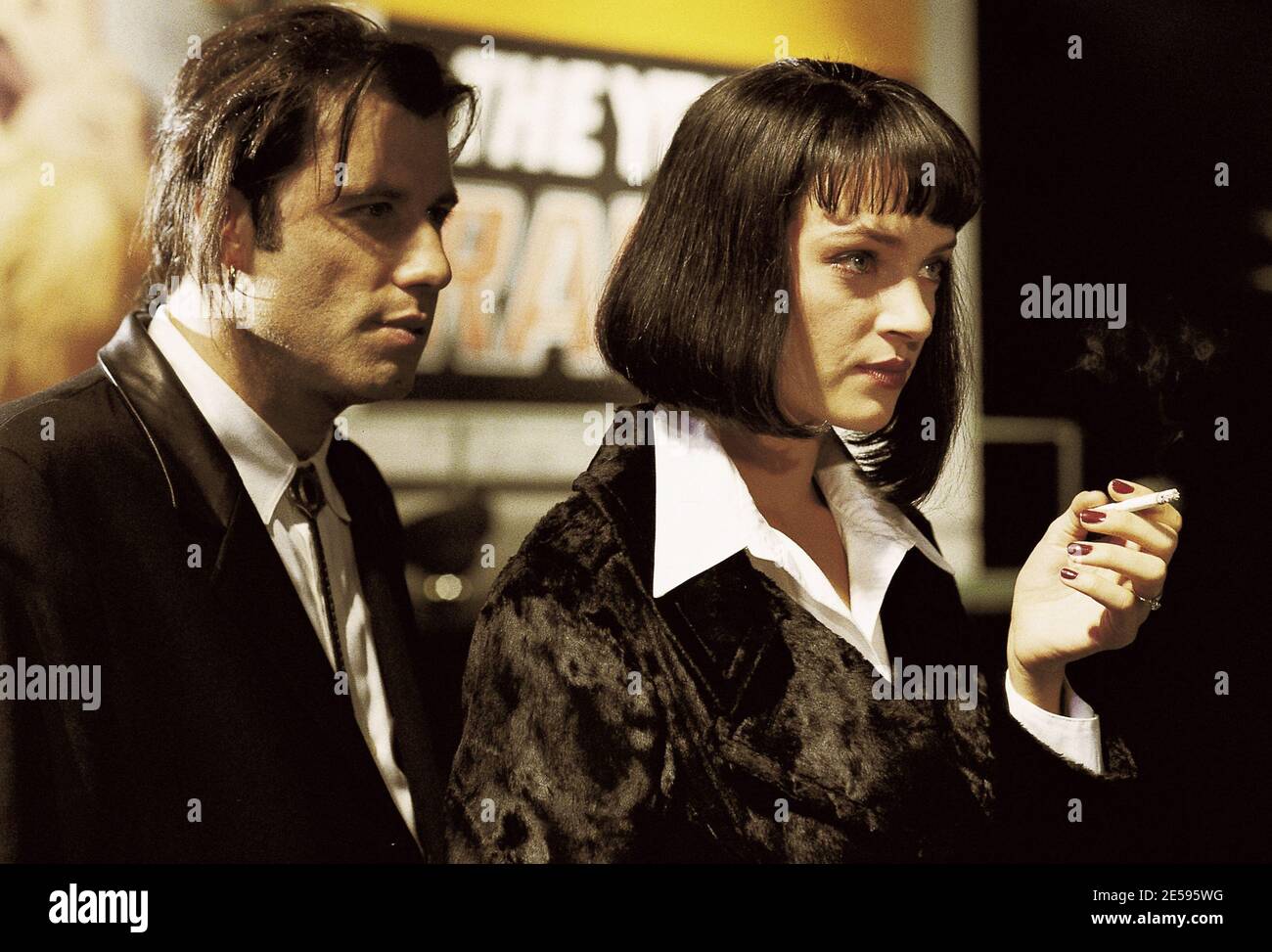

Video John Travolta Indulges In A Pulp Fiction Steak In Miami

Apr 24, 2025

Video John Travolta Indulges In A Pulp Fiction Steak In Miami

Apr 24, 2025 -

Nba Probe Into Ja Morant Incident What We Know So Far

Apr 24, 2025

Nba Probe Into Ja Morant Incident What We Know So Far

Apr 24, 2025