Trump Rejects Calls To Dismiss Federal Reserve Chair Powell

Table of Contents

The Reasons Behind Calls for Powell's Dismissal

The calls to dismiss Jerome Powell stemmed from a combination of economic criticism and accusations of political bias. Understanding these factors is crucial to grasping the intensity of the debate surrounding the "Trump Powell Dismissal" issue.

Criticism of Interest Rate Hikes

A primary source of discontent towards Powell centered on his interest rate hikes. Critics argued that these increases, aimed at curbing inflation, negatively impacted economic growth.

- Inflationary pressures: While inflation did reach decades-high levels, critics argued that Powell's aggressive rate hikes were overly drastic and contributed to slowing economic growth, potentially leading to a recession.

- Unemployment impact: Concerns were raised about the potential for increased unemployment as a result of the tightening monetary policy. Data on job losses in specific sectors was often cited to support these claims.

- GDP growth slowdown: Critics pointed to slower GDP growth figures as evidence that Powell's policies were stifling economic expansion. Comparisons were often made to GDP growth under previous Fed Chairs.

- Specific Policies: The implementation of quantitative tightening (QT), a policy to reduce the Federal Reserve's balance sheet, was specifically targeted as a factor negatively impacting the economy.

- Trump's Criticism: Former President Trump frequently and vocally criticized Powell's interest rate policies, directly linking them to the perceived weakening of the economy and blaming them for hindering his political agenda.

Allegations of Political Bias

Beyond economic criticisms, accusations of political bias against Powell surfaced. These allegations tapped into the highly charged political climate and raised concerns about the neutrality of the Federal Reserve.

- Potential Conflicts of Interest: While no concrete evidence of conflicts of interest emerged, some critics implied a potential bias due to Powell's background and past associations.

- Perceived Lack of Political Neutrality: Certain policy decisions were interpreted by some as favoring one political party over another, fueling accusations of a lack of political impartiality.

- Counterarguments: Many economists strongly defended Powell's independence, emphasizing the Fed's mandate to maintain price stability and full employment, irrespective of political pressures. The historical independence of the Federal Reserve was frequently highlighted as a key factor in maintaining a stable economy.

Trump's Rejection and Its Significance

Former President Trump's rejection of calls to dismiss Powell carries significant political and economic ramifications. The "Trump Powell Dismissal" non-event offers valuable insights into the delicate balance between political influence and economic stability.

Political Ramifications

Trump's decision to retain Powell, despite his previous criticisms, has significant political implications.

- Republican Party Unity: The stance on Powell’s leadership remained a point of division within the Republican party, and Trump's decision impacted the party’s image and unity on economic issues.

- Future Presidential Elections: Trump’s position on Powell, and the broader economic policies debated in the “Trump Powell Dismissal” context, potentially played a role in shaping his future political strategy and appeal to voters.

- Executive-Federal Reserve Relationship: Trump's decision, despite his past criticisms, set a precedent for the relationship between future presidents and the Federal Reserve Chair, setting the tone for how much direct political influence will be exerted.

Economic Implications

Maintaining Powell at the helm of the Federal Reserve carries considerable economic implications for the US and the global economy.

- Market Reactions: The stock market and other financial indicators responded positively to the news that Powell would remain in his position, indicating a preference for continuity and stability within the central bank.

- Investor Confidence: The continued leadership of Powell provided a degree of certainty and increased investor confidence in the stability of US monetary policy.

- International Perceptions: Maintaining Powell helped solidify international perception of the US financial system’s stability and the Fed’s commitment to its mandate. A change of leadership would have potentially sent ripples of uncertainty across global markets.

Alternative Perspectives and Counterarguments

While the criticisms of Powell's leadership are valid points of discussion, counterarguments highlight the importance of the Federal Reserve's independence and the complexities of monetary policy.

Defense of Powell's Policies

Arguments supporting Powell's approach to monetary policy often focus on the long-term goals of price stability and full employment.

- Successful Economic Indicators: While inflation and unemployment were both concerns, the Fed's policies were often praised for preventing a larger economic downturn.

- Economist Support: Many respected economists defended Powell's actions, emphasizing the need for a balanced approach to monetary policy that acknowledges the complexity of the macroeconomic landscape.

- Long-Term Strategies: The long-term goals of the Federal Reserve, such as controlling inflation, were often emphasized as justifications for the policies implemented under Powell's leadership.

The Importance of Federal Reserve Independence

The independence of the Federal Reserve is paramount to maintaining a stable and predictable economy. Political interference can have disastrous consequences.

- Negative Consequences of Political Interference: History is replete with examples where political interference in monetary policy led to inflation, economic instability and even financial crises.

- Historical Examples: The various hyperinflationary episodes around the world serve as stark reminders of the dangers of political interference in central banking.

Conclusion

The "Trump Powell Dismissal" debate highlighted the intricate interplay between political pressures and economic policy. While valid criticisms existed regarding Powell's interest rate hikes and potential political biases, counterarguments stressed the importance of the Federal Reserve's independence and the long-term benefits of stable monetary policy. Trump’s decision to retain Powell ultimately underscores the considerable economic implications of a leadership change at the Federal Reserve. Understanding this dynamic is crucial for navigating future economic and political challenges. To stay informed on further developments in this ongoing debate, continue following relevant news sources and exploring articles on monetary policy and the Federal Reserve. Stay engaged with the "Trump Powell Dismissal" discussion and its ongoing repercussions on the US economy.

Featured Posts

-

John Travoltas Miami Steakhouse Adventure A Pulp Fiction Inspired Meal

Apr 24, 2025

John Travoltas Miami Steakhouse Adventure A Pulp Fiction Inspired Meal

Apr 24, 2025 -

Analysis Chinese Stocks In Hong Kong Benefit From Reduced Trade Friction

Apr 24, 2025

Analysis Chinese Stocks In Hong Kong Benefit From Reduced Trade Friction

Apr 24, 2025 -

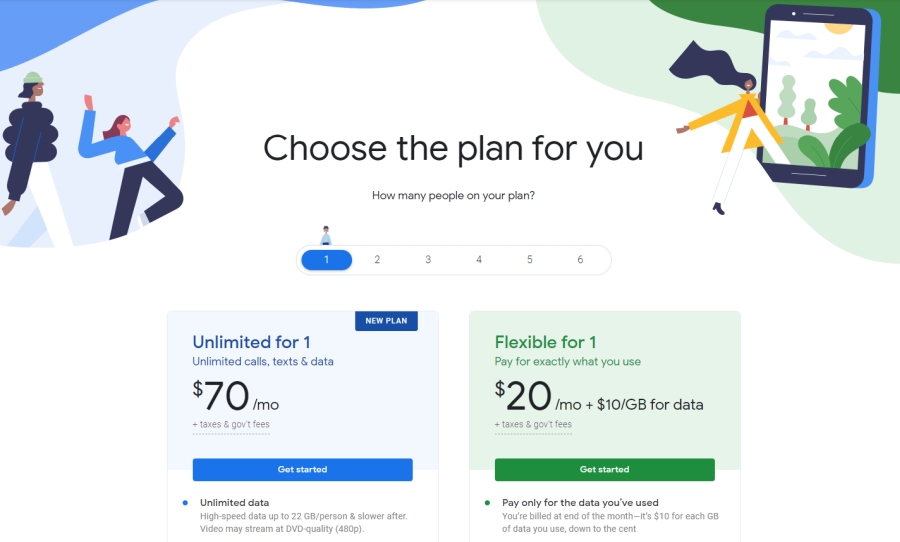

Compare Google Fis 35 Unlimited Plan To Competitors

Apr 24, 2025

Compare Google Fis 35 Unlimited Plan To Competitors

Apr 24, 2025 -

Klaus Schwab And The Wef An Exclusive Look At The Ongoing Investigation

Apr 24, 2025

Klaus Schwab And The Wef An Exclusive Look At The Ongoing Investigation

Apr 24, 2025 -

From Scatological Documents To Podcast Gold An Ai Driven Approach

Apr 24, 2025

From Scatological Documents To Podcast Gold An Ai Driven Approach

Apr 24, 2025