Trump's Economic Policies And The Future Of The Federal Reserve

Table of Contents

Trump's Tax Cuts and Their Impact on the Federal Reserve

The 2017 Tax Cuts and Jobs Act, a cornerstone of Trump's economic agenda, significantly lowered both corporate and individual tax rates. The intended effect was to stimulate economic growth through increased investment and consumer spending. While the economy did experience a short-term boost, the long-term consequences are still being debated. The tax cuts led to a substantial increase in the national debt, forcing the Federal Reserve to navigate a complex landscape of potential inflation and the need for carefully calibrated monetary policy responses.

- Increased budget deficit: The tax cuts dramatically widened the budget deficit, adding trillions to the national debt.

- Stimulatory effect on the economy (short-term vs. long-term): Initial economic growth was observed, but the sustainability of this growth remains a subject of ongoing analysis. Some economists argue the boost was temporary, while others point to longer-term positive impacts.

- Federal Reserve's response to potential inflation: The increased deficit and economic stimulus raised concerns about inflation, leading the Federal Reserve to closely monitor economic indicators and adjust interest rates accordingly.

- Changes in bond yields: The increased government borrowing influenced bond yields, impacting investment strategies and potentially influencing the Fed's actions.

Deregulation and Its Influence on the Financial System

The Trump administration pursued a significant deregulation agenda, impacting various sectors, including finance and the environment. Financial deregulation aimed to reduce the burden on businesses, but critics argued it increased systemic risk. The Federal Reserve, tasked with maintaining financial stability, faced the challenge of balancing economic growth with the potential for increased instability arising from reduced regulatory oversight.

- Impact on banking regulations: Relaxing regulations potentially led to increased risk-taking by financial institutions.

- Increased risk in the financial system: The reduced oversight created a potential for increased risk and vulnerability within the financial system.

- Federal Reserve's role in oversight and regulation: The Fed had to adapt its supervisory and regulatory approaches to address the changing landscape.

- Potential for future crises: Concerns exist that the deregulation could contribute to future financial crises, necessitating a robust response from the Federal Reserve.

Trade Wars and Their Economic Consequences for the Federal Reserve

The Trump administration initiated several trade disputes, imposing tariffs on imported goods and engaging in trade wars, particularly with China. These actions significantly impacted global trade flows and created economic uncertainty. The Federal Reserve had to contend with the resulting effects on inflation, supply chains, and overall economic outlook.

- Impact on inflation and supply chains: Tariffs contributed to increased prices for consumers and disrupted global supply chains, adding to inflationary pressures.

- Uncertainty in the global markets: The trade wars created significant uncertainty in global markets, impacting investor confidence and business investment.

- Federal Reserve's reaction to trade-related uncertainty: The Fed needed to consider the impact of trade uncertainty on its monetary policy decisions.

- Potential for recessionary pressures: The trade disputes contributed to economic slowdowns in certain sectors and raised concerns about potential recessionary pressures.

The Long-Term Implications for the Federal Reserve's Independence

A key aspect of the relationship between the Trump administration and the Federal Reserve was the potential for political interference in the central bank's operations. Maintaining its independence from political pressure is crucial for the Fed's effectiveness in managing the economy. Any erosion of this independence could have significant long-term consequences.

- Maintaining independence amidst political pressures: The Federal Reserve must navigate political pressures to preserve its ability to make objective monetary policy decisions.

- Transparency and accountability of the Federal Reserve: Transparency and accountability are essential for maintaining public trust in the Federal Reserve's independence.

- Potential for future conflicts between the Federal Reserve and the executive branch: The potential for future conflicts highlights the ongoing need to safeguard the Fed's independence.

- The importance of a non-partisan central bank: A non-partisan central bank is vital for effective macroeconomic management and avoiding politically motivated decisions.

Understanding the Interplay: Trump's Economic Policies and the Federal Reserve's Path Forward

Trump's economic policies presented the Federal Reserve with a series of complex challenges, demanding careful navigation of economic stimulus, inflation risks, financial stability, and the preservation of its independence. Understanding the interplay between presidential economic policies and the Federal Reserve's actions is crucial for comprehending the dynamics of the US economy. To further your understanding of "Trump's Economic Policies and the Federal Reserve," delve deeper into the available research and continue following developments in monetary policy and its impact on the broader economy. Resources like the Federal Reserve's website and publications from reputable economic think tanks offer valuable insights.

Featured Posts

-

California Surpasses Japan As Worlds Fourth Largest Economy

Apr 26, 2025

California Surpasses Japan As Worlds Fourth Largest Economy

Apr 26, 2025 -

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025

The Military Base At The Heart Of Us China Rivalry

Apr 26, 2025 -

Trumps Skepticism Towards Ukraines Nato Accession An Overview

Apr 26, 2025

Trumps Skepticism Towards Ukraines Nato Accession An Overview

Apr 26, 2025 -

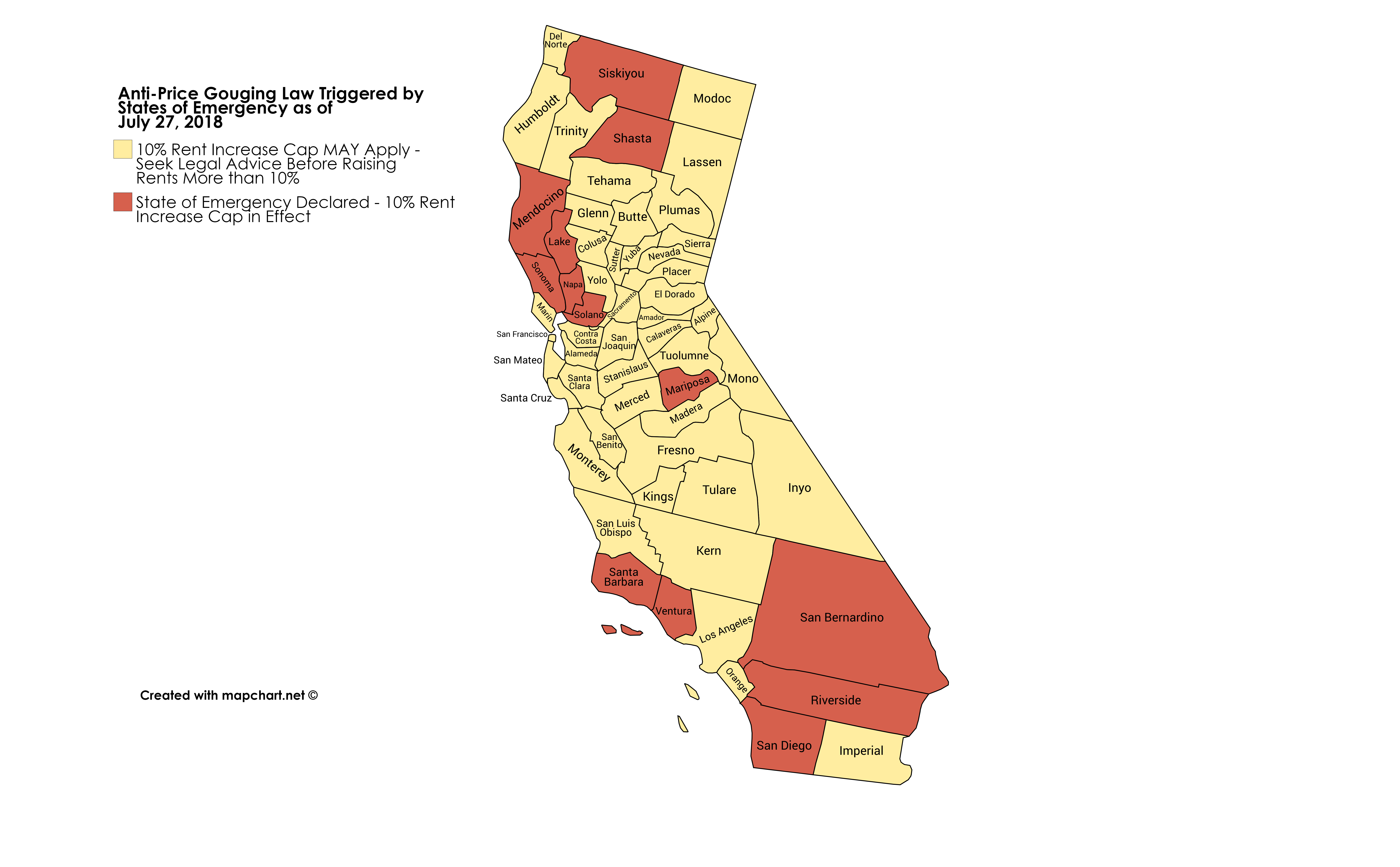

La Fires Price Gouging Concerns Raised By Reality Tv Star

Apr 26, 2025

La Fires Price Gouging Concerns Raised By Reality Tv Star

Apr 26, 2025 -

Point72 Traders Exit As Emerging Markets Focused Fund Closes

Apr 26, 2025

Point72 Traders Exit As Emerging Markets Focused Fund Closes

Apr 26, 2025