Trump's Policies And The Bitcoin (BTC) Price Rise

Table of Contents

Trump's Deregulatory Approach and Bitcoin's Appeal

Trump's administration championed a deregulatory approach across various sectors, potentially creating a more favorable environment for Bitcoin's growth. This reduced government intervention could have indirectly boosted Bitcoin's appeal as a refuge from perceived overregulation in traditional financial markets.

Reduced Government Intervention

- Examples of deregulation efforts: The Trump administration sought to reduce regulations on banks and financial institutions, potentially fostering a climate where investors sought alternative assets outside traditional, heavily regulated markets. This reduction in regulatory oversight might have encouraged greater investment in less regulated assets like Bitcoin.

- Increased investor interest in alternative assets: As confidence in traditional financial systems wavered, some investors turned towards alternative investments, including cryptocurrencies like Bitcoin, seeking higher returns and perceived freedom from regulatory burdens. The perceived lower regulatory risk of Bitcoin relative to traditional assets likely contributed to its increased adoption.

- Reduced trust in fiat currencies: Trump's economic policies, particularly his fiscal spending and potential inflationary pressures, might have eroded some investors' trust in fiat currencies, leading them to seek alternative stores of value such as Bitcoin. This shift in trust towards digital assets like Bitcoin helped fuel its price surge.

Keyword integration: deregulation, cryptocurrency regulation, alternative investment, Bitcoin adoption, regulatory uncertainty.

Inflationary Pressures and Bitcoin as a Hedge

Trump's fiscal policies, including significant tax cuts and increased government spending, fueled concerns about potential inflationary pressures within the US economy. This inflationary environment could have driven investors towards Bitcoin as a potential inflation hedge.

Impact of Fiscal Policies

- Explanation of inflation: Inflation erodes the purchasing power of fiat currencies. As prices rise, the value of money decreases.

- Correlation between inflation and Bitcoin price: Historically, periods of high inflation have often been correlated with increased interest in Bitcoin, as investors seek to protect their assets from the devaluation caused by inflation.

- Investor behavior during inflationary periods: Investors often look for assets that are less susceptible to inflation, and Bitcoin, with its limited supply, has been viewed by some as a potential store of value during inflationary periods, leading to increased demand.

Keyword integration: inflation, Bitcoin hedge, fiscal policy, monetary policy, inflation protection, purchasing power.

Geopolitical Uncertainty and Safe-Haven Demand for Bitcoin

Trump's often unpredictable foreign policy contributed to a period of increased geopolitical uncertainty. This heightened uncertainty drove investors towards safe-haven assets, potentially benefiting Bitcoin's price.

Trump's Foreign Policy and Market Volatility

- Examples of geopolitical events during Trump's presidency: Trade wars, strained relationships with key allies, and unpredictable diplomatic actions created market volatility.

- Bitcoin's role as a safe haven asset: During times of geopolitical instability, investors often seek assets perceived as safe havens, which can lead to increased demand for Bitcoin. Bitcoin's decentralized nature might be seen as a shelter from the uncertainties of global politics.

- Investor flight to safety: As investors sought protection from geopolitical risks, they might have moved assets into Bitcoin, contributing to price increases.

Keyword integration: geopolitical risk, safe haven asset, Bitcoin investment, market uncertainty, global volatility, decentralized currency.

The Role of Social Media and Trump's Influence

Trump's prolific use of social media and his pronouncements on economic issues potentially influenced market sentiment toward Bitcoin. His public statements could have directly or indirectly impacted public perception and subsequent market trends.

Public Discourse and Market Sentiment

- Examples of Trump's statements related to the economy or cryptocurrencies: While Trump didn't directly comment extensively on Bitcoin, his broader pronouncements on economic policy could have impacted investor sentiment towards alternative assets.

- Impact on public perception of Bitcoin: Trump's statements regarding the economy and financial markets indirectly influenced the overall investment climate, which in turn could have impacted investors' perceptions of and interest in Bitcoin.

- Social media influence on market trends: Social media's role in disseminating information and shaping public opinion can significantly influence market trends. Trump's tweets and social media activity could have affected the general perception of Bitcoin.

Keyword integration: social media influence, market sentiment, public opinion, Trump’s tweets, Bitcoin price reaction, media coverage.

Conclusion

This analysis explores the potential correlation between Trump's policies—his deregulatory approach, fiscal policies, foreign policy, and social media influence—and the fluctuations in the Bitcoin (BTC) price. While multiple factors undoubtedly influence Bitcoin's price, understanding the potential links highlighted here is crucial for navigating the cryptocurrency market. It's essential to acknowledge that this is one perspective, and further research is necessary for a complete understanding.

Call to Action: While the relationship between Trump's policies and Bitcoin's price rise is complex and requires further study, understanding this potential correlation is vital for navigating the volatile cryptocurrency market. Continue learning about the factors influencing Bitcoin (BTC) prices and make informed decisions about your cryptocurrency investments. Stay updated on the latest developments in both political and cryptocurrency markets to effectively manage your Bitcoin (BTC) portfolio.

Featured Posts

-

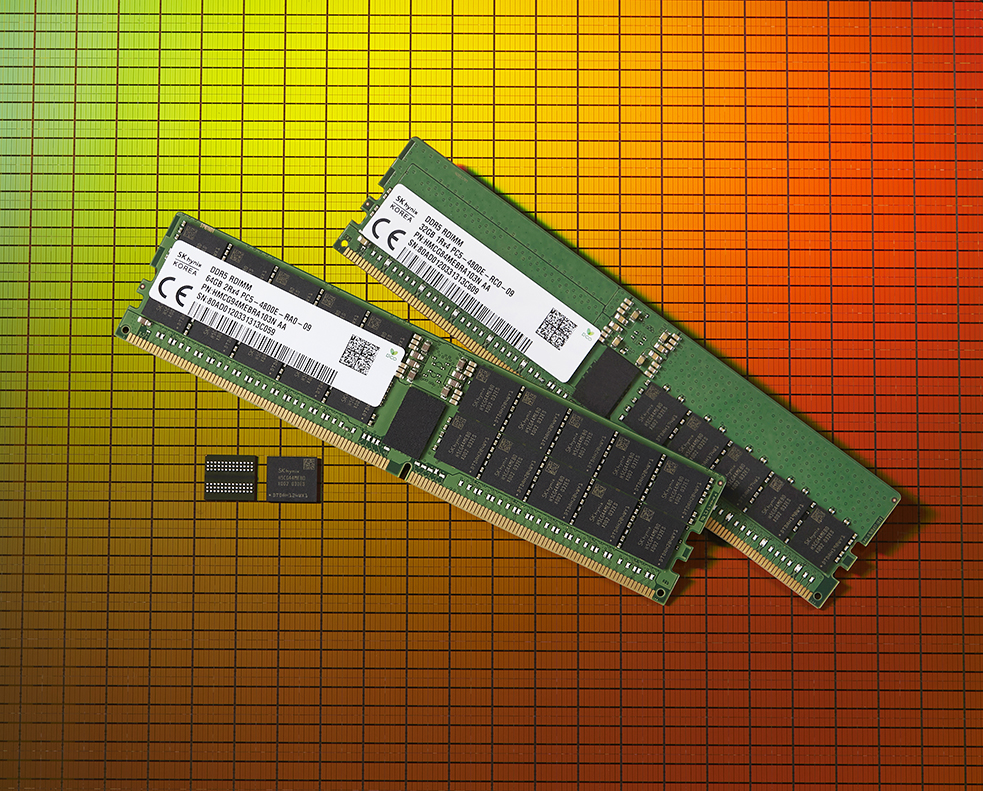

Sk Hynix New Dram Leader Thanks To Ai Advancements

Apr 24, 2025

Sk Hynix New Dram Leader Thanks To Ai Advancements

Apr 24, 2025 -

Judge Abrego Garcias Warning Stonewalling In Us Legal Cases Must End

Apr 24, 2025

Judge Abrego Garcias Warning Stonewalling In Us Legal Cases Must End

Apr 24, 2025 -

Elite Universities Facing Trump Administration Funding Cuts A Financial Response

Apr 24, 2025

Elite Universities Facing Trump Administration Funding Cuts A Financial Response

Apr 24, 2025 -

The Bold And The Beautiful Spoilers Wednesday April 23 Finns Vow To Liam

Apr 24, 2025

The Bold And The Beautiful Spoilers Wednesday April 23 Finns Vow To Liam

Apr 24, 2025 -

The Closure Of Anchor Brewing Company Whats Next For San Franciscos Iconic Brewery

Apr 24, 2025

The Closure Of Anchor Brewing Company Whats Next For San Franciscos Iconic Brewery

Apr 24, 2025