Understanding High Stock Market Valuations: BofA's Analysis

Table of Contents

BofA's Key Findings on Current Stock Market Valuations

BofA's recent research suggests that current stock market valuations are elevated compared to historical averages, although the degree of overvaluation varies depending on the metric used and the sector considered. While BofA doesn't necessarily declare a "bubble," their analysis points to a level of risk that investors should carefully consider.

Specific data points from BofA's research (note: specific numbers would need to be sourced from a current BofA report for accuracy) might include:

-

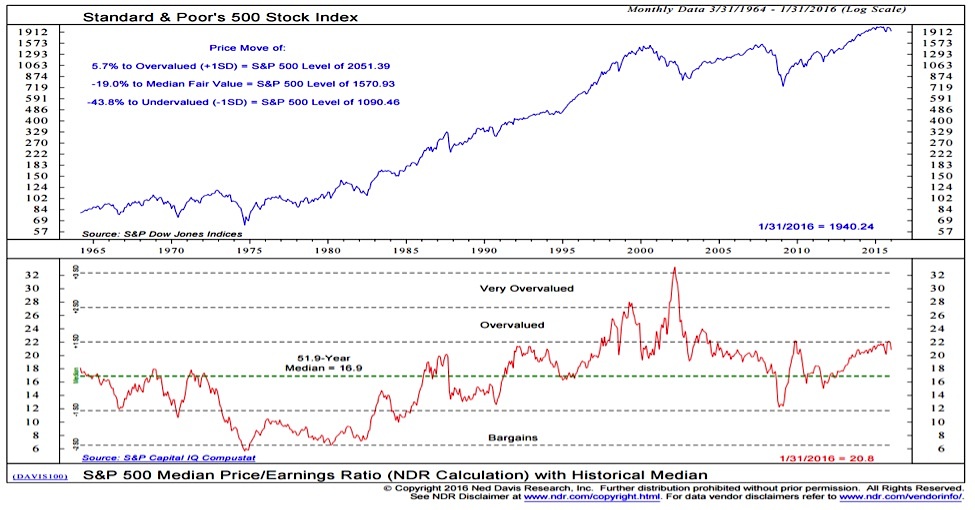

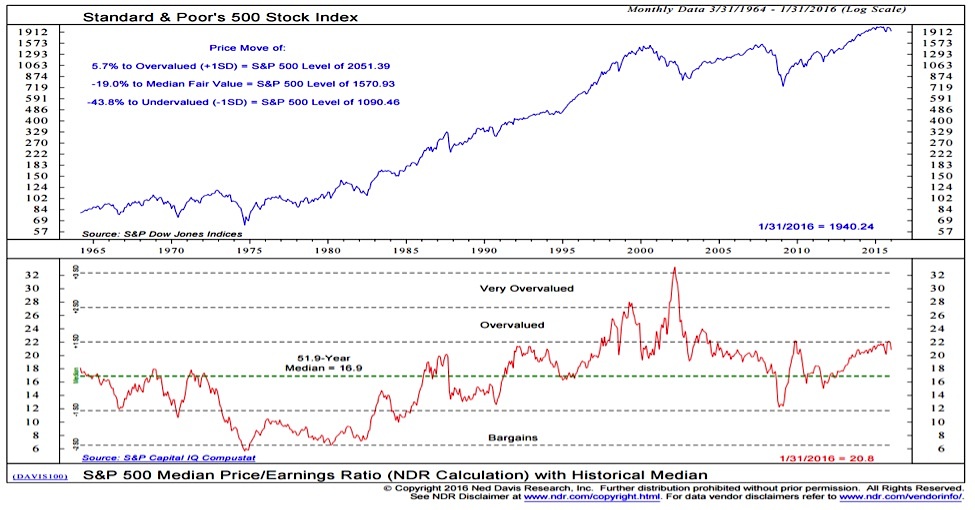

Price-to-Earnings (P/E) Ratios: BofA may highlight that P/E ratios for the S&P 500 are above their long-term average, suggesting stocks are trading at a premium.

-

Cyclically Adjusted Price-to-Earnings (CAPE) Ratios: Similar to P/E, the CAPE ratio, which smooths out earnings fluctuations, could also show elevated valuations.

-

Other Valuation Metrics: BofA might incorporate other metrics like dividend yield, price-to-book ratio, and enterprise value-to-EBITDA to provide a more comprehensive picture.

-

Bullet Point 1: The analysis typically covers major indices like the S&P 500, Nasdaq Composite, and potentially Dow Jones Industrial Average, providing a broad view of market valuations.

-

Bullet Point 2: BofA's research might reveal significant differences in valuations across sectors. For example, technology stocks may be trading at significantly higher multiples than more cyclical industries.

-

Bullet Point 3: BofA likely employs a combination of quantitative and qualitative methods in their valuation analysis, considering historical data, macroeconomic forecasts, and company-specific fundamentals.

Factors Contributing to High Stock Market Valuations

Several factors contribute to the elevated stock market valuations observed by BofA. These include:

-

Low Interest Rates: Historically low interest rates reduce the cost of borrowing for companies and incentivize investment, supporting higher stock prices. This also increases the present value of future earnings, making companies appear more attractive.

-

Quantitative Easing (QE): Central banks' QE programs have injected significant liquidity into the markets, pushing up asset prices, including stocks. This excess liquidity fuels higher demand and drives up stock prices.

-

Inflation Expectations: Moderate inflation expectations can sometimes support higher valuations as companies can pass on increased costs to consumers, maintaining profitability. However, high and unpredictable inflation is a significant risk.

-

Bullet Point 1: Low interest rates directly impact the discount rate used in discounted cash flow (DCF) models, a common valuation technique. Lower discount rates lead to higher present values of future cash flows, justifying higher stock prices.

-

Bullet Point 2: Strong corporate earnings growth, driven by factors like technological innovation or increased consumer spending, can support higher valuations, as investors are willing to pay more for companies with robust growth prospects.

-

Bullet Point 3: Market psychology and investor sentiment play a crucial role. Periods of optimism and exuberance can drive valuations beyond what is justified by fundamentals alone, leading to speculative bubbles.

Risks Associated with High Stock Market Valuations

High stock market valuations, as noted by BofA's analysis, bring several risks:

-

Market Corrections or Crashes: If valuations are deemed unsustainable, a sharp correction or even a market crash could occur, leading to significant losses for investors. This is a primary concern when dealing with high stock market valuations.

-

Rising Interest Rates: A rise in interest rates increases borrowing costs for companies, reducing profitability and potentially leading to lower stock prices. This can significantly impact valuations.

-

Inflation: High inflation erodes corporate profits and reduces the real value of future earnings, leading to lower valuation multiples. Unexpected inflation is a major threat to high valuations.

-

Bullet Point 1: History shows that periods of high valuations are often followed by market corrections. Studying historical patterns offers valuable insights into potential outcomes.

-

Bullet Point 2: A sudden shift in investor sentiment, perhaps triggered by unexpected economic news or geopolitical events, can lead to rapid declines in stock prices.

-

Bullet Point 3: Identifying market bubbles and precisely timing market corrections is notoriously difficult, making risk management crucial.

Navigating High Stock Market Valuations: Strategies for Investors

Investors can employ several strategies to mitigate risks in a high-valuation environment:

-

Diversification: Diversifying across asset classes (stocks, bonds, real estate, etc.) and sectors reduces exposure to any single market segment. A diversified portfolio mitigates losses.

-

Value Investing: Focusing on value investing involves identifying undervalued companies with strong fundamentals and trading at attractive prices relative to their intrinsic value. Finding undervalued companies requires thorough research and due diligence.

-

Defensive Stocks and Bonds: Consider including defensive stocks (less sensitive to economic downturns) and bonds in your portfolio to provide stability during market corrections. Defensive investments are important in high-valuation markets.

-

Bullet Point 1: Thoroughly analyze a company's financial statements, earnings growth, and competitive landscape before investing. Understand the company's business model and its place in the industry.

-

Bullet Point 2: Maintain a long-term investment horizon and avoid making emotional decisions based on short-term market fluctuations. A long-term perspective is essential for success.

-

Bullet Point 3: Explore alternative investments, such as private equity or commodities, to further diversify your portfolio and reduce overall risk.

Conclusion

BofA's analysis provides crucial insights into the complexities of current stock market valuations. Understanding the factors driving these valuations, along with the associated risks, is essential for informed investment decisions. By carefully considering diversification strategies, focusing on fundamental analysis, and maintaining a long-term perspective, investors can navigate the challenges and opportunities presented by potentially high stock market valuations. Remember to conduct your own thorough research and consider seeking professional financial advice before making any investment decisions related to stock market valuations. Understanding stock market valuations is key to successful investing.

Featured Posts

-

Understanding Tylor Megills Success A Look At His Mets Statistics

Apr 28, 2025

Understanding Tylor Megills Success A Look At His Mets Statistics

Apr 28, 2025 -

Blue Jays Vs Red Sox Complete Lineups And Buehlers Return

Apr 28, 2025

Blue Jays Vs Red Sox Complete Lineups And Buehlers Return

Apr 28, 2025 -

75

Apr 28, 2025

75

Apr 28, 2025 -

Why Richard Jefferson Keeps Taking Jabs At Shaquille O Neal

Apr 28, 2025

Why Richard Jefferson Keeps Taking Jabs At Shaquille O Neal

Apr 28, 2025 -

Luigi Mangiones Supporters Their Concerns And Expectations

Apr 28, 2025

Luigi Mangiones Supporters Their Concerns And Expectations

Apr 28, 2025