Understanding The Dynamics: Professional Selling And The Individual Investor Response

Table of Contents

Analyzing Investor Psychology in the Sales Process

Understanding individual investor psychology is paramount for successful professional selling. Investment decisions are rarely purely rational; emotions significantly influence choices.

Emotional vs. Rational Decision-Making

Individual investors often prioritize emotional factors – fear, greed, and hope – over logical analysis. This leads to cognitive biases like confirmation bias (seeking information confirming pre-existing beliefs) and herd mentality (following the actions of others).

- Fear of Missing Out (FOMO): This powerful emotion can lead investors to make impulsive decisions, often neglecting risk assessment.

- Anchoring Bias: Investors may overemphasize the first piece of information received, influencing subsequent judgments.

- Market Sentiment: The overall mood of the market significantly impacts investor confidence and risk appetite.

Professional sellers can utilize tools like behavioral finance models and investor profiling to identify and address these emotional factors, tailoring their approach accordingly. For example, acknowledging and validating an investor's concerns about market volatility can build trust and facilitate a more rational discussion.

Risk Tolerance and Investment Goals

Different investor profiles – conservative, moderate, aggressive – respond differently to selling approaches. Aligning selling strategies with investor risk profiles and objectives is essential.

- Risk Tolerance Influences Product Selection: Conservative investors may prefer low-risk investments like bonds, while aggressive investors might seek higher-risk, higher-return options like stocks.

- Tailoring Sales Pitches: A sales pitch emphasizing capital preservation is suitable for a conservative investor, whereas one highlighting growth potential is more appropriate for an aggressive investor.

Understanding and respecting investor goals – retirement planning, wealth preservation, or capital appreciation – is key to building trust and achieving successful sales outcomes.

Effective Communication Strategies for Professional Selling

Effective communication is the cornerstone of successful professional selling in the context of individual investor response.

Building Trust and Credibility

Transparency, honesty, and clear communication are vital for establishing rapport with individual investors. A strong reputation and positive client testimonials significantly influence trust.

- Active Listening and Empathy: Demonstrating genuine interest in the investor's needs and concerns fosters trust.

- Addressing Concerns Effectively: Openly acknowledging and addressing potential risks and challenges builds confidence.

- Demonstrating Expertise: Clearly articulating your knowledge and experience reassures investors of your competence.

Building trust is a long-term investment that pays off with stronger client relationships and increased sales success.

Tailoring the Sales Message

Generic sales pitches rarely resonate with individual investors. Personalization is crucial for maximizing impact.

- Personalized Language and Data: Using the investor's name and referencing their specific financial situation demonstrates care and attention.

- Leveraging Communication Channels: Employing a multi-channel approach – email, phone calls, and in-person meetings – allows for more effective communication tailored to individual preferences.

Adapting your approach based on individual needs and preferences results in more meaningful interactions and increased chances of closing deals.

Navigating Regulatory Compliance and Ethical Considerations

Adhering to regulatory guidelines and ethical standards is non-negotiable when interacting with individual investors.

Disclosure and Transparency Requirements

Full disclosure of all relevant information, including potential risks and conflicts of interest, is essential. Transparency builds trust and protects both the investor and the seller.

- Relevant Regulations: Compliance with regulations such as those set by the Securities and Exchange Commission (SEC) in the US or equivalent bodies in other countries is mandatory.

- Best Practices: Maintaining detailed records of all communications and transactions ensures accountability.

Failing to adhere to these standards can lead to severe legal and reputational consequences.

Avoiding Misleading or Deceptive Practices

Manipulative or misleading sales tactics are unethical and potentially illegal. Integrity is paramount in building long-term relationships.

- Deceptive Practices to Avoid: Overpromising returns, misrepresenting risks, or using high-pressure sales tactics can damage trust and harm reputations.

- Long-Term Value Creation: Focusing on providing genuine value and building lasting relationships is a more sustainable and ethical approach than chasing short-term gains.

Conclusion

Mastering the art of professional selling requires a deep understanding of individual investor response. This involves analyzing investor psychology, employing effective communication strategies, and upholding the highest ethical and regulatory standards. By acknowledging the emotional drivers of investment decisions, tailoring communication to individual needs, and prioritizing transparency, professional sellers can cultivate strong, trusting relationships that lead to successful sales outcomes and long-term client loyalty. Learn more about maximizing your success in professional selling by understanding individual investor psychology and implementing ethical sales strategies.

Featured Posts

-

Mets Pitcher Earns Praise For Another Strong Performance

Apr 28, 2025

Mets Pitcher Earns Praise For Another Strong Performance

Apr 28, 2025 -

The 2024 Yankees Lineup Where Will Aaron Judge Play

Apr 28, 2025

The 2024 Yankees Lineup Where Will Aaron Judge Play

Apr 28, 2025 -

Bubba Wallace On Nascar Breaking The Cookie Cutter Mold

Apr 28, 2025

Bubba Wallace On Nascar Breaking The Cookie Cutter Mold

Apr 28, 2025 -

Understanding Aaron Judges 2025 Goal The Significance Of The Push Up Display

Apr 28, 2025

Understanding Aaron Judges 2025 Goal The Significance Of The Push Up Display

Apr 28, 2025 -

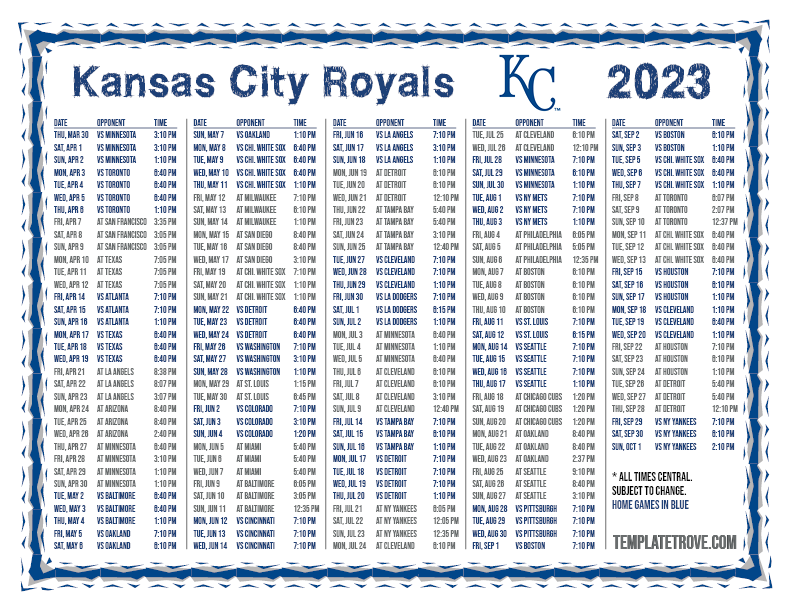

Yankees 2000 Season Diary A Look Back At The Royals Game Win

Apr 28, 2025

Yankees 2000 Season Diary A Look Back At The Royals Game Win

Apr 28, 2025