Weak Retail Sales Fuel Speculation Of Bank Of Canada Rate Cuts

Table of Contents

Declining Retail Sales: A Deeper Dive into the Numbers

The decline in Canadian retail sales is undeniable. Preliminary data for [Insert Month, Year] shows a [Insert Percentage]% decrease compared to the previous month and a [Insert Percentage]% drop compared to the same period last year. This represents a substantial contraction in consumer spending, a key driver of economic activity.

Several sectors have been particularly hard hit:

- Automobile sales: A significant contributor to the overall decline, reflecting reduced consumer confidence and higher borrowing costs.

- Durable goods: Purchases of large appliances and furniture have fallen sharply, suggesting consumers are delaying non-essential purchases.

- [Insert other affected sectors and data]: Provide further examples with supporting data.

Several factors contribute to this worrying trend:

- High inflation: Persistently elevated prices erode consumer purchasing power, forcing many to cut back on spending.

- Increased interest rates: Higher borrowing costs make it more expensive to finance large purchases, dampening demand.

- Weakening consumer confidence: Uncertainty about the future economic outlook is leading consumers to adopt a more cautious approach to spending.

[Insert chart or graph visualizing the decline in retail sales across different sectors and time periods].

The Bank of Canada's Current Monetary Policy Stance

The Bank of Canada's primary mandate is to maintain price stability and full employment. Its current monetary policy reflects a delicate balancing act between these objectives. Recent decisions have involved [Summarize recent interest rate decisions, including specific percentages and dates]. The Bank utilizes various tools to influence interest rates, primarily the overnight rate, which serves as a benchmark for other borrowing costs in the economy. Changes to the overnight rate directly impact lending rates for banks and other financial institutions, influencing borrowing and investment activity across the country. Currently, the Bank is [Describe the Bank's current approach – e.g., carefully monitoring inflation, assessing economic growth, etc.].

Analyzing the Link Between Weak Retail Sales and Rate Cut Speculation

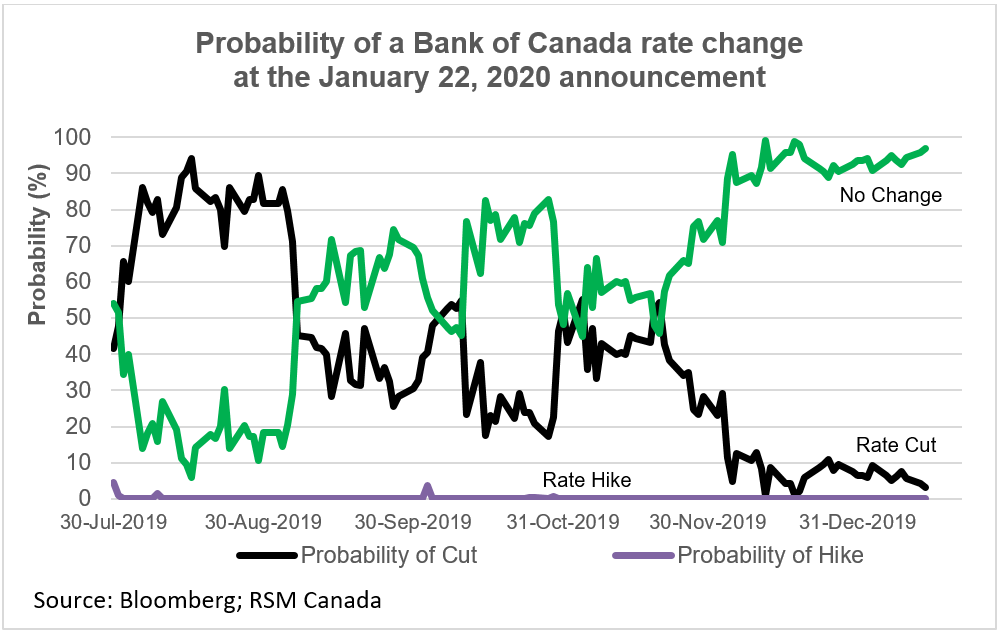

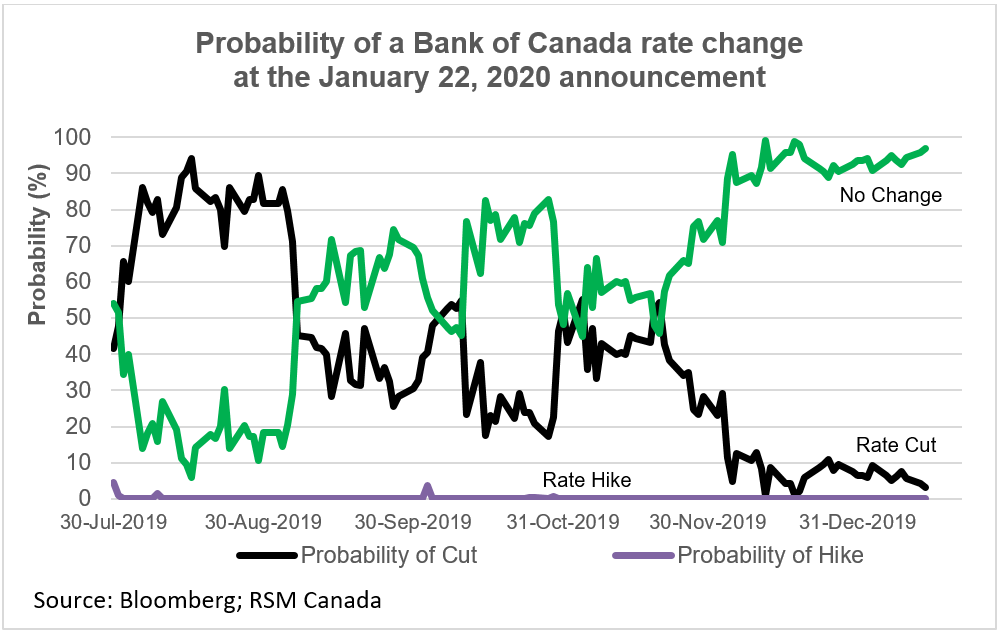

Weak retail sales are a significant leading indicator of economic slowdown. A sustained decline suggests weakening consumer demand, which can ripple through the economy, impacting business investment and employment. In response to a slowing economy, the Bank of Canada might implement monetary easing measures, including Bank of Canada rate cuts, to stimulate borrowing and spending. Lower interest rates make it cheaper to borrow money, potentially boosting investment and consumer confidence.

However, several factors might prevent immediate rate cuts:

- Persistent inflation: If inflation remains stubbornly high, the Bank may hesitate to lower rates, fearing it could further fuel price increases.

- Global economic uncertainty: Uncertainties in the global economic landscape could influence the Bank's decision-making process.

Economists and market analysts offer varying predictions. Some believe that rate cuts are inevitable given the weakening retail sales data, while others predict the Bank will maintain its current stance or even implement further rate hikes depending on the evolution of inflation. [Mention specific expert opinions and their predictions].

Market Reactions and Investor Sentiment

The stock market and other financial markets are closely watching the situation. Weak retail sales and speculation of Bank of Canada rate cuts have led to [Describe the market reaction – e.g., decreased stock prices in certain sectors, changes in bond yields, fluctuations in the Canadian dollar]. Investor sentiment is currently [Describe the prevailing sentiment – e.g., cautious, uncertain, etc.], with implications for investment strategies. Many investors are assessing the potential impact of rate cuts on their portfolios, considering shifts in asset allocation to capitalize on the expected market shifts.

Conclusion: The Outlook for Bank of Canada Rate Cuts and What it Means for You

The correlation between weak retail sales and the increased probability of Bank of Canada rate cuts is undeniable. The Bank of Canada's next move will have significant implications for the Canadian economy and consumers. Rate cuts could potentially boost economic activity, but they also carry risks, particularly if they lead to a resurgence of inflation. The outlook for future rate changes remains uncertain, with the Bank's decisions dependent on evolving economic data and inflation trends.

To stay informed, closely monitor future announcements from the Bank of Canada regarding Bank of Canada rate cuts and keep a close eye on key economic indicators such as retail sales, inflation, and employment data. For those interested in deepening their understanding of Canadian monetary policy and interest rate fluctuations, further resources can be found at [Insert links to relevant resources, such as the Bank of Canada website]. Understanding these dynamics is crucial for navigating the complexities of the Canadian economy and making informed financial decisions.

Featured Posts

-

Metro Vancouver Housing Market Update Slower Rent Growth Persistent Cost Increases

Apr 28, 2025

Metro Vancouver Housing Market Update Slower Rent Growth Persistent Cost Increases

Apr 28, 2025 -

Slight Lineup Shift Coras Approach To Bostons Doubleheader

Apr 28, 2025

Slight Lineup Shift Coras Approach To Bostons Doubleheader

Apr 28, 2025 -

A Look Into The Beliefs Of Luigi Mangiones Supporters

Apr 28, 2025

A Look Into The Beliefs Of Luigi Mangiones Supporters

Apr 28, 2025 -

Mets Rival Pitchers Unbeatable Performance

Apr 28, 2025

Mets Rival Pitchers Unbeatable Performance

Apr 28, 2025 -

Aaron Judges 2025 On Field Goal Prediction The Push Up Revelation

Apr 28, 2025

Aaron Judges 2025 On Field Goal Prediction The Push Up Revelation

Apr 28, 2025