Why Investors Shouldn't Fear High Stock Market Valuations: BofA's Perspective

Table of Contents

BofA's Rationale: Understanding the Current Market Environment

BofA maintains a cautiously optimistic outlook on the current market. While acknowledging the elevated valuations, they emphasize several factors mitigating the risks associated with high stock market valuations. Their analysis is grounded in a multifaceted assessment of economic indicators and sectoral performance.

-

Economic Indicators: BofA considers several key economic indicators. While interest rates are rising, they argue the pace is manageable and consistent with efforts to control inflation. They point to sustained, albeit slower, GDP growth as a positive sign. They also acknowledge that inflation, while still a concern, shows signs of cooling.

-

Undervalued Sectors: Despite the overall high valuations, BofA identifies specific sectors they believe are undervalued or primed for substantial growth. These often include sectors with strong long-term fundamentals, such as certain segments within the healthcare and technology industries. Further analysis identifies resilient consumer spending patterns driving positive growth for particular companies.

-

Acknowledged Risks: BofA acknowledges potential risks, such as geopolitical instability and supply chain disruptions. However, their analysis suggests these risks are largely factored into current market pricing, and the likelihood of a significant market downturn is not as high as some forecasts suggest. They believe the current market is correctly priced and reflective of underlying fundamentals.

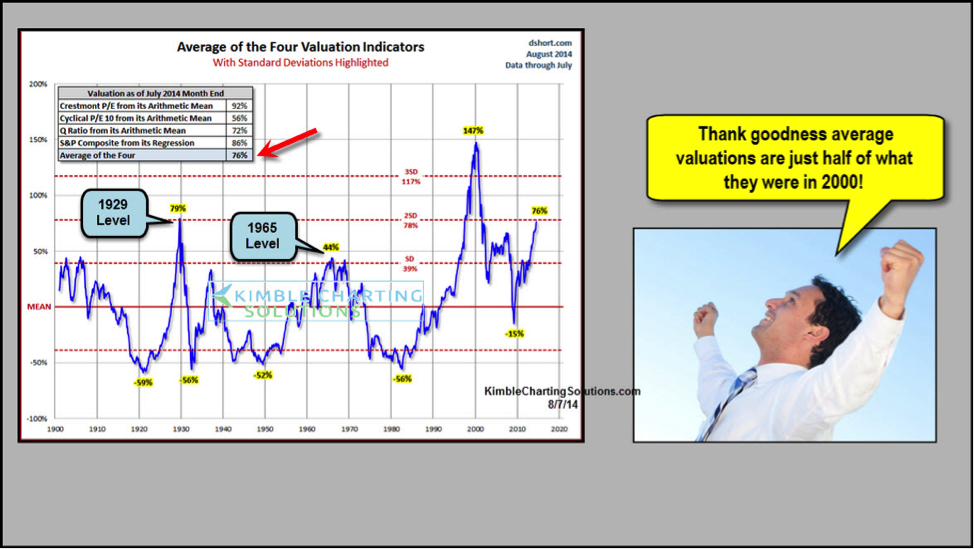

Debunking the "Overvalued Market" Myth: Factors Beyond Price-to-Earnings Ratios

Relying solely on price-to-earnings (P/E) ratios to assess market valuation can be misleading. BofA emphasizes the limitations of traditional metrics in capturing the complexities of the current economic landscape.

-

Alternative Valuation Metrics: BofA favors a more comprehensive approach, incorporating alternative valuation metrics such as discounted cash flow analysis and PEG ratios (Price/Earnings to Growth ratio), which better reflect long-term growth potential.

-

Macroeconomic Influences: Low interest rates in recent years have played a significant role in inflating valuations. BofA’s assessment accounts for this, emphasizing that interest rates are a critical driver of valuation calculations. The current trajectory of interest rates informs the future forecasts and investment strategies of the firm.

-

Long-Term Growth Potential: BofA stresses that a focus on long-term growth potential is paramount. Short-term fluctuations in valuations should be viewed within the context of a much longer-term investment horizon. This focus on long-term growth informs the selection of companies with strong future potential in the BofA portfolio.

The Role of Innovation and Technological Advancements in Justifying High Valuations

Technological advancements and disruptive innovations significantly impact valuations. Certain sectors experiencing rapid technological transformation may warrant higher valuations reflecting their future earnings potential.

-

High-Growth Sectors: Sectors like technology, renewable energy, and certain segments of the healthcare industry are prime examples. Companies at the forefront of innovation frequently see premium valuations reflecting the expected future returns on their advanced technologies.

-

Future Earnings Potential: Innovation fuels exponential growth, driving significantly higher future earnings. This justifies the elevated valuations assigned to these companies. The future value of innovative companies is paramount in BofA's evaluation strategy.

-

Future Value: The concept of "future value" is crucial here. Investors are willing to pay a premium for companies expected to generate substantial returns in the future, even if current earnings might not fully justify the high price tag. This concept is pivotal for BofA's long-term growth strategy.

BofA's Strategic Investment Recommendations for Navigating High Valuations

Despite high stock market valuations, BofA provides strategic recommendations for investors seeking to navigate the current market effectively.

-

Asset Class Diversification: BofA suggests a diversified portfolio that spans various asset classes, including value stocks, growth stocks, and potentially international markets to mitigate risk. Diversification is crucial in any market condition but especially critical with high valuations.

-

Risk Management Strategies: Portfolio rebalancing is crucial to maintain an optimal asset allocation. Regularly reviewing and adjusting your portfolio ensures that you maintain alignment with your long-term financial objectives.

-

Long-Term Investment Horizon: BofA strongly recommends maintaining a long-term investment horizon. This reduces the impact of short-term market volatility and allows for growth potential to fully materialize.

Conclusion: Overcoming Investor Fear and Capitalizing on High Stock Market Valuations – A BofA Perspective

BofA’s perspective challenges the prevailing narrative of impending doom associated with high stock market valuations. By emphasizing a nuanced approach considering factors beyond traditional metrics, macroeconomic influences, and the substantial role of innovation, BofA highlights opportunities for strategic investment. Don't let fear of high stock market valuations paralyze your investment strategy. Use BofA's insights to navigate high stock market valuations effectively. Consult with a financial advisor today to create a personalized investment strategy that aligns with your risk tolerance and long-term goals.

Featured Posts

-

Karen Read Murder Trials A Complete Timeline

Apr 22, 2025

Karen Read Murder Trials A Complete Timeline

Apr 22, 2025 -

Pope Francis A Legacy Of Compassion 1936 2024

Apr 22, 2025

Pope Francis A Legacy Of Compassion 1936 2024

Apr 22, 2025 -

Why Middle Managers Are Essential For Company Success

Apr 22, 2025

Why Middle Managers Are Essential For Company Success

Apr 22, 2025 -

Strengthening Security Partnerships China And Indonesia

Apr 22, 2025

Strengthening Security Partnerships China And Indonesia

Apr 22, 2025 -

Closer Security Links Forged Between China And Indonesia

Apr 22, 2025

Closer Security Links Forged Between China And Indonesia

Apr 22, 2025