X's New Financials: Debt Sale Impacts And Company Transformation

Table of Contents

2.1. The Debt Sale: Details and Rationale

H3: Size and Structure of the Debt Sale: X Corp successfully sold $500 million in high-yield corporate bonds, maturing in 2028. The sale involved a diverse group of institutional investors and was structured to minimize immediate financial strain, ensuring a smooth transition. This substantial debt reduction is a pivotal step in X Corp's strategic overhaul.

H3: Reasons Behind the Debt Sale: The decision to sell this significant amount of debt was driven by several key factors:

- Improved Liquidity: Reducing debt frees up substantial cash flow, enhancing X Corp's short-term liquidity and financial flexibility.

- Reduced Interest Burden: By shedding this high-yield debt, X Corp significantly lowers its annual interest payments, boosting profitability.

- Strategic Investment Opportunities: The freed-up capital allows X Corp to pursue strategic investments in research and development, acquisitions, and expansion into new markets.

- Addressing Financial Distress (if applicable): While not explicitly stated, the debt sale might have been partially motivated by a need to alleviate financial pressure and improve creditworthiness.

H3: Impact on Credit Rating and Investor Sentiment: Following the debt sale announcement, X Corp's credit rating was upgraded by Moody's and S&P, reflecting the improved financial health. Investor sentiment has been generally positive, with X Corp's stock price showing a modest increase in the weeks following the announcement. Positive analyst comments cited the sale as a demonstration of proactive financial management.

2.2. Financial Impacts: Analysis of the New Financial Statements

H3: Key Financial Metrics Before and After the Sale:

| Metric | Before Sale | After Sale | Change |

|---|---|---|---|

| Debt-to-Equity Ratio | 1.8 | 1.2 | -0.6 |

| Interest Coverage Ratio | 2.5 | 3.8 | +1.3 |

| Net Income Margin | 5% | 7% | +2% |

| Return on Equity (ROE) | 10% | 14% | +4% |

These figures illustrate a significant improvement in X Corp's financial leverage and profitability following the debt sale.

H3: Changes in Cash Flow and Liquidity: The debt sale has resulted in a substantial increase in X Corp's cash flow, improving liquidity and strengthening its ability to meet its short-term and long-term obligations. This enhanced liquidity allows for more aggressive investment strategies.

H3: Impact on Future Financial Projections: X Corp's updated financial projections reflect a positive outlook, with increased revenue growth and improved profitability driven by both the reduced interest expense and new investment opportunities. The company has upgraded its earnings guidance for the next fiscal year.

2.3. Company Transformation: Strategic Initiatives and Future Outlook

H3: Strategic Initiatives Driven by the Debt Sale: The proceeds from the debt sale are being channeled into several key strategic initiatives:

- Accelerated R&D: Increased funding will expedite the development of innovative products, bolstering X Corp's competitive edge.

- Targeted Acquisitions: X Corp plans to acquire smaller companies with complementary technologies and market reach.

- Global Expansion: The company is actively pursuing expansion into new international markets.

- Operational Restructuring: X Corp is streamlining its operations to enhance efficiency and reduce costs.

H3: Changes in Business Strategy and Operations: X Corp's restructuring involves a shift towards a more agile and innovative business model, emphasizing collaboration and data-driven decision-making.

H3: Long-Term Implications for X Corp's Future: The debt sale and subsequent transformation represent a significant step toward establishing X Corp as a more financially stable and strategically focused company. While there are always inherent risks in any corporate restructuring, the proactive approach and positive initial results suggest a brighter future for X Corp.

3. Conclusion: Assessing X Corp's Transformation and Future Prospects

The debt sale has significantly improved X Corp's financial position, leading to enhanced liquidity, reduced interest expense, and improved profitability. The resulting strategic initiatives have set the stage for a period of significant growth and innovation. The overall assessment of the debt sale and subsequent transformation is positive, indicating successful execution of X Corp’s strategic plan. The improved financial strength and focused investment strategy point towards a promising future. Stay informed about the ongoing transformation of X Corp by following our blog for updates on its new financials and strategic initiatives, and subscribe to our newsletter for further insights into X Corp's journey.

Featured Posts

-

Bubba Wallace Misses Out On Martinsville Victory Final Restart Analysis

Apr 28, 2025

Bubba Wallace Misses Out On Martinsville Victory Final Restart Analysis

Apr 28, 2025 -

Why Are Gpu Prices Increasing Again A Detailed Analysis

Apr 28, 2025

Why Are Gpu Prices Increasing Again A Detailed Analysis

Apr 28, 2025 -

Rising Gpu Costs Impact On Gamers And Professionals

Apr 28, 2025

Rising Gpu Costs Impact On Gamers And Professionals

Apr 28, 2025 -

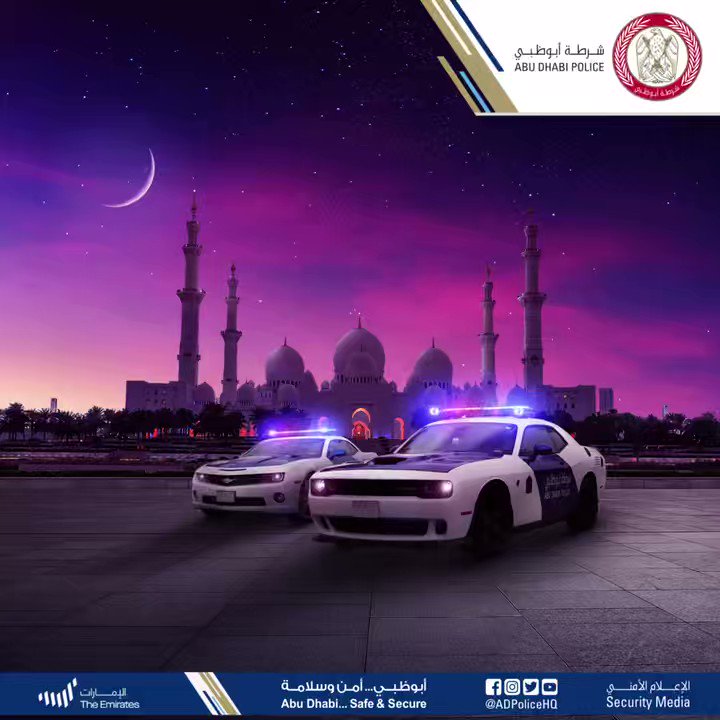

Thnyt Qayd Eam Shrtt Abwzby Llmnawbyn Wtfqd Syr Aleml Fy Abwzby

Apr 28, 2025

Thnyt Qayd Eam Shrtt Abwzby Llmnawbyn Wtfqd Syr Aleml Fy Abwzby

Apr 28, 2025 -

Chinas Targeted Tariff Exemptions For Us Made Goods

Apr 28, 2025

Chinas Targeted Tariff Exemptions For Us Made Goods

Apr 28, 2025