$200 Million Tariff Hit: Colgate (CL) Announces Reduced Sales And Profit Outlook

Table of Contents

The $200 Million Tariff Impact: A Deep Dive into the Numbers

The $200 million tariff impact represents a substantial blow to Colgate's financial health. The company hasn't explicitly broken down the precise sources of this impact, but it's highly likely a combination of factors.

- Import Tariffs on Raw Materials: A significant portion likely stems from increased tariffs on raw materials such as essential oils, flavorings, and packaging components imported for manufacturing. These increased costs directly impact Colgate's production expenses and subsequently, its profit margins.

- Tariffs on Finished Goods: Import tariffs on finished goods sold in certain regions also contribute to the overall impact. This reduces the competitiveness of Colgate's products in specific markets, potentially impacting sales volume and revenue.

The impact isn't uniformly distributed across all geographical regions. While Colgate hasn't released precise regional breakdowns, it's plausible that markets with high import duties and strong competition saw steeper declines. For example, markets in certain regions with high import taxes likely experienced the most significant sales drops.

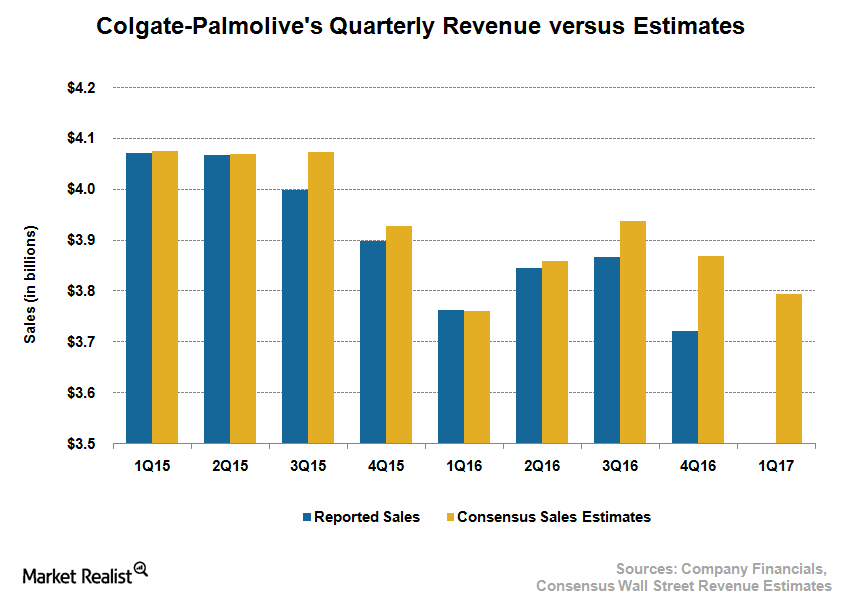

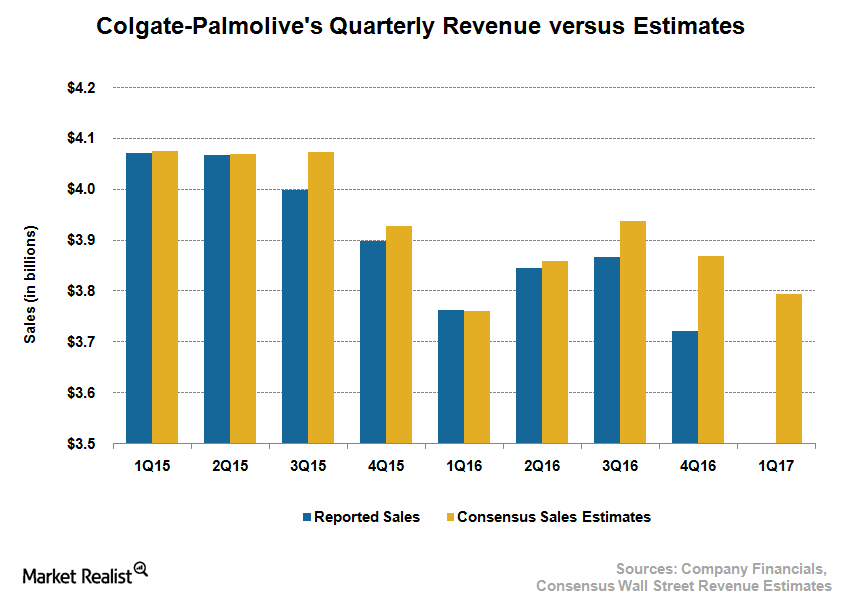

[Insert chart or graph here visually depicting the percentage decrease in profit margins and sales across relevant regions]. This visual representation will clearly illustrate the financial impact of the tariffs. The data for this graphic should be sourced from Colgate's official financial reports and announcements. This helps to increase the credibility of the article.

Colgate's Response to the Tariff Challenges

In response to these significant tariff-related challenges, Colgate has announced several strategic responses aimed at mitigating the negative financial effects. Their official statements highlight a multi-pronged approach:

- Price Adjustments: Colgate is likely adjusting prices in affected markets to offset the increased costs associated with tariffs. However, this approach carries the risk of reduced consumer demand, requiring careful consideration of price elasticity.

- Cost-Cutting Measures: The company is actively pursuing internal cost-cutting measures, examining every aspect of its supply chain and operations to enhance efficiency and reduce expenditures. This may involve streamlining processes, optimizing logistics, and negotiating better deals with suppliers.

- Supply Chain Diversification: To reduce dependency on tariff-affected regions, Colgate is likely diversifying its supply chain by exploring alternative sourcing options and manufacturing locations. This is a longer-term strategy that may take time to yield significant results.

The long-term effectiveness of these strategies will depend heavily on market dynamics, consumer resilience, and the overall global trade environment. The ability to successfully implement these changes will determine how effectively Colgate can navigate this challenging period.

Impact on Investors and Stock Performance

The announcement of the $200 million tariff hit immediately impacted Colgate's stock price (CL). [Insert data on stock price drop percentage here]. Investor sentiment turned cautious, reflecting concerns about the company's short-term profitability.

Analyst ratings have likely been adjusted downward, reflecting the short-term challenges posed by the tariffs. The long-term impact on investors will depend on the successful implementation of Colgate's mitigation strategies and the company's ability to regain lost ground. Investors are closely watching Colgate's next steps to gauge its resilience and future earning potential.

Long-Term Outlook and Future Predictions for Colgate (CL)

The long-term impact of these tariffs on Colgate's business strategy remains uncertain. While the immediate effects are negative, the company's long-term outlook depends on its ability to adapt.

- Changing Consumer Behavior: Price increases due to tariffs may lead to some shifts in consumer behavior. Some consumers might switch to cheaper alternatives or reduce their consumption of Colgate products.

- Future Growth Areas: Colgate might explore new avenues for growth, including focusing on higher-margin products, expanding into emerging markets less affected by tariffs, or investing in innovative product lines to maintain its competitive edge.

The ability of Colgate to effectively manage these challenges will determine its ability to maintain its market position and achieve sustained long-term growth. The company's proactive approach to mitigating risks and adapting to changing market dynamics will be crucial.

Conclusion: Navigating the Tariff Storm: The Future of Colgate (CL)

The $200 million tariff hit represents a significant challenge for Colgate-Palmolive, impacting sales and profits. The company's response, focusing on price adjustments, cost-cutting, and supply chain diversification, will determine its ability to navigate this turbulent period. Investor sentiment remains cautious, but the long-term impact depends on Colgate's success in implementing its strategies and maintaining its competitive edge. To stay informed on Colgate's progress in overcoming these challenges and its future financial outlook, it's important to regularly consult financial news sources and Colgate's official statements. Continuous monitoring of Colgate-Palmolive stock (CL) and its financial reports is crucial for understanding the ongoing impact of these tariffs and the company's overall performance.

Featured Posts

-

Bof As View Understanding And Addressing High Stock Market Valuations

Apr 26, 2025

Bof As View Understanding And Addressing High Stock Market Valuations

Apr 26, 2025 -

Exploring Florida With A Cnn Anchor His Top Picks And Hidden Gems

Apr 26, 2025

Exploring Florida With A Cnn Anchor His Top Picks And Hidden Gems

Apr 26, 2025 -

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 26, 2025

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 26, 2025 -

Navigating The Trump Era The Upcoming Challenges For The Federal Reserve Chair

Apr 26, 2025

Navigating The Trump Era The Upcoming Challenges For The Federal Reserve Chair

Apr 26, 2025 -

Revolutionizing Voice Assistant Development Open Ais Latest Innovation

Apr 26, 2025

Revolutionizing Voice Assistant Development Open Ais Latest Innovation

Apr 26, 2025