$3 Billion Crypto SPAC: Cantor, Tether, And SoftBank Explore Merger

Table of Contents

The Players Involved: A Deep Dive into Cantor, Tether, and SoftBank

This monumental crypto SPAC merger brings together three powerful entities, each bringing unique expertise and resources to the table. Understanding their individual roles is crucial to grasping the potential impact of this deal.

Cantor Fitzgerald: The Financial Heavyweight

Cantor Fitzgerald, a global financial services firm, is known for its expertise in capital markets and its significant experience with SPACs. Its strong reputation and financial strength provide a solid foundation for this ambitious undertaking. Cantor's involvement lends credibility and stability to the merger, attracting institutional investors and signaling confidence in the crypto market's long-term growth.

- Expertise in capital markets: Decades of experience in navigating complex financial transactions.

- History of successful SPACs: A proven track record of successfully executing SPAC mergers.

- Strong network of investors: Access to a wide range of high-net-worth individuals and institutional investors.

Tether: The Stablecoin Giant

Tether, the issuer of the USDT stablecoin, holds a dominant position in the cryptocurrency market. Its massive market capitalization and widespread adoption make it a key player in the crypto ecosystem. However, Tether's involvement also introduces potential risks, primarily related to regulatory scrutiny and the inherent volatility of the stablecoin market.

- Market dominance: USDT is one of the most widely traded cryptocurrencies globally.

- USDT market cap: A significant market capitalization, representing a substantial portion of the overall crypto market.

- Regulatory scrutiny: Tether faces ongoing scrutiny from regulators concerning its reserves and transparency.

- Stablecoin risks and opportunities: The inherent risks and potential rewards associated with investing in stablecoins.

SoftBank: The Tech Investment Powerhouse

SoftBank, a Japanese multinational conglomerate, is renowned for its strategic investments in technology and innovation. Its past investments in the tech and crypto sectors demonstrate its forward-thinking approach and its belief in the long-term potential of disruptive technologies. SoftBank's participation brings significant financial clout and strategic guidance to the merger.

- Venture capital investments: A vast portfolio of investments in numerous tech startups and innovative companies.

- History of significant tech investments: A long track record of successful investments in groundbreaking technology companies.

- Strategic partnerships: A network of strategic partnerships that could further enhance the merger's success.

Potential Implications of the $3 Billion Crypto SPAC Merger

This potential $3 billion crypto SPAC merger carries significant implications for the cryptocurrency market, investors, and regulators alike.

Market Impact and Growth Opportunities

The merger could significantly impact the cryptocurrency market, potentially accelerating its growth and adoption. The combined resources and expertise of the three players could lead to increased institutional investment, further legitimizing the crypto space.

- Increased adoption of crypto: The merger could boost mainstream adoption of cryptocurrencies and blockchain technology.

- Potential price surges: The merger could trigger price increases for various cryptocurrencies, depending on market sentiment.

- Increased institutional investment in crypto: The deal could attract even more institutional money into the crypto market.

Regulatory Scrutiny and Potential Challenges

The merger will undoubtedly face regulatory scrutiny from various jurisdictions. Navigating the complex and evolving regulatory landscape will be crucial for the success of this ambitious undertaking.

- SEC regulations: Compliance with the Securities and Exchange Commission's regulations will be paramount.

- Compliance issues: Ensuring compliance with international regulations and anti-money laundering (AML) laws.

- International regulatory landscape: Navigating the diverse regulatory environments across different countries.

Benefits for Investors

Investors participating in the SPAC could benefit from the high growth potential associated with the cryptocurrency market. However, it's crucial to understand the associated risks before investing.

- High growth potential: Significant potential for high returns on investment due to the explosive growth of the crypto market.

- Diversification opportunities: The merger offers investors diversification opportunities within the broader crypto sector.

- Early access to a major player in the crypto space: The opportunity to gain early access to a potentially dominant force in the crypto market.

The Future of Crypto Mergers and Acquisitions

This $3 billion crypto SPAC merger highlights the increasing trend of mergers and acquisitions in the crypto space. This deal could set a precedent for future transactions, potentially leading to further consolidation within the market.

- Consolidation of the crypto market: The merger could signal a trend towards consolidation among major players in the crypto industry.

- Increased institutional participation in M&A: The deal could encourage more institutional investors to participate in crypto M&A activities.

- Future investment trends: This merger could significantly influence future investment trends in the cryptocurrency market.

Conclusion

The potential $3 billion crypto SPAC merger involving Cantor Fitzgerald, Tether, and SoftBank represents a significant event in the cryptocurrency market. The deal's success will hinge on navigating regulatory challenges and delivering on its ambitious goals. This merger could significantly shape the future of the crypto landscape, accelerating growth and attracting further institutional investment.

Call to Action: Stay informed about the developments of this groundbreaking $3 billion crypto SPAC merger. Follow our updates on the latest news and analysis regarding this monumental crypto SPAC deal and the evolving crypto market. Learn more about the implications of this and other crypto SPAC mergers by subscribing to our newsletter.

Featured Posts

-

Alterya Joins Chainalysis Boosting Blockchain Security With Ai

Apr 24, 2025

Alterya Joins Chainalysis Boosting Blockchain Security With Ai

Apr 24, 2025 -

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 24, 2025

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 24, 2025 -

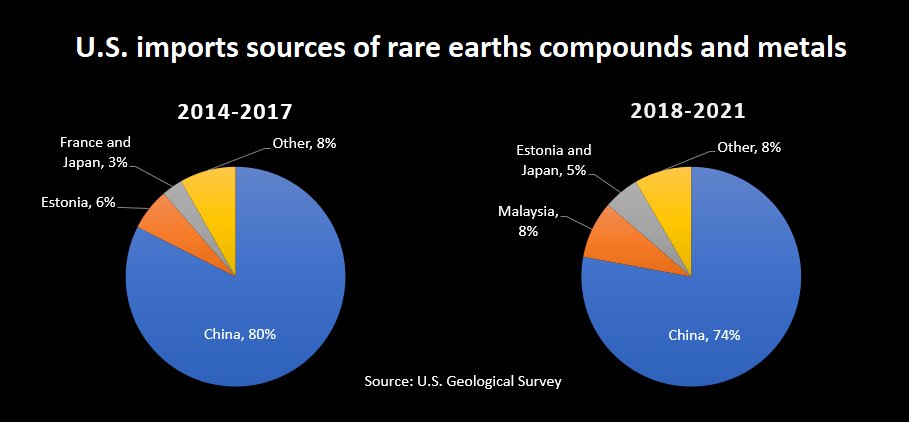

Chinas Rare Earth Export Curbs Hamper Teslas Optimus Robot Development

Apr 24, 2025

Chinas Rare Earth Export Curbs Hamper Teslas Optimus Robot Development

Apr 24, 2025 -

Ices Deportation Order Prevents Columbia Student Mahmoud Khalil From Attending Sons Birth

Apr 24, 2025

Ices Deportation Order Prevents Columbia Student Mahmoud Khalil From Attending Sons Birth

Apr 24, 2025 -

Stock Market Overview Dow S And P 500 April 23rd 2024

Apr 24, 2025

Stock Market Overview Dow S And P 500 April 23rd 2024

Apr 24, 2025