5 Actions To Land A Job In The Booming Private Credit Industry

Table of Contents

Network Strategically Within the Private Credit Sector

Networking is paramount in the private credit industry. Building relationships with key players is crucial for uncovering hidden job opportunities and gaining valuable insights. Here’s how to effectively network:

Attend Industry Events and Conferences

Private credit conferences are breeding grounds for career connections. Actively participate and engage in conversations.

- Identify key conferences: Research and prioritize events like SuperReturn, ACG events, and smaller, niche conferences relevant to your area of interest within private credit (e.g., distressed debt conferences).

- Prepare talking points: Develop concise, compelling statements about your skills and career aspirations within private credit. Highlight your relevant experience and what you bring to the table.

- Follow up strategically: After each event, send personalized emails to individuals you connected with. Reference a specific conversation and reiterate your interest in the private credit industry.

Leverage LinkedIn for Targeted Connections

LinkedIn is an invaluable tool for connecting with private credit professionals. Don't just passively observe; actively engage.

- Research companies and individuals: Identify key players in firms that interest you. Analyze their backgrounds, accomplishments, and areas of expertise within private credit.

- Engage thoughtfully: Don't just connect; comment on posts, share relevant articles, and participate in group discussions to showcase your understanding of private credit principles.

- Optimize your profile: Make sure your profile highlights your relevant skills and experience, utilizing keywords frequently used in private credit job descriptions (e.g., "financial modeling," "credit analysis," "debt restructuring").

Informational Interviews: Gain Insight and Build Relationships

Informational interviews are invaluable for gaining insider knowledge and building relationships.

- Prepare insightful questions: Demonstrate your genuine interest by asking thoughtful questions about their career path, the private credit industry, and any advice they might have for someone entering the field.

- Express gratitude and follow up: Always send a thank-you note after each interview, expressing your appreciation for their time and reiterating your interest in the private credit sector.

- View them as relationship building: These aren't just interviews; they are opportunities to build professional connections that could lead to future opportunities in private credit.

Master In-Demand Skills for Private Credit Roles

Possessing the right skills is crucial for securing a private credit role. Focus on these key areas:

Develop Financial Modeling Expertise

Financial modeling is the backbone of private credit analysis. Master these skills:

- Core modeling techniques: Develop proficiency in discounted cash flow (DCF) analysis, leveraged buyout (LBO) modeling, and other relevant valuation techniques.

- Software proficiency: Become highly skilled in Excel and potentially specialized financial modeling software (e.g., Argus, Bloomberg Terminal).

- Advanced training: Consider pursuing advanced finance courses or certifications to further enhance your skill set in this critical area of private credit.

Sharpen Your Credit Analysis Skills

A deep understanding of credit risk is paramount.

- Credit metrics mastery: Become fluent in key credit metrics such as leverage ratios, interest coverage, and debt service coverage ratios.

- Case study analysis: Practice analyzing case studies and real-world examples to improve your ability to assess credit risk in various scenarios within the private credit market.

- Professional certifications: Consider pursuing a CFA (Chartered Financial Analyst) or CAIA (Chartered Alternative Investment Analyst) charter to signal your expertise in private credit.

Hone Your Communication and Presentation Skills

Effectively communicating your ideas is crucial.

- Clear and concise communication: Practice delivering information clearly and concisely, both verbally and in writing.

- Storytelling abilities: Develop the ability to present your analyses and recommendations in a compelling narrative, tailored to your audience within the private credit industry.

- Seek feedback: Practice your presentation skills and actively solicit feedback from colleagues or mentors to continuously improve.

Target Your Job Search Strategically

A targeted approach significantly increases your chances of success.

Identify Your Niche Within Private Credit

The private credit industry encompasses diverse niches.

- Research sub-sectors: Investigate areas like direct lending, mezzanine finance, distressed debt, and special situations to determine your ideal fit.

- Consider your strengths: Align your chosen niche with your skills and interests. For example, if you excel in financial modeling, direct lending might be a strong fit.

- Tailor your applications: Customize your resume and cover letter to highlight the skills and experience relevant to your chosen niche within private credit.

Tailor Your Resume and Cover Letter

Each application should be unique.

- Keyword optimization: Use keywords directly from the job description to optimize your application materials for applicant tracking systems (ATS).

- Quantify achievements: Whenever possible, quantify your accomplishments using metrics to showcase the impact of your work within a private credit context.

- Proofread meticulously: Ensure your resume and cover letter are free of errors.

Prepare for Behavioral and Technical Interviews

Practice makes perfect.

- STAR method: Use the STAR method (Situation, Task, Action, Result) to answer behavioral interview questions effectively.

- Technical preparation: Review fundamental finance concepts and be prepared to discuss your financial modeling skills and credit analysis experience.

- Practice your delivery: Rehearse your answers aloud to improve your confidence and fluency during the interview process within the private credit industry.

Leverage Your Existing Network and Mentors

Your network can be your greatest asset.

Seek Guidance from Experienced Professionals

Mentorship is invaluable.

- Seek feedback: Ask for feedback on your resume, cover letter, and interview skills from individuals already working in the private credit industry.

- Navigational guidance: Ask for advice on navigating the job search process and understanding the nuances of the private credit industry.

- Build long-term relationships: Maintain contact with your mentors even after securing a job to continue learning and growing within the private credit space.

Utilize Alumni Networks and University Resources

Don't overlook these valuable resources.

- Alumni events: Attend career fairs and networking events hosted by your university or alumni association.

- Online platforms: Utilize online platforms like LinkedIn to connect with alumni working in private credit.

- Seek mentorship: Reach out to alumni for advice and mentorship.

Continuously Learn and Adapt in a Dynamic Market

The private credit landscape is constantly evolving.

Stay Updated on Industry Trends

Continuous learning is crucial for staying competitive.

- Industry publications: Read industry publications, follow thought leaders on social media, and attend industry events to stay informed about market trends.

- Webinars and workshops: Participate in webinars and workshops to expand your knowledge and understanding of new developments.

- Networking: Maintain regular interaction with professionals in the field to gain current insights.

Embrace Lifelong Learning

Continuous professional development is key.

- Certifications: Explore pursuing relevant certifications like the CFA or CAIA to advance your career.

- Online courses: Take online courses and attend workshops to broaden your skill set.

- Seek opportunities: Actively search for opportunities to deepen your expertise in areas relevant to your chosen niche within the private credit industry.

Conclusion

Landing a job in the booming private credit industry requires dedication and a strategic approach. By focusing on these five key actions – networking, skill development, targeted job searching, leveraging your network, and continuous learning – you'll significantly improve your chances of success. Don't delay – start implementing these strategies today to secure your place in this dynamic and rewarding field. Take the first step towards a fulfilling career in the private credit industry now!

Featured Posts

-

Success In Private Credit 5 Dos And Don Ts For Job Applications

Apr 24, 2025

Success In Private Credit 5 Dos And Don Ts For Job Applications

Apr 24, 2025 -

The Business Of Deportation How One Startup Airline Is Leveraging Charter Flights

Apr 24, 2025

The Business Of Deportation How One Startup Airline Is Leveraging Charter Flights

Apr 24, 2025 -

Navigating The Chinese Market The Case Of Bmw And Porsche

Apr 24, 2025

Navigating The Chinese Market The Case Of Bmw And Porsche

Apr 24, 2025 -

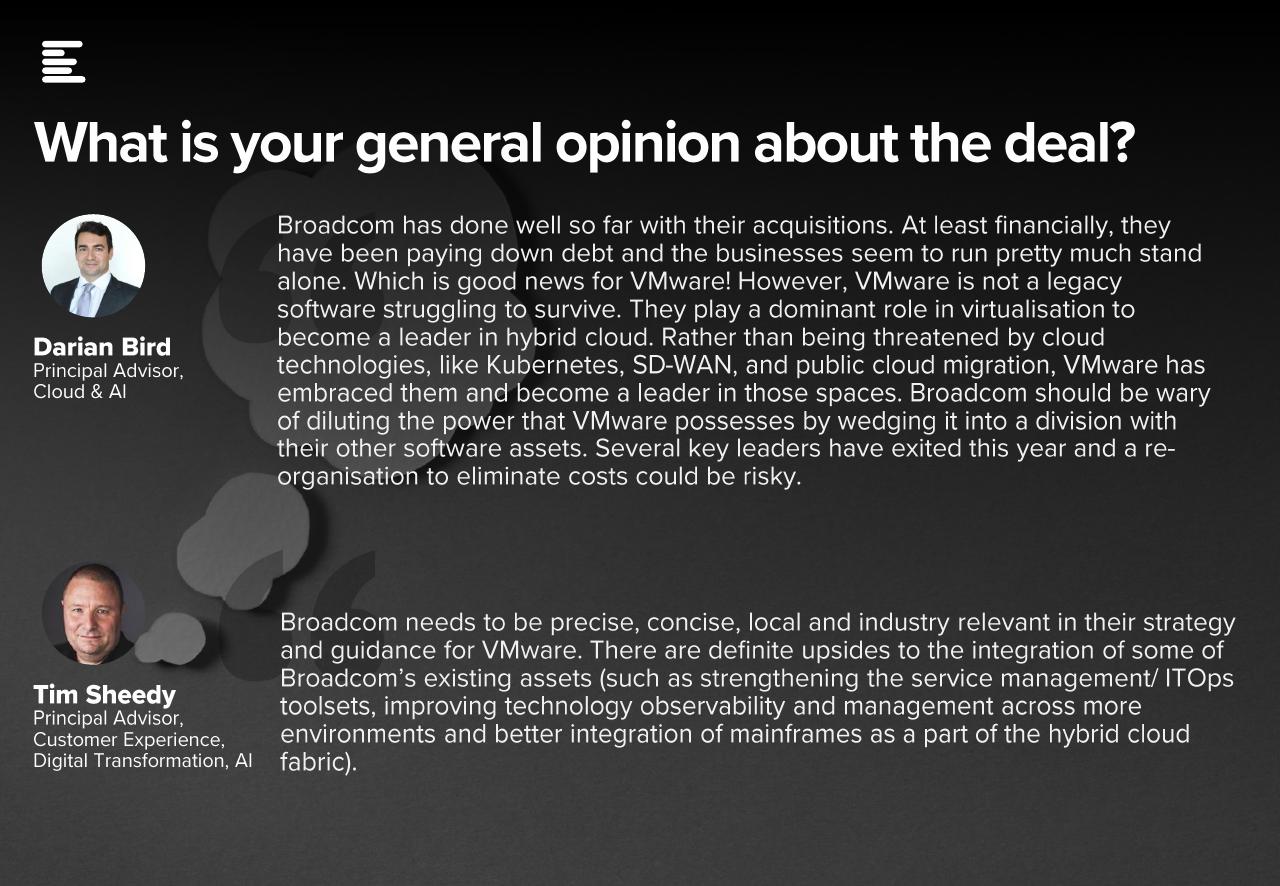

At And T Exposes Extreme Cost Increase In Broadcoms V Mware Proposal

Apr 24, 2025

At And T Exposes Extreme Cost Increase In Broadcoms V Mware Proposal

Apr 24, 2025 -

Hollywood Production Grinds To Halt As Actors Strike Alongside Writers

Apr 24, 2025

Hollywood Production Grinds To Halt As Actors Strike Alongside Writers

Apr 24, 2025