5 Do's And Don'ts For Landing A Job In The Private Credit Boom

Table of Contents

<p>The private credit market is booming, presenting unprecedented opportunities for ambitious finance professionals. However, navigating this competitive landscape requires a strategic approach. This article outlines five crucial do's and don'ts to help you land your dream job in this exciting sector of alternative lending and investment. The demand for skilled professionals in private credit, a significant segment of the broader credit market, is high, making a well-planned job search crucial for success.</p>

<h2>Do's: Maximize Your Chances in the Private Credit Job Market</h2>

<h3>1. Network Strategically</h3>

<p>Building a strong network is paramount in the private credit industry. Don't underestimate the power of personal connections. Networking isn't just about collecting business cards; it's about building genuine relationships.</p>

<ul> <li><b>LinkedIn Optimization:</b> Craft a compelling LinkedIn profile showcasing your experience in finance, particularly highlighting any experience in areas relevant to private credit, such as credit analysis, financial modeling, or portfolio management. Actively engage with industry professionals, join relevant groups, and participate in discussions.</li> <li><b>Industry Events:</b> Attend conferences, workshops, and seminars focused on private credit, alternative lending, and related fields. These events provide excellent networking opportunities and allow you to learn about the latest industry trends.</li> <li><b>Informational Interviews:</b> Reach out to professionals working in private credit firms for informational interviews. These conversations are invaluable for gaining insights into the industry and building relationships.</li> <li><b>Targeted Approach:</b> Research specific private credit firms that align with your skills and career goals. Target your networking efforts towards firms known for their expertise in areas like direct lending, distressed debt, or real estate finance.</li> </ul>

<h3>2. Tailor Your Resume and Cover Letter</h3>

<p>Generic applications rarely succeed in a competitive market like private credit. Each application should be meticulously tailored to the specific job description and the firm's investment strategy.</p>

<ul> <li><b>Keyword Optimization:</b> Incorporate keywords from the job posting throughout your resume and cover letter. This helps your application get past Applicant Tracking Systems (ATS) and into the hands of a human recruiter.</li> <li><b>Quantifiable Achievements:</b> Showcase your accomplishments with quantifiable results. Instead of stating "Managed a portfolio," write "Managed a $75 million portfolio, exceeding projected returns by 10%." </li> <li><b>Highlight Relevant Skills:</b> Emphasize skills directly relevant to private credit, such as financial modeling, credit analysis, underwriting, portfolio management, and legal knowledge pertaining to private debt.</li> <li><b>Company Research:</b> Demonstrate your understanding of the firm's investment strategy, recent deals, and overall market position within your cover letter. This shows genuine interest and initiative.</li> </ul>

<h3>3. Master the Technical Skills</h3>

<p>Private credit demands a strong foundation in technical skills. Proficiency in these areas is non-negotiable.</p>

<ul> <li><b>Financial Modeling:</b> Develop advanced skills in Excel and other financial modeling software. Practice building complex models for credit analysis, leveraged buyout valuations, and other private credit-related scenarios.</li> <li><b>Credit Analysis:</b> Master the art of analyzing financial statements, understanding credit scores, assessing risk, and making informed lending decisions. Familiarity with different credit rating agencies and their methodologies is crucial.</li> <li><b>Legal and Regulatory Knowledge:</b> Understand the legal and regulatory landscape of private credit and alternative lending. Stay updated on relevant laws and regulations.</li> <li><b>Continuous Learning:</b> Pursue relevant certifications like the Chartered Financial Analyst (CFA) or Chartered Alternative Investment Analyst (CAIA) to demonstrate your commitment to professional development. Online courses and workshops are valuable supplemental resources.</li> </ul>

<h3>4. Prepare for Behavioral and Technical Interviews</h3>

<p>Thorough interview preparation is crucial for success. Practice answering common questions and research the firm extensively.</p>

<ul> <li><b>Behavioral Questions:</b> Practice answering behavioral interview questions, such as those focusing on teamwork, problem-solving, and conflict resolution. Use the STAR method (Situation, Task, Action, Result) to structure your responses.</li> <li><b>Technical Questions:</b> Prepare for in-depth technical questions related to financial modeling, credit analysis, valuation methodologies, and current market trends in the private credit space.</li> <li><b>Firm Research:</b> Research the firm's investment strategy, recent transactions, and key personnel. This demonstrates genuine interest and allows you to ask insightful questions during the interview.</li> <li><b>Market Knowledge:</b> Showcase your knowledge of current market conditions, including interest rate trends, economic forecasts, and their potential impact on the private credit market. Stay updated on industry news and publications.</li> </ul>

<h2>Don'ts: Avoid These Pitfalls When Seeking Private Credit Roles</h2>

<h3>1. Don't Neglect Networking</h3>

<p>Relying solely on online applications is a mistake. Active networking is essential for uncovering hidden opportunities and building relationships with key players in the private credit market.</p>

<h3>2. Don't Submit Generic Applications</h3>

<p>Each application should be tailored to the specific requirements of the job and the firm's unique culture. Generic applications demonstrate a lack of effort and are unlikely to be successful.</p>

<h3>3. Don't Underestimate Technical Skills</h3>

<p>Strong quantitative and analytical skills are crucial for success in private credit. Invest time and effort in developing and refining these skills.</p>

<h3>4. Don't Underprepare for Interviews</h3>

<p>Thorough interview preparation is essential. Practice your responses, research the firm, and anticipate potential questions to avoid appearing unprepared.</p>

<h3>5. Don't Ignore the Importance of Cultural Fit</h3>

<p>Research the firm's culture and values to ensure a good fit. Demonstrating alignment with the firm's culture during the interview process significantly increases your chances of success.</p>

<h2>Conclusion</h2>

<p>Landing a job in the thriving private credit market requires dedication and a strategic approach. By following these do's and don'ts, focusing on networking, tailoring your applications, mastering technical skills, and preparing thoroughly for interviews, you'll significantly improve your chances of success. Don't delay; start your job search in the exciting world of private credit today! Remember to leverage your skills and network strategically to secure a position in this booming sector of alternative lending and investment. The private credit job market offers rewarding career paths for those who are prepared to put in the effort.</p>

Featured Posts

-

Chinas Energy Strategy Middle Eastern Lpg As Us Alternative

Apr 24, 2025

Chinas Energy Strategy Middle Eastern Lpg As Us Alternative

Apr 24, 2025 -

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Lawsuit

Apr 24, 2025

Ray Epps V Fox News A Deep Dive Into The January 6th Defamation Lawsuit

Apr 24, 2025 -

A Fathers Remembrance John Travolta Posts Photo To Remember Son Jett On His Birthday

Apr 24, 2025

A Fathers Remembrance John Travolta Posts Photo To Remember Son Jett On His Birthday

Apr 24, 2025 -

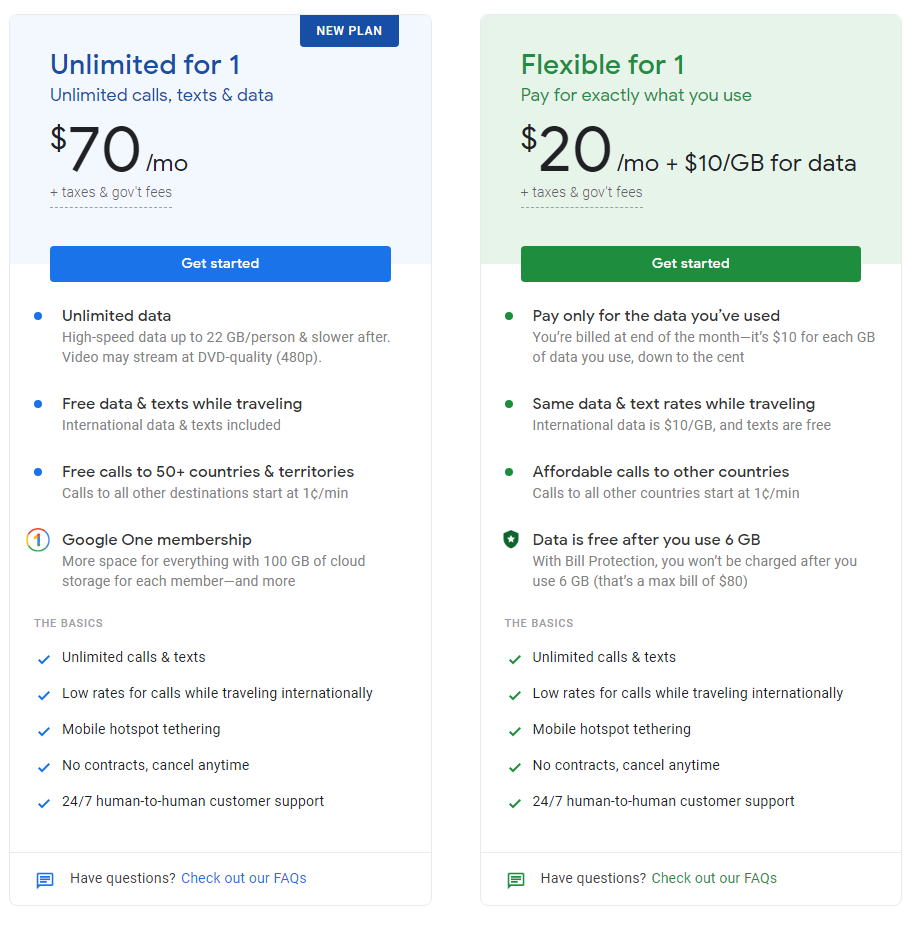

Understanding Google Fis New 35 Month Unlimited Plan

Apr 24, 2025

Understanding Google Fis New 35 Month Unlimited Plan

Apr 24, 2025 -

Tina Knowles Breast Cancer Diagnosis The Importance Of Mammograms

Apr 24, 2025

Tina Knowles Breast Cancer Diagnosis The Importance Of Mammograms

Apr 24, 2025