AbbVie (ABBV): New Drugs Fuel Sales Beat, Leading To Upgraded Profit Projections

Table of Contents

AbbVie is a global biopharmaceutical leader focused on developing and marketing innovative medicines across several key therapeutic areas, including immunology, oncology, neuroscience, and ophthalmology. This diverse portfolio allows them to navigate market fluctuations and capitalize on emerging opportunities. The positive Q3 results are a significant win, boosting investor confidence and reinforcing AbbVie's position as a major player in the pharmaceutical sector.

Strong Sales Performance Driven by New Drug Launches

AbbVie's Q3 earnings clearly demonstrate the power of its innovative drug portfolio. The company's impressive sales growth is largely attributed to the outstanding performance of its newer entrants.

Rinvoq and Skyrizi Success

Rinvoq and Skyrizi, AbbVie's key immunology biologics, have been significant contributors to the company's overall sales surge. Rinvoq, approved for treating rheumatoid arthritis, psoriatic arthritis, and other inflammatory conditions, saw robust sales growth. Similarly, Skyrizi, approved for psoriasis, psoriatic arthritis, and Crohn's disease, continued its strong market penetration. These drugs' success underscores AbbVie's prowess in developing effective treatments within the competitive immunology market.

Contribution of Other Key Products

While Rinvoq and Skyrizi are leading the charge, other established AbbVie products continue to contribute substantially to the company's revenue stream. Humira, although facing biosimilar competition in some markets, maintains a significant market share and still generates strong sales. The performance of these established products, alongside the success of newer medications, demonstrates a diversified revenue stream that provides stability and reduces reliance on single products.

- Specific sales figures: While precise figures will vary depending on the official release, reports indicate strong double-digit growth for both Rinvoq and Skyrizi. (Source: AbbVie Q3 2023 Earnings Release – Insert official link here when available)

- Market share data: Rinvoq and Skyrizi have captured significant market share in their respective therapeutic areas, displacing older treatments and indicating strong physician and patient preference. (Source: Cite relevant market research reports here)

- Growth projections: AbbVie's management has expressed confidence in the continued growth trajectory of these key products, projecting further expansion in the coming quarters.

Upgraded Profit Projections and Financial Outlook

AbbVie's Q3 earnings report wasn't just about strong sales; it also involved a significant upward revision of the company's profit projections.

Revised Earnings Guidance

The improved financial outlook reflects the exceeding expectations across various key performance indicators. AbbVie raised its full-year earnings per share (EPS) guidance, indicating greater confidence in its financial performance for the remainder of the year. This substantial upward revision is directly linked to the robust sales of Rinvoq, Skyrizi, and the continued success of its other key products.

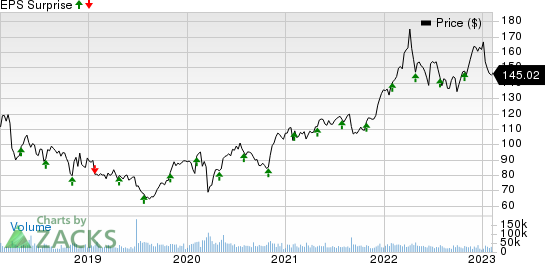

Investor Confidence and Market Reaction

The market reacted positively to AbbVie's stellar Q3 results. ABBV stock price saw a significant increase following the earnings announcement, reflecting investor confidence in the company's future. The positive market reaction is a clear indicator of the impact of these strong financial results on investor sentiment.

- Specific numbers: The official earnings release will detail the precise numerical adjustments to AbbVie's earnings guidance. (Source: AbbVie Q3 2023 Earnings Release – Insert official link here when available)

- Stock price change: Track the ABBV stock price movements in the days following the earnings announcement to see the market's response. (Source: Major financial news outlets and stock market trackers)

- Analyst quotes: Look for commentary from financial analysts and AbbVie executives to gauge the overall sentiment surrounding the company's performance. (Source: Financial news websites and transcripts of earnings calls)

Long-Term Growth Strategy and Research & Development

AbbVie's success isn't solely based on its current product portfolio. The company's robust research and development (R&D) pipeline is a key driver of its long-term growth strategy.

Pipeline of Future Drugs

AbbVie is actively investing in research and development, with a pipeline of promising new drugs in various stages of clinical trials. These innovative therapies target unmet medical needs across various therapeutic areas, providing opportunities for future revenue growth and solidifying the company's position as a leader in pharmaceutical innovation. The success of Rinvoq and Skyrizi highlights the effectiveness of AbbVie's R&D strategy.

Competitive Landscape

The pharmaceutical industry is highly competitive. AbbVie faces competition from other major pharmaceutical companies. However, AbbVie's strong R&D efforts, strategic partnerships, and a diverse portfolio allow it to maintain a competitive edge in the market and manage risks effectively.

- Promising drugs in the pipeline: AbbVie regularly updates its investors on its R&D progress. Details on upcoming drugs are usually found in their investor relations section. (Source: AbbVie Investor Relations website)

- Key competitors: Identify and analyze the key players in AbbVie's therapeutic areas to understand the competitive landscape. (Source: Market research reports and industry analyses)

- Competitive advantages: Assess AbbVie's strengths, such as its R&D capabilities, sales force, and global reach, to understand its competitive advantages.

Conclusion: AbbVie (ABBV) – A Strong Performer with a Bright Future

AbbVie's strong Q3 2023 earnings, driven by the remarkable success of Rinvoq and Skyrizi and complemented by the continued performance of established products, have resulted in upgraded profit projections and a very positive investor response. The company's robust R&D pipeline and strategic initiatives further solidify its positive long-term outlook. Considering the strong financial results and promising future, AbbVie presents a compelling investment opportunity in the pharmaceutical sector. If you are interested in learning more about AbbVie (ABBV) and its investment opportunities, consider conducting further research and perhaps seeking professional financial advice before making any investment decisions. Invest in AbbVie and potentially benefit from the growth of this pharmaceutical giant.

Featured Posts

-

The Federal Reserves Next Leader Facing The Aftermath Of The Trump Presidency

Apr 26, 2025

The Federal Reserves Next Leader Facing The Aftermath Of The Trump Presidency

Apr 26, 2025 -

Hegseth Rattled Exclusive Details On Pentagon Leaks Polygraph Threats And Internal Fights

Apr 26, 2025

Hegseth Rattled Exclusive Details On Pentagon Leaks Polygraph Threats And Internal Fights

Apr 26, 2025 -

From Egypt To The Nfl Ahmed Hassaneins Historic Bid

Apr 26, 2025

From Egypt To The Nfl Ahmed Hassaneins Historic Bid

Apr 26, 2025 -

Office365 Executive Inboxes Targeted In Multi Million Dollar Hack

Apr 26, 2025

Office365 Executive Inboxes Targeted In Multi Million Dollar Hack

Apr 26, 2025 -

La Wildfires A Reflection Of Our Times Through Disaster Betting

Apr 26, 2025

La Wildfires A Reflection Of Our Times Through Disaster Betting

Apr 26, 2025