The Federal Reserve's Next Leader: Facing The Aftermath Of The Trump Presidency

Table of Contents

The selection of the next Federal Reserve Chair is a pivotal moment for the US economy. The individual chosen will inherit a complex economic landscape significantly shaped by the policies of the Trump presidency. This article examines the key challenges facing the next Fed leader, considering the economic aftermath of the previous administration and the crucial decisions that lie ahead. The future of US monetary policy, and indeed the stability of the American economy, hangs in the balance.

<h2>Economic Legacy of the Trump Administration</h2>

The Trump administration's economic policies left a lasting impact on the US economy, creating both opportunities and significant challenges for the next Federal Reserve Chair. Understanding this legacy is crucial for navigating the complexities of the current economic climate. Key aspects include:

-

Tax Cuts and Jobs Act (TCJA): The TCJA, enacted in 2017, significantly reduced corporate and individual income tax rates. While stimulating short-term economic growth, it also contributed to a substantial increase in the national debt. Economists debate the long-term effects, with some arguing that the tax cuts fueled unsustainable levels of spending, while others point to increased investment as a positive outcome. The impact on inflation remains a subject of ongoing analysis.

-

Deregulation: The Trump administration pursued a policy of deregulation across various sectors, including finance and environmental protection. While proponents argued that deregulation boosted economic efficiency, critics raised concerns about increased systemic risk and environmental damage. The long-term consequences of reduced regulatory oversight on financial stability remain a significant concern for the next Fed Chair.

-

Trade Wars: The administration's initiation of trade wars, particularly with China, disrupted global supply chains and contributed to increased uncertainty in the global economy. These trade disputes led to higher prices for some goods and impacted economic growth, leaving lasting scars on international trade relationships that the next Fed Chair must navigate.

-

Fiscal Policies: The combination of tax cuts and increased government spending under the Trump administration led to a rapid expansion of the national debt. This increased debt burden places constraints on future fiscal policy and presents a significant challenge for the next Fed Chair in managing the overall economic stability of the US. The long-term consequences of this fiscal trajectory require careful consideration and strategic planning.

<h2>Inflation and Interest Rate Challenges</h2>

Controlling inflation is a primary mandate of the Federal Reserve. The next Fed Chair will inherit an environment characterized by potentially persistent inflationary pressures. This necessitates careful management of interest rates and monetary policy tools.

-

Current Inflationary Environment: The current inflation rate, while fluctuating, remains a significant concern. Various factors contribute to this, including supply chain disruptions, increased demand, and energy price volatility. Understanding the root causes is critical for effective policy responses.

-

Monetary Policy Tools: The Fed employs various tools to manage inflation, including adjusting the federal funds rate (interest rates), conducting quantitative easing (QE) or quantitative tightening (QT), and communicating its policy intentions to the market. The effectiveness of each tool varies depending on the specific economic circumstances.

-

Trade-offs: Controlling inflation often requires slowing economic growth. The next Fed Chair must navigate the delicate balance between curbing inflation and maintaining a healthy level of economic activity, avoiding a potential recession. This requires a nuanced understanding of the economy's intricacies and a capacity for strategic decision-making under pressure.

-

Interest Rate Hikes: The impact of interest rate hikes on different sectors of the economy can vary significantly. Higher interest rates can dampen borrowing and investment, potentially slowing economic growth, while also impacting consumer spending and housing markets. The next Fed Chair will need a keen eye on the ripple effects of these decisions across various economic sectors.

<h2>Financial Regulation and Systemic Risk</h2>

Maintaining financial stability is another critical responsibility of the Federal Reserve. The next Chair will need to carefully assess the current regulatory landscape and address potential systemic risks.

-

State of Financial Regulation: The regulatory environment following the Dodd-Frank Act, introduced after the 2008 financial crisis, has undergone some adjustments under different administrations. Evaluating the effectiveness of the existing regulations and identifying areas needing further attention is crucial.

-

Systemic Risk: The interconnectedness of the financial system creates the potential for systemic risk – a large-scale disruption that could have cascading effects throughout the economy. Identifying and mitigating these risks is a key priority for the next Fed Chair.

-

Regulatory Reforms: The need for potential regulatory reforms or adjustments will depend on the evolving financial landscape. Balancing the need for robust regulation with the desire to avoid stifling economic growth requires careful consideration and a pragmatic approach.

-

Banking Supervision: The Fed plays a significant role in supervising financial institutions. Ensuring the soundness of banks and other financial institutions is critical for maintaining the stability of the financial system. Effective oversight demands a proactive and vigilant approach.

<h3>The Geopolitical Landscape and the Fed</h3>

The US economy is deeply intertwined with the global economy. The next Federal Reserve Chair must consider the impact of geopolitical events on domestic economic conditions.

-

Global Economic Uncertainty: Events such as the war in Ukraine, supply chain disruptions, and escalating geopolitical tensions significantly impact the US economy. These external shocks create uncertainty and complicate the task of monetary policy management.

-

International Monetary Cooperation: The Fed plays a crucial role in international monetary cooperation, coordinating policies with other central banks to manage global economic stability. Effective coordination is essential in dealing with global challenges and maintaining a stable international financial system.

-

Balancing Domestic and International Concerns: The next Fed Chair must effectively balance domestic economic priorities with the need for international cooperation. This requires navigating complex geopolitical considerations and effectively managing the intertwined nature of the global and domestic economies.

<h2>Conclusion</h2>

The next Federal Reserve Chair faces a daunting array of challenges, including managing the economic legacy of the Trump presidency, addressing persistent inflationary pressures, navigating the complexities of financial regulation, and responding to an increasingly uncertain geopolitical landscape. The success of the next Fed Chair will significantly impact the future trajectory of the US economy. Understanding these multifaceted challenges is crucial for informed participation in the economic discourse. Stay informed about the Federal Reserve's decisions and their implications for the economy. Follow our updates on the next Federal Reserve Chair and the future of US monetary policy to stay abreast of these critical developments.

Featured Posts

-

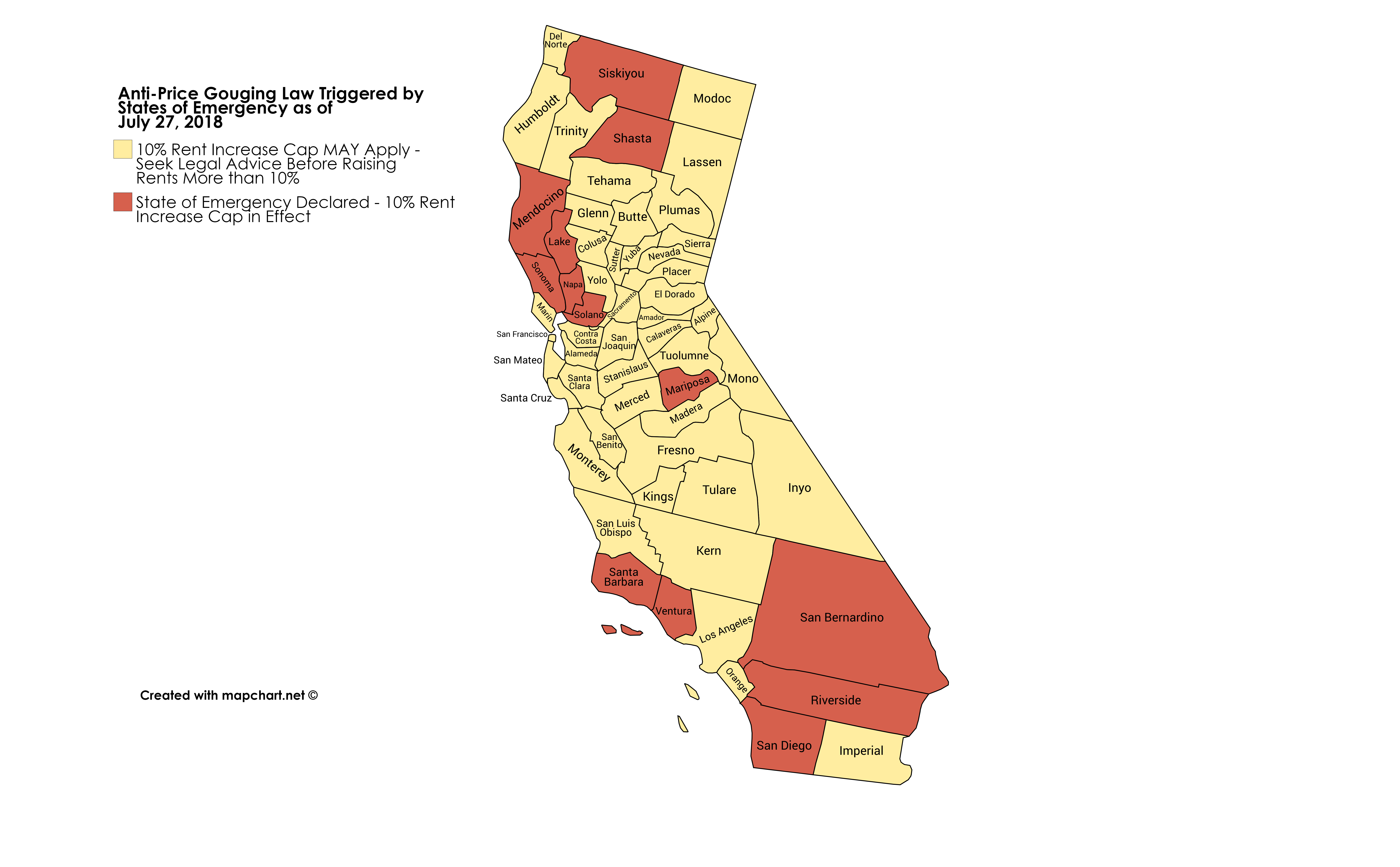

La Fires Price Gouging Concerns Raised By Reality Tv Star

Apr 26, 2025

La Fires Price Gouging Concerns Raised By Reality Tv Star

Apr 26, 2025 -

Middle Management The Unsung Heroes Of Business Growth And Employee Development

Apr 26, 2025

Middle Management The Unsung Heroes Of Business Growth And Employee Development

Apr 26, 2025 -

Could Ahmed Hassanein Become The First Egyptian Nfl Draft Pick

Apr 26, 2025

Could Ahmed Hassanein Become The First Egyptian Nfl Draft Pick

Apr 26, 2025 -

From Egypt To The Nfl Ahmed Hassaneins Historic Bid

Apr 26, 2025

From Egypt To The Nfl Ahmed Hassaneins Historic Bid

Apr 26, 2025 -

Ftc Challenges Court Ruling On Microsoft Activision Deal

Apr 26, 2025

Ftc Challenges Court Ruling On Microsoft Activision Deal

Apr 26, 2025