Addressing Investor Concerns: BofA's View On Current Stock Market Valuations

Table of Contents

BofA's Overall Assessment of Current Market Valuations

BofA's recent reports indicate a nuanced view on current stock market valuations. While not definitively declaring the market as overvalued or undervalued, their analysis suggests a cautious optimism. They acknowledge elevated valuations in certain sectors, but also highlight potential for growth in others. Their assessment relies heavily on a combination of traditional and forward-looking valuation metrics.

-

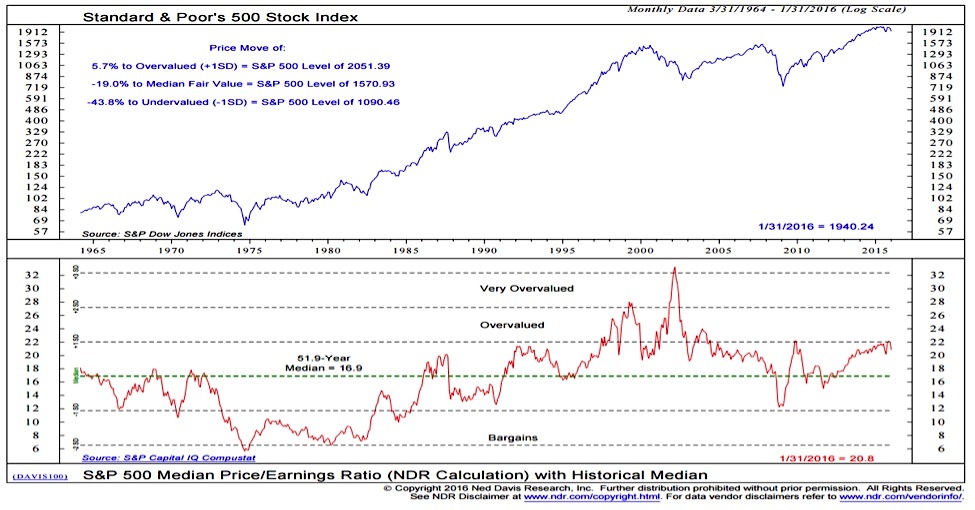

Bullet Point 1: BofA utilizes a range of valuation metrics including Price-to-Earnings (P/E) ratios, Price-to-Sales (P/S) ratios, and discounted cash flow (DCF) analysis to assess the intrinsic value of equities. They emphasize the importance of comparing these ratios to historical averages and considering industry-specific factors.

-

Bullet Point 2: BofA's research suggests that certain sectors, particularly technology and some consumer discretionary stocks, may be relatively overvalued based on current P/E ratios compared to historical averages and projected earnings growth. Conversely, they may see value in certain cyclical sectors poised for growth as economic conditions improve.

-

Bullet Point 3: BofA's predictions for future market performance remain guardedly optimistic. They anticipate moderate growth, but caution investors about potential headwinds such as inflation and interest rate hikes. Their projections often incorporate various economic scenarios and sensitivity analyses to account for uncertainty.

Further Details: BofA's detailed reports often cite specific P/E ratios for different sectors, providing a quantitative basis for their assessments. For example, they might note that the technology sector's average P/E ratio is currently above its long-term average, suggesting potential overvaluation. They also consider factors beyond simple ratios, incorporating qualitative assessments of company fundamentals, competitive landscapes, and macroeconomic trends.

Key Factors Influencing BofA's Valuation Analysis

Several key macroeconomic factors heavily influence BofA's valuation analysis and overall market outlook. Understanding these factors is critical to interpreting their conclusions.

Interest Rate Impacts

Interest rates play a crucial role in BofA's valuation models.

-

Bullet Point 1: Higher interest rates increase the discount rate used in DCF models, reducing the present value of future cash flows and thus lowering the estimated intrinsic value of equities. This is because investors demand a higher return for their investment when interest rates are high.

-

Bullet Point 2: BofA's projections for future interest rate changes are crucial in shaping their stock market outlook. If they forecast further rate hikes, this would generally suggest a more bearish outlook on equity valuations.

-

Bullet Point 3: The impact on different asset classes varies. Higher interest rates generally benefit bonds, making them more attractive compared to equities, potentially leading to a shift in investor allocation.

Inflationary Pressures

Inflation significantly impacts BofA's valuation analysis.

-

Bullet Point 1: High inflation erodes corporate profitability by increasing input costs (raw materials, wages) while potentially limiting pricing power. This negatively impacts earnings growth, a key driver of stock valuations.

-

Bullet Point 2: BofA incorporates inflation expectations into their valuation models through adjustments to their discount rates and earnings forecasts. They closely monitor inflation data and central bank announcements to inform their assumptions.

-

Bullet Point 3: BofA's predictions for future inflation are vital for their market forecasts. Persistent high inflation could negatively impact valuations, while a return to a more stable inflationary environment could support higher valuations.

Geopolitical Risks

Geopolitical uncertainty introduces significant complexity to BofA's analysis.

-

Bullet Point 1: Specific events like the war in Ukraine or trade tensions between major economies can significantly impact market sentiment and corporate earnings, influencing BofA's valuation assessments. These events introduce considerable uncertainty and volatility.

-

Bullet Point 2: BofA factors geopolitical risk into their models through scenario planning and stress testing. They assess the potential impact of various geopolitical developments on company performance and incorporate these assessments into their valuation estimates.

-

Bullet Point 3: BofA's recommendations for mitigating geopolitical risks often include diversification across geographies and sectors, and potentially hedging strategies to protect against negative market impacts from unforeseen geopolitical events.

BofA's Investment Recommendations Based on Valuation Analysis

Based on their valuation analysis and consideration of macroeconomic factors, BofA offers investment recommendations with varying levels of risk.

-

Bullet Point 1: They might suggest overweighting sectors that they deem undervalued, potentially including specific industries showing resilience to economic headwinds or strong long-term growth potential.

-

Bullet Point 2: BofA's recommended investment strategies often depend on an investor's risk tolerance and time horizon. For example, they may recommend value investing in undervalued companies or growth investing in high-growth sectors, depending on the prevailing market conditions.

-

Bullet Point 3: While specific stock recommendations should always be discussed with a financial advisor, BofA might highlight certain ETFs or broader market indices as suitable investments based on their overall market outlook. Disclaimer: This information is for educational purposes only and does not constitute financial advice.

Further Details: The rationale behind BofA's recommendations is usually explained in detail in their research reports. They often include sensitivity analyses showing how their recommendations might change under various economic scenarios. It is crucial to carefully review this information and consult with a financial professional to assess the suitability of any investment strategy to your individual circumstances.

Conclusion

BofA's assessment of current stock market valuations paints a picture of cautious optimism. They acknowledge elevated valuations in certain sectors but emphasize the need to consider a multitude of factors, including interest rates, inflation, and geopolitical risks. Their recommendations often involve a diversified approach, with a focus on understanding and managing risk. Understanding BofA's perspective on current stock market valuations is crucial for making informed investment decisions. Stay updated on market analysis and consult with a financial advisor to develop a personalized investment strategy tailored to your risk tolerance and financial goals. Learn more about BofA's insights on stock market valuations by [link to relevant BofA resources].

Featured Posts

-

Is Liam Dying The Bold And The Beautiful Spoilers On His Critical Condition

Apr 24, 2025

Is Liam Dying The Bold And The Beautiful Spoilers On His Critical Condition

Apr 24, 2025 -

Death Of Sophie Nyweide Mammoth And Noah Actress Passes Away At 24

Apr 24, 2025

Death Of Sophie Nyweide Mammoth And Noah Actress Passes Away At 24

Apr 24, 2025 -

The Rise Of Disaster Betting Examining The Los Angeles Wildfire Example

Apr 24, 2025

The Rise Of Disaster Betting Examining The Los Angeles Wildfire Example

Apr 24, 2025 -

U S Border Patrol Sees Fewer Apprehensions At Canada U S Border White House Data

Apr 24, 2025

U S Border Patrol Sees Fewer Apprehensions At Canada U S Border White House Data

Apr 24, 2025 -

Understanding The India Market Rally Niftys Impressive Growth

Apr 24, 2025

Understanding The India Market Rally Niftys Impressive Growth

Apr 24, 2025