Understanding The India Market Rally: Nifty's Impressive Growth

Table of Contents

Economic Fundamentals Fueling the Nifty's Ascent

The India market rally's strength is deeply rooted in robust economic fundamentals. Several key factors contribute to the Nifty 50's impressive performance and overall market optimism.

Strong GDP Growth

India's consistent high GDP growth rate is a primary driver of the India market rally. The country has consistently outperformed many global economies, fostering investor confidence. For example, [insert recent GDP growth statistic, citing source]. This positive trend is projected to continue, with forecasts suggesting [insert projected GDP growth, citing source].

- Key sectors driving growth:

- Information Technology (IT) services, benefiting from global demand.

- Manufacturing, fueled by government initiatives like "Make in India."

- The services sector, encompassing diverse industries like finance and healthcare.

- Government initiatives supporting expansion:

- Massive infrastructure development projects, boosting related industries.

- Reforms aimed at improving the "ease of doing business" in India, attracting foreign investment.

Positive Foreign Investment

Significant Foreign Institutional Investment (FII) inflows have significantly boosted the Nifty's performance and the overall India market rally. The positive sentiment towards the Indian economy is attracting considerable foreign capital.

- Reasons for increased FII interest:

- Improving macroeconomic indicators, showcasing India's resilience.

- Long-term growth potential, attracting investors seeking high returns.

- A relatively stable political environment compared to other emerging markets.

- Impact of global macroeconomic factors on FII flows: While global uncertainties can influence FII flows, India's strong fundamentals often provide a buffer against global headwinds.

Improving Consumer Sentiment

Rising consumer confidence is another vital element contributing to the India market rally. Increased spending power is driving growth across various sectors.

- Factors driving improved consumer sentiment:

- Rising disposable incomes, leading to increased consumer spending.

- A positive employment outlook, boosting confidence and spending.

- Government schemes aimed at boosting rural incomes.

- Impact of consumer spending on various sectors: Increased consumer spending fuels growth in sectors like automobiles, consumer durables, and retail.

Sector-Specific Performances Driving the India Market Rally

Beyond macroeconomic factors, specific sectors have played a crucial role in the Nifty's ascent and the overall India market rally.

Technology Sector Boom

The IT sector has been a significant contributor to the Nifty's growth. The global demand for technology services and the presence of major Indian IT companies have propelled this sector's performance.

- Leading tech companies and their performance: [Mention examples and their contribution to market growth].

- Impact of global demand for technology services: The global shift towards digitalization has fueled demand for Indian IT services.

Financial Services Sector Strength

The financial services sector, including banks and insurance companies, has also shown strong performance, bolstering the India market rally.

- Performance of banks and insurance companies: [Mention key indicators and trends].

- Impact of government regulations and reforms: Government initiatives aimed at strengthening the financial sector have improved investor confidence.

Infrastructure Development's Positive Impact

Significant investments in infrastructure development have had a ripple effect across the economy, supporting the India market rally.

- Government initiatives and private sector investments: [Mention examples of major infrastructure projects].

- Impact on related sectors: Infrastructure development boosts sectors like cement, steel, and construction.

Potential Risks and Challenges to the Nifty's Growth

While the outlook is positive, several potential risks and challenges could impact the Nifty's growth and the overall India market rally.

Inflationary Pressures

Rising inflation is a concern, potentially impacting consumer spending and market sentiment.

- Impact of rising interest rates: Interest rate hikes to combat inflation can dampen economic growth.

- Government's strategies to control inflation: [Discuss government measures to manage inflation].

Geopolitical Uncertainties

Global geopolitical events can influence the Indian market.

- Specific geopolitical events and their potential impact: [Mention potential events and their possible consequences].

- Strategies for mitigating geopolitical risks: Diversification and hedging strategies can help mitigate these risks.

Regulatory Changes

Future regulatory changes could affect market dynamics.

- Potential changes and their potential effects: [Discuss potential regulatory changes and their impact].

- Adaptability of the market to regulatory changes: The Indian market has historically shown resilience to regulatory changes.

Conclusion

The India market rally, reflected in the Nifty 50's impressive growth, is driven by a confluence of factors: strong economic fundamentals, sector-specific performances, and positive investor sentiment. While potential risks exist, the underlying strength of the Indian economy suggests continued growth. Understanding the India market rally and the Nifty 50's growth trajectory is crucial for informed investment decisions. Continue your research and explore the exciting opportunities within the Indian stock market. Consider consulting with a financial advisor before making any investment decisions.

Featured Posts

-

Chat Gpt Ceo Hints At Open Ais Potential Google Chrome Acquisition

Apr 24, 2025

Chat Gpt Ceo Hints At Open Ais Potential Google Chrome Acquisition

Apr 24, 2025 -

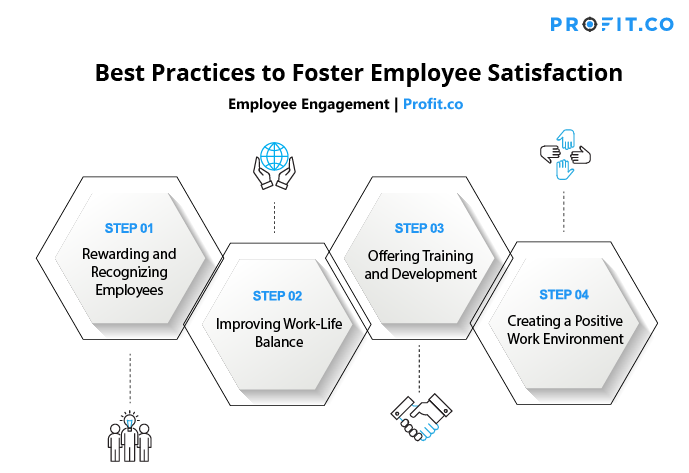

The Importance Of Middle Management Driving Productivity And Employee Satisfaction

Apr 24, 2025

The Importance Of Middle Management Driving Productivity And Employee Satisfaction

Apr 24, 2025 -

Btc Price Increase Analyzing The Impact Of Trumps Policies And Fed Decisions

Apr 24, 2025

Btc Price Increase Analyzing The Impact Of Trumps Policies And Fed Decisions

Apr 24, 2025 -

Toxic Chemicals From Ohio Train Derailment Building Contamination And Its Duration

Apr 24, 2025

Toxic Chemicals From Ohio Train Derailment Building Contamination And Its Duration

Apr 24, 2025 -

Uil State Bound Hisd Mariachis Whataburger Video Goes Viral

Apr 24, 2025

Uil State Bound Hisd Mariachis Whataburger Video Goes Viral

Apr 24, 2025