Analyzing The Canadian Dollar's Performance Against Major Currencies

Table of Contents

The CAD's Relationship with the US Dollar (USD): A Deep Dive

The Canadian and US economies are deeply intertwined, resulting in a strong correlation between the CAD and USD exchange rates. This close relationship means movements in one currency often directly influence the other. Several factors drive this dynamic:

-

Oil Prices: Canada is a major exporter of crude oil. Higher oil prices generally boost the CAD, as increased demand for Canadian exports strengthens the currency. Conversely, lower oil prices tend to weaken the CAD. Monitoring oil price fluctuations (e.g., using benchmarks like West Texas Intermediate and Brent Crude) is crucial for understanding CAD/USD movements.

-

Interest Rate Differentials: The difference in interest rates between Canada and the US significantly impacts the CAD/USD exchange rate. Higher interest rates in Canada relative to the US typically attract foreign investment, increasing demand for the CAD and strengthening it.

-

Economic Growth: Robust economic growth in Canada, compared to the US, can strengthen the CAD. Key indicators like Canadian Gross Domestic Product (GDP) growth, employment numbers, and consumer confidence play a vital role.

-

Geopolitical Factors: Geopolitical events impacting North America, such as trade disputes or political instability, can significantly affect both economies and influence the CAD/USD exchange rate.

[Insert chart/graph illustrating CAD/USD exchange rate over the past year, clearly labeled and sourced.]

Analyzing the CAD Against the Euro (EUR)

The CAD/EUR exchange rate is influenced by global economic conditions and the relative health of the Canadian and European economies. A strong Eurozone economy generally benefits the EUR, potentially putting downward pressure on the CAD. Conversely, weakness in the Eurozone can strengthen the CAD. Factors affecting this pair include:

-

Eurozone Interest Rates: Changes in the European Central Bank's (ECB) interest rate policy directly impact the Euro and, consequently, the CAD/EUR exchange rate.

-

Political Stability within the EU: Political instability or uncertainty within the European Union can negatively affect the Euro and influence the CAD/EUR exchange rate.

-

Global Trade Dynamics Involving the EU: Global trade flows and economic relationships between Canada and the European Union significantly impact the exchange rate.

Understanding the CAD's Performance Against the British Pound (GBP)

The CAD/GBP exchange rate reflects the economic performance of both Canada and the United Kingdom. Brexit's long-term effects continue to influence the GBP, indirectly affecting its relationship with the CAD. Key drivers include:

-

Global Trade and Economic Growth: Strong economic growth in either Canada or the UK tends to strengthen its respective currency.

-

Interest Rate Policies: The Bank of England's monetary policy and interest rate decisions impact the GBP and its value against the CAD. Similarly, the Bank of Canada's decisions influence the CAD's strength.

Assessing the CAD versus the Japanese Yen (JPY)

The CAD/JPY exchange rate exhibits unique dynamics compared to other pairings. The JPY is often considered a safe-haven currency, meaning it tends to appreciate during times of global uncertainty. This safe-haven demand can influence the CAD/JPY exchange rate irrespective of Canada's economic performance. Key factors include:

-

Safe-Haven Demand: During periods of global economic or geopolitical turmoil, investors often flock to the JPY, increasing its value against other currencies, including the CAD.

-

Bank of Japan Monetary Policy: The Bank of Japan's monetary policy significantly affects the JPY's value. Quantitative easing or other unconventional monetary policies can influence the CAD/JPY exchange rate.

Key Indicators for Predicting Canadian Dollar Movement

Predicting CAD movements requires careful monitoring of several key economic indicators:

-

Canadian Gross Domestic Product (GDP) Growth: Strong GDP growth signals a healthy economy and typically supports the CAD.

-

Canadian Inflation Rate: High inflation can weaken the CAD as it erodes purchasing power.

-

Bank of Canada Interest Rate Decisions: Interest rate changes directly influence the CAD's value.

-

Commodity Prices (Especially Oil): Fluctuations in oil prices, a major Canadian export, significantly impact the CAD.

By analyzing these indicators and their trends, one can gain valuable insights into potential future CAD performance.

Conclusion: Final Thoughts on Analyzing the Canadian Dollar's Performance

Analyzing the Canadian dollar's performance against major currencies requires a multifaceted approach, considering various economic, geopolitical, and monetary factors. The relationships between the CAD and other major currencies are dynamic and complex. Understanding these intricate relationships is key to navigating the foreign exchange market successfully. To stay ahead in the ever-changing foreign exchange market, regularly revisit our site for further analysis of the Canadian dollar's performance and to continue analyzing the Canadian dollar's performance against major currencies by regularly monitoring key economic indicators and staying updated on global events.

Featured Posts

-

Transgender Sports Ban Minnesota Attorney General Files Lawsuit Against Trump

Apr 24, 2025

Transgender Sports Ban Minnesota Attorney General Files Lawsuit Against Trump

Apr 24, 2025 -

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025

Canadas Conservatives Tax Cuts And Deficit Reduction Plan

Apr 24, 2025 -

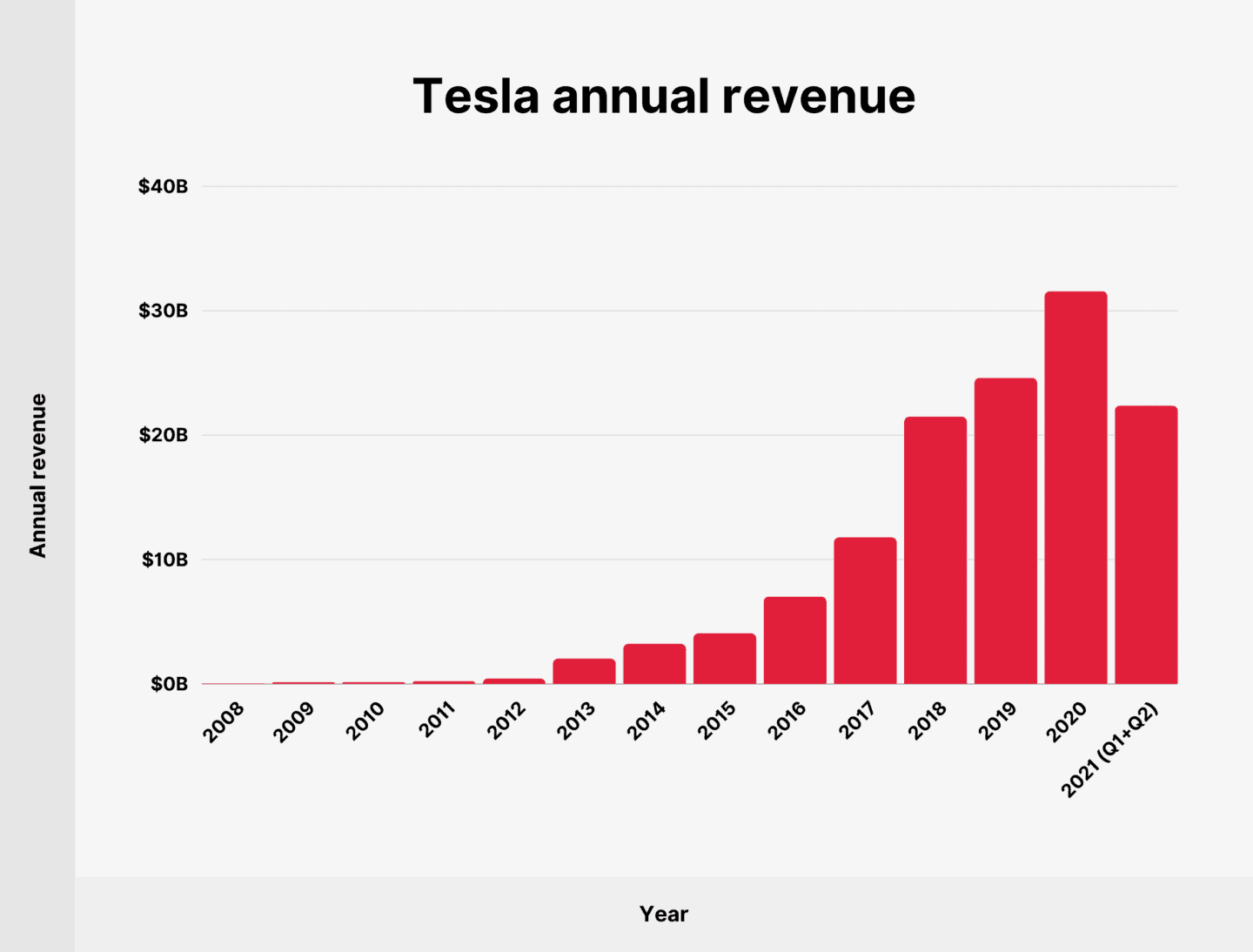

Tesla Earnings Decline 71 Net Income Drop In First Quarter

Apr 24, 2025

Tesla Earnings Decline 71 Net Income Drop In First Quarter

Apr 24, 2025 -

Ja Morant Under Nba Investigation A Report On The Recent Incident

Apr 24, 2025

Ja Morant Under Nba Investigation A Report On The Recent Incident

Apr 24, 2025 -

Harvards Lawsuit Against Trump Administration Will Talks Begin

Apr 24, 2025

Harvards Lawsuit Against Trump Administration Will Talks Begin

Apr 24, 2025