Tesla Earnings Decline: 71% Net Income Drop In First Quarter

Table of Contents

Keywords: Tesla earnings, Tesla Q1 2024, Tesla net income, Tesla stock, electric vehicle market, Tesla profit margin, Tesla price cuts, automotive industry, EV sales, Tesla financials.

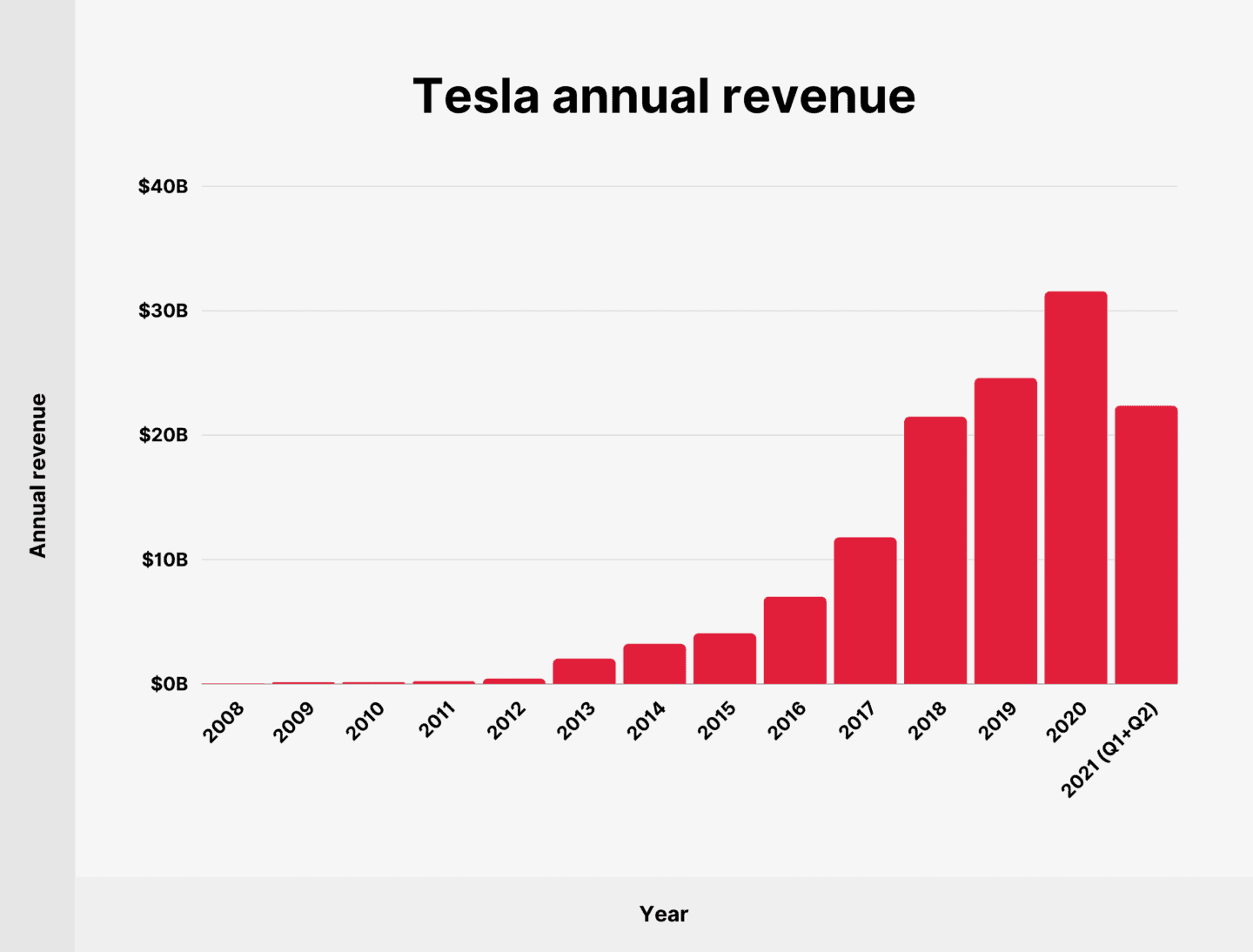

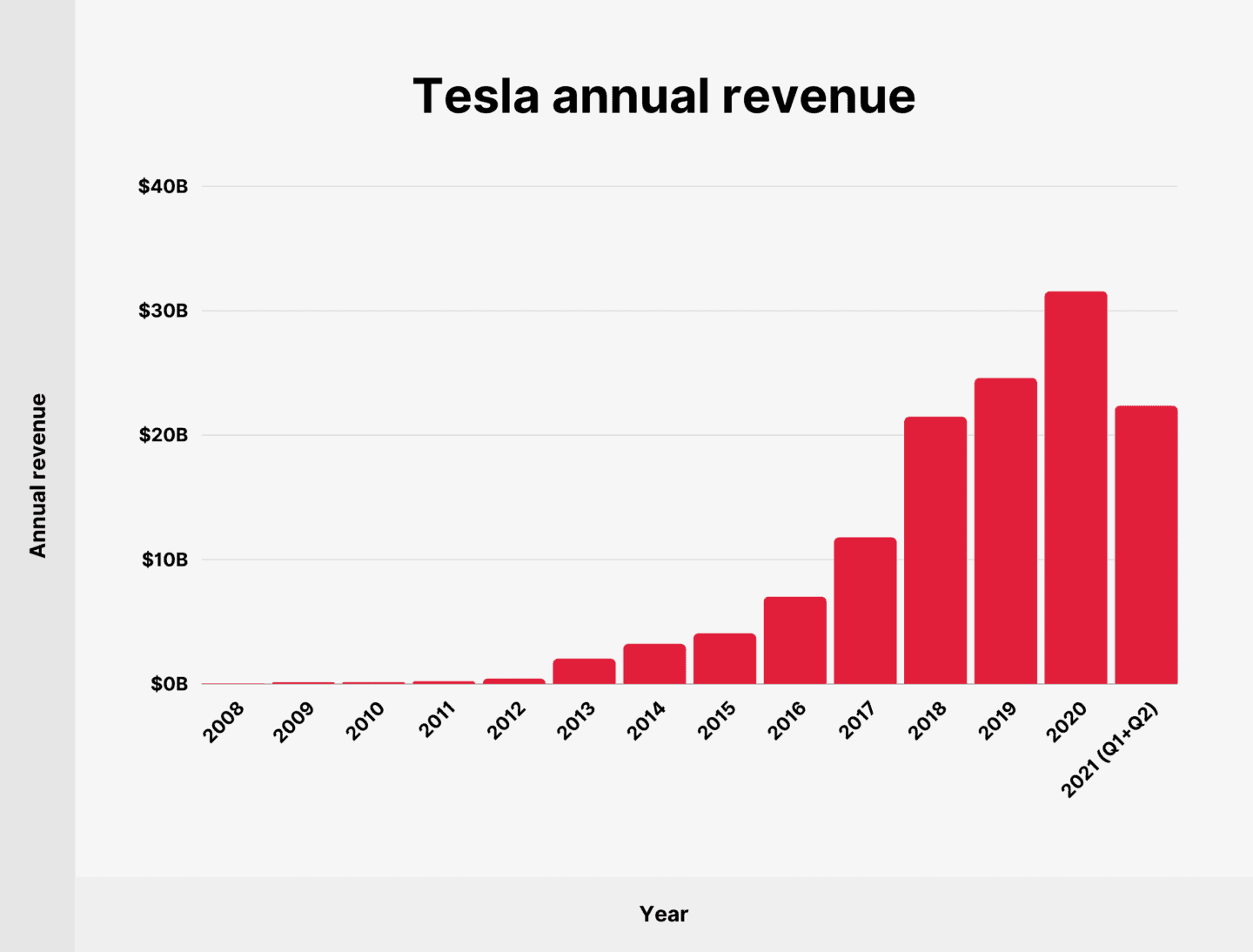

Tesla, the electric vehicle (EV) pioneer, reported a staggering 71% drop in net income for the first quarter of 2024, sending shockwaves through the financial markets. This significant decline marks a sharp reversal from previous quarters and raises serious questions about the company's future prospects. This article delves into the key factors contributing to this dramatic fall in Tesla earnings and analyzes its potential implications. The impact on Tesla stock and the broader electric vehicle market is significant, and understanding the reasons behind this downturn is crucial.

Price Cuts and Their Impact on Profit Margins

Aggressive Pricing Strategy

Tesla's aggressive price cuts, implemented across its model lineup to stimulate sales volume in an increasingly competitive EV market, played a major role in the reduced net income. This strategy, while boosting sales figures, significantly compressed profit margins.

- Price Reductions: Tesla slashed prices by an average of 10-20% on several models in Q1 2024, depending on the region and specific configuration. The Model 3 and Model Y experienced the most substantial reductions.

- Revenue per Vehicle: The price cuts directly translated to a lower revenue per vehicle sold, impacting the overall top line despite the increase in sales volume.

- Trade-off Analysis: Tesla's decision highlights a strategic trade-off: prioritizing market share and sales volume over maximizing profit margins in the short term. This gamble aims to solidify its position in a rapidly expanding EV market.

- Q1 Earnings Data: The Q1 2024 earnings report clearly illustrated this correlation – increased sales units did not offset the significant decrease in revenue per unit.

Competition in the EV Sector

The burgeoning EV sector is experiencing a surge in competition. Established automakers and new EV startups are aggressively entering the market, intensifying the price war and putting pressure on Tesla's profit margins.

- Key Competitors: Companies like BYD, Volkswagen, and Rivian are gaining significant market share, offering competitive pricing and innovative features.

- Competitive Pricing Strategies: Competitors are deploying various pricing strategies, including aggressive discounts and attractive lease options, directly impacting Tesla's ability to maintain premium pricing.

- New EV Models: The continuous influx of new EV models from established and emerging players intensifies competition and further erodes Tesla's market dominance.

Production and Delivery Challenges

Supply Chain Disruptions

Persistent supply chain disruptions continued to hamper Tesla's production capabilities in Q1 2024. These disruptions, stemming from various global factors, resulted in production delays and increased manufacturing costs.

- Bottlenecks: Shortages of key components like battery materials (lithium, nickel, cobalt) and semiconductor chips remain significant challenges.

- Production Targets: Supply chain issues prevented Tesla from meeting its planned production targets, resulting in lost revenue and impacting overall profitability.

- Cost Implications: The cost of sourcing components increased significantly due to supply chain constraints, adding to the pressure on profit margins.

Demand Fluctuations

Changes in market demand also contributed to the decline in Tesla earnings. Several factors impacted consumer demand for EVs, affecting production planning and sales.

- Economic Slowdowns: Concerns about a potential global economic slowdown led to some consumers delaying major purchases like EVs.

- Regional Variations: Demand for EVs varied significantly across different regions, impacting Tesla's ability to optimize production and distribution.

- Government Incentives: Changes in government incentives and subsidies for EVs in certain markets also influenced consumer purchasing decisions.

Increased Operating Costs

Rising Raw Material Prices

The soaring prices of raw materials, particularly lithium and other battery components, significantly impacted Tesla's manufacturing costs and profitability.

- Price Increases: The cost of lithium, a crucial element in EV batteries, has skyrocketed in recent years, directly affecting Tesla's production expenses.

- Manufacturing Costs: The increase in raw material prices directly translated into higher manufacturing costs per vehicle, squeezing profit margins.

- Mitigation Strategies: Tesla is exploring various mitigation strategies, including vertical integration and sourcing raw materials from alternative suppliers, but these initiatives take time to implement and yield results.

Research and Development Expenses

Tesla's substantial investments in research and development (R&D) also affected its short-term profitability. While crucial for long-term growth, these investments represent a significant expense.

- Major R&D Initiatives: Tesla continues to invest heavily in battery technology, autonomous driving systems, and new vehicle platforms.

- Long-Term Benefits: These R&D investments are aimed at maintaining Tesla's technological edge and driving future innovation.

- Financial Position: The substantial R&D expenditure, while essential for long-term competitiveness, contributed to the company's reduced net income in Q1 2024.

Investor Reaction and Future Outlook

Stock Market Response

The Q1 2024 earnings report triggered a negative reaction in the stock market, resulting in a significant drop in Tesla's stock price and impacting investor sentiment.

- Stock Price Fluctuations: Tesla's stock price experienced a substantial decline following the announcement of the lower-than-expected earnings.

- Analyst Ratings and Forecasts: Many analysts revised their forecasts for Tesla's future performance, reflecting concerns about the company's profitability.

- Investor Confidence: The earnings report undoubtedly shook investor confidence, raising questions about Tesla's ability to maintain its growth trajectory.

Tesla's Strategic Response

Tesla is likely to implement various strategic measures to address the decline in earnings and restore profitability. These measures may include cost-cutting initiatives and adjustments to pricing and production strategies.

- Cost-Cutting Measures: Expect increased focus on operational efficiency, streamlining manufacturing processes, and potentially further supply chain optimization efforts.

- Sales and Margin Improvement Strategies: Tesla might refine its pricing strategy, focusing on higher-margin models or regions while maintaining sales volume.

- Long-Term Growth Prospects: Despite the challenges, Tesla's long-term growth prospects remain tied to the continued expansion of the EV market and its ability to remain at the forefront of technological innovation.

Conclusion

Tesla's 71% drop in net income for Q1 2024 represents a significant challenge for the company. The confluence of price cuts impacting profit margins, production hurdles, rising operating costs, and intense competition in the EV market have all contributed to this dramatic decline. While the future remains uncertain, Tesla's strategic responses and long-term vision will be crucial in determining its ability to navigate these headwinds and regain its position as a leading player in the electric vehicle market. Stay informed about future Tesla earnings reports and the evolving landscape of the electric vehicle market to understand the ongoing impact of this significant downturn. Understanding Tesla's financial performance is crucial for investors and industry watchers alike.

Featured Posts

-

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025 -

Dollar Gains Ground Against Major Peers Amid Eased Trump Powell Tensions

Apr 24, 2025

Dollar Gains Ground Against Major Peers Amid Eased Trump Powell Tensions

Apr 24, 2025 -

The Bold And The Beautiful April 9 Recap Steffy Blames Bill Finn In Icu Liams Demand For Secrecy

Apr 24, 2025

The Bold And The Beautiful April 9 Recap Steffy Blames Bill Finn In Icu Liams Demand For Secrecy

Apr 24, 2025 -

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 24, 2025

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 24, 2025 -

Gambling On California Wildfires A Troubling Trend

Apr 24, 2025

Gambling On California Wildfires A Troubling Trend

Apr 24, 2025