Are BMW And Porsche Losing Ground In China? A Market Analysis

Table of Contents

H2: Declining Sales Figures and Market Share

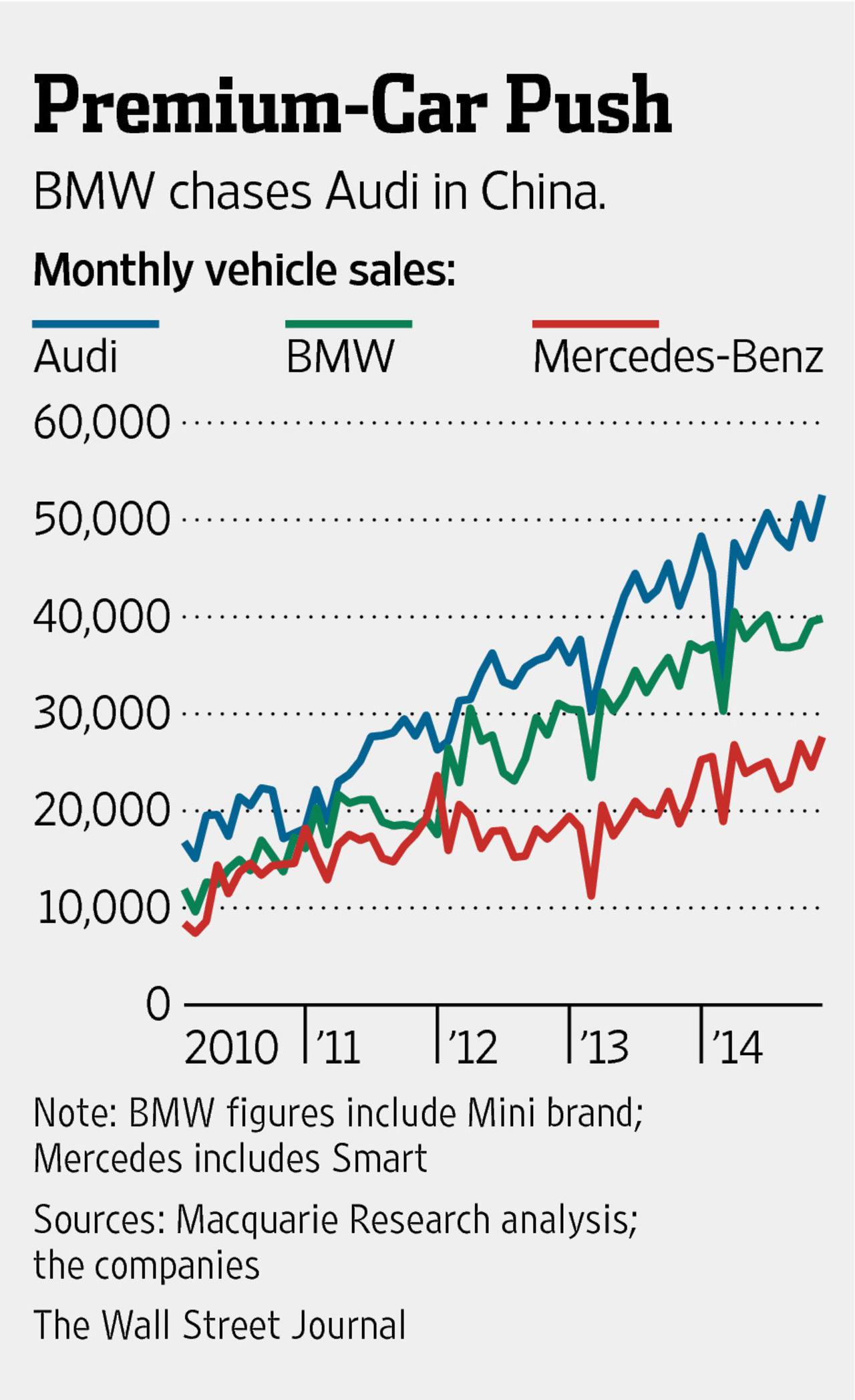

The recent performance of BMW and Porsche in China reveals a complex picture, suggesting a potential loss of ground compared to previous years and to competitors.

H3: BMW's Performance in China

BMW's performance in China has shown signs of slowing down. While precise sales figures fluctuate, a year-on-year comparison reveals a less robust growth trajectory than in previous years.

- Specific sales figures: While precise, real-time data requires accessing paid market research reports, publicly available information often shows a slowing growth rate compared to previous years' double-digit increases.

- Comparison to previous years: A clear trend of decelerating growth is evident, indicating a potential saturation point or increased competitive pressure.

- Market share percentage: BMW's market share in the luxury segment has likely decreased slightly, though it remains a significant player. The exact percentage requires accessing up-to-date market reports.

- Reasons for decline (if any): Potential reasons include increased competition from both established rivals and the rise of domestic electric vehicle (EV) brands.

Keyword integration: BMW China sales, BMW market share China, BMW sales decline China, BMW luxury car sales China

H3: Porsche's Position in the Chinese Market

Porsche, despite its strong brand recognition and loyal following, also faces similar challenges. Its growth in China, while still positive in some years, is not as explosive as it once was.

- Specific sales figures: Similar to BMW, precise figures are often behind paywalls, however, public reports suggest a slower growth than previously experienced.

- Comparison to previous years: A trend of slowing growth is observable, necessitating a strategic response to maintain its market position.

- Market share percentage: Porsche’s market share, while maintaining a premium position, shows a potential decline compared to previous periods.

- Reasons for decline (if any): Competition from other luxury brands and the expanding EV market are major factors affecting Porsche’s growth.

Keyword integration: Porsche China sales, Porsche market share China, Porsche sales decline China, Porsche luxury car sales China

H3: Comparison with Competitors

The competitive landscape in China is rapidly evolving. Mercedes-Benz and Audi continue to be strong competitors, while domestic brands like Nio and Xpeng are aggressively capturing market share, particularly in the burgeoning EV segment.

- Sales figures of competitors: Mercedes-Benz and Audi consistently report strong sales in China, while Nio and Xpeng are exhibiting impressive growth, often outpacing established brands.

- Market share comparison: The data shows a clear increase in the market share of Mercedes-Benz and Audi, alongside the noticeable emergence of Chinese EV brands like Nio and Xpeng.

- Successful strategies of competitors: Competitors are effectively leveraging advanced technologies, aggressive marketing strategies, and localized production to cater to Chinese consumer preferences.

Keyword integration: Mercedes-Benz China sales, Audi China sales, Chinese electric vehicle market, Nio sales China, Xpeng sales China

H2: Shifting Consumer Preferences in China

Understanding shifting consumer preferences is crucial to interpreting the performance of BMW and Porsche in China.

H3: Rise of Electric Vehicles (EVs)

The remarkable growth of the EV market in China is reshaping the automotive landscape. BMW and Porsche, while introducing EVs, are not yet fully capitalizing on this trend.

- Sales figures of EVs in China: The Chinese EV market is experiencing explosive growth, accounting for a significant and increasing percentage of overall vehicle sales.

- BMW and Porsche EV models: Both brands have launched EV models, but their market penetration compared to dedicated EV manufacturers remains relatively low.

- Comparison with Chinese EV brands: Chinese EV brands are ahead in terms of model range, charging infrastructure integration, and local consumer understanding.

- Charging infrastructure: The rapid expansion of charging infrastructure in China is further boosting EV adoption, a factor that BMW and Porsche need to address more aggressively.

Keyword integration: Electric vehicles China, China EV market, BMW electric cars China, Porsche electric cars China, China EV charging infrastructure

H3: Emphasis on Technology and Features

Chinese consumers place a strong emphasis on advanced technology and features.

- Desired features by Chinese consumers: Connectivity, autonomous driving features, and advanced driver-assistance systems (ADAS) are highly valued.

- Comparison of technology features: While BMW and Porsche offer advanced technology, their offerings may not be as comprehensive or cutting-edge compared to some competitors, particularly in specific features tailored to the Chinese market.

- Importance of in-car technology: In-car technology is a key differentiator for luxury car buyers in China.

Keyword integration: Autonomous driving China, connected car technology China, ADAS China

H3: Brand Perception and Marketing Strategies

The effectiveness of BMW and Porsche’s marketing strategies in China needs careful review.

- Marketing campaigns: While both brands invest significantly in marketing, their campaigns might need to be more effectively targeted to resonate with younger Chinese consumers.

- Brand image: Maintaining a premium brand image while adapting to evolving consumer preferences is critical.

- Social media engagement: A stronger social media presence and engagement are vital for reaching younger demographics.

- Strategies for reaching younger audiences: Targeted marketing campaigns focusing on digital channels and influencer collaborations are crucial.

Keyword integration: Luxury car marketing China, BMW marketing strategy China, Porsche marketing strategy China

H2: Economic and Political Factors

Macroeconomic conditions and government policies significantly influence the Chinese automotive market.

H3: Impact of Economic Slowdown

A potential economic slowdown in China could directly impact luxury car sales.

- Economic indicators: Monitoring economic indicators like GDP growth and consumer confidence is essential to predict future trends.

- Consumer spending: A reduction in consumer spending would likely reduce demand for luxury goods, including luxury cars.

- Impact on luxury goods sales: Luxury car sales are highly susceptible to economic fluctuations.

Keyword integration: China economic growth, luxury goods market China

H3: Government Regulations and Policies

Government regulations and policies shape the automotive industry in China.

- Emission standards: Stricter emission standards are pushing manufacturers towards electrification.

- Import tariffs: Import tariffs can impact the pricing and competitiveness of imported vehicles.

- Incentives for electric vehicles: Government incentives for EVs are boosting their adoption.

Keyword integration: China automotive regulations, China EV subsidies

3. Conclusion

This analysis suggests that while BMW and Porsche remain significant players in the Chinese luxury car market, their dominance is facing significant challenges. The rise of electric vehicles, evolving consumer preferences, and macroeconomic conditions are all contributing to a more complex and competitive environment. To retain market share, BMW and Porsche must significantly adapt their strategies. This includes accelerating EV development, prioritizing technological advancements, and implementing innovative marketing campaigns specifically tailored to the unique needs and desires of the Chinese consumer. Continuous monitoring of the BMW and Porsche market share in China, along with further research into consumer behavior, is crucial for these brands to navigate this dynamic market successfully. Understanding and responding to these changes will be paramount for maintaining their position in this increasingly competitive market.

Featured Posts

-

Power Finance Corporations Fy 25 Dividend Announcement March 12th

Apr 27, 2025

Power Finance Corporations Fy 25 Dividend Announcement March 12th

Apr 27, 2025 -

La Garantia De Gol De Alberto Ardila Olivares Un Analisis

Apr 27, 2025

La Garantia De Gol De Alberto Ardila Olivares Un Analisis

Apr 27, 2025 -

Nbc Chicago Hhs Taps Anti Vaccine Advocate To Investigate Debunked Autism Vaccine Link

Apr 27, 2025

Nbc Chicago Hhs Taps Anti Vaccine Advocate To Investigate Debunked Autism Vaccine Link

Apr 27, 2025 -

Nueve Meses Despues De Ser Madre El Impresionante Regreso De Bencic Al Triunfo

Apr 27, 2025

Nueve Meses Despues De Ser Madre El Impresionante Regreso De Bencic Al Triunfo

Apr 27, 2025 -

The Rise Of Disaster Betting Examining The Case Of The Los Angeles Wildfires

Apr 27, 2025

The Rise Of Disaster Betting Examining The Case Of The Los Angeles Wildfires

Apr 27, 2025