Assessing The Influence Of Tax Credits On Minnesota's Film Industry

Table of Contents

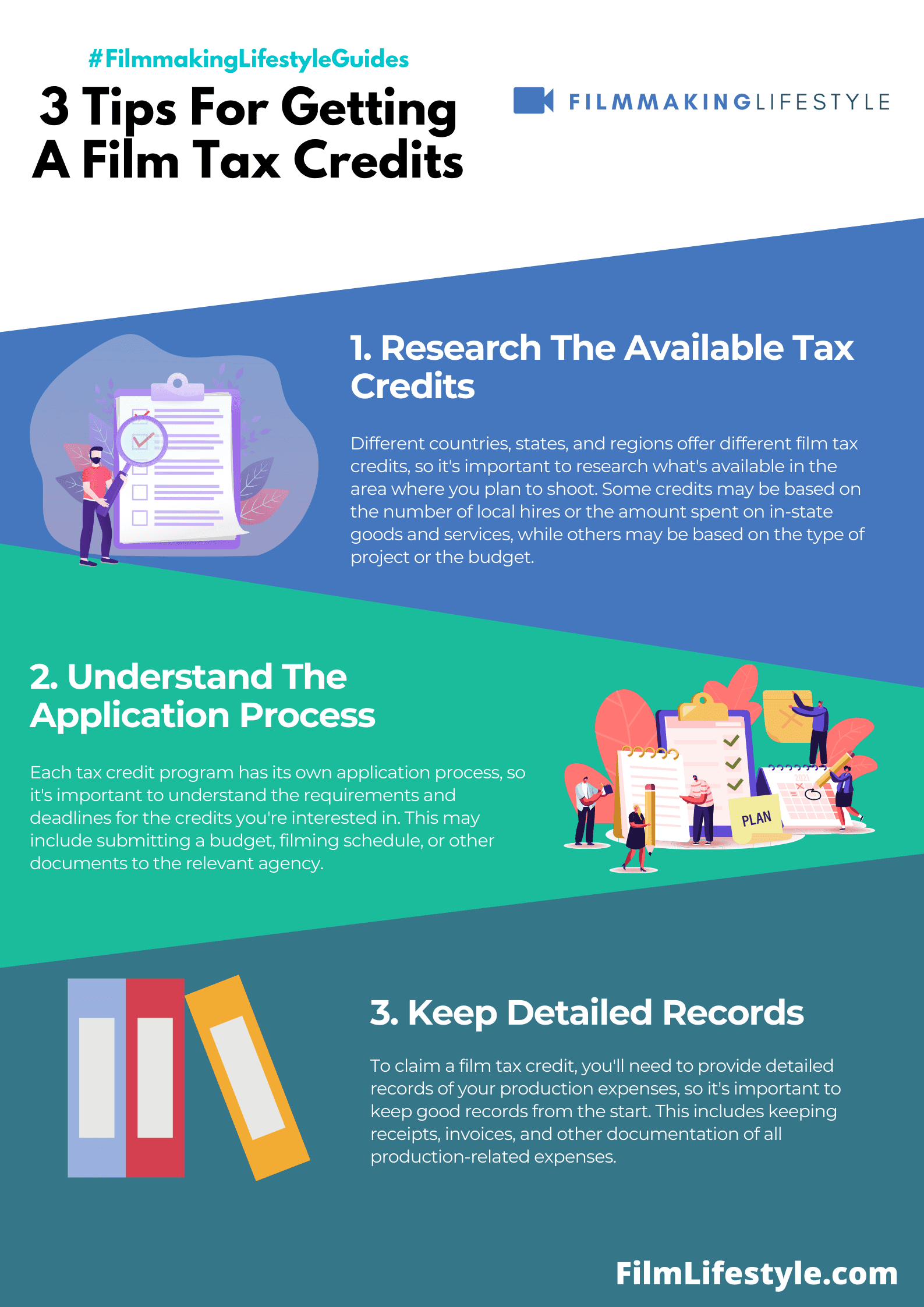

The Structure and Scope of Minnesota Film Tax Credits

The Minnesota film tax credit program offers financial incentives to encourage film production within the state. This initiative aims to stimulate economic growth, create jobs, and enhance Minnesota's profile as a desirable location for filmmaking. Understanding the specifics of the program is key to grasping its influence.

-

Types of productions eligible: The program typically covers a range of productions, including feature films, television series, commercials, documentaries, and animation. Specific eligibility criteria may apply based on the project's budget and other factors.

-

Percentage of eligible expenses covered: The credit often covers a percentage of qualifying production expenses incurred within Minnesota. This percentage can vary depending on the type of production and may be subject to caps.

-

Spending thresholds and requirements: Producers generally need to meet certain spending thresholds within Minnesota to qualify for the tax credit. This ensures that the incentives directly benefit the state's economy. Detailed documentation of expenses is required for claiming the credit.

-

Recent changes or proposed changes to the legislation: The Minnesota film tax credit program, like many similar incentive programs, is subject to periodic review and potential adjustments. Keeping abreast of these changes is essential for those involved in film production in Minnesota. These changes might include adjustments to credit amounts, eligibility requirements, or the overall budget allocated to the program. The intended goals remain consistent, focusing on boosting economic activity and creating a vibrant film industry ecosystem within the state.

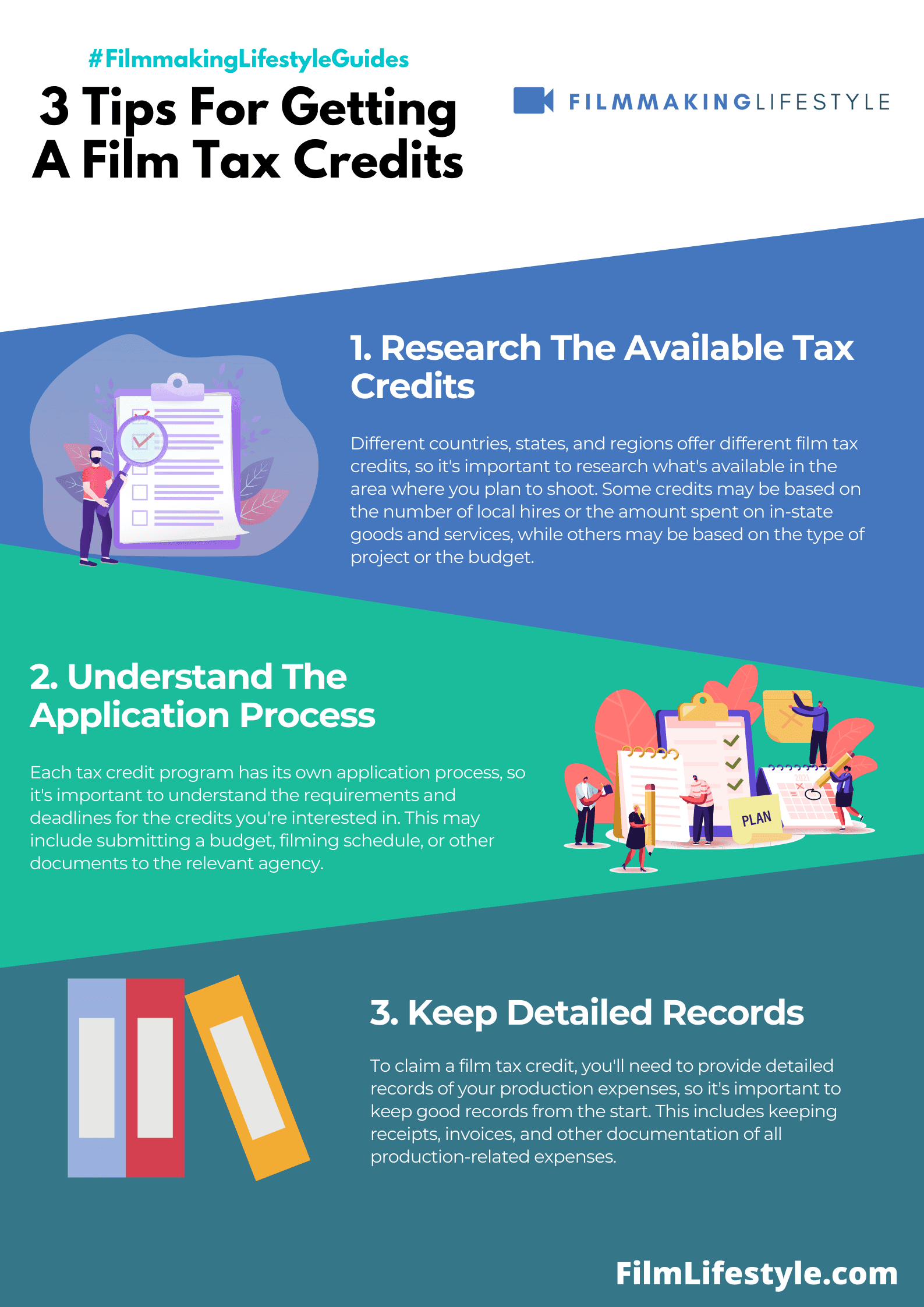

Economic Impact Analysis: Jobs and Investment

The economic impact of Minnesota film tax credits is a complex issue that requires a thorough analysis. While quantifying the exact impact is challenging, several key metrics provide valuable insights.

-

Jobs created directly and indirectly: Film productions create a wide range of jobs, from on-set crew members (camera operators, gaffers, sound technicians) to off-set roles (post-production editors, marketing professionals, administrative staff). The tax credits incentivize this job creation, leading to both direct and indirect employment opportunities.

-

Types of jobs created: The Minnesota film tax credit program has demonstrably contributed to a diversity of job roles within the industry. This diversity contributes to a more robust and resilient local film industry.

-

Economic modeling studies: Economic impact studies often use multiplier effects to estimate the broader economic ripple effects of film production spending. These studies attempt to quantify the total economic benefit, considering the spending by crew members, actors, and the production company itself, which in turn stimulates spending in local businesses. These models often demonstrate a significant return on investment for the state in terms of tax revenue generated by increased economic activity. The availability of such studies will vary depending on the resources dedicated to their creation.

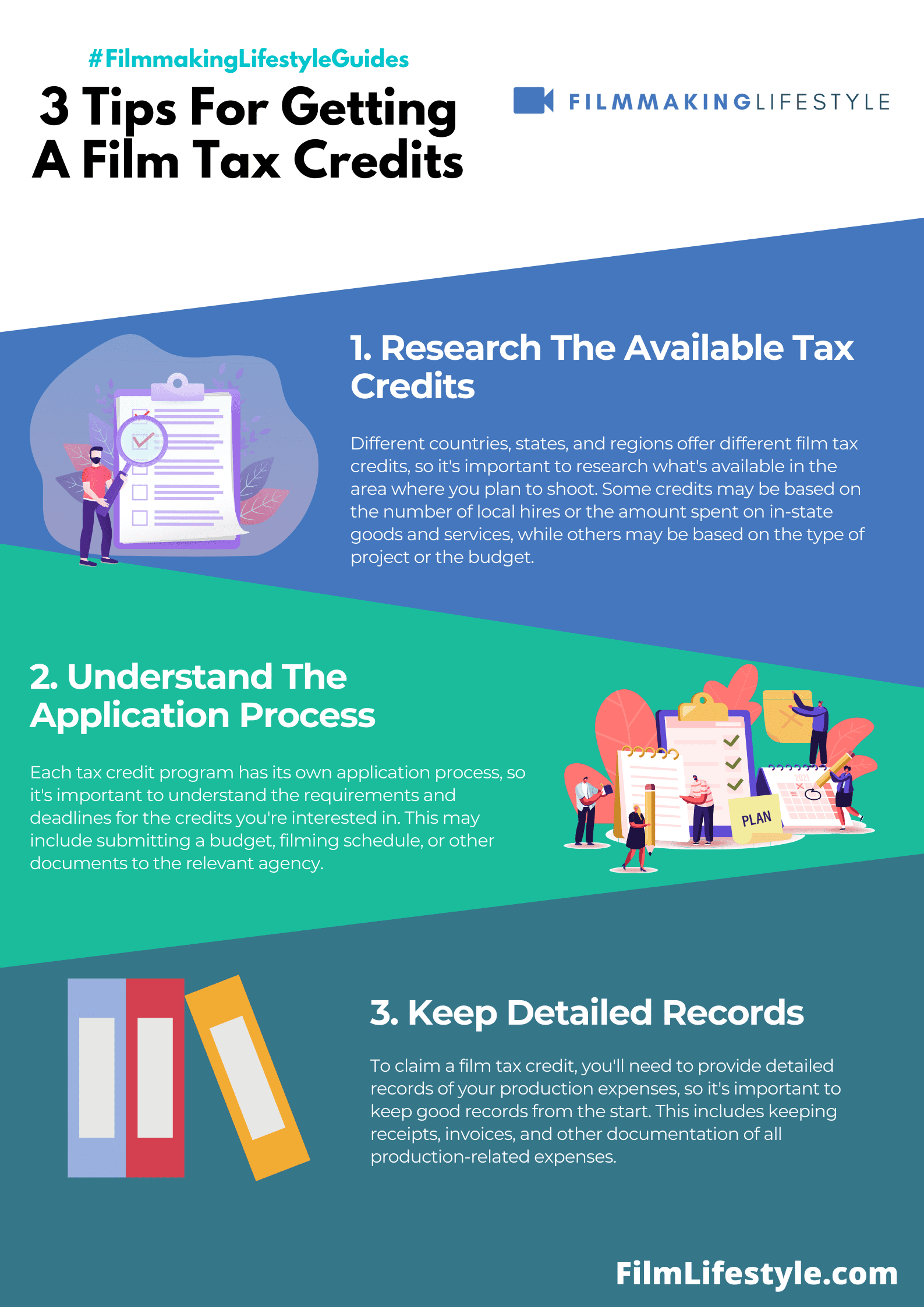

Qualitative Impacts: Industry Growth and Development

Beyond the quantifiable economic impacts, the Minnesota film tax credits have spurred positive qualitative changes within the state's film industry.

-

Growth of related businesses: The increased film production activity has led to the growth of related businesses, such as equipment rental companies, post-production facilities, and catering services. This creates a more comprehensive and self-sustaining film industry ecosystem.

-

Development of local talent and skills: The influx of film productions provides opportunities for local talent to gain experience and develop their skills. This can contribute to a higher skilled workforce and strengthen the local film industry over time.

-

Increased profile of Minnesota as a film production location: The success of the film tax credit program has raised Minnesota's profile as an attractive location for filmmaking. This increased visibility can lead to further investment and production opportunities.

-

Impact on local businesses: The increased spending by film crews and productions stimulates local economies. Businesses such as restaurants, hotels, and transportation services benefit directly from the spending associated with film productions.

Challenges and Future Considerations for Minnesota Film Tax Credits

Despite the positive impacts, several challenges remain for the Minnesota film tax credit program.

-

Budgetary constraints: The cost of the tax credit program needs to be carefully managed within the state's overall budget. Balancing the benefits of the program with fiscal responsibility is a key consideration for policymakers.

-

Potential for abuse or inefficiencies: Any incentive program has the potential for abuse or inefficiencies. Robust oversight and transparent administration are crucial to ensure the program's integrity and maximize its impact.

-

Competition from other states: Many other states offer similar film tax incentives. Minnesota needs to remain competitive to attract film productions and maintain its position in the industry.

-

The need for ongoing evaluation and potential adjustments: Regular evaluation of the program's effectiveness is crucial to identify areas for improvement and make necessary adjustments to ensure its long-term success.

Potential improvements could include targeted incentives for specific types of productions or collaborations with other economic development initiatives to maximize the program’s positive impact.

Conclusion

This article has explored the multifaceted influence of Minnesota film tax credits on the state's film industry. While the credits have demonstrably contributed to job creation, investment, and industry growth, ongoing evaluation and potential adjustments are necessary to maximize their impact and address challenges such as budgetary concerns and competition from other states. Further research into the long-term effects of the Minnesota film tax credits is crucial to ensure their continued effectiveness in fostering a vibrant and sustainable film industry. To stay informed about the latest developments in Minnesota film incentives and their impact on the industry, continue to follow updates on [link to relevant government website or industry news source]. Understanding the complexities of Minnesota film tax credits is vital for stakeholders seeking to leverage these incentives for economic growth.

Featured Posts

-

Assessing The Influence Of Tax Credits On Minnesotas Film Industry

Apr 29, 2025

Assessing The Influence Of Tax Credits On Minnesotas Film Industry

Apr 29, 2025 -

Post Covid Migration In Germany Border Controls Cited As Key Factor

Apr 29, 2025

Post Covid Migration In Germany Border Controls Cited As Key Factor

Apr 29, 2025 -

Anthony Edwards Loses Paternity Battle Ayesha Howard Granted Custody

Apr 29, 2025

Anthony Edwards Loses Paternity Battle Ayesha Howard Granted Custody

Apr 29, 2025 -

Us Attorney Generals Warning To Minnesota Compliance With Trumps Transgender Athlete Ban

Apr 29, 2025

Us Attorney Generals Warning To Minnesota Compliance With Trumps Transgender Athlete Ban

Apr 29, 2025 -

Minnesota Immigrants Upward Mobility A Study On Higher Paying Jobs

Apr 29, 2025

Minnesota Immigrants Upward Mobility A Study On Higher Paying Jobs

Apr 29, 2025