Bank Of Canada's Rate Pause: Expert Analysis From FP Video

Table of Contents

Economic Factors Behind the Bank of Canada's Decision

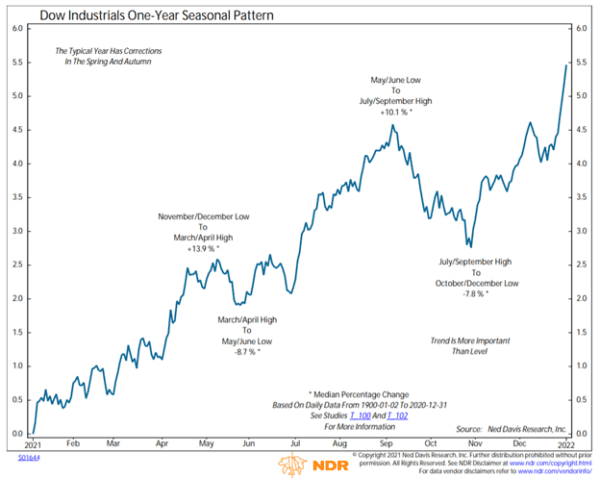

The Bank of Canada's decision to pause interest rate increases wasn't arbitrary; it reflects a complex interplay of economic indicators. The current state of the Canadian economy presents a mixed bag. While inflation has shown signs of cooling, it remains stubbornly above the Bank's target range. Simultaneously, GDP growth has decelerated, raising concerns about a potential recession. This delicate balance influenced the Bank's decision to hold rates steady.

-

Inflation Rate Trends and Projections: While inflation has decreased from its peak, it's still higher than the Bank of Canada's 2% target. The future trajectory of inflation remains uncertain, depending heavily on global commodity prices and supply chain dynamics.

-

Current Unemployment Figures and Forecasts: The unemployment rate currently sits at [insert current unemployment rate], indicating a relatively strong labor market. However, concerns remain about potential job losses in certain sectors if economic growth falters further.

-

Impact of Global Economic Slowdown on Canada: Global economic uncertainty, including potential recessions in major economies, poses a significant risk to Canada's export-oriented industries. This external pressure played a role in the Bank's cautious approach.

-

Housing Market Conditions and their Influence: The Canadian housing market has shown signs of cooling, influenced by previous interest rate hikes. The Bank considered the potential impact of further rate increases on an already softening market.

Expert Opinions from the FP Video: Diverse Perspectives on the Rate Pause

The FP Video featured a panel of leading economists offering diverse perspectives on the Bank of Canada's rate pause. While there was general agreement on the need for caution, opinions diverged on the future trajectory of interest rates.

-

Expert 1's Opinion and Rationale: [Summarize Expert 1's viewpoint, including their reasoning and evidence presented in the video. Mention specific data points or arguments used].

-

Expert 2's Perspective and Supporting Data: [Summarize Expert 2's viewpoint, including their reasoning and evidence. Highlight any contrasting viewpoints compared to Expert 1].

-

Any Disagreements and their Underlying Causes: The experts debated the potential risks associated with a prolonged pause, with some expressing concerns about reigniting inflationary pressures, while others emphasized the need to avoid triggering a recession.

-

Key Takeaways from the Expert Discussion: The overall consensus from the FP Video experts suggested a wait-and-see approach, with the Bank of Canada closely monitoring economic indicators before making further decisions on interest rates.

Potential Implications of the Bank of Canada's Rate Pause

The Bank of Canada's rate pause has far-reaching implications across various sectors of the Canadian economy. The short-term effects are likely to be relatively muted, but long-term consequences will depend on the unfolding economic landscape.

-

Impact on the Housing Market: The pause could provide some relief to the housing market, preventing a further sharp decline in prices. However, the long-term impact depends on other factors, such as consumer confidence and mortgage rates.

-

Effects on Consumer Spending and Debt Levels: With interest rates on hold, borrowing costs remain relatively high, potentially dampening consumer spending and impacting household debt levels.

-

Influence on Business Investment and Job Creation: Businesses may remain cautious about investment and hiring decisions until there's greater clarity on the economic outlook.

-

Potential Risks Associated with the Pause: The primary risk is that inflation could reaccelerate if the pause proves to be too lengthy, requiring the Bank to resume rate hikes later.

Looking Ahead: Future Predictions and Monetary Policy Scenarios

Predicting the Bank of Canada's next move is challenging, but several factors could influence future interest rate decisions. The path ahead could involve further rate hikes if inflation proves persistent, a sustained pause, or even potential rate cuts if the economy weakens significantly.

-

Possible Future Inflation Projections: The Bank will closely monitor inflation data to gauge the effectiveness of its current policy. Higher-than-expected inflation could trigger future rate increases.

-

Potential Economic Growth Scenarios: Stronger-than-expected economic growth could also lead to further rate hikes, while a significant economic slowdown might warrant rate cuts.

-

Factors that Could Trigger a Change in Monetary Policy: Key factors influencing future decisions include global economic developments, domestic inflation, and employment figures.

-

Expert Predictions for the Coming Months/Years: [Summarize the expert predictions from the FP Video regarding future interest rate changes and the overall economic outlook].

Conclusion: Understanding the Significance of the Bank of Canada's Rate Pause

The Bank of Canada's decision to pause interest rate hikes is a complex issue with significant implications for the Canadian economy. This analysis, informed by expert insights from the FP Video, highlights the intricate interplay of economic factors driving this crucial decision. Understanding the "Bank of Canada's Rate Pause" and its potential ramifications is essential for individuals, businesses, and policymakers alike. To gain a deeper understanding of the nuances of this pivotal moment in Canadian monetary policy, we strongly encourage you to watch the full FP Video. Stay informed about future developments by subscribing to the FP channel for ongoing updates on interest rate decisions and their impact on the Canadian economy.

Featured Posts

-

Build Voice Assistants With Ease Open Ais 2024 Developer Announcements

Apr 22, 2025

Build Voice Assistants With Ease Open Ais 2024 Developer Announcements

Apr 22, 2025 -

Saudi Aramco Invests In Electric Vehicle Technology With Byd Partnership

Apr 22, 2025

Saudi Aramco Invests In Electric Vehicle Technology With Byd Partnership

Apr 22, 2025 -

The Selection Of A New Pope A Look Inside Papal Conclaves And Their Procedures

Apr 22, 2025

The Selection Of A New Pope A Look Inside Papal Conclaves And Their Procedures

Apr 22, 2025 -

Harvard Faces 1 Billion Funding Cut Trump Administrations Fury Explained

Apr 22, 2025

Harvard Faces 1 Billion Funding Cut Trump Administrations Fury Explained

Apr 22, 2025 -

Higher Stock Prices Higher Risks What Investors Should Know

Apr 22, 2025

Higher Stock Prices Higher Risks What Investors Should Know

Apr 22, 2025