Higher Stock Prices, Higher Risks: What Investors Should Know

Table of Contents

Understanding the Correlation Between Higher Stock Prices and Risk

The inverse relationship between current stock price and future returns is a fundamental concept in investing. Simply put, higher current prices often mean lower potential future returns. This isn't always the case, but it's a strong correlation to understand. When a stock's price is significantly elevated, the potential for substantial gains diminishes, while the potential for loss increases.

Illustrative Examples:

- Overvalued Stocks: Companies whose stock prices exceed their intrinsic value based on fundamentals (earnings, assets, etc.) are prime examples. These "overvalued" stocks are particularly vulnerable to price corrections when the market re-evaluates their true worth.

- Market Bubbles: History is rife with examples of market bubbles, periods of rapid price increases driven by speculation rather than fundamentals. The dot-com bubble of the late 1990s and the housing bubble of the mid-2000s serve as stark reminders of the dangers of chasing high prices without considering underlying value.

- Speculative Investments: Investments in companies with little to no proven track record or substantial revenue streams often exhibit high price volatility. While they may offer high potential returns, the risk of losing the entire investment is equally high.

Key Points:

- Higher prices often reflect inflated expectations, exceeding the company's actual performance and future potential.

- Increased competition for limited supply drives prices up, creating a scenario where even minor negative news can trigger significant sell-offs.

- The potential for significant price corrections is substantial if market sentiment shifts negatively, leading to rapid price declines.

- Investors entering at higher prices have less margin of safety – a buffer against potential losses – than those who bought at lower prices.

Identifying Potential Red Flags in High-Priced Stocks

Before investing in stocks with higher prices, it’s crucial to perform thorough due diligence. Relying solely on the price increase is a risky strategy. Instead, investors should analyze key valuation metrics and fundamental data.

Key Valuation Metrics:

- Price-to-Earnings Ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio often suggests that the stock is overvalued relative to its earnings.

- Price-to-Sales Ratio (P/S): This compares a company's stock price to its revenue per share. A high P/S ratio can indicate overvaluation, especially if the company is not yet profitable.

- Price-to-Book Ratio (P/B): This compares a company's stock price to its book value (assets minus liabilities). A high P/B ratio might suggest overvaluation.

Dangers of Ignoring Fundamentals:

Chasing high stock prices without considering fundamental analysis is a recipe for disaster. Ignoring a company's financial health, competitive landscape, and growth prospects can lead to significant losses when the market corrects.

Warning Signs:

- High P/E ratios exceeding industry averages and historical norms often signal potential overvaluation.

- Rapid price appreciation without a corresponding increase in earnings or revenue is a significant warning sign of a speculative bubble.

- Analyze the company's debt levels and overall financial health; high debt can make a company vulnerable during economic downturns.

- Consider industry-specific factors and the competitive landscape; intense competition can limit a company's growth potential.

Strategies for Mitigating Risk in a High-Price Market

Investing in a market with higher stock prices requires a cautious approach and a robust risk management strategy. Diversification and disciplined investing are key.

Effective Risk Mitigation Strategies:

- Diversification: Spread your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce the impact of losses in any single asset. Don't put all your eggs in one basket.

- Dollar-Cost Averaging (DCA): Invest a fixed amount of money at regular intervals (e.g., monthly) regardless of the market price. DCA helps reduce the impact of market volatility by averaging your purchase price over time.

- Thorough Due Diligence: Before investing in any stock, thoroughly research the company's financials, competitive landscape, management team, and future prospects.

- Realistic Investment Goals and Risk Tolerance: Set realistic investment goals that align with your risk tolerance. Don't invest money you can't afford to lose.

- Financial Advisor: Consider consulting with a qualified financial advisor for personalized guidance tailored to your individual financial situation and investment objectives.

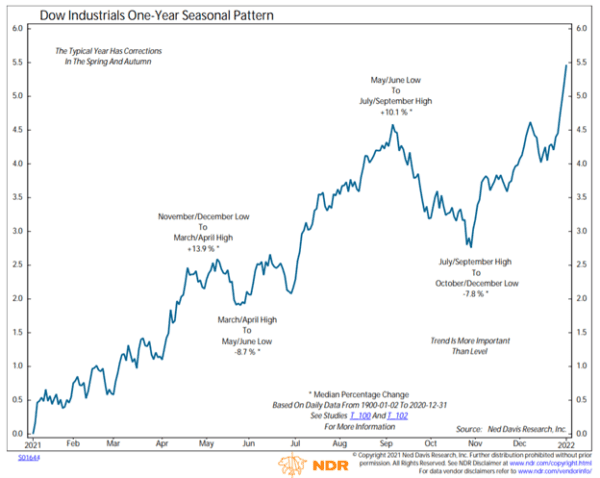

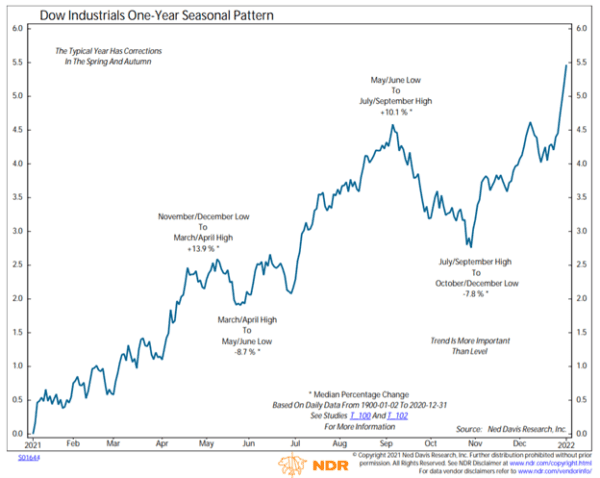

The Role of Market Volatility and Sentiment

Market volatility and investor sentiment are powerful forces that can drive stock prices up beyond rational valuations. Understanding these dynamics is essential for navigating a high-price market.

Understanding Volatility and Sentiment:

- Investor Sentiment: Positive investor sentiment can fuel rapid price increases, creating a self-reinforcing cycle of buying and price appreciation. However, this sentiment can quickly shift, leading to sharp price drops.

- Unexpected Events: Economic downturns, geopolitical instability, and unexpected company news can quickly reverse upward trends in stock prices.

- Market Corrections: Market corrections are a normal part of the investment cycle. Be prepared for potential losses and have an exit strategy in place. Avoid panic selling during market downturns.

Conclusion

Higher stock prices frequently signal increased risk. Understanding valuation metrics, diversifying your portfolio, conducting thorough due diligence, and maintaining a realistic risk tolerance are crucial for navigating this complex relationship successfully. Ignoring these factors can lead to significant financial losses. Don't let the allure of higher stock prices blind you to the inherent risks involved. Take control of your investment strategy and make informed decisions by understanding the dynamics of higher stock prices and higher risks. Learn more about effective risk management techniques and build a resilient investment portfolio today.

Featured Posts

-

Chinas Economic Model And The Risks Of Rising Tariffs

Apr 22, 2025

Chinas Economic Model And The Risks Of Rising Tariffs

Apr 22, 2025 -

Pope Francis A Legacy Of Compassion 1936 2024

Apr 22, 2025

Pope Francis A Legacy Of Compassion 1936 2024

Apr 22, 2025 -

Live Stock Market Updates Dow Futures And Dollar Reaction To Trade News

Apr 22, 2025

Live Stock Market Updates Dow Futures And Dollar Reaction To Trade News

Apr 22, 2025 -

Why Middle Managers Are Essential For Company Success

Apr 22, 2025

Why Middle Managers Are Essential For Company Success

Apr 22, 2025 -

Fbi Uncovers Millions In Losses From Executive Office365 Account Compromises

Apr 22, 2025

Fbi Uncovers Millions In Losses From Executive Office365 Account Compromises

Apr 22, 2025