BofA Says: Don't Worry About Stretched Stock Market Valuations

Table of Contents

Recent market performance has some investors concerned about stretched stock market valuations. High price-to-earnings ratios (P/E) and seemingly inflated prices are prompting anxieties about a potential market correction. However, Bank of America (BofA), a financial giant, offers a contrasting perspective, suggesting that the current situation may not be as alarming as it initially seems. This article delves into BofA's analysis and explores the key arguments supporting their optimistic outlook, while also acknowledging potential counterarguments and risks.

BofA's Rationale Behind Downplaying Valuation Concerns

BofA's relatively calm assessment of stretched stock market valuations rests on several key pillars. They aren't dismissing the high valuations entirely, but rather offering a more nuanced perspective, considering several counterbalancing factors.

Strong Corporate Earnings as a Counterbalance

BofA argues that robust corporate earnings are significantly offsetting concerns about high P/E ratios. They point to the strength and resilience of many sectors, even in the face of persistent inflation and economic uncertainty. This strong earnings growth, they contend, justifies, at least to some extent, the higher valuations.

For example, the technology sector has shown remarkable resilience, with many companies reporting strong revenue growth and positive profit margins. Similarly, the healthcare sector, driven by aging populations and technological advancements, continues to demonstrate consistent earnings growth.

- Strong revenue growth in key sectors. Data shows significant year-over-year revenue increases in technology, healthcare, and consumer staples, demonstrating the underlying strength of the corporate sector.

- Resilience in the face of economic headwinds. Many companies have demonstrated an ability to manage rising costs and maintain profitability, showcasing adaptability and strong management.

- Positive profit margins despite inflationary pressures. Despite inflationary pressures, numerous companies have managed to maintain healthy profit margins, demonstrating pricing power and operational efficiency. (Illustrative chart/data would be inserted here showing profit margin trends).

The Role of Interest Rates and Monetary Policy

BofA's analysis also incorporates the Federal Reserve's monetary policy and its impact on valuations. While interest rate hikes can theoretically curb inflation and potentially cool down the stock market, BofA's assessment suggests a more moderate impact than some fear. They argue that the Fed's actions are calibrated to manage inflation without triggering a severe economic downturn.

- Analysis of the current interest rate environment. BofA likely acknowledges the current interest rate levels and their potential impact on borrowing costs and investment decisions.

- BofA's predictions for future interest rate movements. Their analysis will include predictions on future interest rate adjustments, considering the evolving economic landscape.

- Impact of monetary policy on investor sentiment. The analysis would incorporate the likely influence of the Fed's actions on investor confidence and overall market sentiment.

Long-Term Growth Prospects and Future Market Potential

BofA's optimistic outlook extends to the long-term growth prospects of the economy. They identify several key drivers for continued growth, suggesting that current valuations, while high, might still be justified given the potential for future expansion.

- Key sectors with high growth potential. These may include renewable energy, artificial intelligence, and biotechnology, all expected to experience significant growth in the coming years.

- Technological advancements driving future growth. Technological innovation continues to disrupt industries and create new opportunities for investment and growth.

- Long-term macroeconomic trends supporting the market. Factors like a growing global middle class and ongoing technological advancements contribute to a positive long-term outlook.

Counterarguments and Potential Risks

While BofA presents a relatively optimistic view, it's crucial to acknowledge potential counterarguments and risks. A balanced perspective is essential for informed investment decisions.

Addressing Criticisms of BofA's Analysis

Critics might argue that BofA's optimistic outlook is overly simplistic and fails to account for the full range of potential risks. Concerns about a potential market correction or even a more significant downturn remain valid.

- Risk of inflation remaining persistent. Stubborn inflation could erode corporate earnings and negatively impact stock valuations.

- Possibility of a recession impacting corporate earnings. A recession could significantly impact corporate earnings, leading to a sharp market correction.

- Geopolitical uncertainties impacting market stability. Geopolitical events and international tensions can introduce unexpected volatility into the markets.

Diversification and Risk Management Strategies

Regardless of BofA's assessment, diversification and risk management remain paramount. Investors should not rely solely on one perspective but should implement strategies to mitigate potential losses.

- Importance of a well-diversified investment portfolio. Spreading investments across different asset classes reduces the impact of any single investment performing poorly.

- Strategies for managing risk in a volatile market. This could include hedging strategies, stop-loss orders, and careful monitoring of portfolio performance.

- Importance of long-term investment horizons. A long-term perspective can help mitigate the impact of short-term market fluctuations.

Conclusion

BofA's analysis suggests that while stock market valuations may appear stretched, strong corporate earnings and a considered view of monetary policy offer a mitigating perspective. The bank's analysts highlight the importance of considering long-term growth prospects alongside current valuations. However, investors should still acknowledge potential risks, including persistent inflation, a potential recession, and geopolitical uncertainties. Implementing appropriate diversification and risk management strategies remains crucial. While BofA suggests not to panic about stretched stock market valuations, careful consideration of individual investment strategies remains crucial. Stay informed about market trends and consult with a financial advisor to determine the best approach for your individual circumstances and risk tolerance. Don't hesitate to research further into BofA's full report on stock market valuations to gain a deeper understanding.

Featured Posts

-

Auto Carrier Faces 70 Million Loss From Us Port Fees

Apr 26, 2025

Auto Carrier Faces 70 Million Loss From Us Port Fees

Apr 26, 2025 -

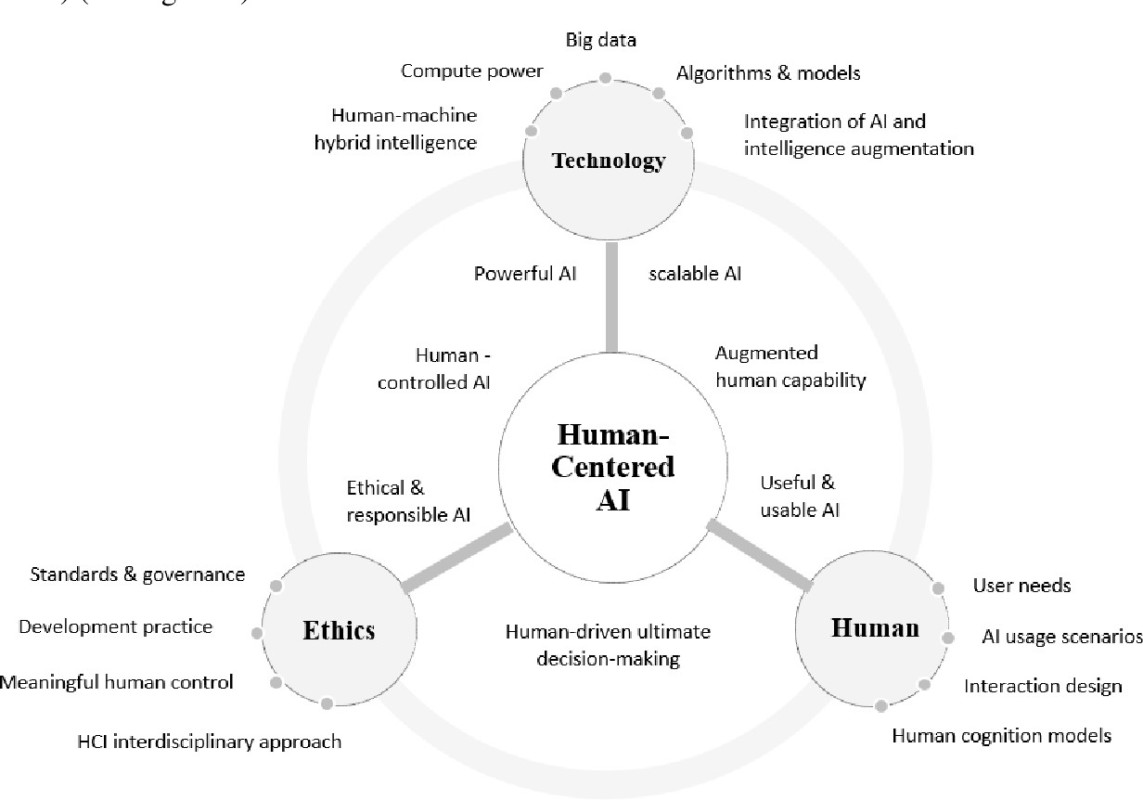

Microsoft On The Future Of Ai Prioritizing Human Needs In Design

Apr 26, 2025

Microsoft On The Future Of Ai Prioritizing Human Needs In Design

Apr 26, 2025 -

California Surpasses Japan As Worlds Fourth Largest Economy

Apr 26, 2025

California Surpasses Japan As Worlds Fourth Largest Economy

Apr 26, 2025 -

Beyond Disney 7 Top Orlando Restaurants For 2025

Apr 26, 2025

Beyond Disney 7 Top Orlando Restaurants For 2025

Apr 26, 2025 -

Construction Of Worlds Tallest Abandoned Skyscraper To Resume After A Decade

Apr 26, 2025

Construction Of Worlds Tallest Abandoned Skyscraper To Resume After A Decade

Apr 26, 2025

Latest Posts

-

Nbc Chicago Hhs Taps Anti Vaccine Advocate To Investigate Debunked Autism Vaccine Link

Apr 27, 2025

Nbc Chicago Hhs Taps Anti Vaccine Advocate To Investigate Debunked Autism Vaccine Link

Apr 27, 2025 -

Controversial Hhs Decision Anti Vaccine Activist To Examine Disproven Autism Vaccine Claims

Apr 27, 2025

Controversial Hhs Decision Anti Vaccine Activist To Examine Disproven Autism Vaccine Claims

Apr 27, 2025 -

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Debunked Autism Vaccine Claims

Apr 27, 2025

Nbc Los Angeles Hhs Taps Anti Vaccine Activist To Investigate Debunked Autism Vaccine Claims

Apr 27, 2025 -

Controversial Hhs Appointment Anti Vaccine Advocate To Examine Vaccine Autism Link

Apr 27, 2025

Controversial Hhs Appointment Anti Vaccine Advocate To Examine Vaccine Autism Link

Apr 27, 2025 -

Hhs Uses Anti Vaccine Advocate To Investigate Debunked Autism Vaccine Connection

Apr 27, 2025

Hhs Uses Anti Vaccine Advocate To Investigate Debunked Autism Vaccine Connection

Apr 27, 2025