BofA's Take: Why Stretched Stock Market Valuations Shouldn't Deter Investors

Table of Contents

Strong Corporate Earnings and Profit Growth Outpace Valuation Concerns

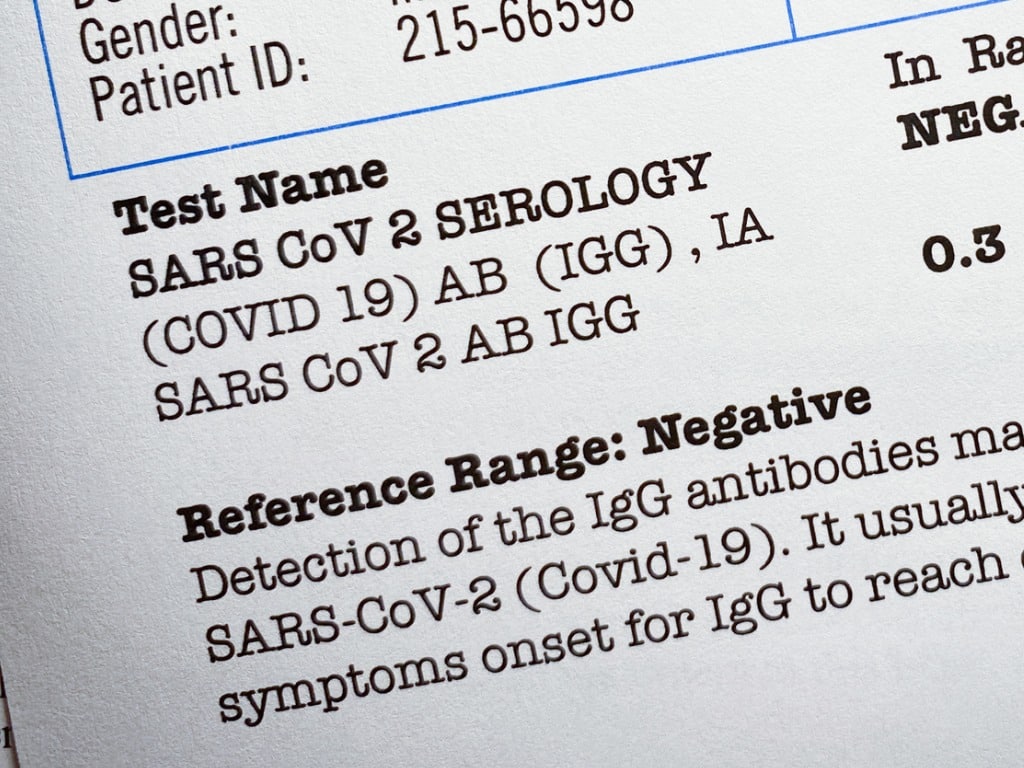

Despite concerns about high valuations, robust corporate earnings and strong profit growth are key reasons why BofA maintains a positive outlook. These positive fundamentals offer a counterbalance to valuation anxieties.

Robust Earnings Reports

Recent corporate earnings reports have been overwhelmingly positive, defying expectations and pushing stock prices higher. This strong performance across various sectors indicates underlying strength in the economy.

- Technology: The tech sector, despite some recent volatility, continues to show robust earnings growth driven by cloud computing, software-as-a-service (SaaS), and artificial intelligence (AI).

- Financials: Banks and financial institutions have benefited from rising interest rates, boosting their profitability.

- Consumer Staples: Companies providing essential goods have demonstrated resilience even in the face of inflationary pressures.

Companies like Microsoft, Apple, and JPMorgan Chase have exceeded analysts' expectations, demonstrating the strength of their business models and underlying market demand. These strong results signal that the current market valuations might not be as inflated as some believe.

Future Earnings Projections

Positive analyst projections for future earnings growth provide further support for continued investment. Reputable financial institutions are forecasting continued growth, suggesting that the current valuation levels might be justified by future performance.

- Sustained Growth: Analysts predict continued earnings growth for the next few years, driven by factors such as technological innovation and global economic expansion.

- Positive Revisions: Many analysts have recently revised their earnings forecasts upwards, indicating increased confidence in corporate profitability.

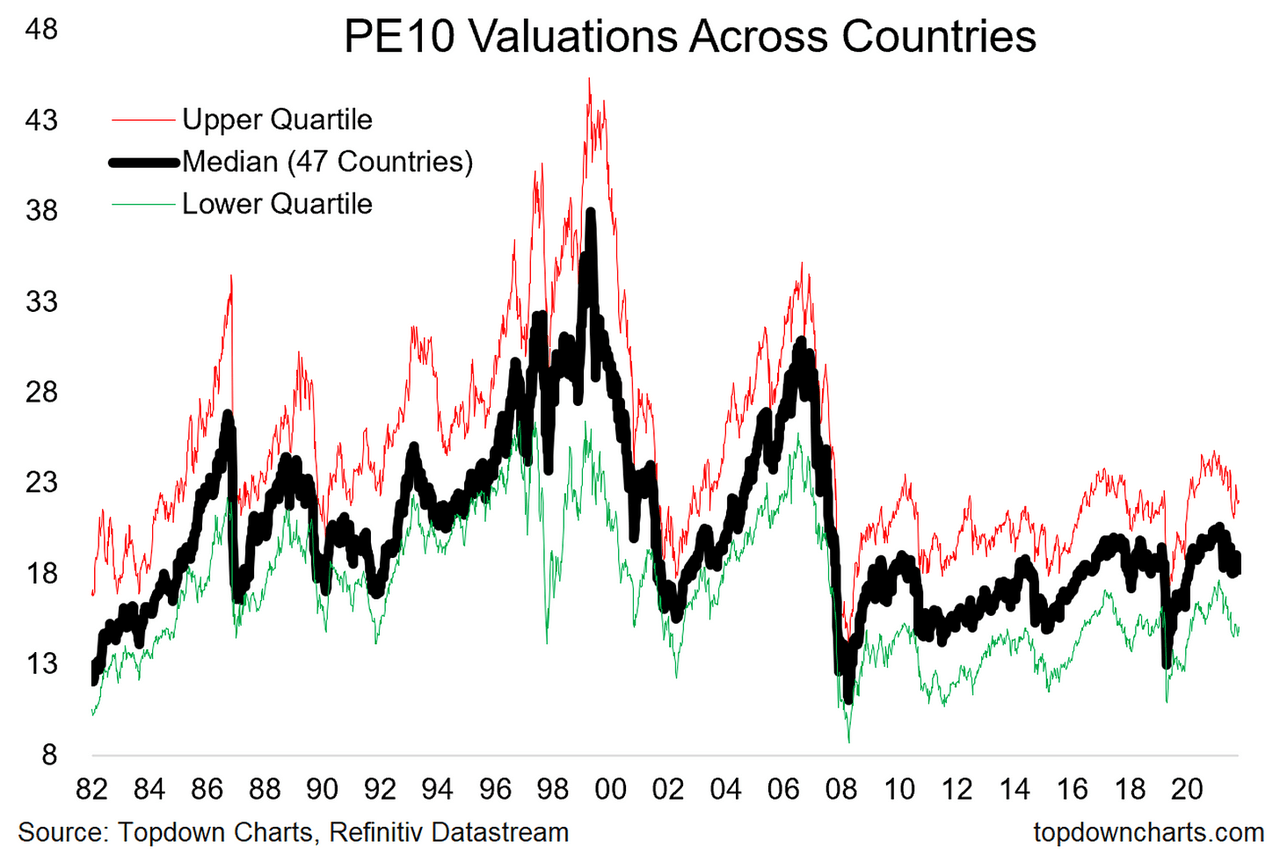

- Price-to-Earnings Ratio (P/E): While P/E ratios may appear high in certain sectors, projected earnings growth often justifies these levels, making valuations less of a concern in the long run.

Low Interest Rates and Monetary Policy Support Equity Markets

Low interest rates continue to play a significant role in supporting equity markets. Historically low borrowing costs encourage investors to seek higher returns in the stock market.

Impact of Low Interest Rates

When interest rates are low, the yield on bonds becomes less attractive compared to the potential returns from equities. This drives capital towards equities, pushing prices higher and supporting valuations.

- Bond Yields vs. Equity Returns: The low yields on government and corporate bonds make equities a more compelling investment, particularly for long-term investors seeking growth.

- Quantitative Easing (QE): Monetary policies like QE have injected liquidity into the market, further supporting asset prices including equities.

Future Monetary Policy Expectations

While interest rates are expected to rise gradually, the trajectory is likely to remain supportive of equity markets. BofA's predictions (and other financial institutions’) suggest a slow and measured approach to rate increases, minimizing the negative impact on stock valuations.

- Gradual Rate Hikes: The anticipation of gradual interest rate increases minimizes the risk of a sudden market shock.

- Economic Data Dependence: Central banks will likely base their interest rate decisions on economic data, making rate adjustments predictable and manageable for investors.

Long-Term Growth Potential Outweighs Short-Term Valuation Risks

Investing in the stock market is inherently a long-term strategy, and focusing solely on short-term valuations can be detrimental. The long-term growth potential of the global economy and technological innovations far outweigh the short-term risks associated with seemingly stretched valuations.

Technological Innovation and Disruption

Technological advancements continue to drive economic growth and create new investment opportunities. Sectors such as renewable energy, artificial intelligence, and biotechnology offer significant long-term growth potential.

- Disruptive Technologies: New technologies are constantly disrupting established industries, creating new market leaders and investment opportunities.

- Growth Sectors: Investors should consider exposure to high-growth sectors to benefit from the long-term potential of technological advancements.

Global Economic Growth

Sustained global economic growth, though with potential headwinds, fuels corporate earnings and supports stock market valuations.

- Emerging Markets: Emerging markets present attractive growth opportunities, particularly in Asia and Africa.

- Global Trade: While trade tensions occasionally arise, global trade remains a significant driver of economic growth.

Strategic Portfolio Diversification Mitigates Risk

A well-diversified portfolio is crucial in mitigating the risks associated with seemingly high valuations. Diversification across sectors and asset classes minimizes the impact of any single market downturn.

Sector Diversification

Spreading investments across different market sectors reduces the dependence on the performance of any particular industry.

- Defensive Sectors: Consider allocating a portion of your portfolio to defensive sectors like consumer staples and healthcare, which tend to be less volatile than cyclical sectors.

- Growth Sectors: Balance defensive sectors with exposure to high-growth sectors to capture the upside potential.

Asset Allocation Strategies

A balanced portfolio including stocks, bonds, and potentially other asset classes like real estate or commodities further reduces risk.

- Risk Tolerance: Your asset allocation strategy should align with your risk tolerance and investment timeframe.

- Professional Advice: Consult with a financial advisor to develop a personalized asset allocation strategy that meets your individual needs and goals.

Conclusion

In summary, while stretched stock market valuations are a valid concern, several factors suggest that they shouldn't deter investors from participating in the market. Strong corporate earnings, low interest rates, long-term growth potential, and the opportunity to mitigate risk through diversification all contribute to BofA's positive outlook. Don't let the perceived high valuations of the current market deter you. BofA's analysis suggests that strategic investment in a diversified portfolio, considering factors like strong earnings and low interest rates, can still yield significant returns. Learn more about building a robust investment strategy in today's market and navigating these stretched stock market valuations.

Featured Posts

-

Trumps Protectionist Policies Impact On Us Global Financial Dominance

Apr 22, 2025

Trumps Protectionist Policies Impact On Us Global Financial Dominance

Apr 22, 2025 -

Lab Owner Convicted For Fraudulent Covid 19 Test Results

Apr 22, 2025

Lab Owner Convicted For Fraudulent Covid 19 Test Results

Apr 22, 2025 -

South Sudan And The Us To Coordinate Deportees Return

Apr 22, 2025

South Sudan And The Us To Coordinate Deportees Return

Apr 22, 2025 -

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025

Why Investors Shouldnt Fear High Stock Market Valuations Bof As Perspective

Apr 22, 2025 -

Fox News Faces Defamation Lawsuit From Trump Supporter Ray Epps Over January 6th Claims

Apr 22, 2025

Fox News Faces Defamation Lawsuit From Trump Supporter Ray Epps Over January 6th Claims

Apr 22, 2025