Bullion Investment: A Safe Haven Amidst Global Trade Uncertainty

Table of Contents

Understanding Bullion Investment

What is Bullion?

Bullion refers to precious metals, primarily gold, silver, platinum, and palladium, in refined and unfabricated form. These metals are typically purchased in the form of bars or coins, often with a specific purity (e.g., 24-karat gold). The value of bullion is directly tied to the market price of the underlying metal, making it a relatively straightforward investment. Understanding the different types of bullion available, and their associated purity levels, is crucial for any serious bullion investor.

Why Invest in Bullion?

Precious metals have historically served as a reliable store of value, holding their worth even during times of economic turmoil. Investing in bullion offers several key advantages:

- Hedge against inflation: Bullion's value often rises during periods of high inflation, protecting your purchasing power.

- Portfolio diversification: Bullion provides a tangible asset that is not correlated with traditional investments like stocks and bonds, offering valuable portfolio diversification.

- Tangible asset, not subject to counterparty risk: Unlike many investments, bullion is a physical asset you own, not subject to the risks associated with financial institutions or intermediaries.

- Protection against currency devaluation: Bullion can act as a safeguard against currency fluctuations, providing stability during times of economic uncertainty.

Types of Bullion Investments

There are several ways to participate in the bullion market:

- Physical bullion: Owning physical gold bars or coins offers direct ownership and control. However, it requires secure storage and carries some handling and insurance costs.

- Bullion ETFs (Exchange-Traded Funds): These funds invest in precious metals and are traded on stock exchanges, providing liquidity and diversification benefits. They offer a convenient way to gain exposure to bullion without the need for physical storage.

- Mining stocks: Investing in companies that mine precious metals offers higher potential returns but also carries significantly higher risk. The success of these investments depends heavily on the mining company's performance and the price of the metal itself.

Bullion Investment and Global Trade Uncertainty

Safe Haven Asset

Bullion, particularly gold, has long been considered a "safe haven" asset. During times of economic instability or geopolitical uncertainty, investors often flock to gold, driving up demand and its price. Historical examples, such as the 2008 financial crisis, demonstrate gold's ability to retain its value, or even increase in value, during times of market turmoil.

Impact of Trade Wars and Sanctions

Trade wars and sanctions introduce significant uncertainty into global markets. This uncertainty often fuels demand for bullion as investors seek to protect their assets from potential losses. The resulting increase in demand can lead to higher bullion prices, benefiting those who have invested in precious metals.

Currency Fluctuations and Bullion

Currency fluctuations can significantly impact investment returns. Bullion, priced in US dollars globally, can act as a hedge against currency devaluation. If your home currency weakens, the value of your bullion holdings may increase when converted back to your local currency.

Strategies for Bullion Investment

Diversification

A crucial element of successful investing is diversification. Including bullion in your portfolio can reduce overall risk by diversifying away from traditional assets. This diversification strategy can help smooth out portfolio performance during market fluctuations.

Long-Term Perspective

Bullion investment is best viewed as a long-term strategy. While short-term price fluctuations occur, the historical value of precious metals suggests a long-term upward trend. Avoid short-term trading and focus on a patient, strategic approach.

Risk Management

While bullion offers stability, it's essential to understand and manage risks. These include:

- Storage: Secure storage is crucial for physical bullion.

- Market fluctuations: Bullion prices are subject to market forces, and they can decline.

- Counterfeit bullion: Be vigilant against buying counterfeit coins or bars.

Choosing the Right Bullion

The choice of bullion depends on your investment goals and risk tolerance. Gold generally offers greater stability, while silver and platinum might provide higher growth potential but also increased volatility. Carefully research and consider your specific circumstances before choosing your precious metal.

Where to Buy Bullion

Reputable Dealers

It is critical to purchase bullion from reputable dealers with a proven track record. Look for dealers with transparent pricing, secure shipping, and readily available verification of authenticity for physical bullion.

Storage Options

Several storage options exist for physical bullion:

- Home storage: This offers control but requires robust security measures.

- Bank vaults: Banks offer secure storage but might charge fees.

- Specialized storage facilities: These facilities provide high-security storage specifically designed for precious metals.

Conclusion

Global trade uncertainty necessitates a diversified investment strategy. Bullion investment, with its inherent value and historical performance as a safe haven asset, offers a compelling way to protect your wealth during economic instability. By understanding the different types of bullion investments, employing sound risk management strategies, and choosing reputable dealers, you can effectively utilize bullion to safeguard your financial future. Start your bullion investment journey today and explore the world of precious metals as a vital part of your overall investment plan. Learn more about the benefits of bullion investment as a safe haven and build a more resilient portfolio.

Featured Posts

-

The Federal Reserves Next Leader Facing The Aftermath Of The Trump Presidency

Apr 26, 2025

The Federal Reserves Next Leader Facing The Aftermath Of The Trump Presidency

Apr 26, 2025 -

Cassidy Hutchinson To Publish Memoir Detailing Jan 6 Experience

Apr 26, 2025

Cassidy Hutchinson To Publish Memoir Detailing Jan 6 Experience

Apr 26, 2025 -

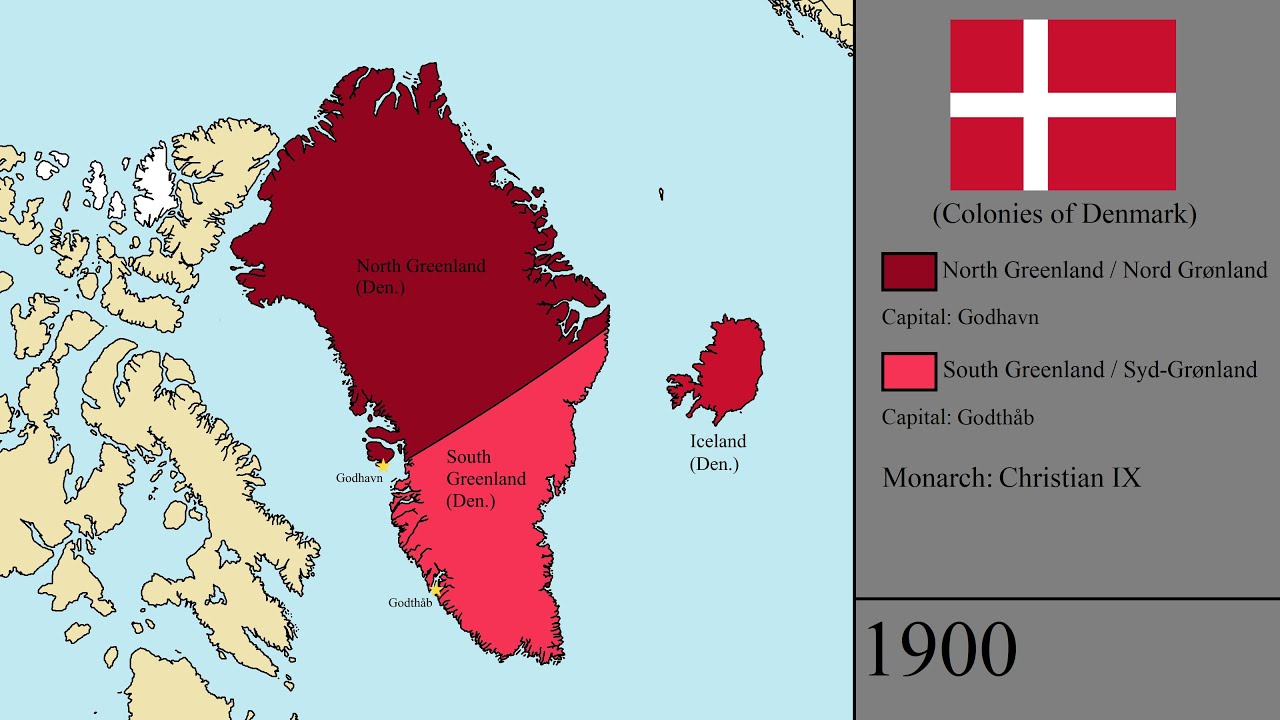

Greenland Denmark Points Finger At Russia For Fabricated News Heightening Us Dispute

Apr 26, 2025

Greenland Denmark Points Finger At Russia For Fabricated News Heightening Us Dispute

Apr 26, 2025 -

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 26, 2025

Covid 19 Test Fraud Lab Owner Admits To Falsifying Results

Apr 26, 2025 -

Meta Under Trump Zuckerbergs Challenges And Opportunities

Apr 26, 2025

Meta Under Trump Zuckerbergs Challenges And Opportunities

Apr 26, 2025