CAD Exchange Rate Fluctuations: Factors Affecting The Canadian Dollar

Table of Contents

Commodity Prices and the CAD

Canada's economy is heavily reliant on commodity exports, creating a strong correlation between commodity prices and the Canadian dollar's value. The country is a major exporter of oil, natural gas, lumber, and other resources. Therefore, global demand for these commodities directly impacts the CAD exchange rate.

- Increased commodity demand leads to a higher CAD value: When global demand for Canadian commodities rises (e.g., increased global economic growth), the demand for the Canadian dollar increases, strengthening its value.

- Decreased commodity demand weakens the CAD: Conversely, a decline in global demand, perhaps due to a recession, weakens the Canadian dollar as exports decrease and the demand for the currency falls.

- Global economic growth impacts commodity demand and therefore the CAD: Periods of strong global economic growth typically translate to increased demand for raw materials, boosting the CAD. Recessions have the opposite effect.

- Geopolitical events affecting commodity markets (e.g., war, sanctions) influence the CAD: Geopolitical instability in major oil-producing regions or sanctions impacting energy trade can significantly impact commodity prices and, consequently, the CAD. For instance, the war in Ukraine significantly impacted global energy prices, influencing CAD exchange rates.

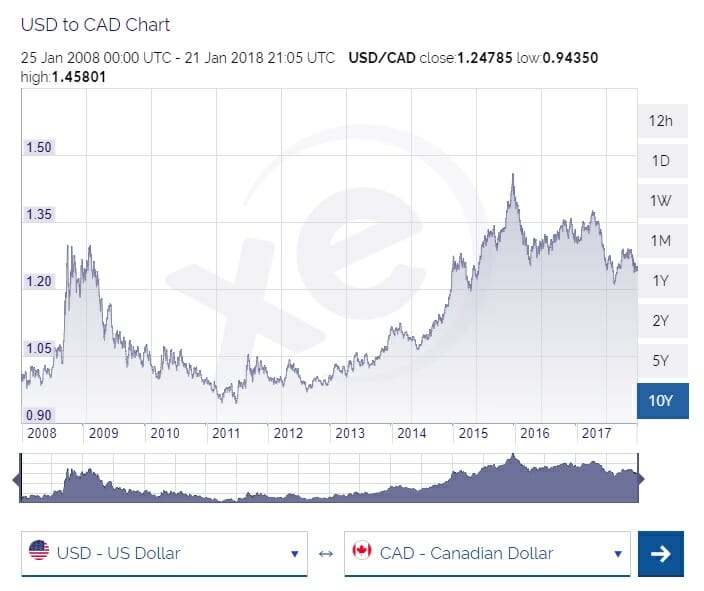

[Insert relevant chart or graph here showing the historical correlation between commodity prices (e.g., oil price) and the CAD exchange rate.]

Interest Rate Differentials and Monetary Policy

Interest rate differentials between Canada and other major economies significantly influence capital flows and, consequently, the CAD exchange rate. Investors seek higher returns, leading to capital flows that impact currency values.

- Higher Canadian interest rates attract foreign investment, strengthening the CAD: When the Bank of Canada raises interest rates relative to other countries, it makes Canadian assets more attractive to foreign investors, increasing demand for the CAD and strengthening its value.

- Lower Canadian interest rates can weaken the CAD as investors seek higher returns elsewhere: Conversely, lower interest rates in Canada relative to other countries can lead to capital outflow, weakening the CAD as investors seek better returns in other markets.

- Bank of Canada's monetary policy decisions significantly impact interest rates and the CAD: The Bank of Canada's announcements regarding interest rate adjustments are closely watched by markets, often leading to immediate and significant fluctuations in the CAD exchange rate.

- Impact of quantitative easing or other non-traditional monetary policies: The use of quantitative easing or other unconventional monetary policies can influence the CAD exchange rate by impacting interest rates and overall market liquidity.

Geopolitical Factors and Global Economic Conditions

Global events profoundly influence the CAD exchange rate. Political instability, trade wars, and pandemics all create uncertainty in the global market, affecting investor confidence and capital flows.

- Global economic slowdowns negatively impact commodity demand and weaken the CAD: A global recession typically reduces demand for commodities, negatively impacting the Canadian economy and weakening the CAD.

- Political uncertainty in major trading partners can lead to CAD volatility: Uncertainty in major trading partners like the US or the EU can create volatility in the CAD as investors react to potential risks.

- Trade agreements and negotiations significantly impact the CAD: The negotiation and implementation of trade agreements (e.g., USMCA) can significantly affect the Canadian economy and consequently, the CAD's value.

- Examples of past geopolitical events and their impact on the CAD: The COVID-19 pandemic and the 2008 financial crisis are prime examples of global events that led to significant CAD fluctuations.

Investor sentiment and risk aversion play a critical role here. During periods of heightened global uncertainty, investors often move towards "safe haven" currencies like the US dollar, leading to a weaker CAD.

US Dollar Strength and its Impact on the CAD

The US dollar's strength has a considerable impact on the CAD exchange rate. Given the significant trade relationship between the two countries and the USD's role as a global reserve currency, USD strength often translates to CAD weakness.

- A stronger USD typically weakens the CAD: When the US dollar appreciates against other currencies, the CAD usually depreciates.

- Factors affecting the USD (e.g., US economic data, Federal Reserve policy): Factors influencing the US dollar, such as US economic data releases and Federal Reserve monetary policy decisions, indirectly affect the CAD.

- How USD strength impacts Canadian exports and imports: A stronger USD makes Canadian exports more expensive for US buyers, potentially reducing demand and impacting the Canadian economy and the CAD.

Conclusion

CAD exchange rate fluctuations are influenced by a complex interplay of factors, primarily commodity prices, interest rate differentials, geopolitical events, and the strength of the US dollar. Understanding these factors is paramount for businesses and individuals involved in international transactions. Ignoring these influences can lead to significant financial losses. To mitigate risk, stay informed on CAD exchange rate fluctuations by regularly monitoring key economic indicators and consulting financial experts. Utilize reliable resources to track CAD exchange rates and global economic data, enabling you to make informed decisions regarding international trade and investment.

Featured Posts

-

Trump Administration Immigration Crackdown Faces Legal Challenges

Apr 24, 2025

Trump Administration Immigration Crackdown Faces Legal Challenges

Apr 24, 2025 -

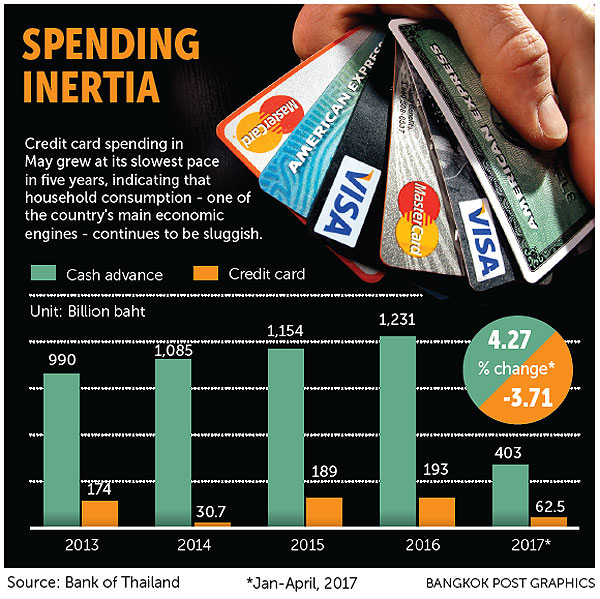

The Impact Of Reduced Non Essential Spending On Credit Card Companies

Apr 24, 2025

The Impact Of Reduced Non Essential Spending On Credit Card Companies

Apr 24, 2025 -

Nba All Star Weekend Green Moody And Hield Among The Participants

Apr 24, 2025

Nba All Star Weekend Green Moody And Hield Among The Participants

Apr 24, 2025 -

Nba All Star Weekend Herros 3 Pointer And Cavs Skills Challenge Win

Apr 24, 2025

Nba All Star Weekend Herros 3 Pointer And Cavs Skills Challenge Win

Apr 24, 2025 -

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 24, 2025

Ryujinx Emulator Shut Down Following Nintendo Contact

Apr 24, 2025