Canada's Economic Outlook: The Need For Fiscal Responsibility

Table of Contents

Current State of the Canadian Economy

Economic Growth and Challenges

Canada's economy has shown resilience in recent years, but faces significant headwinds. While the Canadian GDP has demonstrated growth, the rate fluctuates, influenced by global economic trends and domestic factors. Inflation remains a persistent challenge, impacting purchasing power and household budgets. The unemployment rate, while relatively low, varies across provinces and sectors.

- Canadian GDP Growth: Recent GDP growth figures show a [insert latest data and source], indicating [interpret the data - e.g., moderate growth, slowing growth, etc.].

- Inflation Rate Canada: The current inflation rate stands at [insert latest data and source], significantly impacting consumer spending and business costs.

- Unemployment Canada: The unemployment rate is currently at [insert latest data and source], with variations across different demographics and geographic locations.

- Key Growth Sectors: Growth has been fueled by sectors such as technology, particularly in software and AI development, and resource extraction, benefiting from global demand for commodities like oil and gas. However, these sectors are also vulnerable to global market fluctuations.

- Economic Growth Challenges: Challenges include persistent inflation, global economic uncertainty, and supply chain disruptions that continue to impact businesses and consumers. The ongoing war in Ukraine and its global ripple effects also add to the economic uncertainties.

Government Debt and Deficit

Canada's government debt and budget deficit are significant concerns, requiring careful management. The level of government debt has increased in recent years, primarily due to increased social spending to address pandemic-related challenges and reduced tax revenues during periods of economic uncertainty.

- Canadian Government Debt: The current level of Canadian government debt is [insert latest data and source], representing a debt-to-GDP ratio of [insert latest data and source].

- Budget Deficit Canada: The budget deficit for the current fiscal year is projected to be [insert latest data and source].

- Factors Contributing to the Deficit: This is largely attributed to increased spending on social programs, infrastructure projects, and pandemic relief measures, coupled with reduced tax revenue during periods of economic slowdown.

- Long-Term Implications: High debt levels can lead to increased interest payments, reduced government capacity for investment in essential services, and increased vulnerability to economic shocks. This underscores the critical need for effective debt management strategies.

The Importance of Fiscal Responsibility

Sustainable Economic Growth

Fiscal responsibility is fundamental to achieving sustainable economic growth in Canada. Prudent fiscal policies, including responsible spending and effective revenue generation, foster investor confidence, leading to lower interest rates and improved credit ratings.

- Investor Confidence: Responsible government finances attract foreign and domestic investment, stimulating economic activity and job creation.

- Interest Rates: Lower government borrowing costs translate into lower interest rates for businesses and consumers, boosting economic growth.

- Credit Rating: A strong credit rating reflects the government’s ability to manage its finances effectively, ensuring access to capital markets at favorable terms.

- Consequences of Uncontrolled Spending: Conversely, uncontrolled government spending can lead to higher interest rates, reduced investor confidence, and a weaker credit rating, ultimately hindering long-term economic growth.

Protecting Social Programs

Fiscal responsibility is not just about balancing the budget; it's about ensuring the long-term viability of essential social programs that Canadians rely upon. Sustainable fiscal management safeguards healthcare, education, and social security for future generations.

- Social Programs Canada: Maintaining adequate funding for healthcare, education, and social security requires a long-term approach to fiscal planning.

- Healthcare Funding: Responsible fiscal management is critical to ensure access to quality healthcare services for all Canadians.

- Education Funding: Investing in education is an investment in Canada's future, requiring consistent and sustainable funding.

- Social Security: Protecting social security benefits requires careful planning and responsible fiscal policies to ensure the program's long-term solvency. Unsustainable debt jeopardizes the future of these vital programs.

Strategies for Achieving Fiscal Responsibility

Revenue Generation

Increasing government revenue without unduly burdening taxpayers requires strategic approaches. This involves exploring various avenues to enhance tax revenue collection and optimize tax policies.

- Tax Reform Canada: Modernizing the tax system through targeted tax reforms can improve efficiency and fairness.

- Tax Revenue: Closing tax loopholes and improving tax collection efficiency can significantly increase tax revenues. This requires investing in the Canada Revenue Agency's capabilities.

- Fiscal Policy Strategies: Diversification of revenue streams, beyond reliance on income tax, should be explored. This might include consideration of environmental taxes or other revenue-generating mechanisms.

Expenditure Management

Controlling and reducing government spending requires a multi-pronged approach. This includes improving program efficiency, eliminating wasteful spending, and prioritizing essential services.

- Government Spending Cuts: Implementing targeted spending cuts while prioritizing essential services requires careful analysis and planning.

- Efficient Government: Streamlining government operations and improving program delivery can lead to substantial savings.

- Public-Private Partnerships: Leveraging public-private partnerships can be an effective way to deliver public services more efficiently and cost-effectively.

- Expenditure Review: Regular and rigorous reviews of government spending are crucial to identify areas for improvement and cost reduction.

Conclusion

Canada's economic outlook requires a renewed commitment to fiscal responsibility. The current state of the Canadian economy, characterized by challenges like inflation and high debt levels, necessitates prudent fiscal policies. Sustainable economic growth and the protection of vital social programs depend on responsible spending, effective revenue generation, and efficient government operations. Strategies such as tax reform, expenditure management, and public-private partnerships are essential tools for navigating the path to fiscal sustainability. We must demand fiscal responsibility from our government, support policies promoting fiscal sustainability, and learn more about Canada's economic outlook and fiscal challenges. Advocate for fiscally responsible leadership to secure a strong and prosperous future for all Canadians. The need for fiscal responsibility is not just an economic imperative; it is a social and ethical obligation to future generations. Let's ensure Canada's economic outlook reflects a commitment to long-term fiscal health and prosperity.

Featured Posts

-

Shark Infested Beach Swimmer Vanishes Body Discovered

Apr 24, 2025

Shark Infested Beach Swimmer Vanishes Body Discovered

Apr 24, 2025 -

Steffy And Liams Comfort Finns Warning The Bold And The Beautiful Spoilers For Thursday February 20

Apr 24, 2025

Steffy And Liams Comfort Finns Warning The Bold And The Beautiful Spoilers For Thursday February 20

Apr 24, 2025 -

Why Pope Francis Ring Will Be Destroyed After His Death The Significance Of The Fishermans Ring

Apr 24, 2025

Why Pope Francis Ring Will Be Destroyed After His Death The Significance Of The Fishermans Ring

Apr 24, 2025 -

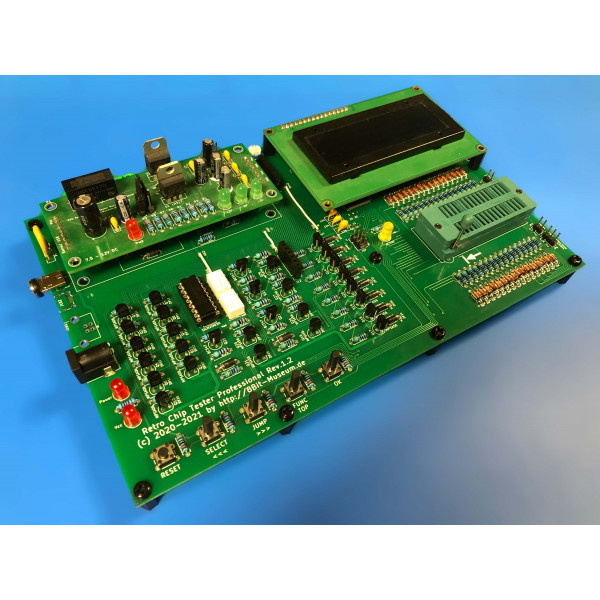

Chinese Buyout Firm Considers Selling Chip Tester Utac Market Implications

Apr 24, 2025

Chinese Buyout Firm Considers Selling Chip Tester Utac Market Implications

Apr 24, 2025 -

Zuckerberg And Trump A New Era For Tech And Politics

Apr 24, 2025

Zuckerberg And Trump A New Era For Tech And Politics

Apr 24, 2025