Chinese Buyout Firm Considers Selling Chip Tester UTAC: Market Implications

Table of Contents

UTAC's Significance in the Semiconductor Testing Landscape

UTAC holds a considerable position within the global semiconductor testing market. Its influence extends beyond simple market share; the company possesses unique technological prowess and a robust client base crucial to the industry's stability.

Market Share and Technological Prowess

UTAC's precise market share remains undisclosed, but industry analysts estimate it holds a significant percentage in several key segments. Its competitive edge stems from several key technological advancements:

- Proprietary algorithms for advanced node testing: UTAC's algorithms enable faster and more accurate testing of cutting-edge chips.

- High-throughput testing platforms: These platforms significantly increase the volume of chips that can be tested daily, optimizing production efficiency.

- Advanced failure analysis capabilities: UTAC offers detailed failure analysis reports, helping manufacturers quickly identify and resolve production issues.

- Patents in semiconductor testing methodologies: These patents protect UTAC's unique testing procedures and give it a significant competitive advantage.

Key clients rely heavily on UTAC's capabilities, including several leading manufacturers of smartphones, high-performance computing chips, and automotive semiconductors. The disruption of these relationships would have far-reaching consequences.

Geographic Reach and Client Base

UTAC boasts a global reach, with operations and clients spanning numerous regions:

- North America: A strong presence in the US and Canada, serving major chip designers and manufacturers.

- Asia: Significant operations in Taiwan, South Korea, and China, catering to the region's booming semiconductor industry.

- Europe: A growing client base in Europe, particularly in Germany and the Netherlands.

This diverse client base, while providing geographical diversity, also highlights the potential for disruptions across several key markets should the sale impact UTAC's operational capacity or client relationships.

Impact on Supply Chain Dynamics

The sale of UTAC could create significant ripple effects throughout the semiconductor testing supply chain:

- Potential delays in testing services: A change in ownership could lead to temporary disruptions, particularly during the transition period.

- Supply contract renegotiations: Existing clients may need to renegotiate contracts, potentially leading to price increases or service reductions.

- Increased consolidation within the industry: The sale could trigger further mergers and acquisitions within the semiconductor testing sector, impacting overall industry competitiveness.

Potential Buyers and Their Motivations

Several entities could be interested in acquiring UTAC, each with their own distinct motivations.

Strategic Investors

Large semiconductor companies or established industry players could be driven by several factors:

- Vertical integration: Acquiring UTAC would allow them to control a critical part of their supply chain, reducing reliance on external vendors.

- Market expansion: The acquisition could provide access to new technologies, markets, and client relationships.

- Eliminating a competitor: A direct competitor might seek to acquire UTAC to gain a significant market share advantage.

Private Equity Firms

Private equity firms might view UTAC as an attractive investment opportunity:

- Restructuring and improving profitability: Private equity firms often restructure acquired companies to improve efficiency and increase profitability before an eventual sale.

- Portfolio diversification: Adding UTAC to their portfolio enhances the diversity of their investments within the technology sector.

- Potential for a lucrative exit strategy: After a period of restructuring and growth, private equity firms typically aim to sell their stake at a profit.

Geopolitical Implications

The involvement of a Chinese buyout firm adds a layer of geopolitical complexity:

- National security concerns: Governments might raise concerns about the potential transfer of sensitive testing technologies.

- Trade implications: The sale could trigger scrutiny under international trade regulations.

- Regulatory hurdles: The transaction could face delays or even be blocked due to regulatory reviews and approvals in various jurisdictions.

Market Implications of the UTAC Sale

The sale of UTAC will likely have profound implications for the semiconductor testing market.

Pricing and Competition

The new owner's strategies will greatly influence pricing and competition:

- Price increases: A new owner aiming for higher profit margins could lead to increased testing costs for chip manufacturers.

- Increased competition: The sale might encourage competitors to invest more heavily in R&D, potentially driving innovation and lower prices in the long term.

Innovation and Technological Advancements

The future of innovation at UTAC hinges on the buyer's priorities:

- Continued R&D investments: A buyer committed to R&D could drive further advancements in semiconductor testing technologies.

- Reduced R&D investments: Conversely, a focus on short-term profitability could lead to a slowdown in innovation.

Consolidation and Market Share Shifts

The sale could trigger a wave of consolidation within the semiconductor testing market:

- Increased market share for the acquirer: The buyer will gain a significant increase in market share.

- Increased competitive pressure on remaining players: Other firms may need to react strategically to maintain their competitiveness.

Conclusion: The Future of UTAC and the Semiconductor Testing Market

The potential sale of UTAC represents a pivotal moment for the semiconductor testing market. The implications extend beyond financial considerations, touching upon technological advancements, geopolitical sensitivities, and overall industry dynamics. The identity of the eventual buyer and their subsequent strategies will significantly shape the future competitive landscape. Keep an eye on the developments surrounding the sale of UTAC; follow the news regarding this significant event in the Chinese buyout firm and chip tester market to understand its full impact. Learn more about the implications of the potential UTAC sale and its effect on the global semiconductor industry.

Featured Posts

-

Fbi Investigation Exposes Multi Million Dollar Office365 Executive Account Hack

Apr 24, 2025

Fbi Investigation Exposes Multi Million Dollar Office365 Executive Account Hack

Apr 24, 2025 -

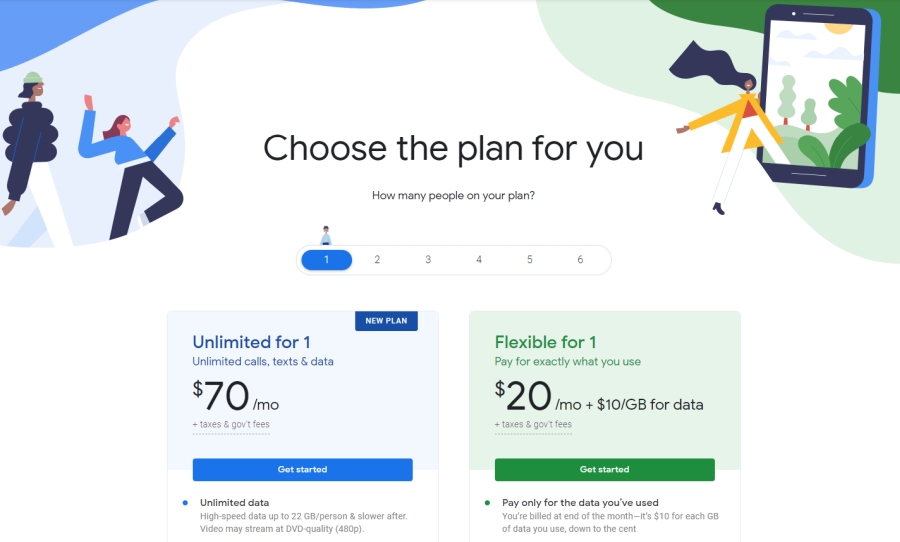

Compare Google Fis 35 Unlimited Plan To Competitors

Apr 24, 2025

Compare Google Fis 35 Unlimited Plan To Competitors

Apr 24, 2025 -

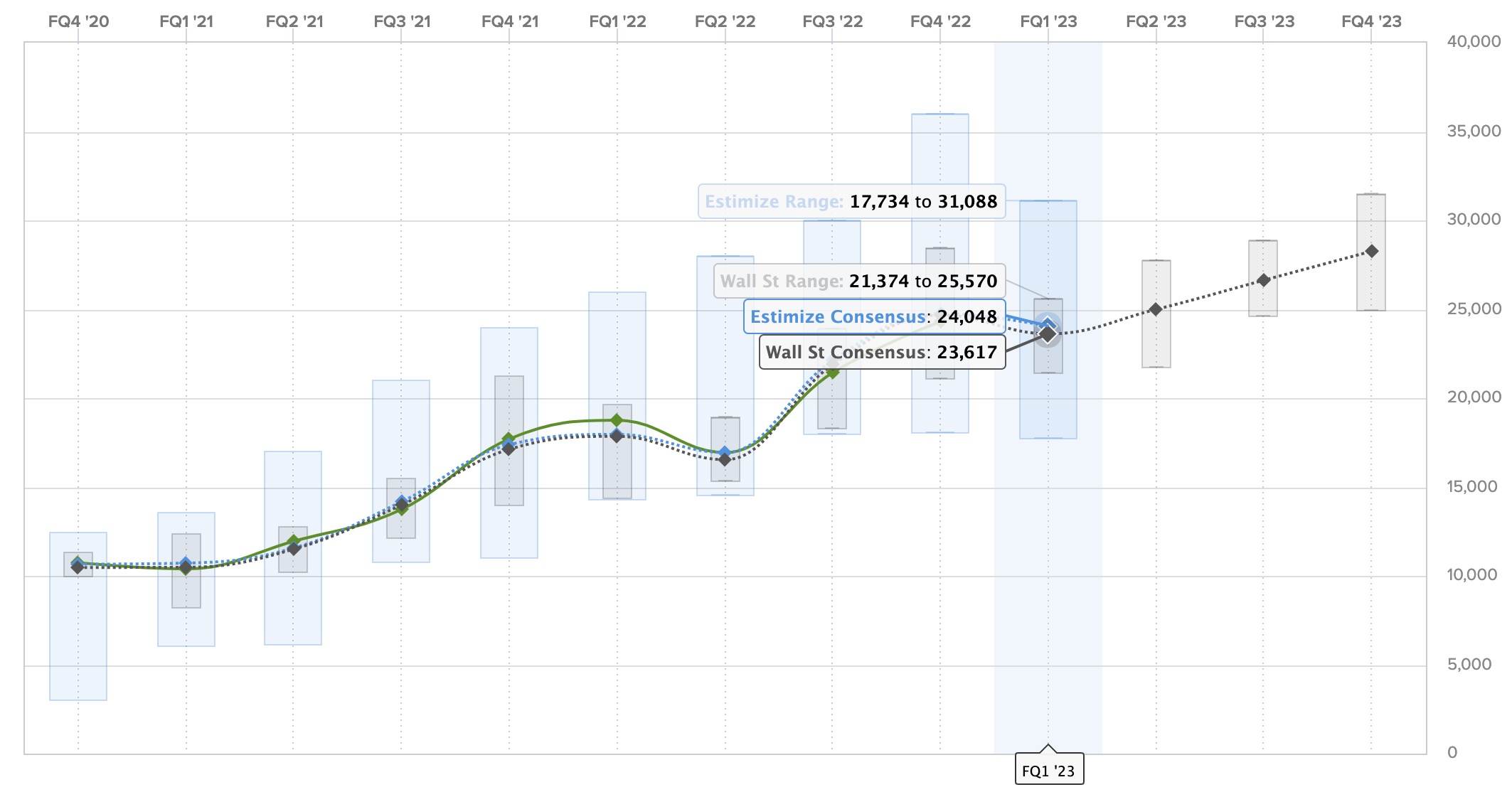

Tesla Q1 Earnings Net Income Plunges 71 Amidst Political Headwinds

Apr 24, 2025

Tesla Q1 Earnings Net Income Plunges 71 Amidst Political Headwinds

Apr 24, 2025 -

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025 -

Trumps Immigration Policies New Legal Obstacles Emerge

Apr 24, 2025

Trumps Immigration Policies New Legal Obstacles Emerge

Apr 24, 2025