Canadian Dollar's Unexpected Dip: Strength Against USD, Weakness Elsewhere

Table of Contents

The CAD's Strength Against the USD: A Closer Look

The Canadian dollar's resilience against the USD is a noteworthy phenomenon deserving of in-depth analysis. Several key elements contribute to this seemingly paradoxical strength.

Impact of Rising Interest Rates in Canada

The Bank of Canada's aggressive interest rate hikes have played a significant role in attracting foreign investment. Higher interest rates make Canadian assets more attractive to international investors seeking higher returns, increasing demand for the CAD and thus strengthening it against the USD.

- Interest Rate Differentials: The difference in interest rates between Canada and the US directly impacts currency exchange rates. When Canadian interest rates are higher, investors borrow in USD, convert to CAD, invest in Canadian assets, and reap higher returns. This increased demand for CAD strengthens its value.

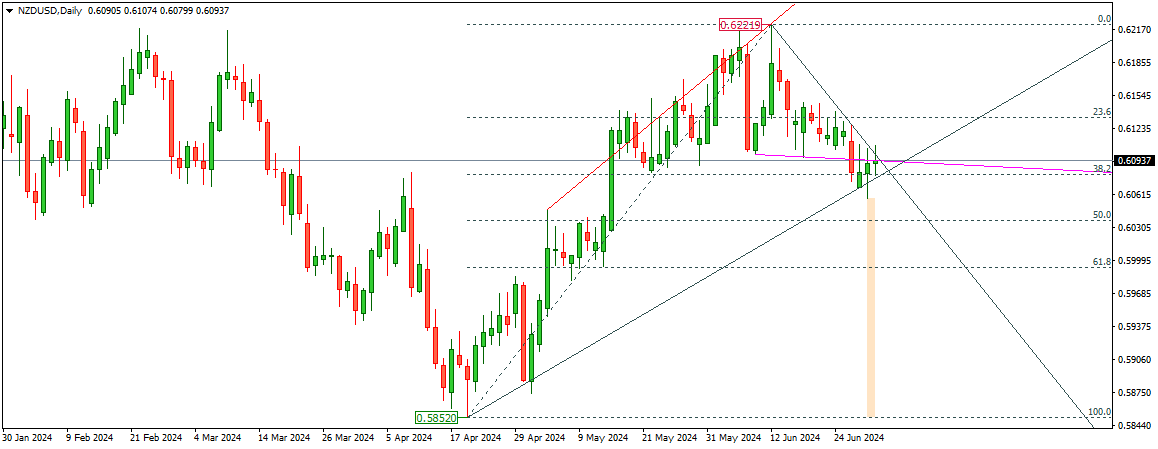

- Data Correlation: While specific data requires real-time market analysis, historical data demonstrates a strong positive correlation between Bank of Canada rate hikes and the strengthening of the CAD against the USD. (Note: Insert relevant chart or graph here if available).

- Risks of High Interest Rates: It’s important to note that while higher interest rates can boost the CAD, they can also negatively impact economic growth by slowing down borrowing and investment within Canada itself. This is a critical balancing act for the Bank of Canada.

The Role of Commodity Prices

Canada's economy is heavily reliant on commodity exports, particularly oil. Stronger global commodity prices, especially oil prices, significantly impact the CAD's value.

- Commodity Demand: High global demand for Canadian resources, such as oil and lumber, increases the demand for CAD, as buyers need to convert their currencies to purchase these commodities.

- Global Energy Dynamics: Fluctuations in global energy demand and supply directly affect oil prices, which in turn impact the CAD's performance. A surge in global oil demand typically strengthens the CAD against the USD. (Note: Insert relevant chart or graph here if available).

US Economic Weakness

The relative weakness of the US economy compared to Canada's also contributes to the CAD's strength against the USD.

- Inflation and Interest Rates: High inflation and aggressive interest rate hikes in the US can weaken the USD as investors seek more stable and higher-yielding alternatives.

- Recessionary Concerns: Concerns about a potential US recession can further diminish the appeal of the USD, making the CAD a more attractive option for investors.

Weakness Against Other Major Currencies: Diverging Trends

Despite its strength against the USD, the CAD has displayed weakness against other major currencies, highlighting the complex interplay of global economic forces.

Global Economic Slowdown

A global economic slowdown negatively impacts the Canadian dollar against stronger currencies.

- Investor Sentiment: Global uncertainty affects investor sentiment, leading to capital flight from emerging markets, including Canada, and a shift towards more stable currencies. This decreases demand for the CAD.

- Capital Flows: Reduced global trade and investment flows negatively impact the CAD's value relative to other major currencies.

Safe-Haven Currencies

During times of global uncertainty, investors often flock to safe-haven currencies like the USD or Japanese Yen.

- Risk Aversion: Periods of geopolitical instability or economic downturn drive investors to seek the perceived safety of these currencies, reducing demand for riskier assets like the CAD.

Geopolitical Factors

Geopolitical events and uncertainties significantly impact currency markets and the CAD’s performance.

- Global Conflicts and Trade Wars: Global conflicts and trade tensions introduce volatility and uncertainty, making investors less likely to hold CAD.

- Political Instability: Political instability, both domestically and internationally, can influence investor confidence and affect the CAD's exchange rate.

Conclusion: Navigating the Volatility of the Canadian Dollar

The Canadian dollar's recent performance showcases the complex interplay of various economic and geopolitical factors. Its strength against the USD is largely attributed to higher interest rates in Canada, strong commodity prices, and relative weakness in the US economy. However, its weakness against other major currencies reflects a global economic slowdown, investor preference for safe-haven assets, and ongoing geopolitical uncertainties. Understanding these nuanced dynamics is crucial for navigating the volatility of the Canadian dollar.

Key Takeaways:

- Higher Canadian interest rates attract foreign investment, strengthening the CAD against the USD.

- Strong commodity prices, especially oil, boost demand for the CAD.

- Global economic slowdown and safe-haven currency demand weaken the CAD against other major currencies.

- Geopolitical factors introduce significant volatility to the CAD's exchange rate.

Call to Action: Understanding the Canadian Dollar's Unexpected Dip is crucial for informed financial decisions. Stay informed about CAD fluctuations and consult with financial experts before making any investment decisions related to the Canadian dollar or currency trading. Stay tuned for further analysis on the Canadian dollar's movement.

Featured Posts

-

Potential Sale Of Chip Tester Utac By Chinese Buyout Firm

Apr 24, 2025

Potential Sale Of Chip Tester Utac By Chinese Buyout Firm

Apr 24, 2025 -

Brett Goldstein On Ted Lassos Revival A Thought Dead Cats Resurrection

Apr 24, 2025

Brett Goldstein On Ted Lassos Revival A Thought Dead Cats Resurrection

Apr 24, 2025 -

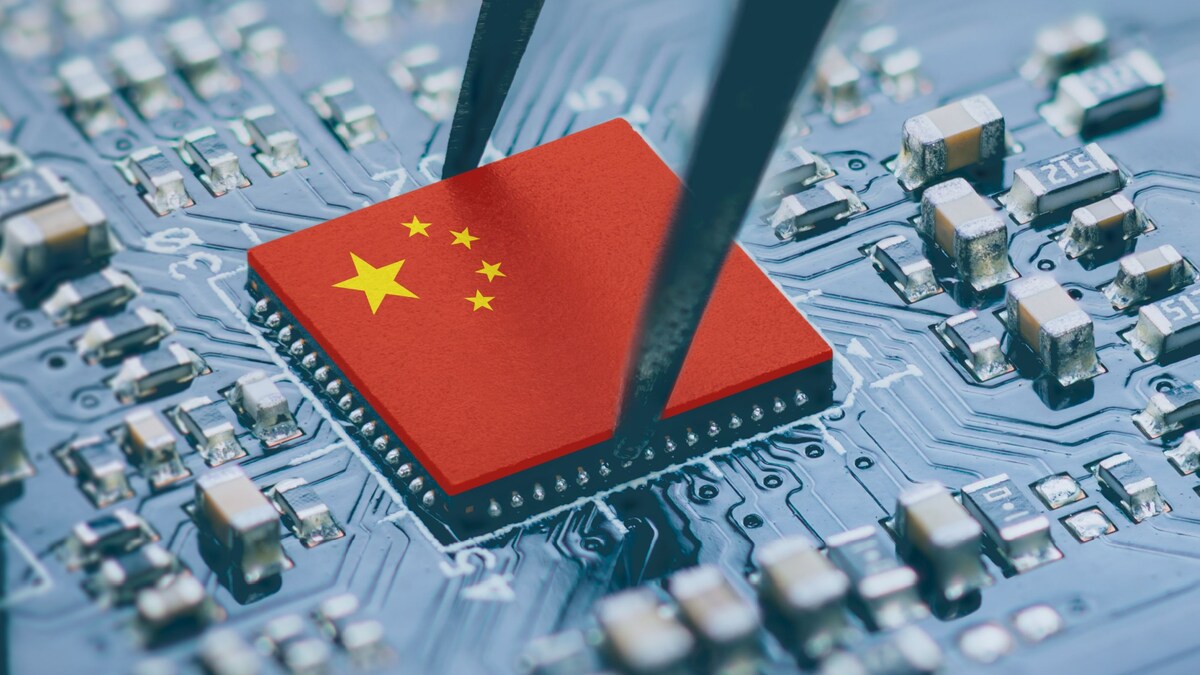

China Diversifies Lpg Imports Middle East Replaces Us Amid Tariffs

Apr 24, 2025

China Diversifies Lpg Imports Middle East Replaces Us Amid Tariffs

Apr 24, 2025 -

Tesla Earnings Decline 71 Net Income Drop In First Quarter

Apr 24, 2025

Tesla Earnings Decline 71 Net Income Drop In First Quarter

Apr 24, 2025 -

Tensions Rise South Carolina Voters Confrontation With Rep Nancy Mace

Apr 24, 2025

Tensions Rise South Carolina Voters Confrontation With Rep Nancy Mace

Apr 24, 2025