China's Economic Policies And Their Effect On Today's Stock Market: Dow Futures Analysis

Table of Contents

China's Recent Economic Policy Shifts and Their Rationale

China's recent economic policy adjustments reflect a shift away from stringent controls towards a more market-oriented approach. However, the transition is complex and carries both opportunities and risks.

Zero-COVID Policy's Impact and its Dismantling

The zero-COVID policy, while initially successful in containing the virus, severely hampered economic growth and disrupted global supply chains.

- Decreased consumer spending: Lockdowns and restrictions led to a significant drop in consumer confidence and spending, impacting various sectors.

- Factory shutdowns: Production was severely curtailed, leading to shortages and delays in manufacturing and exports.

- Export disruptions: Global supply chains were disrupted, causing delays and increasing costs for businesses worldwide.

- Global inflation pressures: Shortages and supply chain disruptions contributed to increased inflation globally.

The sudden dismantling of the zero-COVID policy, while aimed at boosting economic activity, created its own set of challenges, including a surge in COVID-19 cases and further strain on the healthcare system. The short-term impact was significant volatility, while the long-term effects are still unfolding and will depend on the effectiveness of subsequent policy responses and the speed of economic recovery.

Real Estate Sector Regulation and its Fallout

China's real estate sector, a significant driver of economic growth, has faced stringent regulatory measures aimed at controlling a burgeoning property bubble. The Evergrande crisis highlighted the systemic risks within the sector.

- Impact on construction: Construction activity slowed significantly, impacting employment and related industries.

- Impact on related industries: Industries such as cement, steel, and furniture experienced reduced demand.

- Impact on consumer confidence: Concerns about property values and market stability affected consumer sentiment.

- Systemic risk analysis: The interconnectedness of the real estate sector with the broader financial system posed a significant systemic risk.

The government has implemented measures to mitigate risks, including providing financial support to some developers and promoting affordable housing initiatives. However, the long-term consequences of these policies on foreign investment and investor sentiment remain to be seen.

Stimulus Packages and Infrastructure Investments

The Chinese government has announced several stimulus packages aimed at boosting economic growth and supporting key sectors. These packages typically focus on infrastructure investments.

- Focus areas of investment: Infrastructure projects, renewable energy, and technological advancement are key areas of focus.

- Expected economic impact: Increased employment, improved infrastructure, and a potential boost to economic activity are anticipated outcomes.

- Potential drawbacks: Over-reliance on debt-financed investment, potential for inefficient allocation of resources, and environmental concerns are potential drawbacks.

The effectiveness of past stimulus measures has been mixed. While they have helped to boost short-term growth, concerns remain about the long-term sustainability of this approach. The impact of these investments on Dow futures will largely depend on their success in stimulating global demand and supply chain recovery.

The Correlation Between Chinese Economic Policies and Dow Futures

Changes in China's economic policies have a significant impact on global markets, creating a strong correlation with Dow futures.

Transmission Mechanisms

The effects of Chinese economic policies on Dow futures are transmitted through several channels:

- Supply chain disruptions: Changes in Chinese production and exports directly impact global supply chains, affecting US companies and the Dow.

- Commodity price fluctuations: China's demand for commodities influences global prices, which impacts US companies involved in commodity trading and production.

- Investor sentiment: Uncertainty about China's economic outlook can impact global investor sentiment, causing fluctuations in stock markets, including the Dow.

- Currency exchange rates: Changes in the value of the Chinese Yuan affect global exchange rates, indirectly impacting the Dow.

These factors directly and indirectly affect US companies listed on the Dow Jones Industrial Average, leading to corresponding movements in Dow futures.

Analyzing Dow Futures Movements in Relation to Chinese Policy Announcements

Analyzing Dow futures movements following Chinese policy announcements requires a combination of technical and fundamental analysis.

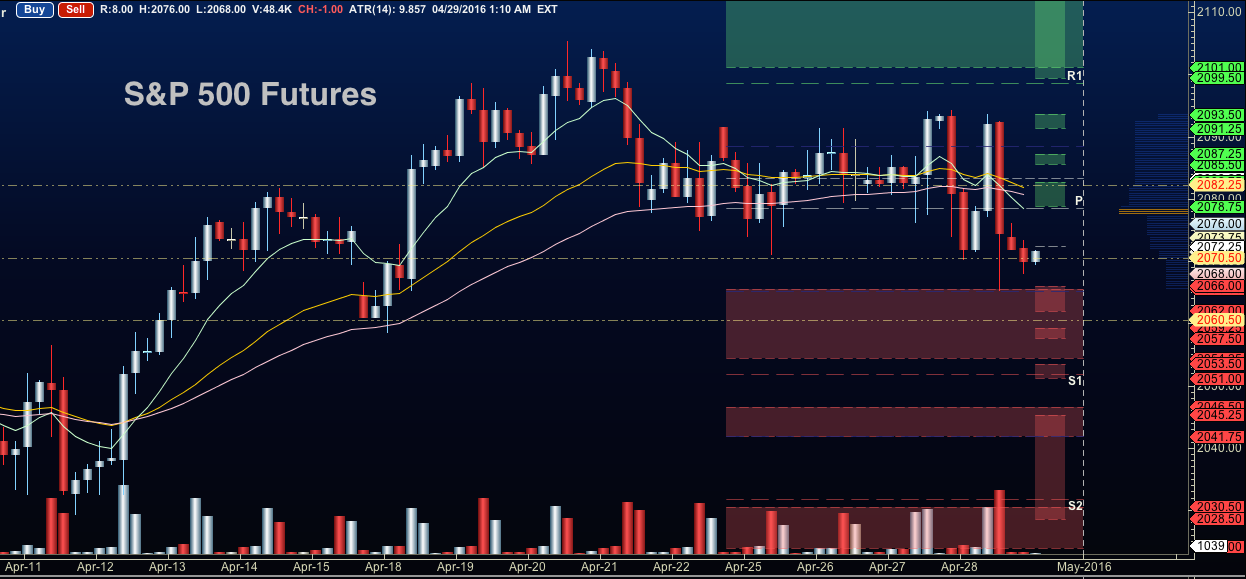

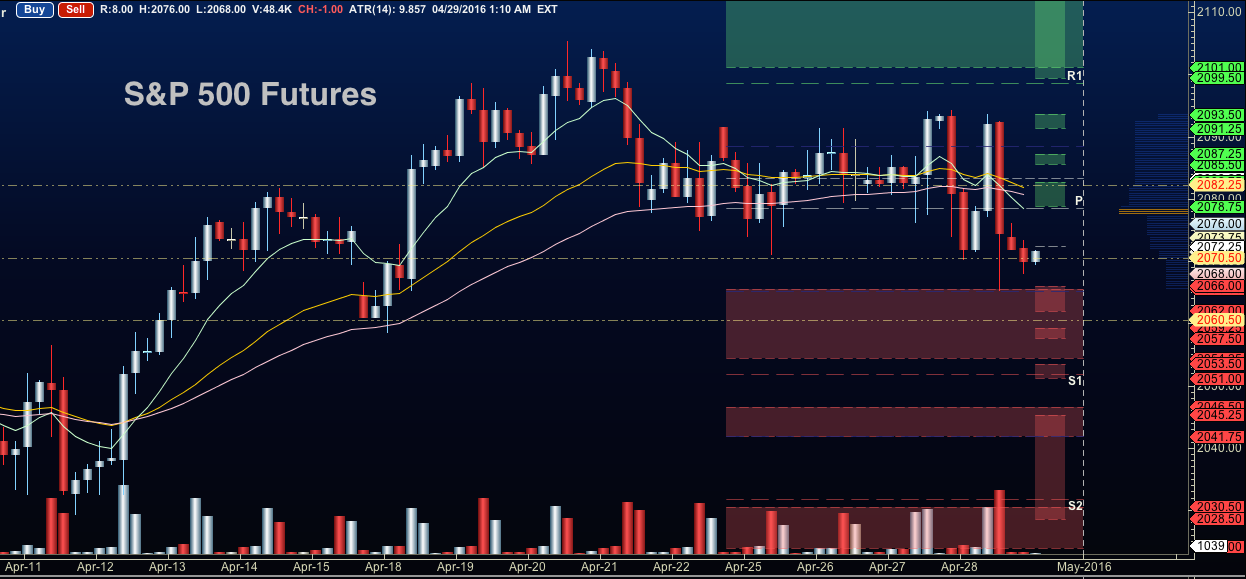

- Examples of policy impact: For example, announcements of new stimulus packages often lead to short-term increases in Dow futures, while news of stricter regulations can lead to declines. (Charts/graphs would be included here in a published article.)

- Technical analysis: This involves studying price charts and patterns to identify potential trading opportunities.

- Fundamental analysis: This involves analyzing underlying economic factors, such as GDP growth, inflation, and interest rates.

- Hedging and risk management: Hedging strategies, like using futures contracts, can help mitigate risks associated with Chinese policy uncertainty.

Forecasting the Future Impact of China's Economic Policies on the Dow

Predicting the future impact of China's economic policies on the Dow requires considering both short-term and long-term perspectives.

Short-Term Outlook

The near-term outlook for Dow futures is characterized by significant uncertainty.

- Potential for volatility: Continued policy adjustments and economic data releases are likely to create volatility in the Dow futures market.

- Opportunities for investors: Informed investors can identify potential trading opportunities by carefully analyzing policy announcements and market reactions.

- Risk factors to consider: Geopolitical risks, potential supply chain disruptions, and inflation remain important factors to consider.

Long-Term Projections

The long-term impact of China's economic policies on the Dow will depend on several factors:

- Potential for growth: Successful implementation of reform measures could lead to sustained economic growth in China, potentially benefiting the global economy and the Dow.

- Challenges to overcome: Addressing challenges such as debt levels, income inequality, and environmental concerns will be crucial for long-term success.

- Geopolitical considerations: China's role in the global economy and its relationship with other major economies will significantly influence the long-term outlook. Different policy outcomes will lead to varied scenarios regarding Dow futures performance.

Conclusion

China's economic policies exert a substantial influence on global markets, including the Dow futures market. Understanding the interplay between these policies—from the dismantling of zero-COVID to real estate regulation and stimulus packages—is crucial for investors. Analyzing the correlation between policy announcements and Dow futures movements allows for more informed investment decisions. By carefully monitoring China's economic landscape and its policy shifts, investors can better navigate the complexities of the global market and make strategic choices regarding Dow futures trading and investments. Stay informed about China's economic policies for better Dow futures analysis.

Featured Posts

-

The Karen Read Case A Detailed Timeline Of Legal Proceedings

Apr 26, 2025

The Karen Read Case A Detailed Timeline Of Legal Proceedings

Apr 26, 2025 -

Blue Origins Rocket Launch Halted By Vehicle Subsystem Problem

Apr 26, 2025

Blue Origins Rocket Launch Halted By Vehicle Subsystem Problem

Apr 26, 2025 -

Europe Rejects Trump Administrations Ai Regulatory Push

Apr 26, 2025

Europe Rejects Trump Administrations Ai Regulatory Push

Apr 26, 2025 -

La Palisades Fire Which Celebrities Lost Their Homes

Apr 26, 2025

La Palisades Fire Which Celebrities Lost Their Homes

Apr 26, 2025 -

The Federal Reserves Next Leader Facing The Aftermath Of The Trump Presidency

Apr 26, 2025

The Federal Reserves Next Leader Facing The Aftermath Of The Trump Presidency

Apr 26, 2025