Consumers Curb Spending: Impact On Credit Card Companies

Table of Contents

Decreased Transaction Volume and Revenue

Reduced consumer spending translates directly into fewer credit card transactions. This decrease in activity significantly impacts the revenue streams of credit card companies, which rely heavily on transaction fees and interest payments. The ripple effect is felt across the entire credit card ecosystem.

-

Lower Merchant Fees: Fewer purchases mean lower merchant fees collected by credit card companies from businesses. This reduction in interchange fees directly affects the bottom line of credit card issuers. Restaurants, retailers, and online merchants all contribute to this vital revenue stream, and a decline in their transactions means a decline in fees for the credit card companies.

-

Reduced Interest Income: As consumers spend less, they carry lower balances, resulting in reduced interest income for credit card issuers. This is particularly impactful for cards with high interest rates, as these typically generate the most interest revenue. A decrease in revolving credit utilization directly impacts this key revenue source.

-

Impact on Annual Fees: While less directly tied to spending, lower spending might lead to consumers canceling premium credit cards with annual fees. Consumers are more likely to scrutinize expenses during times of economic uncertainty, and annual fees are often among the first to be cut.

Increased Credit Risk and Delinquency Rates

When consumers cut spending, it can signal financial hardship. This increases the likelihood of missed payments and credit card delinquency, posing a significant risk to credit card companies.

-

Higher Default Rates: Consumers facing financial difficulties may default on their credit card payments, leading to increased losses for credit card companies. This necessitates increased provisioning for loan losses and can significantly impact profitability.

-

Stringent Lending Practices: Credit card companies may tighten their lending criteria, making it harder for consumers to obtain credit, thus further impacting transaction volume. This cautious approach aims to mitigate risk but also potentially reduces the overall market size for credit card companies.

-

Increased Provision for Loan Losses: Companies are forced to increase their reserves to account for the anticipated rise in bad debts. This reduces profitability and can impact the company's overall financial health. This increased provisioning is a crucial indicator of the risk assessment performed by credit card companies.

Strategies to Mitigate Risk

Credit card companies are actively implementing strategies to counteract the negative effects of reduced consumer spending. These include:

-

Targeted Marketing Campaigns: Offering attractive rewards programs, cashback incentives, and promotional offers to stimulate spending and retain customers. These campaigns often focus on specific demographics and spending habits.

-

Improved Fraud Detection: Minimizing losses due to fraudulent transactions becomes paramount during economic downturns. Investing in advanced fraud detection technology and security measures is crucial.

-

Diversification of Revenue Streams: Exploring alternative revenue sources beyond transaction fees, such as subscription services (like credit score monitoring), financial management tools, and partnerships with other financial institutions.

Impact on Credit Card Company Stock Prices

The reduction in consumer spending has a direct effect on the stock prices of credit card companies, reflecting investor sentiment and the overall financial health of the industry.

-

Investor Sentiment: Negative news about reduced consumer spending often leads to decreased investor confidence, impacting stock valuations. Stock prices often reflect the perceived risk and future profitability of the company.

-

Reduced Profitability: Lower profits directly correlate with lower stock prices. Analysts carefully monitor key financial metrics such as net interest income, provision for loan losses, and return on equity to assess the impact of reduced spending.

-

Market Volatility: The credit card sector can experience significant volatility depending on broader economic trends and consumer confidence. External factors like interest rate hikes and inflation also play a significant role.

Conclusion

The trend of consumers curbing spending presents significant challenges for credit card companies. Decreased transaction volume, increased credit risk, and the resulting impact on profitability are all major concerns. Credit card companies are responding with various strategies to mitigate these risks, but the ultimate success of these strategies will depend on broader economic factors and consumer behavior. Staying informed about consumer spending trends and the financial health of credit card companies is crucial for both investors and consumers alike. Understanding the intricacies of how consumers curb spending impacts this industry is key to navigating the current economic climate. Monitor key indicators and stay informed to make the best financial decisions in this evolving landscape.

Featured Posts

-

A Look Into The Lives Of Chalet Girls In Europes Exclusive Ski Resorts

Apr 24, 2025

A Look Into The Lives Of Chalet Girls In Europes Exclusive Ski Resorts

Apr 24, 2025 -

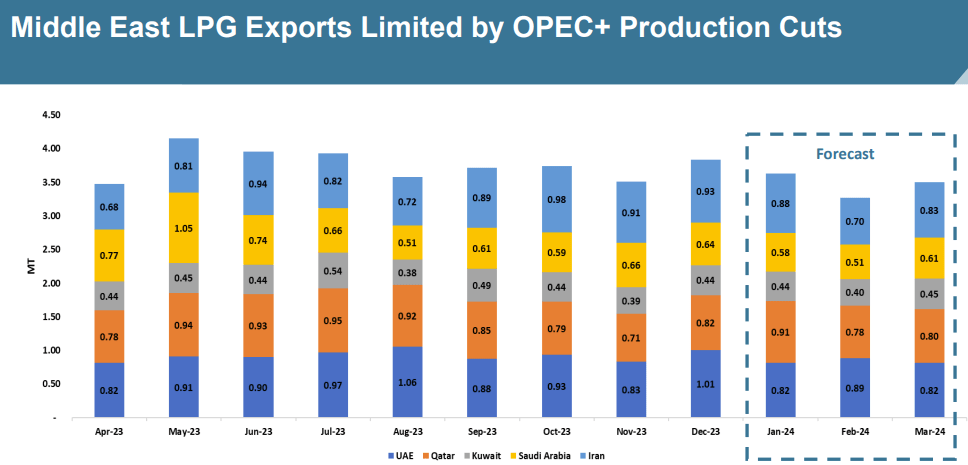

Impact Of Us Tariffs China Turns To Middle East For Lpg Imports

Apr 24, 2025

Impact Of Us Tariffs China Turns To Middle East For Lpg Imports

Apr 24, 2025 -

Future Of Utac Chinese Buyout Firm To Decide On Sale

Apr 24, 2025

Future Of Utac Chinese Buyout Firm To Decide On Sale

Apr 24, 2025 -

Court Ruling Impacts E Bays Liability For Banned Chemical Listings

Apr 24, 2025

Court Ruling Impacts E Bays Liability For Banned Chemical Listings

Apr 24, 2025 -

John Travoltas Miami Steakhouse Adventure A Pulp Fiction Inspired Meal

Apr 24, 2025

John Travoltas Miami Steakhouse Adventure A Pulp Fiction Inspired Meal

Apr 24, 2025