Dollar Gains Ground Against Major Peers Amid Eased Trump-Powell Tensions

Table of Contents

Eased Trump-Powell Tensions and Market Stability

The relationship between former President Trump and former Fed Chair Powell was often turbulent, marked by public criticism and uncertainty regarding monetary policy. Trump's frequent attacks on Powell's interest rate decisions created significant market volatility, impacting investor confidence and the dollar's performance. This uncertainty undermined the perceived stability of the US economy, leading to periods where the dollar lost ground against other currencies. However, the easing of these tensions since Trump left office has dramatically changed the landscape.

The reduced antagonism between the executive and the central bank has fostered a more predictable and stable environment. This improved predictability has boosted investor confidence, leading to increased demand for US assets, including the dollar. Past conflicts, characterized by Trump's calls for lower interest rates and Powell's commitment to independent monetary policy, created significant uncertainty. This uncertainty led to periods of heightened volatility in the foreign exchange market, often resulting in the dollar losing ground.

- Reduced uncertainty about future monetary policy: The clearer communication and more consistent policy approach from the Fed have improved market predictability.

- Improved investor sentiment towards US assets: The reduced political risk has encouraged greater foreign investment in US assets.

- Increased demand for the dollar as a safe-haven asset: In times of global uncertainty, the dollar often benefits from its status as a safe-haven currency.

Economic Indicators Supporting Dollar Strength

Beyond the political landscape, robust US economic indicators are significantly contributing to the "Dollar Gains Ground" phenomenon. Strong GDP growth, coupled with controlled inflation and a healthy employment market, paint a picture of a thriving US economy. This positive economic performance outpaces many of its major global competitors, making the dollar an increasingly attractive investment.

Compared to other major economies grappling with slower growth, higher inflation, or economic instability, the US economy appears relatively resilient. This relative strength directly translates into a higher demand for the dollar.

- Strong US GDP growth compared to other major economies: Sustained economic growth strengthens the dollar's appeal.

- Rising US interest rates attracting foreign investment: Higher interest rates make US assets more attractive to foreign investors, increasing demand for the dollar.

- Positive employment data reinforcing a strong US economy: Low unemployment rates indicate a healthy economy, further boosting the dollar's value.

Impact on Other Major Currencies

The strengthening dollar has had a noticeable impact on other major currencies. The Euro, for instance, has weakened against the dollar due to concerns about the Eurozone economy and ongoing energy challenges. Similarly, the Yen has been affected by the Bank of Japan's monetary policy, which has kept interest rates low. The Pound Sterling, meanwhile, continues to be impacted by the lingering uncertainties surrounding Brexit and its effects on the UK economy.

- Euro weakened due to concerns about the Eurozone economy: Economic slowdowns and high inflation in Europe weigh on the Euro's value.

- Yen weakened due to Bank of Japan's monetary policy: The Bank of Japan's continued low interest rate policy makes the Yen less attractive to investors.

- Pound affected by Brexit-related uncertainties: Ongoing economic and political uncertainty following Brexit continues to impact the Pound.

Future Outlook for the US Dollar

The short-term outlook for the dollar suggests a continued period of appreciation, barring any unforeseen major economic or geopolitical shocks. However, the long-term outlook is more nuanced and dependent on several factors, including global economic growth, inflation rates, and geopolitical stability. Uncertainties remain, and potential shifts in global economic conditions could alter the dollar's trajectory.

Potential future events that could impact the dollar's performance include shifts in global trade relations, unexpected economic slowdowns in the US or other major economies, and escalating geopolitical tensions.

- Potential for further dollar appreciation in the short-term: Based on current trends, the dollar is likely to continue its upward trajectory in the near future.

- Long-term outlook dependent on global economic conditions: The long-term value of the dollar will be significantly shaped by global economic forces.

- Geopolitical risks could impact the dollar's value: Unexpected geopolitical events could introduce volatility into the market and affect the dollar's value.

Conclusion: Dollar Gains Ground – What to Expect Next

The recent "Dollar Gains Ground" trend is a result of several converging factors. The easing of Trump-Powell tensions has created a more stable and predictable market environment, boosting investor confidence. Meanwhile, strong US economic indicators, compared to relatively weaker performances in other major economies, are further fueling the dollar's rise. This strength has negatively impacted other major currencies, which have weakened in relation to the US dollar. While the short-term outlook suggests continued dollar strength, the long-term trajectory will depend on several evolving factors. To stay ahead of these changes and understand the continuing impact of factors driving US Dollar strength and Dollar Gains, we urge you to stay informed. Subscribe to our newsletter for regular updates on the latest developments affecting the dollar's performance and continue following our analysis to understand why the dollar gains ground.

Featured Posts

-

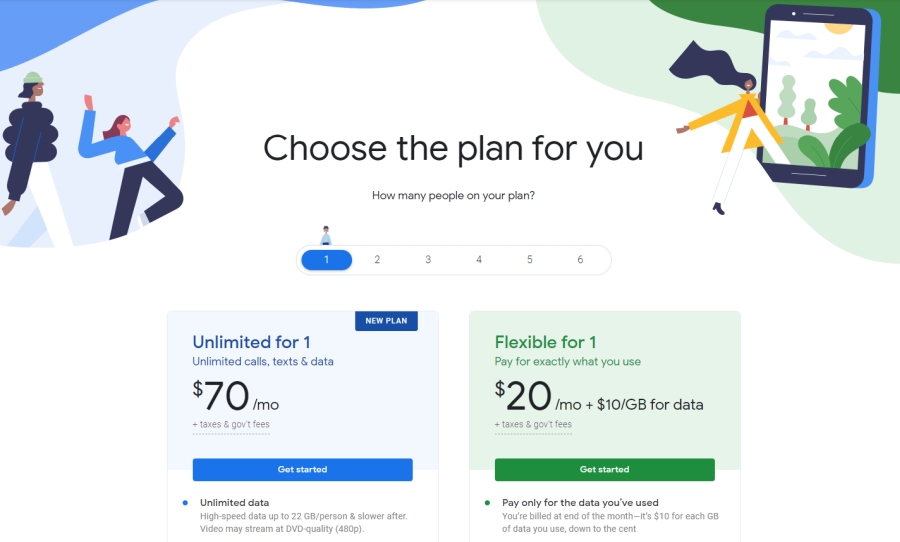

Compare Google Fis 35 Unlimited Plan To Competitors

Apr 24, 2025

Compare Google Fis 35 Unlimited Plan To Competitors

Apr 24, 2025 -

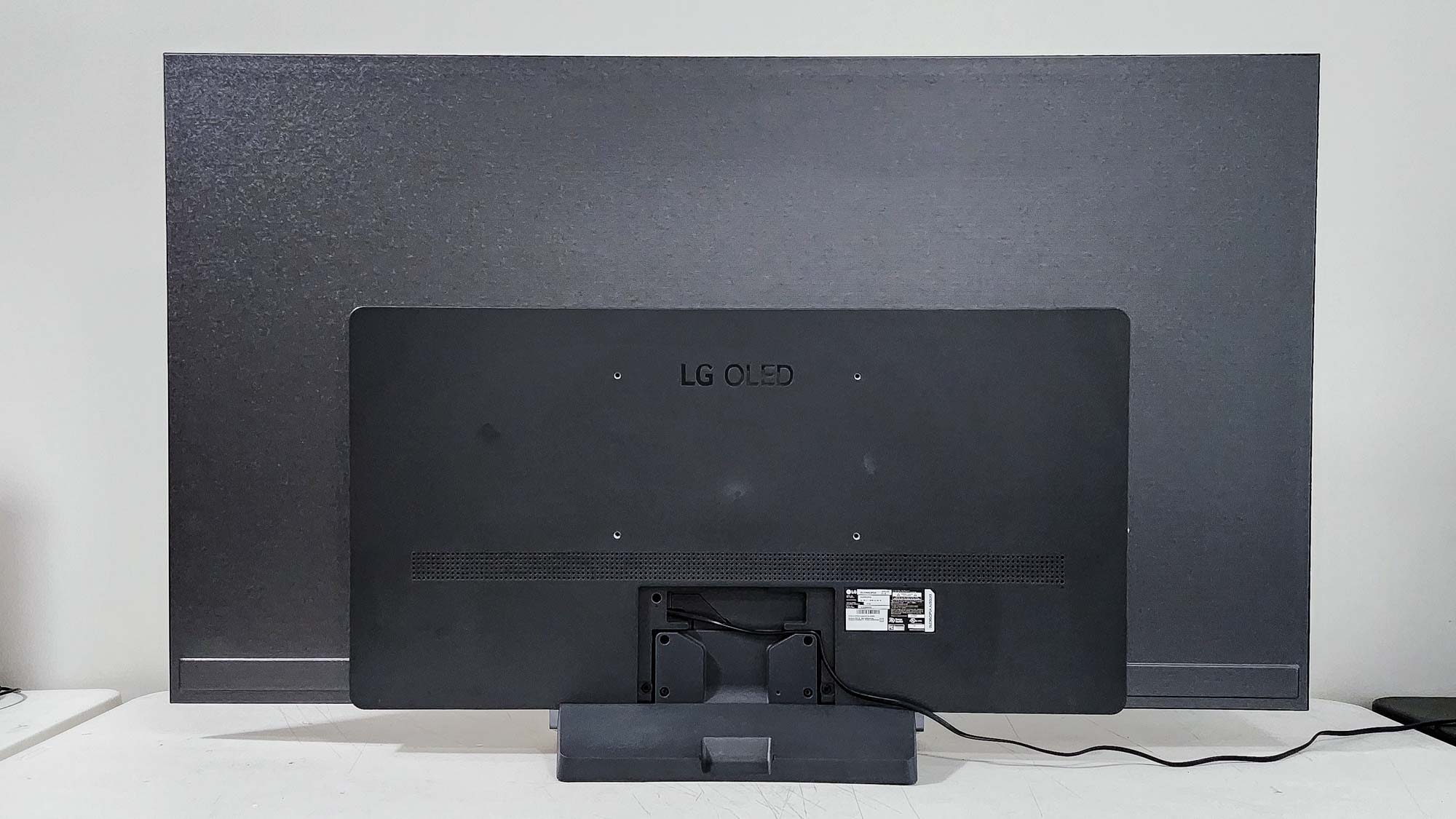

My Experience With The Lg C3 77 Inch Oled Television

Apr 24, 2025

My Experience With The Lg C3 77 Inch Oled Television

Apr 24, 2025 -

Emerging Markets Rally Outpacing Us Stock Market Performance

Apr 24, 2025

Emerging Markets Rally Outpacing Us Stock Market Performance

Apr 24, 2025 -

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025

Minnesota Attorney General Sues Trump Over Transgender Sports Ban

Apr 24, 2025 -

Pope Francis A Globalized Church Facing Deep Divisions

Apr 24, 2025

Pope Francis A Globalized Church Facing Deep Divisions

Apr 24, 2025