High Stock Market Valuations: Why Investors Shouldn't Panic (BofA)

Table of Contents

Understanding Current Stock Market Valuations

Assessing whether the market is "overvalued" requires understanding key metrics. Commonly used indicators include:

- Price-to-Earnings Ratio (P/E): This compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for future growth.

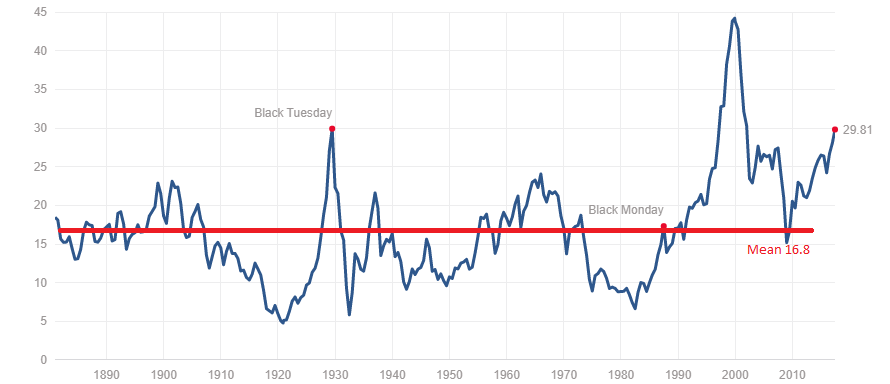

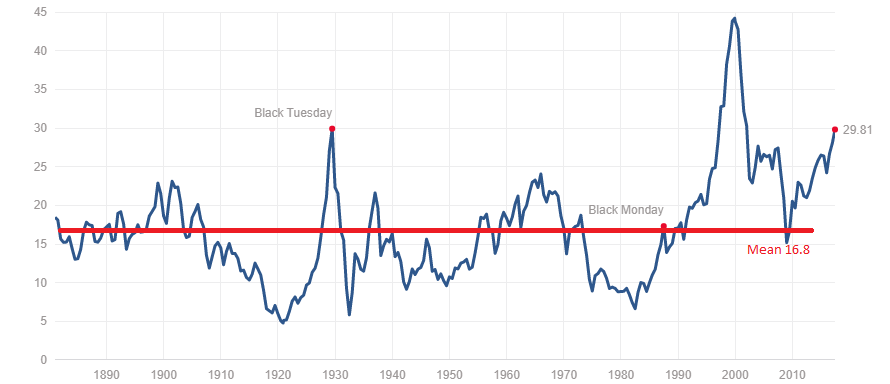

- Shiller P/E (CAPE): This is a cyclically adjusted P/E ratio that smooths out earnings fluctuations over a ten-year period, providing a longer-term perspective on valuation.

- Market Cap to GDP: This metric compares the total market capitalization of all publicly traded companies to the nation's gross domestic product. A high ratio may suggest overvaluation.

Currently, many of these metrics show elevated readings compared to historical averages. For instance, the Shiller P/E ratio is currently above its long-term average, suggesting that stocks are trading at a premium relative to their historical earnings. However, it’s crucial to note:

- Historical Comparisons: While comparing current valuations to historical averages provides context, it's not a perfect predictor of future performance. Changes in economic conditions, technological advancements, and monetary policy can significantly impact market dynamics.

- Bias in Metrics: Each valuation metric has its limitations and potential biases. For example, the P/E ratio can be skewed by accounting practices and industry differences. Therefore, relying on a single metric is insufficient.

Factors Supporting Current Market Levels Despite High Valuations

Despite seemingly high stock market valuations, several factors are contributing to the current market levels:

-

Low Interest Rates: Extremely low interest rates globally decrease the opportunity cost of investing in stocks. Lower discount rates used in valuation models translate to higher present values of future earnings, potentially justifying higher stock prices.

- Lower discount rates increase the present value of future cash flows, making stocks more attractive relative to bonds.

- This effect encourages investors to seek higher returns in the equity market, potentially pushing valuations higher.

-

Technological Innovation and Growth: The rapid pace of technological innovation, particularly in sectors like technology, biotechnology, and renewable energy, is driving substantial growth and creating new investment opportunities. These innovative companies often command higher valuations due to their growth potential.

- Companies in the technology sector, for example, have demonstrated remarkable revenue and earnings growth in recent years, supporting their premium valuations.

- The emergence of disruptive technologies continuously reshapes the market landscape, potentially justifying higher valuations for companies positioned to benefit.

-

Strong Corporate Earnings and Profitability: While valuations might appear high, many companies are demonstrating robust earnings growth and profitability. This underlying strength can help sustain current market levels, even with elevated valuations.

- Data on corporate profit margins and earnings-per-share growth, readily available from financial news sources and research firms, demonstrates consistent improvements in many sectors.

- Stronger-than-expected corporate earnings reports can counterbalance concerns about high valuations and support investor sentiment.

Why Panic Selling is Unwise

Emotional decision-making in investing is often detrimental. Panic selling during periods of perceived high stock market valuations is rarely a winning strategy:

- Market Timing is Difficult: Accurately predicting market tops and bottoms is exceptionally challenging, even for seasoned professionals. Trying to time the market often leads to poor investment outcomes.

- Long-Term Perspective: Market fluctuations are inherent; corrections and recoveries are a natural part of the market cycle. A long-term investment horizon helps weather these storms.

- Historical data shows numerous instances of market corrections followed by substantial recoveries. Focusing on the long term minimizes the impact of short-term volatility.

- Dollar-Cost Averaging & Diversification: Dollar-cost averaging (investing a fixed amount at regular intervals) and maintaining a diversified portfolio mitigate risk and reduce the impact of market volatility.

- Risk Mitigation: Investors can mitigate the risks associated with high valuations by diversifying their portfolios across different asset classes, sectors, and geographies. Strategic asset allocation tailored to individual risk tolerance further enhances risk management.

Alternative Investment Strategies in a High-Valuation Market

When traditional equity valuations seem stretched, consider alternative options:

- Bonds: Fixed-income investments, especially government bonds, can offer a safe haven during periods of market uncertainty.

- Real Estate: Real estate can provide diversification and potentially higher returns, although it's less liquid than stocks.

- Alternative Investments: Hedge funds, private equity, and commodities can offer opportunities for risk-adjusted returns, but these often require sophisticated knowledge and higher minimum investments. BofA, and other financial institutions often publish detailed analyses on these investment strategies, providing a wealth of resources for investors.

A Measured Approach to High Stock Market Valuations

In conclusion, while high stock market valuations are indeed a cause for some caution, they are not a reason for widespread panic. Several factors, including low interest rates, technological innovation, and strong corporate earnings, are supporting current market levels. The key is to adopt a measured and disciplined approach: focus on long-term investing, diversify your portfolio, and consider alternative investment strategies to help mitigate risks. Don't let emotional reactions dictate your investment choices. Instead, develop a well-informed investment strategy tailored to your risk tolerance and financial goals. Consult with a qualified financial advisor for personalized guidance on navigating high stock market valuations and building a resilient investment portfolio.

Featured Posts

-

Kyivs Response To Trumps Plan For Ending The Ukraine Conflict

Apr 22, 2025

Kyivs Response To Trumps Plan For Ending The Ukraine Conflict

Apr 22, 2025 -

Tariff Impacts On Chinas Export Led Economy A Deeper Dive

Apr 22, 2025

Tariff Impacts On Chinas Export Led Economy A Deeper Dive

Apr 22, 2025 -

Stock Market Valuations Bof A Explains Why Investors Shouldnt Worry

Apr 22, 2025

Stock Market Valuations Bof A Explains Why Investors Shouldnt Worry

Apr 22, 2025 -

Supreme Court Obamacare Case Trumps Role And Rfk Jr S Potential Gain

Apr 22, 2025

Supreme Court Obamacare Case Trumps Role And Rfk Jr S Potential Gain

Apr 22, 2025 -

Analyzing The English Language Leaders Debate 5 Crucial Economic Insights

Apr 22, 2025

Analyzing The English Language Leaders Debate 5 Crucial Economic Insights

Apr 22, 2025