Live Stock Market Updates: Dow Futures And Dollar Reaction To Trade News

Table of Contents

Impact of Trade News on Dow Futures

Trade announcements, whether concerning new tariffs, trade deals, or trade war escalations, have a significant impact on Dow futures. The correlation is strong; positive news generally boosts investor confidence, leading to price increases, while negative news creates uncertainty and often results in price decreases.

- Positive Trade News: Announcements like successful trade negotiations, reduced tariffs, or the easing of trade tensions often lead to increased investor confidence, driving up Dow futures prices. This reflects optimism about future economic growth and corporate profitability.

- Negative Trade News: Conversely, news of increased tariffs, trade disputes, or protectionist policies generally leads to a decrease in Dow futures prices. Investors become wary, anticipating reduced profits and potentially slower economic growth.

- Recent Examples: For instance, the signing of a major trade agreement often leads to a positive market reaction in the short term, while the threat of new tariffs can trigger immediate sell-offs and downward pressure on Dow futures. Specific examples should be referenced based on current events.

- Sensitive Sectors: Sectors like technology and manufacturing are particularly sensitive to trade news. These sectors are heavily reliant on global supply chains and are therefore disproportionately affected by trade disputes and tariff changes.

Analyzing Dow Futures Contracts

Dow futures contracts are derivative instruments that allow investors to speculate on the future direction of the Dow Jones Industrial Average. Understanding these contracts is crucial for interpreting market movements. Key terms to understand include:

- Contract Size: This specifies the number of Dow Jones index points each contract represents.

- Margin: This refers to the initial deposit required to enter a futures contract.

- Long/Short Positions: A long position is a bet that the Dow will rise, while a short position is a bet that it will fall.

The Dollar's Reaction to Trade Developments

The US dollar's value often exhibits an inverse relationship with trade uncertainty. A strong dollar can make US exports more expensive, potentially hindering trade negotiations and slowing economic growth. Conversely, a weaker dollar can boost US exports by making them more competitive in the global market. However, a weaker dollar also increases import costs, potentially fueling inflation.

- Strong Dollar Impact: A strong US dollar makes American goods more expensive for foreign buyers, potentially leading to a trade deficit and negatively impacting US businesses that rely on exports.

- Weak Dollar Impact: A weak dollar, while boosting exports, also increases the cost of imports, leading to higher prices for consumers.

- Trade Agreement Influence: Recent trade agreements, depending on their specific terms, can significantly influence the US dollar's value. Favorable agreements tend to support a stronger dollar, while negative developments often lead to a weakening dollar.

- Safe-Haven Currency: The US dollar is often considered a "safe-haven currency." During times of global trade war anxieties or uncertainty, investors tend to flock to the dollar, driving its value upwards as they seek stability.

Understanding Forex Market Dynamics

The foreign exchange (forex or FX) market is where currencies are traded. The value of the US dollar is determined by supply and demand in this global marketplace. Factors influencing the dollar’s value include interest rates, economic data, geopolitical events, and, importantly, trade developments.

Strategies for Navigating Market Volatility

Navigating the volatility stemming from trade-related news requires careful planning and risk management. Here are some strategies investors can employ:

- Diversification: Diversifying your investment portfolio across different asset classes and sectors can help to reduce your overall risk.

- Stay Informed: Keeping abreast of global trade developments is critical for informed investment decisions. Regularly review live stock market updates and economic news.

- Hedging Strategies: Hedging strategies, such as using futures contracts or options, can help mitigate potential losses from adverse trade news.

- Derivatives: Consider using options or other derivatives to manage risk exposure to specific sectors or assets sensitive to trade developments.

Conclusion: Stay Informed with Live Stock Market Updates

Trade news significantly impacts Dow futures and the US dollar. Understanding this relationship is crucial for making informed investment decisions. By staying informed about global trade developments and utilizing appropriate risk management strategies, investors can navigate this volatile market more effectively. Stay ahead of the curve by regularly checking our website for the latest live stock market updates and expert analysis on Dow futures and the US dollar’s reaction to trade news. Informed investment decisions are essential in the face of global economic uncertainty.

Featured Posts

-

Ukraine Under Fire Russia Launches Deadly Air Strikes Amid Us Peace Efforts

Apr 22, 2025

Ukraine Under Fire Russia Launches Deadly Air Strikes Amid Us Peace Efforts

Apr 22, 2025 -

Federal Trade Commission Launches Investigation Into Open Ai And Chat Gpt

Apr 22, 2025

Federal Trade Commission Launches Investigation Into Open Ai And Chat Gpt

Apr 22, 2025 -

New Business Hot Spots Where To Invest And Grow In Country Name

Apr 22, 2025

New Business Hot Spots Where To Invest And Grow In Country Name

Apr 22, 2025 -

Supreme Court Obamacare Case Trumps Role And Rfk Jr S Potential Gain

Apr 22, 2025

Supreme Court Obamacare Case Trumps Role And Rfk Jr S Potential Gain

Apr 22, 2025 -

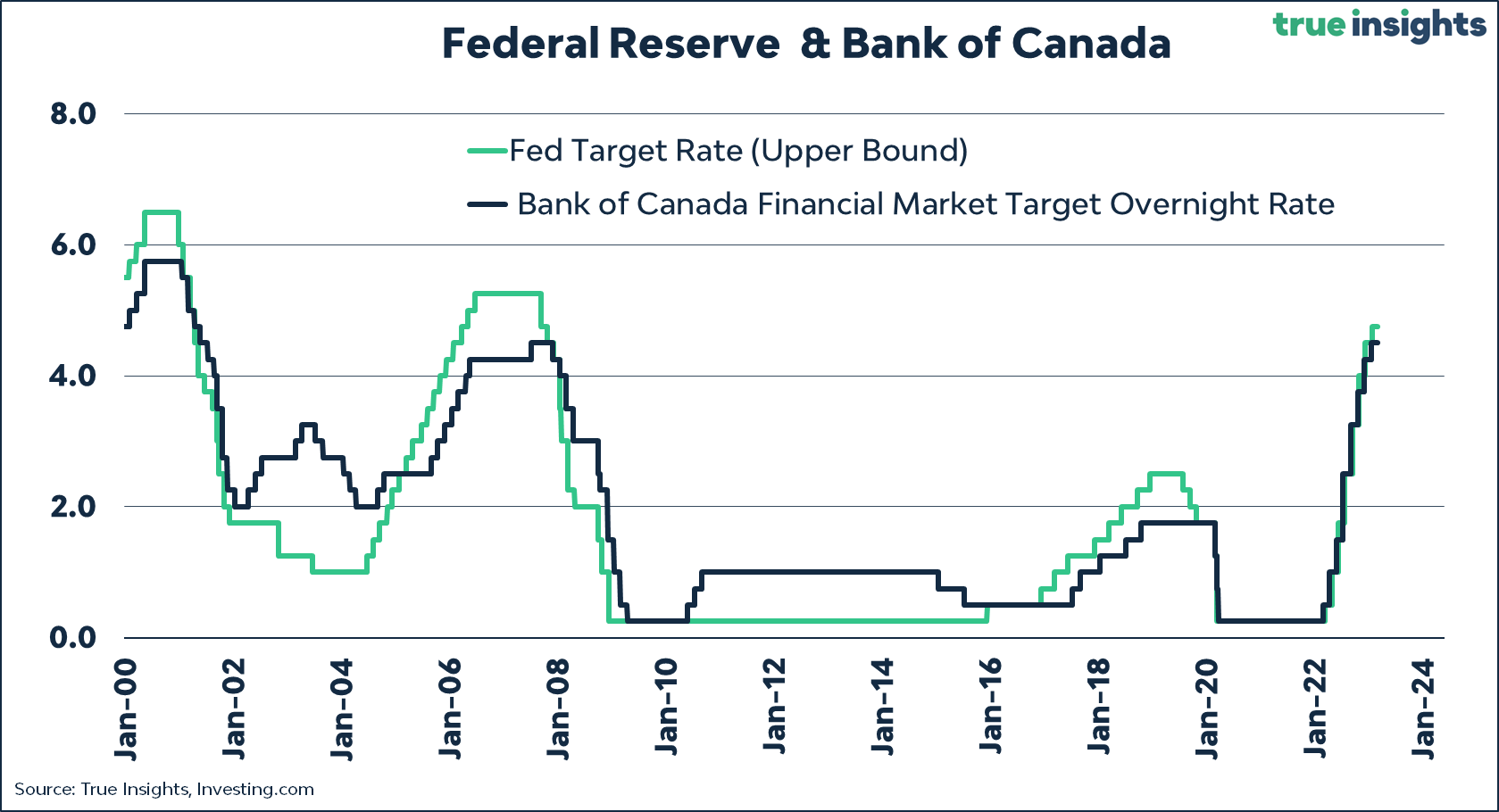

Bank Of Canada Holds Rates Insights From Fp Videos Economic Experts

Apr 22, 2025

Bank Of Canada Holds Rates Insights From Fp Videos Economic Experts

Apr 22, 2025