India's Stock Market Surge: Factors Contributing To Nifty's Rally

Table of Contents

Strong Economic Fundamentals Fueling the Nifty's Rise

The foundation of the Nifty's rally rests on the robust performance of the Indian economy. Several key indicators point to a consistently strong and growing market, attracting both domestic and international investment.

Keywords: Indian GDP growth, FDI in India, economic reforms India, corporate earnings growth, inflation in India, interest rate cuts RBI

-

Robust GDP Growth: India's GDP growth has consistently exceeded expectations, signaling a healthy and expanding economy. This sustained growth provides a solid base for corporate profitability and investor confidence.

-

Increased Foreign Direct Investment (FDI): Significant inflows of FDI demonstrate global confidence in the Indian economy and its long-term growth potential. These investments fuel economic expansion and create further investment opportunities in the stock market.

-

Successful Economic Reforms: The Indian government's ongoing efforts to implement economic reforms, focusing on deregulation and ease of doing business, have created a more favorable environment for businesses and investors.

-

Strong Corporate Earnings: Companies across various sectors have reported strong earnings and profit growth, reflecting the overall health of the Indian economy and boosting investor sentiment. This positive trend is directly reflected in the Nifty's upward trajectory.

-

Controlled Inflation: Relatively controlled inflation compared to global averages provides a stable macroeconomic environment, making India an attractive investment destination. Low inflation supports economic growth and reduces investment risk.

-

Favorable Monetary Policy: The Reserve Bank of India (RBI)'s monetary policy, including potential interest rate cuts, further supports economic growth and encourages investment. Lower interest rates make borrowing cheaper for businesses and stimulate economic activity.

Positive Global Sentiment and Foreign Institutional Investor (FII) Inflows

The surge in the Nifty isn't solely driven by domestic factors; positive global sentiment and significant FII inflows play a crucial role.

Keywords: FII investment India, global market trends, foreign portfolio investment India, dollar weakening, emerging markets investment

-

Global Market Optimism: Increased optimism in global markets has led to a greater appetite for riskier assets, including Indian equities. This positive global sentiment has boosted demand for Indian stocks.

-

Significant FII Inflows: Foreign institutional investors have been pouring capital into the Indian stock market, driven by attractive valuations and growth prospects. This influx of foreign capital fuels demand and pushes prices higher.

-

Weakening US Dollar: The weakening of the US dollar against other major currencies makes Indian assets more attractive to foreign investors, further contributing to the FII inflows.

-

Emerging Market Strength: India's strong economic fundamentals and growth potential have cemented its position as a leading emerging market, attracting global investment.

Sector-Specific Growth Drivers Contributing to the Nifty's Performance

The Nifty's rally is not just a broad-based phenomenon; specific sectors are driving the growth significantly.

Keywords: IT sector India, Pharmaceutical sector India, financial sector India, manufacturing sector India, Nifty sectoral indices

-

IT Sector Boom: The Indian IT sector's robust performance, fueled by strong global demand for IT services, is a major contributor to the Nifty's surge.

-

Pharmaceutical and Healthcare Growth: The pharmaceutical and healthcare sectors are experiencing significant growth, driven by both domestic demand and increasing exports.

-

Financial Services Expansion: The financial services sector, encompassing banking and insurance, is expanding rapidly, reflecting the growing Indian economy and increased financial inclusion.

-

Manufacturing Sector Revival: Government initiatives aimed at boosting the manufacturing sector are showing positive results, leading to increased investment and growth in this vital sector.

-

Nifty Sectoral Indices: Analyzing the performance of individual Nifty sectoral indices provides a granular view of the contributing factors to the overall market rally.

Government Policies and Initiatives Supporting Market Growth

Government policies and initiatives play a crucial role in supporting market growth and investor confidence.

Keywords: Government policies India, infrastructure development India, tax reforms India, ease of doing business India

-

Infrastructure Development: Government initiatives focusing on infrastructure development, such as roads, railways, and power generation, create a more conducive environment for business and investment.

-

Tax Reforms and Incentives: Implementation of various tax reforms and incentives aimed at attracting investment and stimulating economic activity contribute to the positive market sentiment.

-

Ease of Doing Business: Measures to improve the ease of doing business in India, reducing bureaucratic hurdles and streamlining regulations, attract both domestic and foreign investment.

Conclusion

The remarkable surge in India's stock market, reflected in the Nifty's impressive rally, is a confluence of factors: robust economic fundamentals, positive global sentiment and substantial FII inflows, strong sectoral performance, and supportive government policies. Understanding these contributing elements is crucial for investors looking to navigate this dynamic market. To make informed decisions and capitalize on potential investment opportunities in the Nifty 50 and other Indian stocks, stay updated on market trends and consult with qualified financial advisors. Continue researching the factors influencing India's stock market to make the most of this exciting bull market. Understanding India's stock market is key to successful investing.

Featured Posts

-

Game Recap Hield And Payton Key To Warriors Win Over Blazers

Apr 24, 2025

Game Recap Hield And Payton Key To Warriors Win Over Blazers

Apr 24, 2025 -

Death Of Sophie Nyweide Mammoth And Noah Actress Passes Away At 24

Apr 24, 2025

Death Of Sophie Nyweide Mammoth And Noah Actress Passes Away At 24

Apr 24, 2025 -

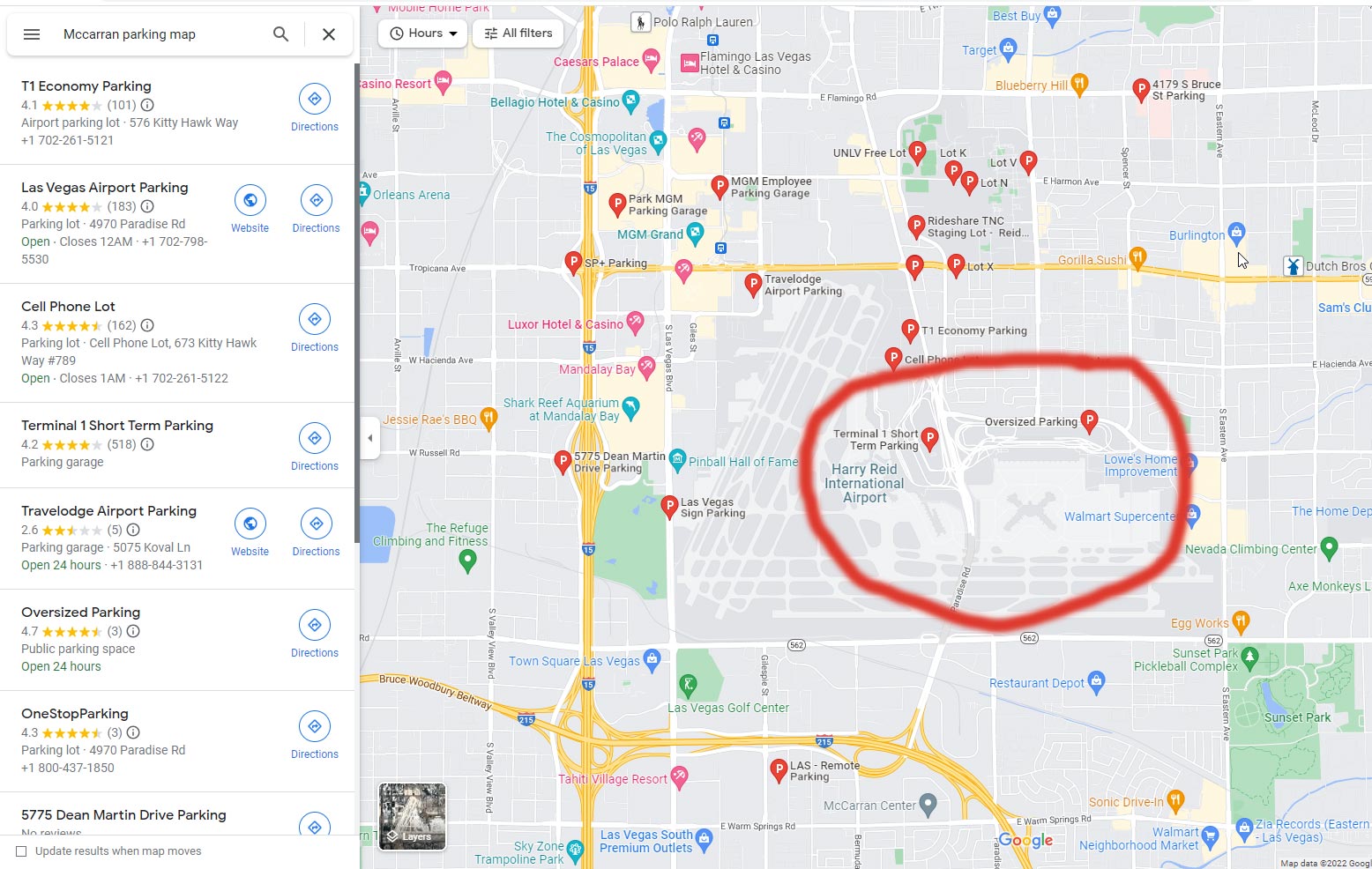

Las Vegas Airport Faa Scrutinizes Collision Risk Factors

Apr 24, 2025

Las Vegas Airport Faa Scrutinizes Collision Risk Factors

Apr 24, 2025 -

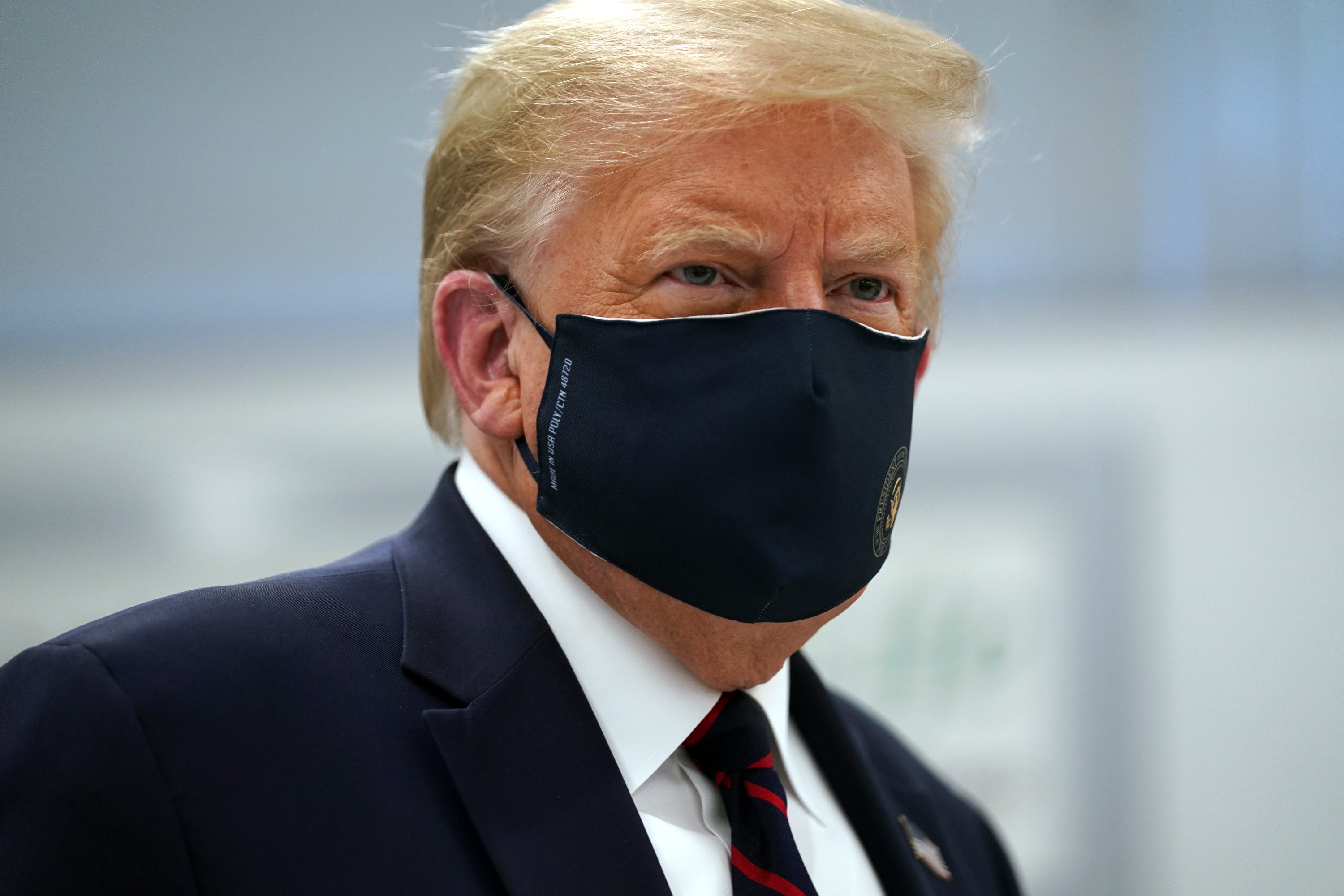

Trumps Policies And The Bitcoin Btc Price Rise

Apr 24, 2025

Trumps Policies And The Bitcoin Btc Price Rise

Apr 24, 2025 -

Future Of Utac Chinese Buyout Firm To Decide On Sale

Apr 24, 2025

Future Of Utac Chinese Buyout Firm To Decide On Sale

Apr 24, 2025