Investing In Canada: Napoleon's Strategic Business Decisions

Table of Contents

The allure of Canadian investments has captivated global investors for decades, drawn by the nation's political stability, robust economy, and abundant natural resources. But what if a figure from a vastly different era, a master strategist known for his calculated risks and ambitious vision, had considered the possibilities? What if Napoleon Bonaparte had turned his gaze towards investing in Canada? This article explores this intriguing hypothetical scenario, analyzing how Napoleon's strategic acumen could have been applied to Canadian investment opportunities, and what his hypothetical portfolio might have looked like. We will delve into the world of Canadian investments, examining the potential for success in various sectors and considering the unique challenges of the Canadian market, all through the lens of Napoleon's legendary strategic thinking.

2. Main Points:

2.1. Napoleon's Strategic Mindset and its Applicability to Canadian Investment

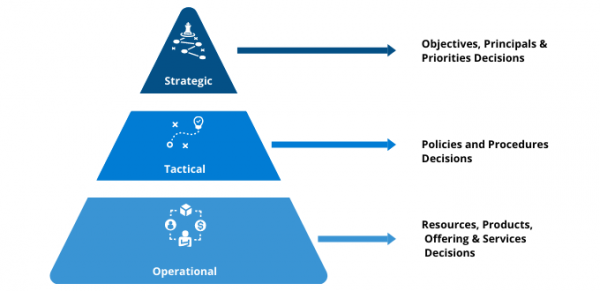

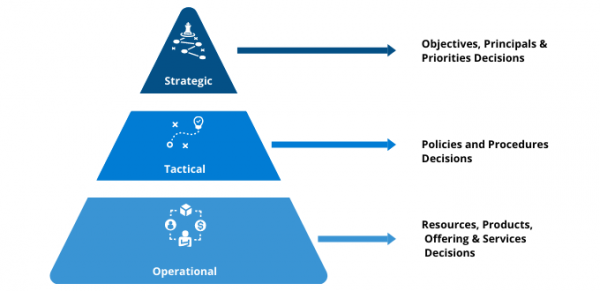

H3: Understanding Napoleon's Strategic Acumen: Napoleon was renowned for his ambition, calculated risk-taking, and a keen eye for long-term gains. He mastered the art of adapting to changing circumstances, constantly assessing and re-evaluating his strategies based on new information. This ability to swiftly adjust to shifting conditions is a vital skill for any successful investor. He understood the importance of controlling resources and logistics—essential elements in securing economic dominance.

H3: Adapting Napoleonic Strategies to the Canadian Market: Napoleon’s strategic traits translate remarkably well into the world of invest in Canada strategies. His focus on resource control mirrors the opportunities presented by Canada's abundant natural resources. His calculated risk-taking finds its parallel in modern portfolio diversification and risk management techniques. Finally, his long-term vision aligns perfectly with the potential for sustained growth in Canada's stable political and economic climate.

- Identifying lucrative sectors mirroring Napoleon's focus on control and resources:

- Resource extraction (oil, gas, mining) – controlling vital commodities for economic leverage.

- Infrastructure development – building the logistical backbone for trade and growth.

- Assessing risk tolerance—comparing his battlefield tactics to modern investment risk management:

- Diversification across sectors to mitigate potential losses, mirroring his deployment of troops across multiple fronts.

- Careful assessment of risk versus reward before committing resources.

- Recognizing long-term growth potential in Canada's stable political and economic environment:

- Investing in sectors with proven track records and future growth potential.

- Understanding and adapting to cyclical market changes.

2.2. Hypothetical Canadian Investments: Napoleon's Portfolio

H3: Resource Sector Investments: Given Napoleon's focus on resource control, a significant portion of his hypothetical Canadian portfolio would likely be dedicated to the resource sector. Investing in Canadian oil sands, mining operations (e.g., gold, nickel, potash), and natural gas production would align with his strategy of securing control over essential commodities. Historical price trends demonstrate the potential for substantial returns, although volatility is inherent in commodity markets.

H3: Infrastructure Development: Napoleon's understanding of logistics and trade would have led him to invest heavily in Canadian infrastructure projects. Investing in railway lines, particularly those connecting resource-rich regions to ports, would have been a priority. The expansion of Canada's canal system and port facilities would also be attractive, ensuring efficient transport of goods. Examples of successful infrastructure projects like the TransCanada Highway and the St. Lawrence Seaway illustrate the significant ROI possible in this sector.

H3: Real Estate and Land Acquisition: Napoleon's skill in land management would have made him a shrewd real estate investor. Speculating on land in strategically located Canadian cities like Toronto, Vancouver, and Montreal—cities with a history of significant population and economic growth—would have yielded substantial returns.

- Resource Sector:

- Investment in Syncrude (oil sands) for control over energy resources.

- Investment in a major potash mine in Saskatchewan for control of agricultural fertilizer.

- Infrastructure Development:

- Investment in the Canadian Pacific Railway for efficient transportation of resources.

- Investment in port expansion in Vancouver to facilitate international trade.

- Real Estate and Land Acquisition:

- Acquisition of land in downtown Toronto anticipating future urban growth.

- Investment in commercial real estate in rapidly developing suburbs.

2.3. Navigating Canadian Regulations and Market Dynamics: A Napoleonic Approach

H3: Understanding Canadian Regulatory Landscape: Napoleon's strategic brilliance would have extended to navigating the intricacies of Canadian investment regulations. He would have ensured meticulous compliance with all relevant laws and would have assembled a team of expert advisors to guide his investments.

H3: Dealing with Market Volatility: The resilience and adaptability that characterized Napoleon's military campaigns would have been equally crucial in navigating the volatility of the Canadian investment market. He would have employed diverse strategies, hedging against potential risks and capitalizing on opportunities presented by market fluctuations.

- Comparing the challenges of investing in Canada to the challenges Napoleon faced during his campaigns:

- Both environments demand careful planning, adaptability, and a deep understanding of the landscape.

- Unforeseen events (e.g., economic downturns, regulatory changes) require swift adjustments, mirroring military responses to unexpected enemy actions.

- Highlighting the importance of due diligence and risk assessment:

- Thorough research and professional advice are crucial to mitigate risks.

- Diversification is key to reducing exposure to market fluctuations.

- Analyzing potential market risks and mitigation strategies:

- Interest rate changes, inflation, and geopolitical events represent potential risks.

- Strategies like hedging, diversification, and establishing stop-loss orders could be used to mitigate risks.

3. Conclusion: Mastering Investing in Canada – A Napoleonic Legacy

Napoleon's strategic brilliance, characterized by ambition, calculated risk-taking, and adaptability, would have served him well in the world of Canadian investments. His hypothetical portfolio, diversified across resource extraction, infrastructure development, and real estate, would have likely yielded substantial returns. His approach highlights the importance of thorough research, risk management, and understanding the regulatory landscape.

Emulate Napoleon's strategic vision and begin your journey into Investing in Canada today! Explore the diverse Canada investment opportunities available and build a portfolio reflective of his calculated and decisive approach. Remember, the principles of strategic thinking remain timeless, regardless of era or market. By understanding and applying these principles, you too can achieve success in the dynamic world of Canadian investments.

Featured Posts

-

Real Time Analysis How A Canadian Travel Boycott Affects The American Economy

Apr 27, 2025

Real Time Analysis How A Canadian Travel Boycott Affects The American Economy

Apr 27, 2025 -

Grand National 2025 Examining Past Horse Fatalities

Apr 27, 2025

Grand National 2025 Examining Past Horse Fatalities

Apr 27, 2025 -

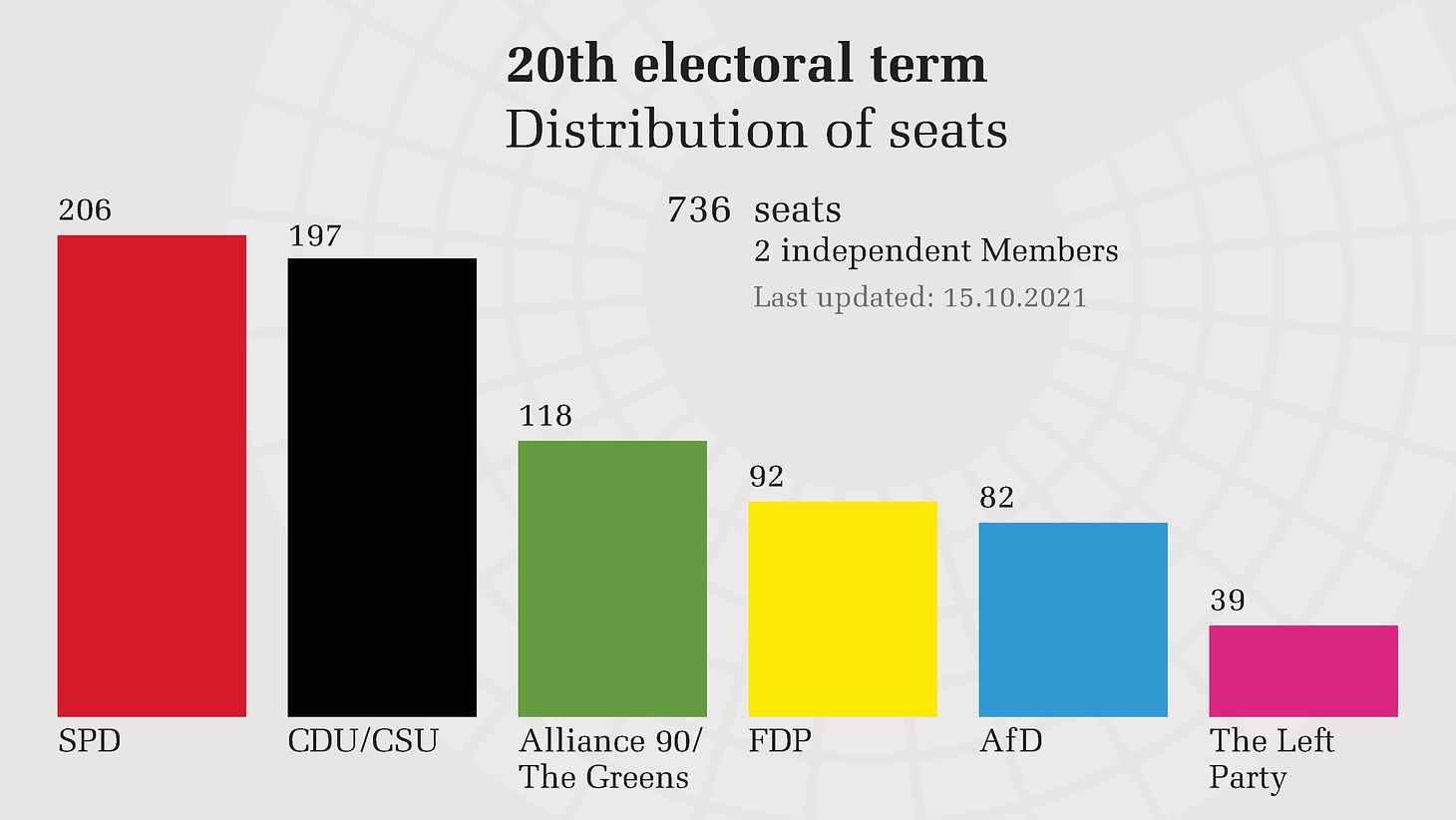

The Dax And The Bundestag Election Results And Market Reactions

Apr 27, 2025

The Dax And The Bundestag Election Results And Market Reactions

Apr 27, 2025 -

Ariana Grandes Tattoo And Hairstyle Choices A Professional Perspective

Apr 27, 2025

Ariana Grandes Tattoo And Hairstyle Choices A Professional Perspective

Apr 27, 2025 -

Navigating The Complexities Automakers Face Headwinds In The Chinese Market

Apr 27, 2025

Navigating The Complexities Automakers Face Headwinds In The Chinese Market

Apr 27, 2025