Navigate The Private Credit Boom: 5 Do's And Don'ts For Job Seekers

Table of Contents

Do's for Securing Private Credit Jobs

1. Network Strategically

Building a strong network is paramount in the private credit industry. It's not just about what you know, but who you know.

- Attend industry conferences and networking events: Events like the SuperReturn conferences, industry-specific webinars, and smaller, regional gatherings offer invaluable opportunities to meet key players in private credit networking.

- Leverage LinkedIn to connect with professionals in private credit firms: Actively engage with posts, join relevant groups, and personalize your connection requests. Use keywords like private credit connections and private credit LinkedIn in your profile and outreach.

- Informational interviews are crucial for gaining insights and making connections: Reach out to professionals for brief conversations to learn about their experiences and gain valuable advice. This demonstrates initiative and genuine interest.

2. Highlight Relevant Skills

Your resume and cover letter are your first impression. Tailor them to emphasize skills highly valued in private credit.

- Emphasize financial modeling, valuation, and credit analysis experience: Quantify your achievements whenever possible. Did you improve a model's accuracy by X%? Did you identify a risk that saved the company Y dollars? Use keywords like private credit skills, financial modeling, credit analysis, and valuation.

- Showcase strong analytical and problem-solving skills: Provide specific examples of how you've tackled complex problems and delivered results. Private equity skills are often transferable, so highlight those as well.

- Demonstrate proficiency in relevant software (e.g., Excel, Bloomberg Terminal): List specific software and your level of expertise. Mention any certifications you possess.

3. Understand the Landscape

The private credit industry encompasses various strategies and firm types. Thorough research is essential.

- Familiarize yourself with various private credit strategies (e.g., direct lending, distressed debt): Understand the nuances of different investment strategies and their associated risks and rewards. Use keywords like private credit strategies, direct lending, and distressed debt.

- Research specific firms and their investment strategies: Go beyond simply reading their website; look for news articles, press releases, and investor presentations to gain deeper insights. Knowing specific firms and their private credit investment strategies demonstrates your dedication.

- Understand the differences between private credit and other asset classes: Demonstrate your knowledge of the broader financial landscape and how private credit fits within it.

4. Prepare for Behavioral Questions

Behavioral interview questions assess your personality and how you've handled past situations.

- Prepare examples that showcase your teamwork, problem-solving, and communication skills: Use the STAR method (Situation, Task, Action, Result) to structure your responses. Keywords like private credit interview and behavioral interview should help you find relevant practice questions.

- Research the firm's culture and values: Align your responses to their values. This demonstrates you've done your homework and are a good fit.

- Be prepared to discuss your career goals and aspirations: Show your enthusiasm for a career in private credit and how this role fits into your long-term plan. Practice answering private credit job interview questions focused on your aspirations.

5. Follow Up Professionally

A thoughtful follow-up can solidify your candidacy.

- After interviews, send personalized thank-you notes: Reiterate your interest and highlight key qualifications discussed during the interview.

- Maintain professional communication throughout the hiring process: Respond promptly and professionally to all communications.

- Follow up appropriately, avoiding excessive contact: One or two follow-up emails are generally sufficient. Using keywords like private credit job application and job interview follow up will help you refine your approach.

Don'ts for Private Credit Job Seekers

1. Neglect Due Diligence

Thorough research is critical; don't apply without understanding the firm and role.

- Understand the firm's investment strategy and culture: Research the firm's history, recent investments, and team structure. Look for information on Glassdoor or LinkedIn to understand the company culture. Use keywords like private credit due diligence and private credit research.

- Research the interviewer and their background: Knowing something about the interviewer demonstrates initiative and helps you tailor your responses.

- Avoid generic applications; tailor your materials to each opportunity: Generic applications show a lack of interest and are easily discarded.

2. Underestimate the Competition

The private credit market is highly competitive; prepare accordingly.

- Prepare thoroughly for interviews and assessments: Practice your answers, research the firm, and familiarize yourself with common assessment types.

- Network extensively to build connections: Networking isn't just about getting a job; it's about building relationships that can lead to future opportunities.

- Highlight your unique strengths and experiences: What makes you stand out from other candidates?

3. Overlook Soft Skills

Technical skills are important, but soft skills are equally crucial.

- Emphasize these skills in your resume, cover letter, and interviews: Use action verbs and provide specific examples.

- Demonstrate your ability to work effectively in a team environment: Provide examples of successful teamwork from previous experiences. Keywords like soft skills, teamwork, and communication skills should be woven throughout your application materials.

- Showcase your adaptability and willingness to learn: The private credit industry is constantly evolving, so demonstrating a growth mindset is vital.

4. Ignore Salary Expectations

Researching salary expectations is crucial for realistic negotiation.

- Research industry salary ranges and be prepared to discuss your expectations: Websites like Glassdoor and Salary.com can provide valuable insights.

- Be realistic about your salary requirements based on experience and location: Overestimating can hurt your chances.

- Understand the total compensation package, including benefits: Consider the full picture, not just the base salary.

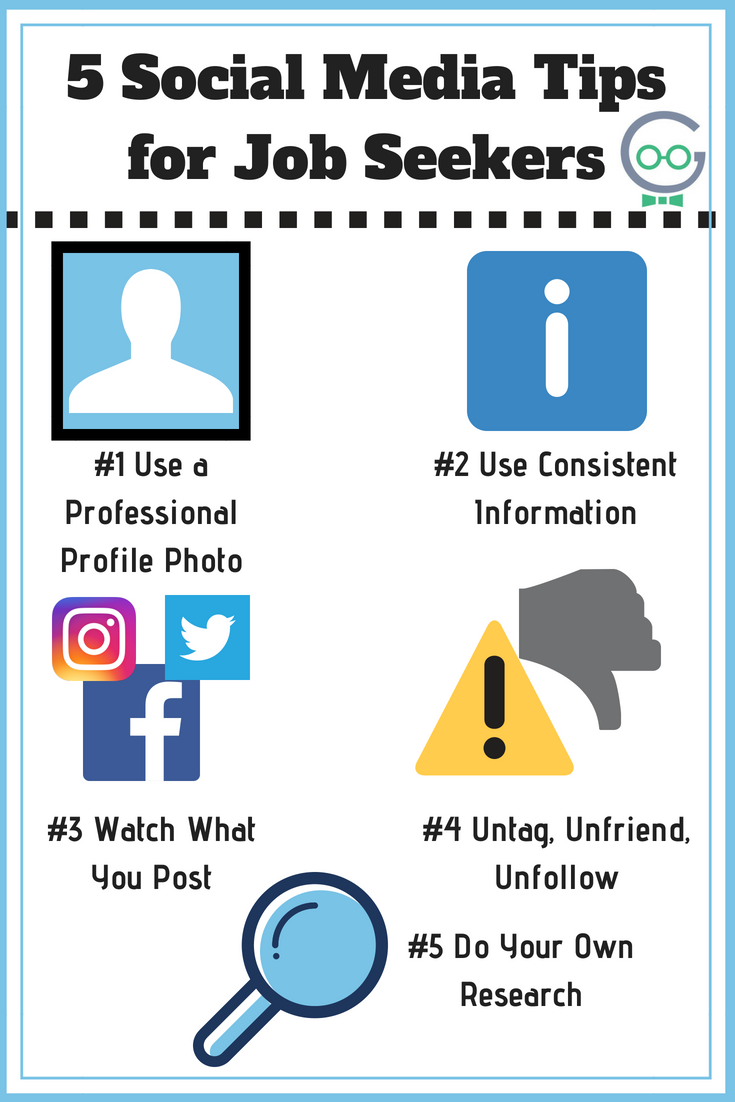

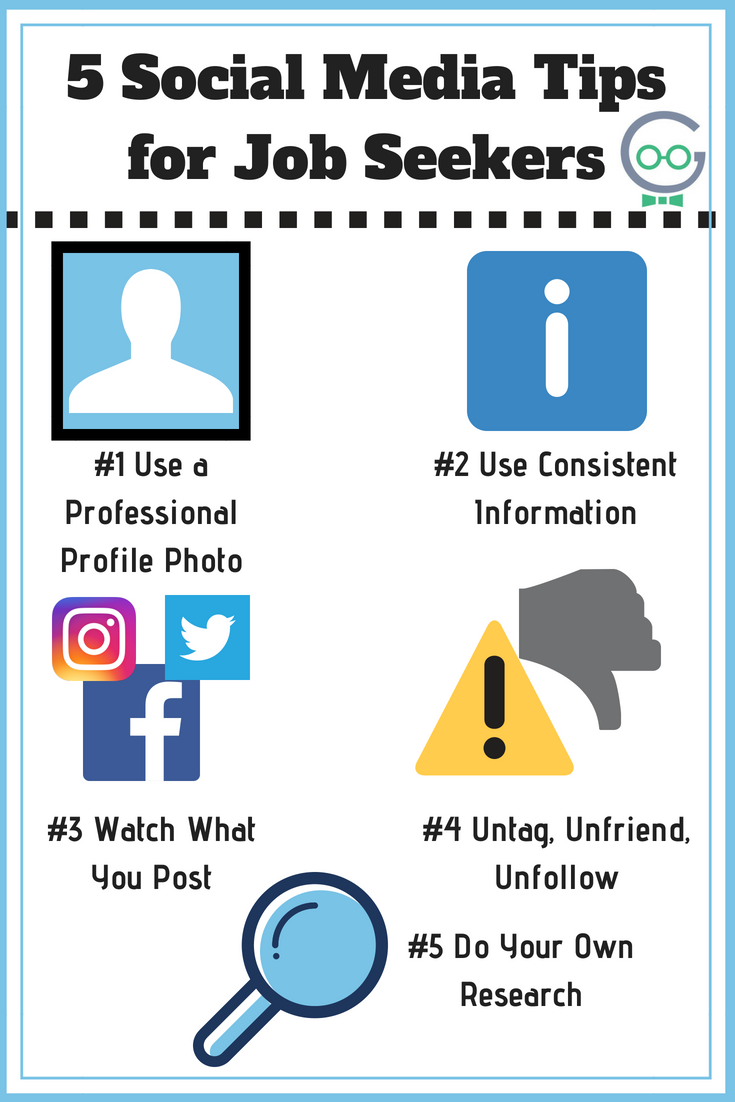

5. Neglect Your Online Presence

Your online presence reflects your professionalism; maintain a polished image.

- Review your social media profiles and ensure they are appropriate: Employers often check social media, so ensure your profiles present a professional image.

- Ensure your LinkedIn profile is up-to-date and highlights relevant skills: Use keywords like private credit throughout your profile.

- Consider creating a professional portfolio website: This can showcase your work and skills to potential employers.

Conclusion

The private credit job market offers tremendous potential for ambitious individuals. By following these do's and don'ts, you can significantly improve your chances of securing a rewarding career in this dynamic sector. Remember to strategically network, highlight your skills, understand the landscape, prepare for interviews, and maintain a professional online presence. Start your journey towards a successful career in private credit today!

Featured Posts

-

Cybercriminal Made Millions Targeting Executive Office365 Accounts Fbi

Apr 24, 2025

Cybercriminal Made Millions Targeting Executive Office365 Accounts Fbi

Apr 24, 2025 -

Conservatives Pledge Tax Relief And Fiscal Responsibility In Canada

Apr 24, 2025

Conservatives Pledge Tax Relief And Fiscal Responsibility In Canada

Apr 24, 2025 -

Trump Administration Signals Openness To Harvard Settlement Talks

Apr 24, 2025

Trump Administration Signals Openness To Harvard Settlement Talks

Apr 24, 2025 -

Stock Market Surge Nasdaq S And P 500 Gains On Tariff Hopes

Apr 24, 2025

Stock Market Surge Nasdaq S And P 500 Gains On Tariff Hopes

Apr 24, 2025 -

Heats Herro Wins 3 Point Contest Cavs Duo Dominates Skills Challenge

Apr 24, 2025

Heats Herro Wins 3 Point Contest Cavs Duo Dominates Skills Challenge

Apr 24, 2025