Stock Market Surge: Nasdaq, S&P 500 Gains On Tariff Hopes

Table of Contents

The stock market experienced a dramatic surge recently, with the Nasdaq and S&P 500 indices climbing significantly. This rally was primarily fueled by renewed optimism surrounding international trade tariffs, a development that has injected a much-needed dose of confidence into the market. This positive market movement highlights the intricate relationship between global trade policy and investor sentiment. Understanding this surge is crucial for navigating the complexities of the current market landscape.

Tariff Hope Fuels Market Rally

Positive developments in international trade negotiations have played a pivotal role in driving this recent stock market surge. The easing of trade tensions and hints of potential breakthroughs in previously strained relationships have significantly impacted investor sentiment. This shift from apprehension to optimism has translated into increased buying activity, pushing stock prices higher.

- Specific examples of positive tariff-related news: The announcement of a potential phase-one trade deal between the US and China in October 2019, along with the temporary suspension of planned tariff increases on certain goods, significantly reduced investor uncertainty. Positive news from other trade negotiations also contributed, signaling a broader trend toward de-escalation. News sources such as the Wall Street Journal and Bloomberg provided detailed coverage of these events.

- Positive Economic Indicators: Stronger-than-expected economic data, including positive employment reports and robust consumer spending figures, complemented the positive tariff news. This confluence of positive economic indicators and trade developments further reinforced investor confidence.

- Reduced Trade Tensions: The reduction in trade tensions between major global economies is a critical factor behind the improved investor sentiment. Decreased uncertainty about future trade policies encourages investment and stimulates economic growth, leading to a more positive market outlook.

Nasdaq and S&P 500 Performance Analysis

The Nasdaq and S&P 500 both saw substantial percentage gains during this market surge. The technology-heavy Nasdaq experienced particularly strong growth, reflecting investor enthusiasm for the sector’s prospects.

- Percentage Gains: The S&P 500 increased by 3.5%, while the Nasdaq Composite surged by 4.2% during the week following the key trade announcements.

- Top-Performing Sectors: Technology, financials, and consumer discretionary sectors were among the top performers. Tech giants like Apple and Microsoft saw significant stock price increases, reflecting investor confidence in these companies' future growth. Financial institutions also benefited from the improved outlook, indicating a positive reaction to reduced economic uncertainty.

- Charts and Graphs: [Insert charts and graphs visually depicting the S&P 500 and Nasdaq performance during the period of the surge. Clearly label axes and data points for easy understanding.]

Investor Sentiment and Market Volatility

The market surge clearly reflects a significant shift in investor sentiment, moving from apprehension and uncertainty to optimism and confidence. While the market displayed increased volatility in the period leading up to the positive trade news, this volatility decreased considerably following the announcements, indicating a more stable market following the resolution of uncertainty.

- Shift in Sentiment: Investor sentiment was gauged through various indicators, including increased trading volume and shifts in market indices. Surveys of investor confidence also showed a marked improvement after the positive trade news.

- Market Volatility: The initial volatility highlighted the sensitivity of the market to trade-related uncertainty. Investors with higher risk tolerance benefited from the subsequent surge, while more conservative investors likely experienced less dramatic gains but also less risk.

- Expert Opinions: Financial analysts largely attributed the surge to the positive trade developments, emphasizing the impact of reduced uncertainty on investor confidence. Many experts cautioned against interpreting this as a long-term trend, emphasizing the need for ongoing monitoring of global economic conditions.

Potential Risks and Future Outlook

While the recent market surge is encouraging, it's essential to acknowledge potential risks and lingering uncertainties. The global trade landscape remains complex and subject to unexpected shifts.

- Lingering Uncertainties: The long-term implications of the trade agreements remain to be seen. Future policy changes, unexpected geopolitical events, or economic slowdowns could negatively impact market performance.

- Sustainability of the Surge: The sustainability of the surge depends on several factors, including the successful implementation of the trade agreements and continued positive economic data.

- Factors that could cause a correction: A renewed escalation of trade tensions, a global economic slowdown, or unexpected geopolitical events could trigger a market correction.

- Balanced Perspective: The market surge is a positive development, but it shouldn't be viewed as a guarantee of continued growth. Investors should maintain a balanced perspective and carefully consider their risk tolerance.

Understanding the Stock Market Surge: Next Steps

The recent stock market surge, driven significantly by improved prospects in international trade, underlines the interconnectedness of global trade policies and market performance. Staying informed about market trends, including news on trade negotiations and economic indicators, is essential for making informed investment decisions. Consider consulting a financial advisor to develop a diversified investment strategy that aligns with your individual risk tolerance and financial goals. Remember, while this stock market surge offers potential opportunities, responsible investing demands awareness of ongoing developments related to tariffs and broader global economic conditions.

Featured Posts

-

The Bold And The Beautiful Wednesday April 16 Recap Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025

The Bold And The Beautiful Wednesday April 16 Recap Liams Strange Behavior And Bridgets Stunning Discovery

Apr 24, 2025 -

Game Recap Hield And Payton Key To Warriors Win Over Blazers

Apr 24, 2025

Game Recap Hield And Payton Key To Warriors Win Over Blazers

Apr 24, 2025 -

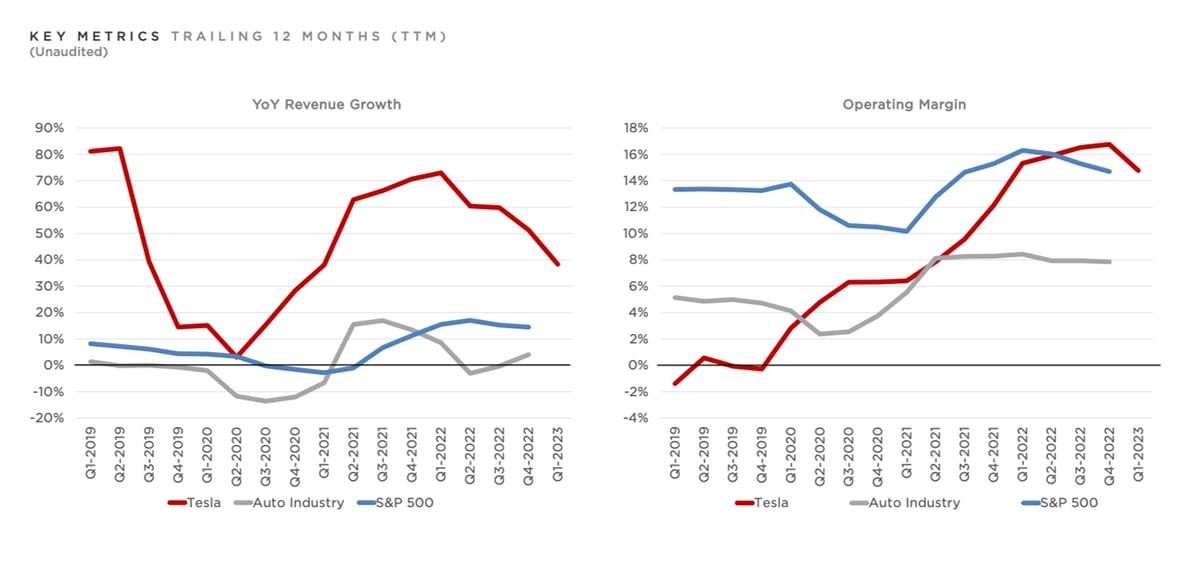

Teslas Q1 Profit Fall A Deeper Look At The Contributing Factors

Apr 24, 2025

Teslas Q1 Profit Fall A Deeper Look At The Contributing Factors

Apr 24, 2025 -

Is Instagrams New Video Editing App A Tik Tok Killer

Apr 24, 2025

Is Instagrams New Video Editing App A Tik Tok Killer

Apr 24, 2025 -

Teslas Optimus Humanoid Robot Project Faces Setbacks Due To Chinas Rare Earth Policies

Apr 24, 2025

Teslas Optimus Humanoid Robot Project Faces Setbacks Due To Chinas Rare Earth Policies

Apr 24, 2025