Private Credit Market Cracks: A Credit Weekly Analysis Of Recent Turmoil

Table of Contents

Rising Interest Rates and Their Impact on Private Credit

The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, have significantly impacted the private credit market. These increases directly translate to higher borrowing costs for companies relying on private debt financing. This is particularly problematic for leveraged buyout (LBO) transactions, a cornerstone of private credit activity.

- Increased funding costs for private equity firms: Higher interest rates make it more expensive for private equity firms to finance acquisitions, reducing their purchasing power and potentially impacting deal valuations. This directly affects the volume of leveraged loans available in the market.

- Reduced deal flow and fewer LBO transactions: The increased cost of capital is leading to a slowdown in LBO activity, as transactions become less economically viable. This decrease in deal flow is a clear indicator of the pressure on the private debt market.

- Higher default risks for highly leveraged companies: Companies with significant existing debt burdens are particularly vulnerable to rising interest rates, increasing their risk of default. This is especially true for those with floating-rate debt, whose interest payments increase directly with interest rate hikes.

Statistics show a strong correlation between interest rate hikes and a decrease in private credit market activity. For instance, [Insert relevant statistic linking interest rate increases to a drop in leveraged loan origination or private debt issuance]. The impact of these "interest rate hikes" on "leveraged loans" and the broader "private debt" market cannot be overstated.

Increased Defaults and Credit Events in the Private Credit Market

The recent surge in defaults within the private credit space is another significant factor contributing to the current turmoil. Businesses across various sectors are struggling to meet their debt obligations, leading to a wave of credit events.

- Examples of high-profile defaults and their consequences: [Include examples of recent high-profile defaults in the private credit market and their subsequent impact, potentially mentioning specific companies and the repercussions for investors and creditors]. These events highlight the fragility of some leveraged companies.

- Analysis of the sectors most vulnerable to defaults: Sectors like real estate and technology, which experienced significant growth during periods of low interest rates and abundant capital, are now particularly vulnerable to defaults. Over-leveraged companies in these sectors are facing increasing difficulty servicing their debt.

- The role of covenant-lite loans in exacerbating defaults: The prevalence of covenant-lite loans, which offer borrowers greater flexibility but provide lenders with less protection, has exacerbated the default problem. The absence of strict covenants leaves lenders with limited recourse in the event of borrower distress.

The rising "default rate" and frequency of "credit events" within the private credit market indicate a significant shift in the risk profile of this asset class. The increasing prevalence of "covenant-lite loans" is a major contributing factor to this "private debt distress."

Investor Sentiment and the Flight to Quality in Private Credit

Market volatility has significantly eroded investor confidence. The resulting "flight to quality" is causing a shift towards higher-quality private credit investments.

- Reduced investor appetite for riskier private credit assets: Investors are becoming increasingly risk-averse, reducing their appetite for lower-quality, higher-yielding private credit assets. This selectivity is reshaping the investment landscape.

- Increased demand for senior secured loans and other less risky instruments: The demand for safer, senior secured loans and other less risky private credit instruments has surged as investors seek to protect their capital. This prioritization of security is typical during market uncertainty.

- Impact on fund raising for private credit managers: The shift in investor sentiment is making it more challenging for private credit managers to raise capital, particularly for funds focused on riskier investments. This funding scarcity is adding to the market's contraction.

The prevailing "investor sentiment" reflects a significant increase in "risk aversion," leading to a pronounced "flight to quality" within the private credit market. This has a noticeable impact on "private credit fund performance" and the overall availability of capital.

The Role of Regulatory Scrutiny in the Current Climate

Increased regulatory scrutiny is adding another layer of complexity to the challenges facing the private credit market. Regulators are paying closer attention to leverage levels, risk management practices, and transparency within the industry.

- Increased reporting requirements for private credit funds: Regulators are implementing more stringent reporting requirements for private credit funds, aiming to improve transparency and oversight. This adds operational burdens and potentially affects investment strategies.

- Potential changes to leverage limits and other regulations: Further regulatory changes, including potential limits on leverage and stricter guidelines on lending practices, are under consideration. These changes could fundamentally alter the market's dynamics.

- Impact on the overall transparency and stability of the market: Increased regulatory scrutiny aims to improve the overall transparency and stability of the private credit market, although it may also lead to increased compliance costs and potentially stifle some aspects of market activity.

Conclusion: Understanding and Navigating Private Credit Market Cracks

The current turmoil in the private credit market is a complex interplay of rising interest rates, increased defaults, shifting investor sentiment, and growing regulatory scrutiny. Understanding these factors is crucial for navigating this evolving landscape. Carefully analyzing risk is paramount. Staying informed about developments in the private credit market through regular analysis of credit weekly reports and expert commentary is essential to understanding and managing risk effectively. Consider subscribing to a relevant service for continued insights into private credit market cracks and potential opportunities. Don't let the cracks in the private credit market catch you off guard; proactively manage risk and stay ahead of the curve.

Featured Posts

-

Professional Help Behind Ariana Grandes Stunning Hair And Tattoo Debut

Apr 27, 2025

Professional Help Behind Ariana Grandes Stunning Hair And Tattoo Debut

Apr 27, 2025 -

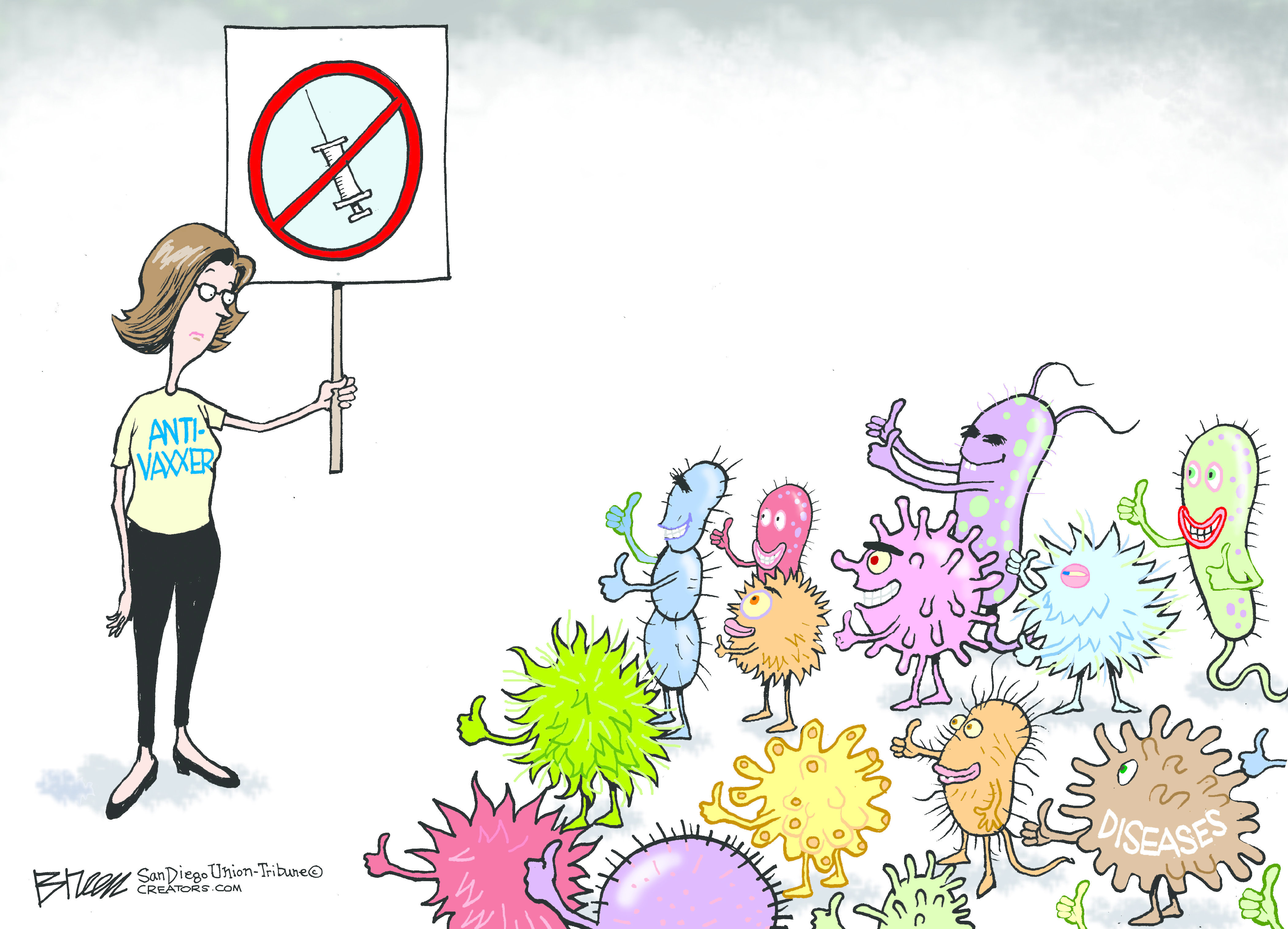

Controversial Appointment Anti Vaxxer Heads Autism Study

Apr 27, 2025

Controversial Appointment Anti Vaxxer Heads Autism Study

Apr 27, 2025 -

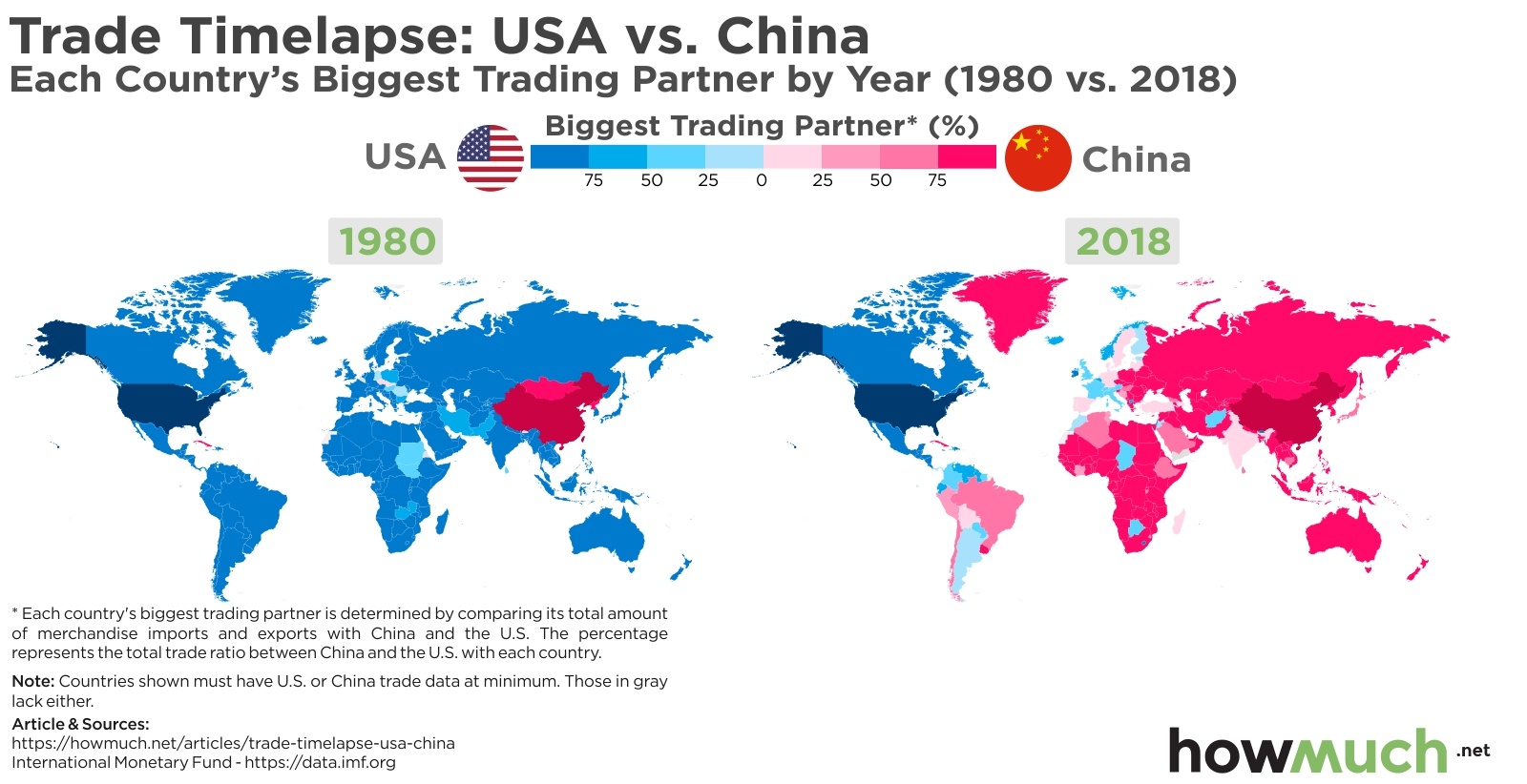

Ackmans Trade War Prediction Us Vs China

Apr 27, 2025

Ackmans Trade War Prediction Us Vs China

Apr 27, 2025 -

Regulierungsmeldung Pne Ag Nach Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Regulierungsmeldung Pne Ag Nach Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

Abu Dhabi Open Belinda Bencics Post Maternity Final

Apr 27, 2025

Abu Dhabi Open Belinda Bencics Post Maternity Final

Apr 27, 2025